An option that expires, either expires ITM, meaning it has some value, or it expires OTM, meaning it expires worthless (Any option that expires precisely ATM also expires worthless).

When an option expires ITM, it’s value is equal to the distance between the strike price and the underlying price at expiry.

Although we will ignore this detail for this lecture, it’s worth mentioning again quickly that Deribit options actually settle on a 30 minute time weighted average price (TWAP) of the relevant Deribit index, rather than the price at the second the option expires. On Deribit you can see a list of each daily delivery price in the delivery price log on the index page.

When there is still time left before an option expires, the option’s value can be split into two parts, its intrinsic value, and its extrinsic value. All options have extrinsic value, but only ITM options have intrinsic value. The intrinsic value is equal to how far in the money the option is.

When an option expires, any extrinsic value resulting from time and volatility has disappeared, so all that is left is any intrinsic value.

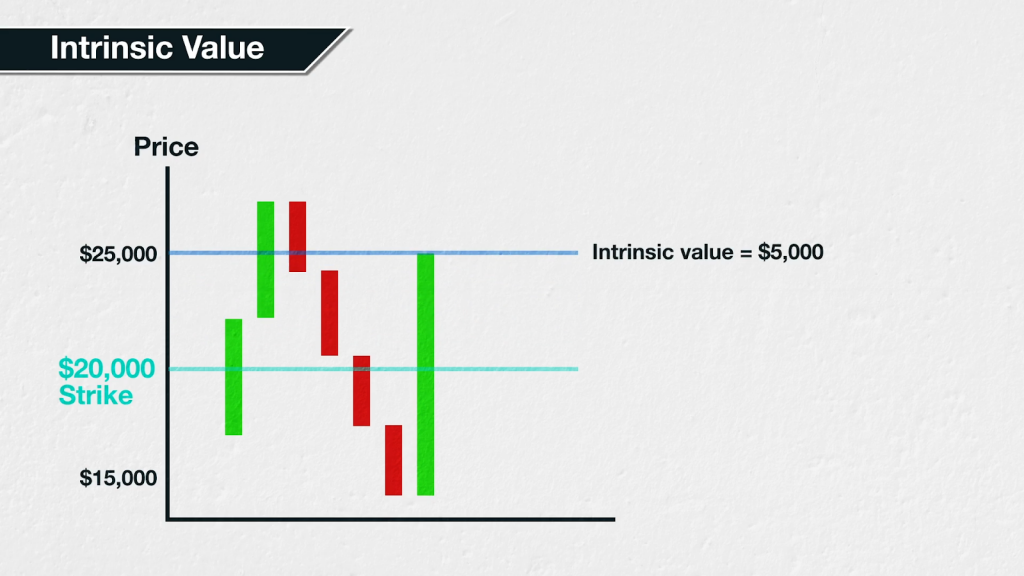

Intrinsic value

As was just mentioned, intrinsic value is how far in the money an option is. For example, imagine you purchase a bitcoin call option with a strike price of $20,000.

If the current price of bitcoin is $15,000, then your call option has an intrinsic value of zero. The call is not in the money so has no intrinsic value currently.

If the current price of bitcoin increases to precisely $20,000, then your call option still has an intrinsic value of zero. While the price is in a much more favourable place relative to the strike price now, the call is still not in the money so has no intrinsic value.

If the current price of bitcoin increases further to $25,000, then your call option has an intrinsic value of $5,000. The current bitcoin price of $25,000 is $5,000 higher than the $20,000 strike price of your call option, meaning your call option is $5,000 in the money, and therefore has an intrinsic value of $5,000.

For put options, they have intrinsic value when the underlying price is below the strike price. If we assume an underlying bitcoin price of $51,000, the following shows the intrinsic value of both puts and calls of various strike prices.

| Underlying bitcoin price at $51,000 | ||

| Strike Price | Call Intrinsic Value | Put Intrinsic Value |

| 40,000 | $11,000 | $0 |

| 45,000 | $6,000 | $0 |

| 50,000 | $1,000 | $0 |

| 55,000 | $0 | $4,000 |

| 60,000 | $0 | $9,000 |

For any strike prices below the current bitcoin price of $51,000, the calls are ITM and have intrinsic value. However, the puts are OTM and have no intrinsic value.

For any strike prices above the current bitcoin price of $51,000, the calls are OTM and have no intrinsic value. However, the puts are ITM and so do have intrinsic value.

