In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Uncertainty in the Middle East.

Certainty as BTC block halving reached.

Spot seemed to oscillate with the former.

Option flow was inconclusive.

BTC Call buyers on the rally, FOMO+shortcovering; Put buyers hedging downside.

ETH Overwriter restructured.

Jun 6.5k Calls swept x50k.

2) Rhetoric, apparent cessation, then reaction was the story of Israel-Iran tensions.

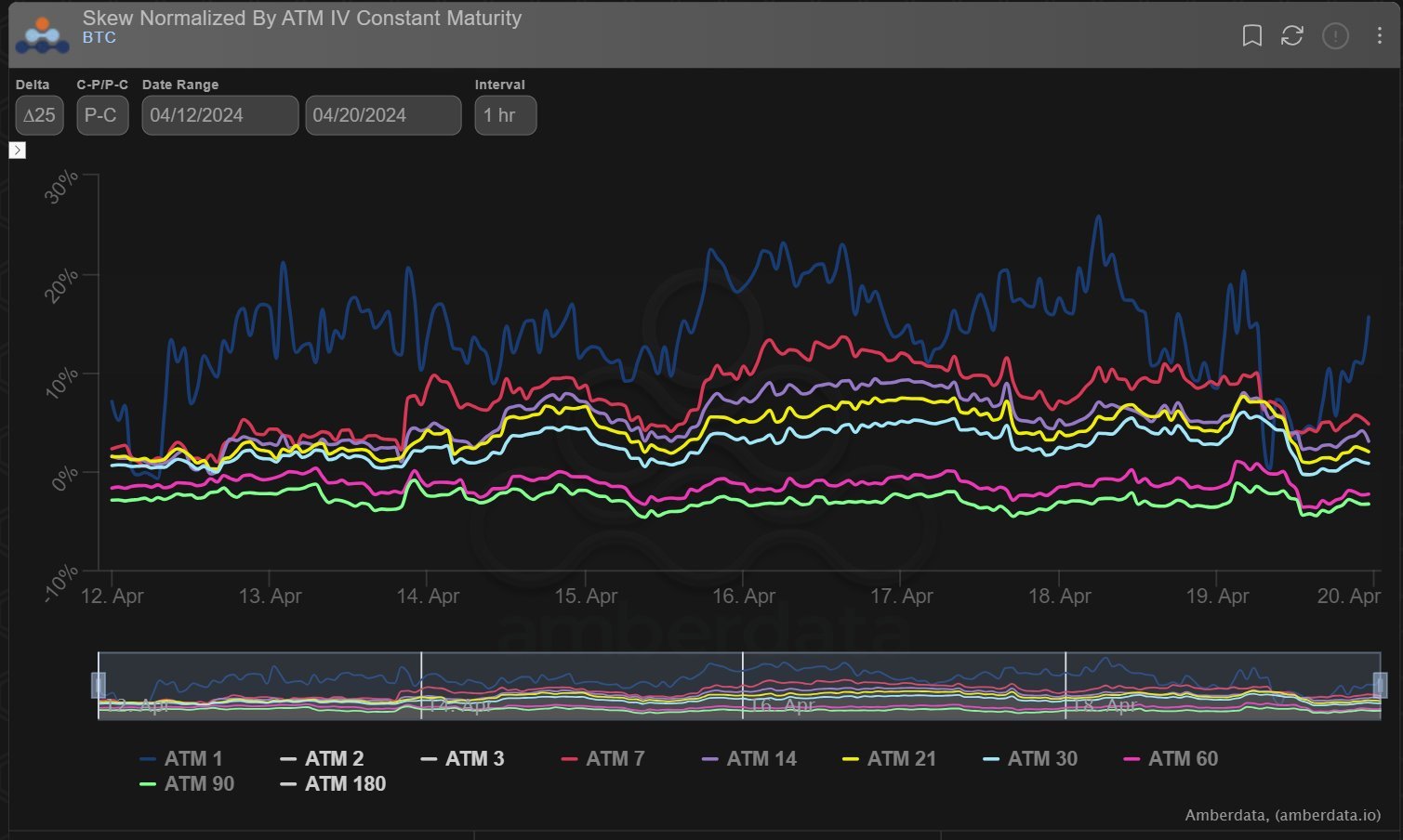

Manifestation chronologically was steep Put Skew to hedge downside, Call buyers as tensions subsided, Put buying to hedge portfolios just in case, and a sweep of the lows on dramatic reports.

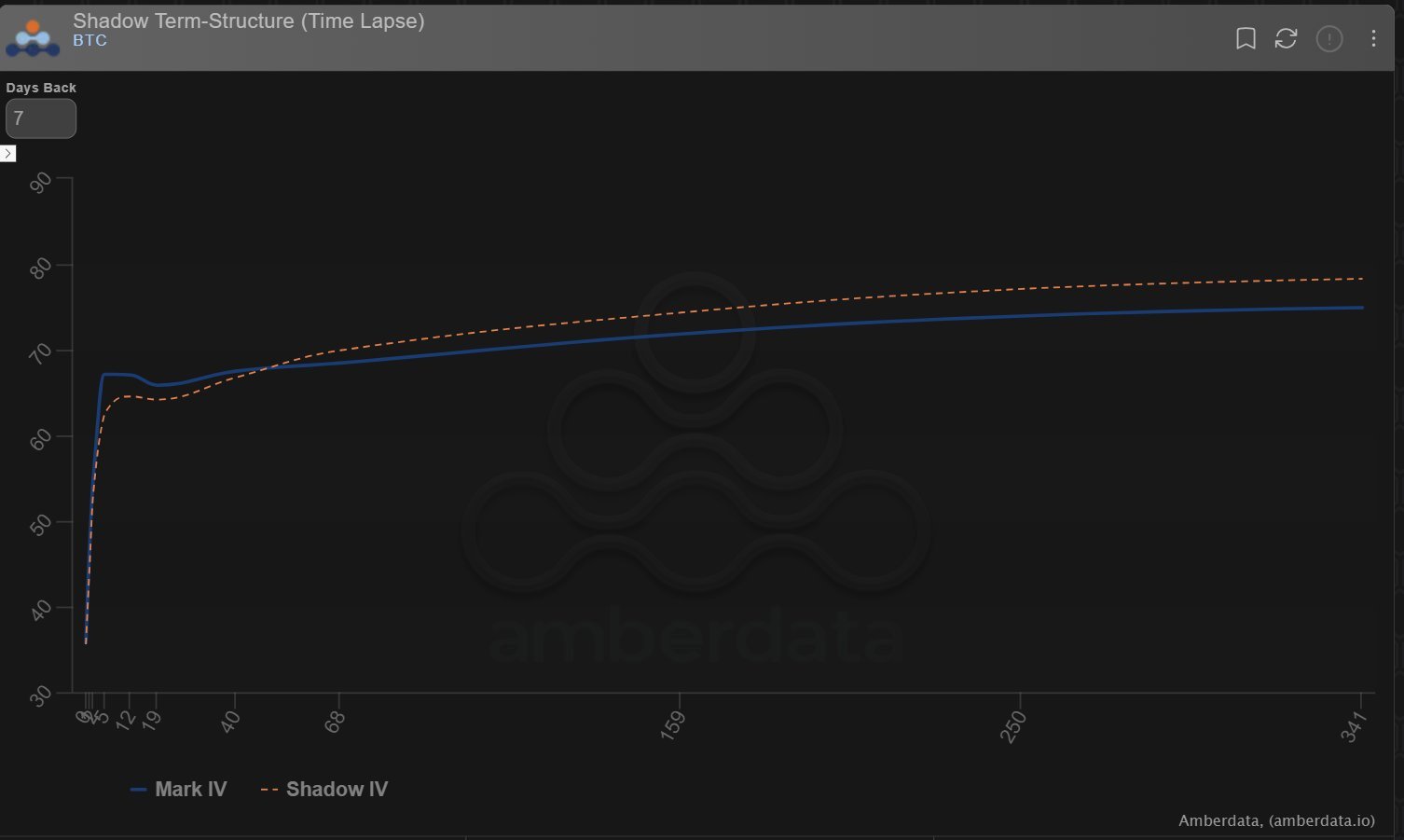

3) Implied Vol firmed on Optionality buying (Call+Put buys), but the wait for Iran-Israel action caused Long IV to drift during times of inaction, and to sharply surge as the market responded to wild reports in the news and the human mind’s interpretation of face-saving rhetoric.

