In this second put example we’re going to sell a put option live on Tastyworks. As with the example in the previous lecture, we will then look at what our potential profit will be at expiration, taking into account the premium we pay and the strike price, and we will then let the option expire. Once the option has expired we will analyse how the position performed and calculate how much profit/loss was made.

We’re using SLV again, so let’s take a quick look at the current price of SLV on a chart I’ve pulled from Trading View.

Today is Monday 14th December 2020, and SLV is currently trading at around $22.20. As with the previous SLV examples, this is a one hour chart of the price, meaning each candle represents one hour.

Let’s say we have a view that the price will finish this week above last week’s low of $21.93, so we decide to sell the $21.50 strike put option that expires this Friday (which is December 18th). Let’s head over to the tastyworks software to check out the prices and place the trade.

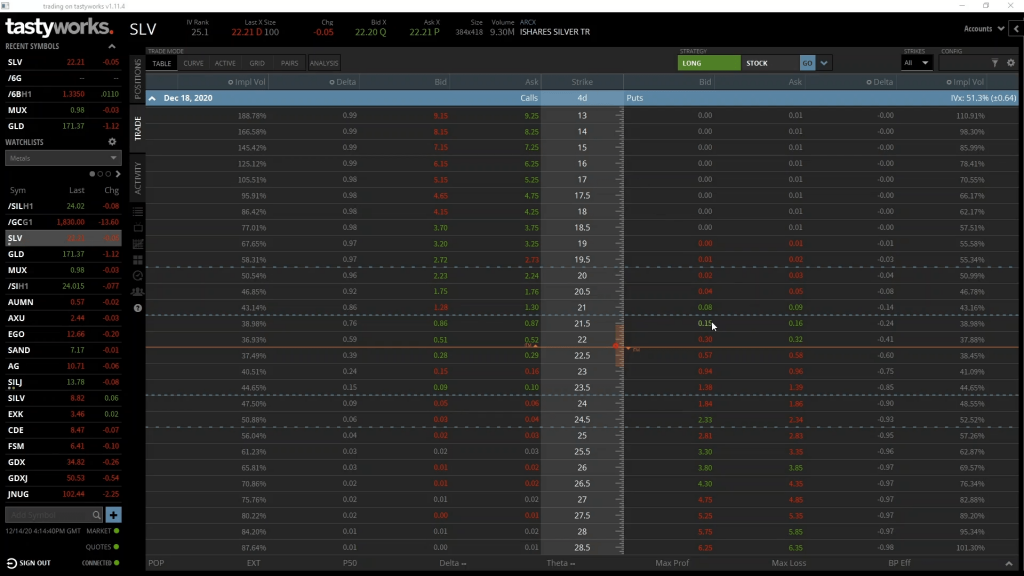

Here we have the option chain for SLV. As you can see in the top left here, I’ve expanded the December 18th expiry date, so every option on the screen here expires on Friday.

We’re interested in the $21.50 strike price, which we can find in the middle column. And we want the put, so we head right from here.

The bid is what we could currently sell this option for immediately, which is 15 cents in this case. The ask is what we could currently buy this option for immediately, which is 16 cents in this case. As we are selling this put today, it’s the bid price that we are interested in.

To populate the order form with an order to sell the put, we can click on the bid price of 15 cents. As in the previous example, instead of just selling straight into the bid price of 15 cents, we’re going to set a limit order with a price of 16 cents. This will mean we aren’t guaranteed to get filled, but if we do get filled, we will have sold the option for a slightly higher price.

After populating the form, I’ve increased the limit price of the order to 16 cents, and will send this into the market to wait for a fill. Once SEND ORDER is clicked, the pop up tells us the order has been sent correctly and is working in the market. Now we just wait to see if someone is willing to buy into our sell order.

It took about 3 minutes to fill this time. We’ve now sold the $21.50 put option that expires in 4 days, and we’ve sold it for $0.16 a share. Before skipping ahead to see what happened, let’s look at what could happen with this position depending on what happens to the price of SLV in the next four days.

What could happen

Let’s remind ourselves of the option parameters we have for this position.

-The underlying asset is shares of SLV

-The option type is put

-The expiry date is 18th December 2020

-The strike price is $21.50

-The option price (or premium) is $0.16 per share

As this is a real world example we will also include the fees in our calculations.

The total fees and commission for our order were $1.15. As the contract multiplier for SLV is 100, each option contract represents 100 shares of SLV. We sold 1 contract, representing 100 shares, so this total fee of $1.15 equates to a fee per share of $0.0115. Again, this per share amount will help us in some of our calculations.

PNL chart

Given all the parameters we just covered, this is the PNL chart at expiry for this option position.

For any price of SLV above the strike price of $21.50, we will make the maximum possible profit. This maximum profit is limited to the premium we collected, minus the fees. We collected a premium of $0.16 per share, and the fees were $0.0115 per share. This gives us a total credit per share of $0.1485. As the contract multiplier is 100 and we sold 1 contract, this equates to a total maximum profit of $14.85. And as usual this amount is what was shown as the total credit when we placed the order on Tastyworks.

If SLV is any price below our strike price of $21.50 at expiry, we can calculate our profit or loss using this formula:

(Premium + Price At Expiration – Strike Price) * Contract Multiplier * Number Of Contracts

This is similar to the formula we gave in lecture 5.3, except because we are the seller it has been multiplied by negative one.

Instead of just using the premium collected per share of $0.16, we can use the total collected per share, which includes the fees. So $0.1485 per share.

The profit/loss line decreasing to the left of our strike price is this same formula plotted for each underlying price of SLV at expiry.

As an example, if the price of SLV at expiration is $20.90, we can calculate our profit as:

(0.1485 + 20.90 – 21.50) * 100 * 1 = -$45.15

If the price of SLV at expiration has decreased to $20.90, the option to sell SLV at $21.50 is clearly worth $0.60 per share, for a total of $60. As we are the seller of this contract this represents a loss for us. As we also collected $14.85 in total for this option, this gives us our total loss of $45.15.

Breakeven

You may remember, the formula for the breakeven point of a put option is:

Breakeven Point = Strike Price – Premium Paid

As with the profit calculations, instead of using just the premium collected, we will use the total credit including fees, which is $0.1485 per share. The breakeven point is then calculated as:

$21.50 – $0.1485 = $21.3515

This is the point at which the profit/loss line crosses the x axis.

What actually happened

Now we’ve studied what could happen, let’s jump forward and find out what actually did happen. Here we have the same 1 hour price chart of SLV we looked at just before placing the trade. Except now of course, it’s the end of Friday 18th December, so the option has expired.

We can see the point in time we sold the put option 4 days ago on the 14th. Since then the price has increased significantly, and finished the Friday session at $23.96. This is well above the strike price of $21.50, so the put option has expired worthless, resulting in the maximum possible profit for this trade of $14.85.

Underlying position comparison

We began with a view that the price would not decrease below last week’s low, and sold the option. This resulted in a maximum profit of $14.85, but how does this profit compare to a position in the underlying? What if we had just bought 100 shares of SLV instead?

The price of SLV was $22.20 when we sold the put option, so we could have purchased 100 shares for $2,220 instead. At the end of Friday the price had increased to $23.96, meaning we could have sold the 100 shares for $2,396. This means that purchasing the shares instead would have resulted in a profit of $176 (minus a few cents in fees).

Due to how far the price rallied higher this week, buying the shares therefore would have resulted in a significantly larger profit than selling the put. By selling the put we capped our potential profit at the premium collected minus fees.

To complete this section you must take the quiz below: