YAM has been dazzling me for a few days. Why do people care about it so much?

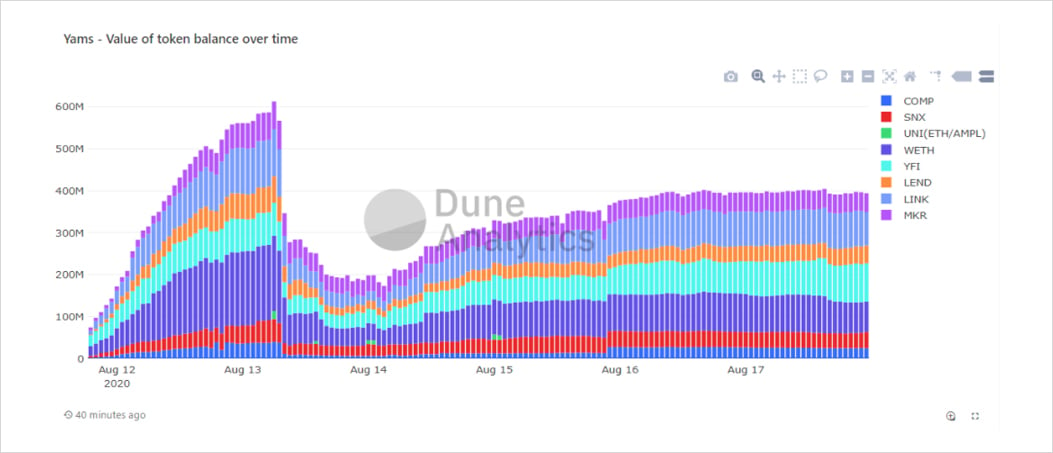

Launched as “an experiment in fair farming, governance, and elasticity,” YAM requires investors to lock up capital in staking pools to earn the token, most of which are issued over the first 30 days. And lock up capital they did – pour it in, in fact, at an unprecedented rate. A mind boggling $600m of different DeFi tokens were staked within the first 24 hours, despite these contracts never having received a formal audit and the small team hacking the entire system together in a mere 10-day sprint.

On the second day, a critical bug permanently locked up $750k of investor funds. The project relied on reaching a quorum of token votes to implement the necessary fix (a result of forking the Compound governance system). But since too many YAM tokens got locked up as well, these tokens couldn’t vote, and the quorum was impossible to reach(1). Further, it became impossible to reach any future quorums, which permanently disabled the governance function of the system.

While many observers predicted YAM’s imminent death, that is not what happened. YAM kept trading at a positive market price. And while the funds dedicated to farming it in the staking contracts temporarily dropped to $200m, they did not collapse to zero, and even recovered to currently around $400m.

Source: Dune Analytics

In the immediate aftermath of these events, talk emerged of forking the system and migrating existing holders over to a second version, and now it looks like that is indeed happening. It’s clear that YAM managed to make its users care about the project, which is an incredible feat.

As an observer to it all, I was curious about how it managed to get so much community-buy in. I think I found two explanations.

The fair launch

I think the first aspect of YAM’s success was how it did the fair launch that has been popularized by Bitcoin. The main property of a fair launch is “no free lunch,” meaning that everyone has the same opportunity to acquire the token. The only way to do this reliably is to make everyone work for it, and have that work be provably costly.

I already argued that liquidity mining is a form of proof-of-work in a previous article, but YAM took the idea even further. Not only does staking have an opportunity cost, because the capital can’t be used elsewhere. But putting money into these unaudited contracts, as weird as it sounds, is part of the game and presents a test of faith for the user. In short, DeFi has found a way to recreate the magic of fair proof-of-work launches with this synthetic form of PoW.

There are many technical and economic reasons to like proof-of-work, but the psychological element is still underexplored. The more time and resources people invest in something, the more value they’ll ascribe to it. Maybe that is crypto’s version of the sunk cost fallacy.

As if to drive that point home, the community quickly raised $115k to fund a protocol audit of version two. Some might see this as throwing bad money after good, but to me, it shows people are genuinely attached to their YAMs.

That said, the fair launch and sunk cost fallacy don’t explain why users rushed into the protocol in the first place. What part of its value proposition was appealing to them?

The rebase mechanism

First, we have to distinguish YAM from tokens that have inherent value in the form of potential future cash flows or governors’ ability to allocate themselves such cash flows. That applies to tokens like COMP, CRV, or YFI, and the moment they go “for sale,” it is only rational for market participants to 1), price them and 2), mine them via the synthetic PoW, as long as the cost of acquisition is lower than what they deem fair.

That is different for tokens like YAM, BASED, and the many others shooting up now. These tokens are not pseudo-equity and have no claim to cash flows. Instead they, like so many other tokens before them, claim to be money(2).

We can tell YAM and its clones are not useful money by looking at their properties, the most dominant of which is its “elasticity”: “At its core, YAM is an elastic supply cryptocurrency, which expands and contracts supply in response to market conditions, initially targeting 1 USD per YAM.” (source)

While not spelled out, the founders imply that the coin can be a stablecoin, but this couldn’t be further from the truth. Coins with rebase mechanisms, such as Ampleforth or YAM, are precisely as stable as bitcoin, namely not at all. They swap volatility in token prices for volatility in token amounts.

For example, when a coin rebases by factor 10, a single $10 coin is split into 10 $1 coins. In a rational market, each account’s purchasing power remains the same, since they all retain the same share of the pie, only with a different numeraire.

This method not only presents no upside over the established “fixed supply with variable coin price,” but it is worse because people have no experience and no mental model in dealing with money like this. So if rebasing doesn’t help make a token good money, why use this mechanism at all?

My theory is that parts of the market fail to understand the simple concept of rebases, as indicated by Ampleforth growing to almost $700m in market cap based on a simple accounting hack, before collapsing back down just as quickly. The traders who do understand are happy to go along until the supply of new money runs out, at which point they pull out their capital and let the coin collapse.

This gives us a clear hint as to why other coins would adopt rebasing. It provides the bait for the uninformed market participants that are needed to fuel the growth of the token and eventually provide exit liquidity for market insiders.

So what is YAM?

As you might have figured by this point, I think of YAM as a Nakamoto Scheme with additional bells and whistles. The term Nakamoto Scheme was coined by Preston Byrne to describe games in which early investors try to exploit late adopters, but whose decentralized architecture sets them apart from traditional Ponzis and pyramid schemes.

Bitcoin itself is a Nakamoto Scheme, and this has been aptly described in the bubble theory of money. The interesting question is: will this bubble eventually stabilize or pop?

To escape the pop, YAM has to find a reason for people to never sell but instead hold it for its utility, and not merely the hope of future price appreciation. We should be real here. Their flawed design will prevent YAM and its many clones from ever becoming money. The remaining alternative would be to grow the protocol into something else entirely. It’s not impossible, given the system’s treasury system(3) and community’s ability to shape it via governance. But it’s not likely either.

(1) Technically, the quorum was met and then lost due to the rebase bug. Source

(2) As indicated by the creators calling it “a cryptocurrency” and a “monetary experiment”

(3) YAM actually charges a protocol tax on every increase in market cap, as 10% of each positive rebase go into a community-governed treasury fund.

AUTHOR(S)