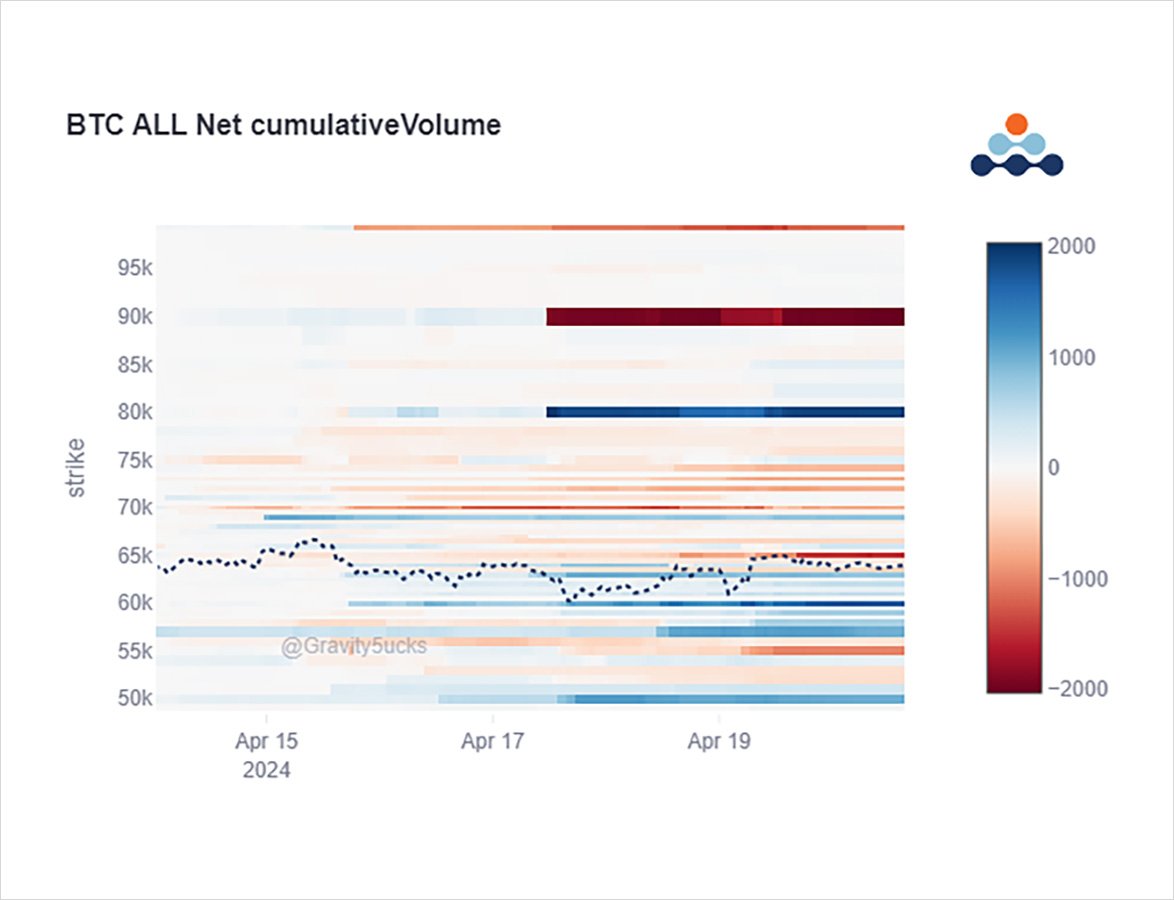

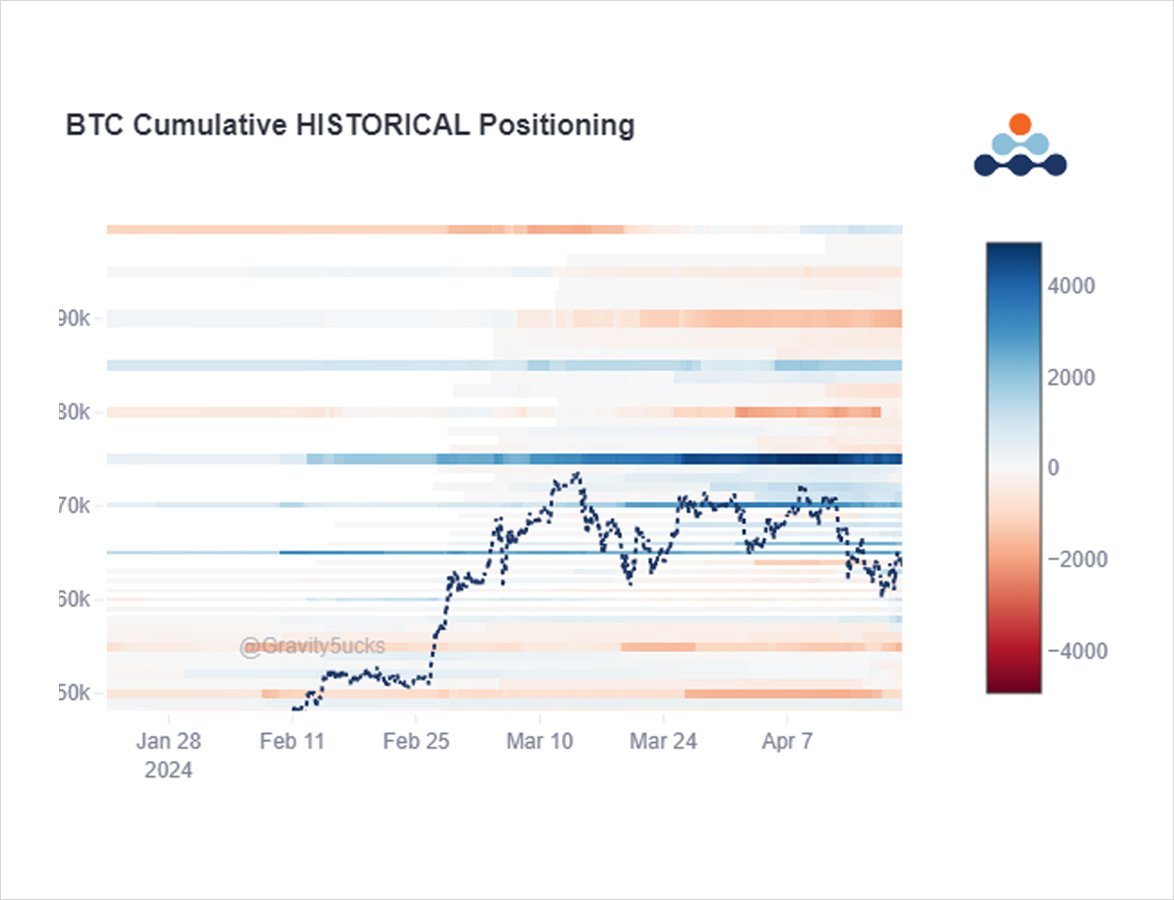

4) Buyers of Apr+May 57-60k Puts, and Apr 60-55k Put spreads to protect.

Buyers of Apr 64k+ 64-70k Call spreads, and May 69k Calls for upside exposure on the bounces. Sellers of Apr, May+Jun 65-70k Calls applying IV pressure.

Restructuring of post-halving Calls, brought nearer.

