In this lecture we’ll look at how a company might use the purchase of a put option to make sure their business remains profitable.

Suppose a company, let’s call them DEF, is growing some corn. It’s currently April, but the corn won’t be ready for sale for another 6 months in October. DEF are worried that if the price of corn falls too much by October, that they won’t be able to sell the corn they have harvested for a price that makes them enough profit.

The current price of corn is $4.50 per bushel, which is a good price for DEF to sell at. The problem is they are not ready to sell the corn yet. After doing some calculations, DEF has estimated that the lowest price that would be acceptable for them to sell the corn at is $3.80/bushel.

What DEF would love is a way to guarantee a minimum price that they can sell their corn for in October when the corn is ready. This could take the form of a legal agreement with another company, let’s call this company UVW, that agrees to purchase the corn from DEF for a minimum of $4 on October 23rd. That is, even if the price of corn decreases to less than $4 per bushel, UVW will be obligated to buy corn from DEF at $4 per bushel.

You may be wondering what’s in it for UVW. Well, in exchange for this valuable agreement, DEF will pay a fee (or premium) to UVW. The fee could be something like $0.10 per bushel. This $0.10 fee per bushel is kept by UVW no matter what happens. So even if the price of corn remains higher than $4 in October, meaning DEF does not need to use the agreement to sell at $4, UVW will still get to keep their fee of $0.10 per bushel.

This agreement between DEF and UVW is essentially a put option. DEF has paid a fee to UVW, and in exchange UVW has given DEF the option to sell them corn at $4 per bushel in October. DEF does not have to sell the corn at $4 per bushel, they just have the option to.

In the previous lecture we listed again the 5 main parameters of an option contract:

-The underlying asset

-The option type

-The expiry date

-The strike price

-The option price

In this example, the underlying asset is corn. The option type is a put option, which is the right to sell the asset. The expiry date is October 23rd. The strike price is $4. And the option price (or premium) is $0.10 per bushel.

Buying a put option is very similar to buying insurance. With insurance you pay a premium to an insurance company in exchange for them covering your losses if the asset you’re insuring is damaged or destroyed. Here, DEF has paid a premium to UVW as insurance against the price of corn decreasing below $4. To DEF this is well worth the premium of $0.10 as it guarantees that they will be able to sell their produce at a price that makes them a profit.

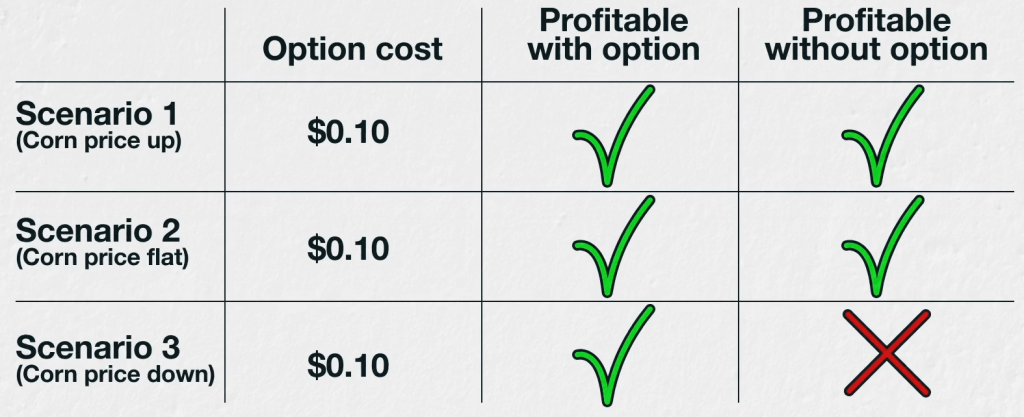

Let’s have a look at what effect buying this put option will have for DEF, based on three different prices of corn on October 23rd.

Scenario 1:

The price of corn has increased to $5.50/bushel on October 23rd. DEF is now ready to sell their corn. The put option gives them the right to sell their corn to UVW for $4/bushel. However, because it’s possible to sell the corn at $5.50/bushel in the open market, there is no point in exercising that right.

DEF therefore sells their corn for $5.50/bushel in the open market. They also paid $0.10/bushel for the put option though, so the net amount they received is $5.40/bushel. This $5.40 is slightly less than they would have received if they had not purchased the put option, but is still much higher than the $3.80/bushel that they calculated as what they needed to make to be profitable.

So in scenario 1, where the price of corn has increased, DEF has a profitable outcome.

Scenario 2:

The price of corn remains unchanged at $4.50/bushel on October 23rd. DEF is now ready to sell their corn. The put option gives them the right to sell their corn to UVW for $4/bushel. However, because it’s still possible to sell the corn at $4.50/bushel in the open market, there is no point in exercising that right.

DEF therefore sells their corn for $4.50/bushel in the open market. They also paid $0.10/bushel for the put option though, so the net amount they received is $4.40/bushel. This $4.40 is slightly less than they would have received if they had not purchased the put option, but is still much higher than the $3.80/bushel that they calculated as what they needed to make to be profitable.

So in scenario 2, where the price of corn has not changed, DEF has a profitable outcome.

Scenario 3:

The price of corn has decreased to $3/bushel on October 23rd. DEF is now ready to sell their corn. The put option gives them the right to sell their corn to UVW for $4/bushel. Because the price of corn is now $3/bushel, it is much more preferable for them to use the option to sell it to UVW for $4/bushel.

DEF therefore exercises the put option with a strike price of $4, which means they receive $4/bushel for the corn. They also paid $0.10/bushel for the put option though, so the net amount received is $3.90. Although the price of corn has fallen significantly, the put option has ensured the amount DEF receives does not fall below $3.90. As this is still above the $3.80 level that they set as an acceptable level, this means they have guaranteed they will make an acceptable profit.

Notice in this final scenario that if DEF had not purchased the $4 put option, the new price of corn of $3 would have meant they failed to get an acceptable price for their produce. This could have resulted in significant losses. In scenarios 1 and 2, the put option was not needed in the end, but it only added a small cost of $0.10/bushel, meaning the year was still profitable. In scenario 3 though, the put option was crucial to keeping DEF profitable, as it netted them an extra $0.90/bushel compared to not buying the put option.

So the put option only added a small cost in all 3 scenarios, but saved the year from catastrophe in scenario 3. This property of having a fixed cost, but having the potential to pay off big, is what makes the buying of options so attractive in certain circumstances.

This lecture has covered one hypothetical example where a put option would be useful, and we will cover many more examples, including live trades, throughout the rest of the course. In the next lecture though, we will study how to calculate the profit or loss of a put option.