Buying a put option gives the holder the right to sell the underlying asset, at the strike price, on the expiry date. The option buyer pays a premium for this right, so why not just sell (or short) the underlying directly in the first place?

The main reason is the fixed risk feature of being long a put option. It can also require less capital than shorting the asset (depending on margin requirements). Put options can also be a useful way to hedge downside risk, while maintaining a long position in the underlying asset.

Fixed risk

As we’ve mentioned a few times already, buying a put option has a fixed risk. The maximum amount the trader can lose is the premium they pay for the option.

Let’s take a look at how the profit/loss of a put option compares to shorting the underlying asset. By doing this we can deduce some of the pros and cons of each.

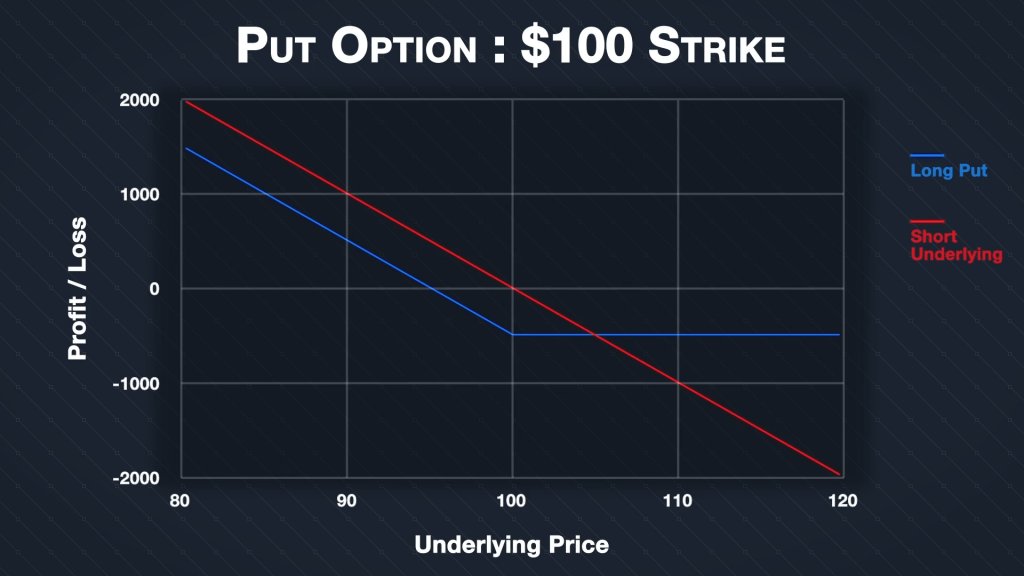

Suppose a stock is trading at $100, and there is a put option for this stock with a strike price also of $100. This put option has a price of $5 per share. This chart shows the profit and loss of the put option at expiration (in blue), and of shorting 100 shares of the underlying (in red).

Shorting (or selling) the stock leads to this straight line (in red) which continues all the way back to an underlying price of zero to the downside, and off to infinity to the upside. If you short 100 shares, every dollar decrease in the underlying price will give you a profit of $100. The only cap on this is if the price falls to zero, which would result in you gaining the full value of the shares you shorted. In this instance as you sold 100 shares at $100 each, if the shares become worthless, you will have gained the full $10,000 you sold them for. Conversely though, every dollar increase in the underlying price will give you a $100 loss, and this is not capped! This means your potential losses when shorting are unlimited.

Let’s compare this to the put option in blue. As you can see, to the downside, the payoff is very similar to shorting the 100 shares. The difference being that as $500 of premium was paid for the option, the profit is $500 less at every point below the $100 strike price. So far it’s not looking favourable for the put option, but now look at what happens when the underlying price increases instead. The losses of the put option position are limited to the $500 premium paid, no matter what happens to the underlying price. Even if the price goes significantly higher to say $300 per share, the loss is still only $500. Compare that to the $20,000 potential loss of shorting the stock outright and price moving to $300, and it’s a clear advantage for the put option.

The point at which these two lines intersect is $105. This can be calculated as the current stock price of $100, plus the premium per share of $5 paid for the option. It’s at this point that the put option would have exactly the same profit/loss as owning the shares. For any point to the right of this, it would be much more beneficial to have the put option rather than the shares. For any point to the left of this, it is a little more profitable to have shorted the shares, but both gain from all further price decreases.

In other words, by opting for the put option instead of shorting the shares initially, you’re sacrificing a small fixed amount of your potential profit, for the guarantee that you can’t lose more than the amount you pay for the option.

Potentially lower cost

How much you require in your account to short something will depend on the margin requirements of whatever platform and asset you are trading. Unless using very high leverage though the capital required to open the short will be higher than the amount required to purchase the option.

Even if high leverage is available, if the price moves against you, you would quickly need to add more funds to keep the short position open. This is not the case for the put option, as the most you will ever need is the amount paid for the option.

This means that by purchasing the put option, you can gain very similar exposure to a decrease in the price of the asset, but without tying up as much capital, and without the risk of needing to add more.

Hedging downside risk

Put options also offer an alternative to closing a long position in the underlying. Imagine for example, if you purchased 100 shares at $60 each, and the price has increased to $100 a share. This leaves you with a nice profit that you would like to protect and so are considering selling the shares. However, what if you still think there is a chance it could continue to increase up to $150?

Selling the shares now to realise your gain of $40 per share would mean you don’t benefit from any further increase in price. If you buy a put option with a strike price of $100 instead, you will still be able to sell the shares at $100 each if the price decreases, but you will also still benefit if the price does indeed continue to increase to $150.

You will of course need to pay the premium to purchase the put option, but if you believe the price is worth paying, the put option may be a superior way of locking in most of your unrealised profit from owning the shares.

The effect of time

As well as the premium that is paid for the put option, there is one major disadvantage worth mentioning, and that’s the inherent time limit that an option has. If the expiry date is reached and price has failed to decrease, the option will expire worthless and result in a loss for the put option trader. To regain exposure to price decreases they would need to buy another put option, whereas a trader who had shorted the shares instead could simply continue to hold the position.

So when purchasing a put option, there is more pressure to be correct about the timing of the move as well, not just the direction.

In summary

Shorting an asset can require a lot of capital, and even if the capital requirements are lowered using leverage, this still means that more capital will need to be added if price increases. Shorting also has the potential for large losses if the price of the asset increases significantly.

Buying a put option will usually require less capital. The maximum loss of a long put option position is also fixed to the premium paid.

These properties make put options ideal for traders who want to limit their risk, while still participating in almost all of any decreases in the underlying price.

The costs of gaining these attractive properties are the premium paid for the option, and the inherent time limit the option trade has to work.