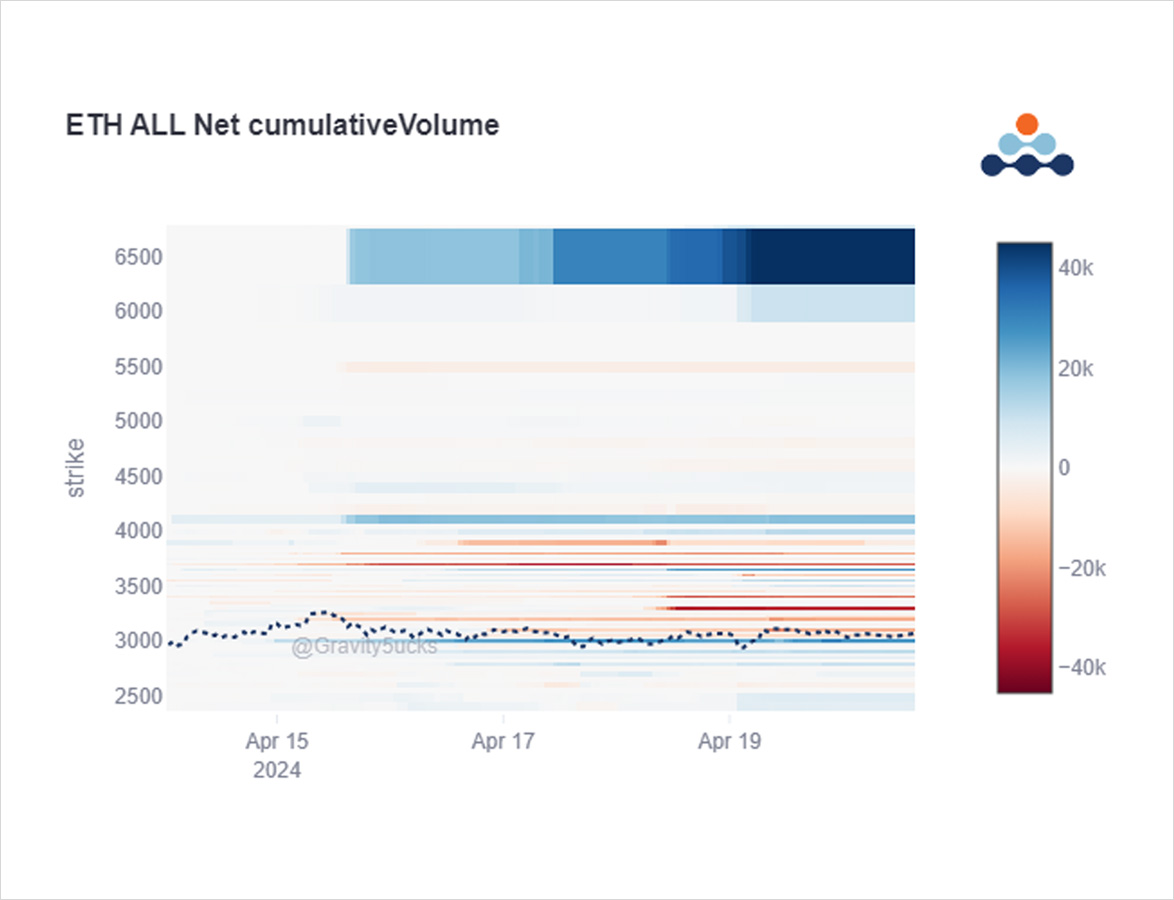

5) ETH flows are less complex.

ETH rally believers remain weak, and opportunities to gain yield by selling Calls are dominant.

Last week’s seller of Apr 3.5-3.6k Calls to fund the Jun ~3k-2.5k Put spreads bought back the Apr Calls and sold May 3.6-3.9k Calls alongside others.

6) A stray conspicuous purchase of 50k Jun 6.5k Calls was out of the blue; $1m spent in premium, but so far OTM an insufficient amount of Vega to override the over-writer’s Vega sales via the May Calls.

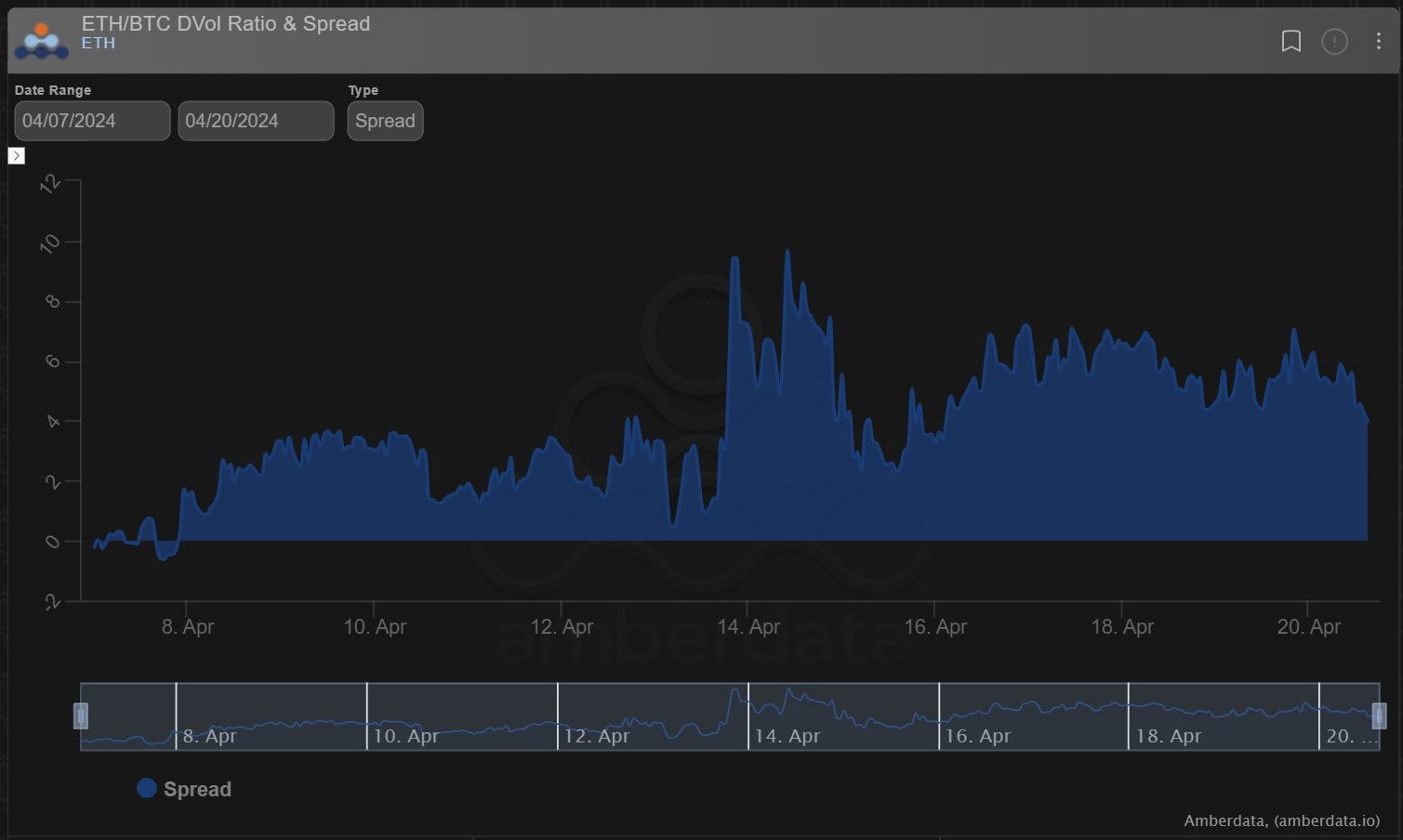

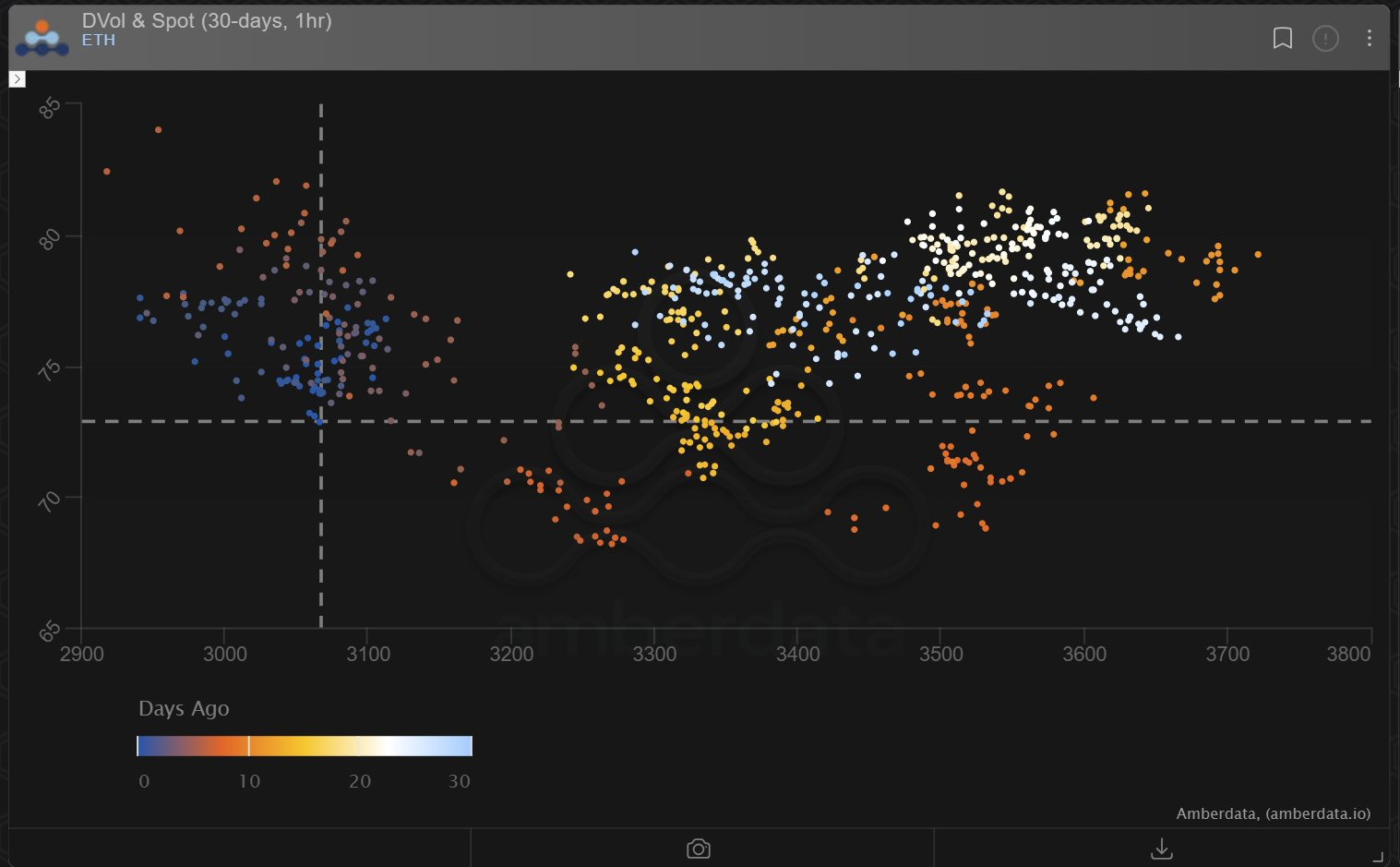

Despite that, ETH IV (using Dvol as a proxy) remained at a premium to BTC.

7) This environment with high Put Skew and downside caution has also changed the dynamic of Spot-Vol correlation with Spot < 61k and 3k (BTC+ETH respectively) causing a reaction pump in IV as fear of severe downside reaction to unprecedented global tensions momentarily took over.

8) 4/20 day BTC Halving occurred earlier today bringing BTC block rewards to 3.25 BTC, cutting BTC emissions by 50%.

Considerable post-Halving dated Call buying has taken place over the last few months, but it has not been certain if this was ETF-related or Halving narrative.

9) Some restructuring of these BTC OTM mid-long dated Calls suggests impatience.

This week we have observed Dec 100k Calls moved to Sep 100+110k Calls x1800, Sep 90k Calls moved to May 80k Calls x1875, May65-Jun70k Calls sold out small, disguised on DSOB.

Term-structure flatter.

10) Rallies post-halving tend not to be immediate, but a narrative now absorbed by a new institutionalized client base perhaps may have driven Call buying or now lead to continued demand.

This is just one of several narratives currently sparring for top-spot in a greater arena.

View Twitter thread.

AUTHOR(S)