A put option gives the holder the right to sell something. The same is true for a cryptocurrency put option. When a put option expires, it’s value will be equal to any amount below the strike price that the underlying price is when the option expires. Again this is true for cryptocurrency put options, so why do we have a separate lecture for calculating the profit/loss of cryptocurrency put options?

Just like with the cryptocurrency call options in section 4, the reason is that while the profit or loss is still calculated in dollars, the cryptocurrency put options on Deribit use the cryptocurrency itself as collateral. This means that after calculating how many dollars the put option is worth at expiry, this amount must then be converted into the cryptocurrency. The premium paid for the option is also set in cryptocurrency, so when calculating the profit we need to subtract the amount of cryptocurrency paid for the option, from the amount of cryptocurrency received.

For this lecture we will be using bitcoin specifically as the cryptocurrency, but this applies equally to the ethereum contracts, or any other contract that uses the asset itself as collateral.

Calculating profit/loss in bitcoin

Example 1

Suppose bitcoin is currently trading at a price of $15,000. We expect the price to decrease so we purchase a bitcoin put option with a strike price of $15,000. The price of this put option is 0.1 BTC, that’s 10 percent of a bitcoin.

At expiry, the price of bitcoin has indeed decreased to $12,000, and we would like to calculate what our profit is. Remember the balances and profits are paid in bitcoin so our end result will be an amount of bitcoin that we have made.

The first step is exactly the same as the steps we took in lecture 5.3, where we calculated the profit/loss of put options that only used dollars. We first calculate how much the option is worth in dollars at expiry.

The price of bitcoin at expiry is $12,000, and the strike price is $15,000, so to calculate the value of the option in dollars, we subtract the underlying price from the strike price.

$15,000 – $12,000 = $3,000

The option is therefore worth $3,000 at expiry. So, how much is this in bitcoin? We know the current price of bitcoin is now $12,000, so $3,000 has a value of 0.25 BTC. This is calculated as:

$3,000 / $12,000 = 0.25

This means that when the option expires, we will receive 0.25 BTC into our account.

There is one more step before we know our total profit/loss for the trade. We need to subtract the premium we paid. We initially paid a premium of 0.1 BTC for this option so our profit/loss can be calculated as:

0.25 – 0.1 = 0.15 BTC

That’s it. Our profit on this put option is 0.15 bitcoin.

General formula

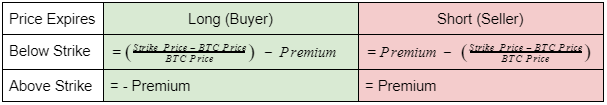

Before we work through some more examples, it’s worth expressing this process as a general formula. As with our calculations from section 5, if the a put option expires out of the money, that is the underlying price is above the strike price at expiry, then the buyer’s loss is equal to the premium paid for the option.

If the underlying price is below the strike price though, then we can calculate the profit or loss in bitcoin using this formula.

And of course, any profit for the buyer is a loss for the seller, and vice versa. So the formulas for the seller’s profit or loss are the negative of the formulas for the buyer’s profit or loss.

Armed with these formulas, let’s tackle a few more calculation examples.

Example 2

Suppose bitcoin is currently trading at a price of $15,500. We expect the price to decrease so we purchase a bitcoin put option with a strike price of $15,000. The price of this put option is 0.06 BTC.

At expiry, the price of bitcoin has indeed decreased to $10,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $10,000 is below the strike price of $15,000, so the put option has some value, and we can use the formula in the top row.

=((Strike Price – BTC Price)/BTC Price) – Option Price

=((15000 – 10000)/10000) – 0.06

=0.5 – 0.06

=0.44

This long put option position therefore made a profit of 0.44 BTC.

Example 3

Suppose bitcoin is currently trading at a price of $22,000. We expect the price to decrease so we purchase a bitcoin put option with a strike price of $21,000. The price of this put option is 0.065 BTC.

At expiry, the price of bitcoin has indeed decreased to $20,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $20,000 is below the strike price of $21,000, so the option has some value, and we can use the formula in the top row.

=((Strike Price – BTC Price)/BTC Price) – Option Price

=((21000 – 20000)/20000) – 0.065

=0.05 – 0.065

= -0.015

This long put option position therefore made a loss of 0.015 BTC. Notice this time that the price still moved in the desired direction, and the option did have some value at expiry, but this value was not large enough to make up for the premium paid for the option. This resulted in a small loss.

This highlights why it is not enough for the price to simply move below the strike price. For the put option to make a profit at expiry, price also needs to move far enough to compensate for the premium paid. In other words to the breakeven point, which we will calculate later in section 6.

Example 4

Suppose bitcoin is currently trading at a price of $18,200. This time, we expect the price to stop decreasing so we sell a bitcoin put option with a strike price of $18,000. The premium we collect for this put option is 0.09 BTC.

At expiry, the price of bitcoin has actually decreased to $16,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $16,000 is below the strike price of $18,000, so the option has some value, and we can use the formula in the top row. But we are the seller this time, so it’s the seller formula that we use.

=Option Price – ((Strike Price – BTC Price)/BTC Price)

=0.09 – ((18000 – 16000)/16000)

=0.09 -0.125

= -0.035

This short put position therefore made a loss of 0.035 BTC.

Example 5

Suppose bitcoin is currently trading at a price of $27,500. We expect the price to stop decreasing so we sell a bitcoin put option with a strike price of $27,000. The premium we collect for this put option is 0.06 BTC.

At expiry, the price of bitcoin has increased slightly to $27,400, and we would like to calculate what our profit or loss is.

The bitcoin price of $27,400 is above the strike price of $27,000, so the option has no value, and we can use the simple formula in the bottom row.

= Premium

= 0.06

This short put position made a profit of 0.06 BTC.

Example 6

One last example. Suppose bitcoin is currently trading at a price of $27,400. We expect the price to decrease so we purchase a bitcoin put option with a strike price of $27,000. The price of this put option is 0.12 BTC.

At expiry, the price of bitcoin has increased to $35,000, and we would like to calculate what our profit or loss is.

The bitcoin price of $35,000 is above the strike price of $27,000, so the option has no value, and we can use the formula in the bottom row.

= – Premium

= – 0.12

This long put option position therefore made a loss of 0.12 BTC. It doesn’t matter that the price of bitcoin increased way above our chosen strike price of $27,000. The maximum a long put option position can lose is the premium paid.

Summary

This lecture should serve as a useful reference for checking how the calculations are made. You may wish to come back to it when we’re working through more examples later in the course, or when you’re calculating the profit/loss of your own option positions.

As we mentioned in section 4, while it is useful to know how to do these calculations yourself, once you’re trading live you’re unlikely to want or need to do these calculations by hand every time. In practice you will use a spreadsheet, option calculator, or a tool like the Deribit position builder (pb.deribit.com).