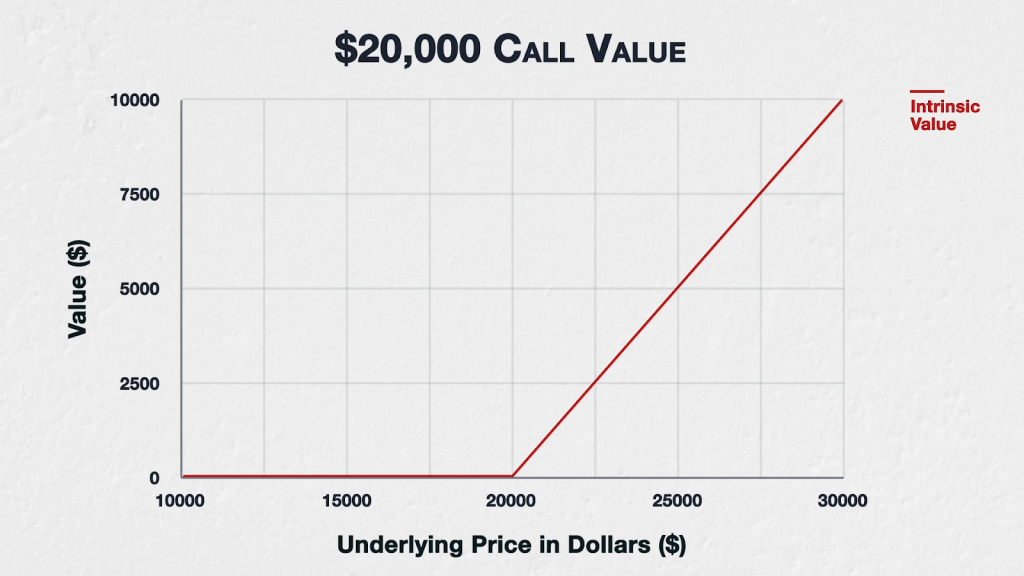

Plotting intrinsic value

We can plot the intrinsic value for every possible underlying price of bitcoin like so.

As you can see the $20,000 strike call option has zero intrinsic value when the price of bitcoin is below $20,000. The intrinsic value then increases linearly 1:1 as the underlying price of bitcoin increases.

You may recognise this shape as this looks almost identical to the profit/loss line at expiry for a call option. The difference here being that no adjustment has been made for the premium paid for the option. Another way you could describe intrinsic value is ‘how much the option would be worth if it was exercised or expired immediately’.

Extrinsic value

If there is still time left before an option expires though, it will also have extrinsic value. If we subtract the intrinsic value from the current price of the option, anything that remains is extrinsic value.

Let’s use the last example where you purchased a $20,000 call option, and the price of bitcoin had increased to $25,000. Let’s also assume that the current price for this option is $8,000.

We already know that the intrinsic value is currently $5,000, because the price of bitcoin is $5,000 higher than our call option’s strike price, meaning the option is $5,000 ITM. To calculate the extrinsic value, we simply subtract this intrinsic value from the current option price.

Extrinsic Value = Option Price – Intrinsic Value

This gives us:

$8,000 – $5,000 = $3,000

So our call option has an extrinsic value of $3,000, and an intrinsic value of $5,000, giving a total value of $8,000 currently.

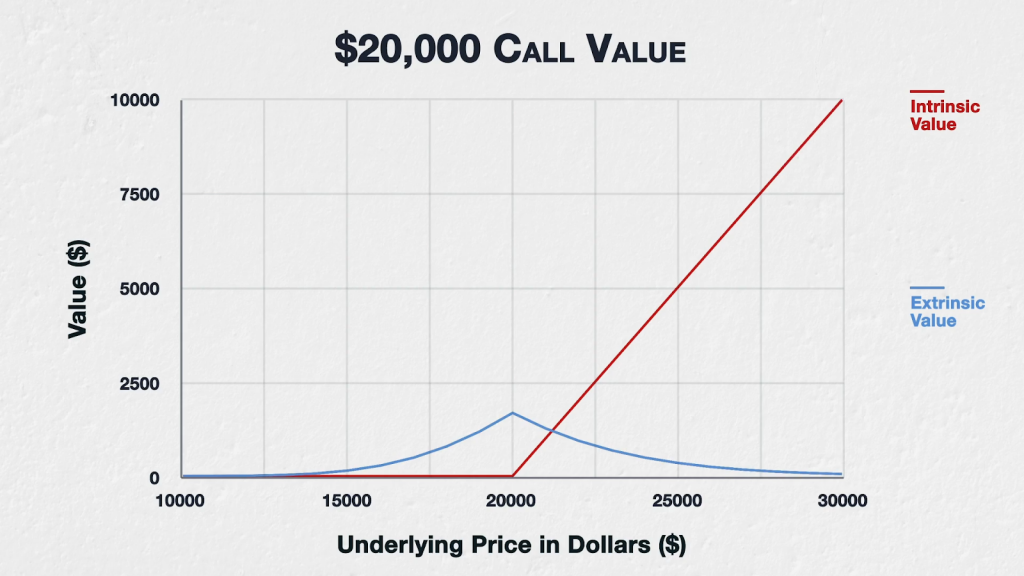

Plotting extrinsic value

We now know how to calculate both intrinsic and extrinsic value, but we still haven’t yet talked about what factors affect the extrinsic value. Intrinsic value is determined by how far in the money the option is, and is therefore not affected by any other parameters. Extrinsic value though, can be affected by:

-Time to expiry

-Implied volatility

-Risk free interest rates

-Dividends

-Where the underlying price is relative to the strike price

Each of these parameters is an input in the Black Scholes option pricing model. The three parameters that have the largest effect on an option’s extrinsic value are time to expiry, implied volatility, and where the underlying price is relative to the strike price. And on Deribit the interest and dividend rates are actually assumed to be zero for Black Scholes calculations.

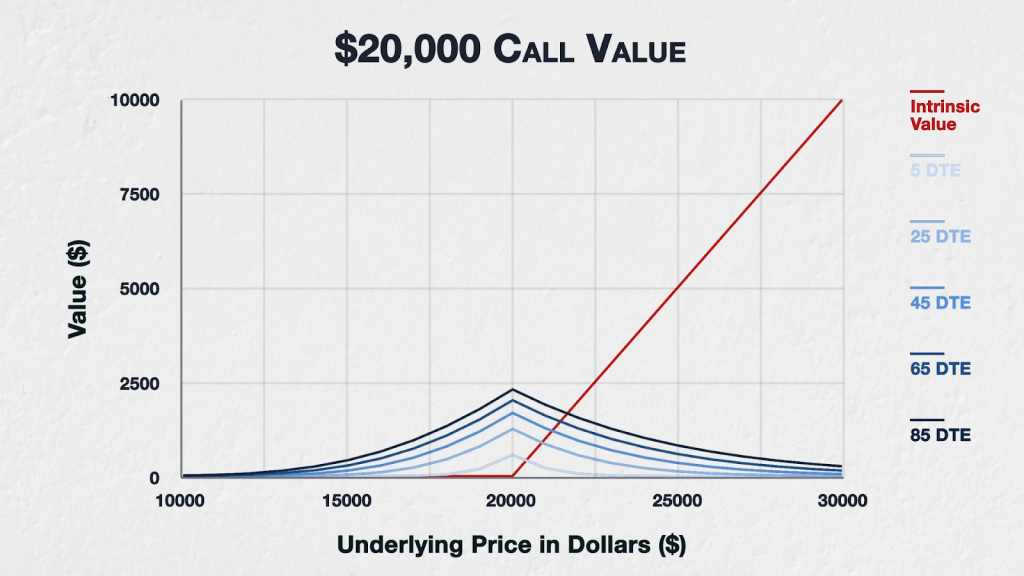

Let’s take a look at how these three main parameters affect the extrinsic value. Here we have the same plot of intrinsic value as before, but now we’ve added the extrinsic value as well, as a separate line.

All other things being equal, the extrinsic value is highest when the option is at the money, and extrinsic value decreases in both directions the further away from the strike price the underlying asset price is.

Time to expiry

For the current extrinsic value line we have assumed a time to expiry of 45 days. Now let’s also add some different values for time to expiry and see how this affects the extrinsic value.

All other parameters have been left the same, so the only change here is the time to expiry. As we can see, the more time left until the option expires, the more extrinsic value the option will have.

These lines have been plotted using a Black Scholes option calculator I made in excel. You can find an example of a web version of one of these calculators here:

http://www.option-price.com/

If you prefer to make your own more powerful calculator in excel, which I strongly recommend, you can use the script made available on this blog: https://www.philadelphia-reflections.com/blog/2394.htm

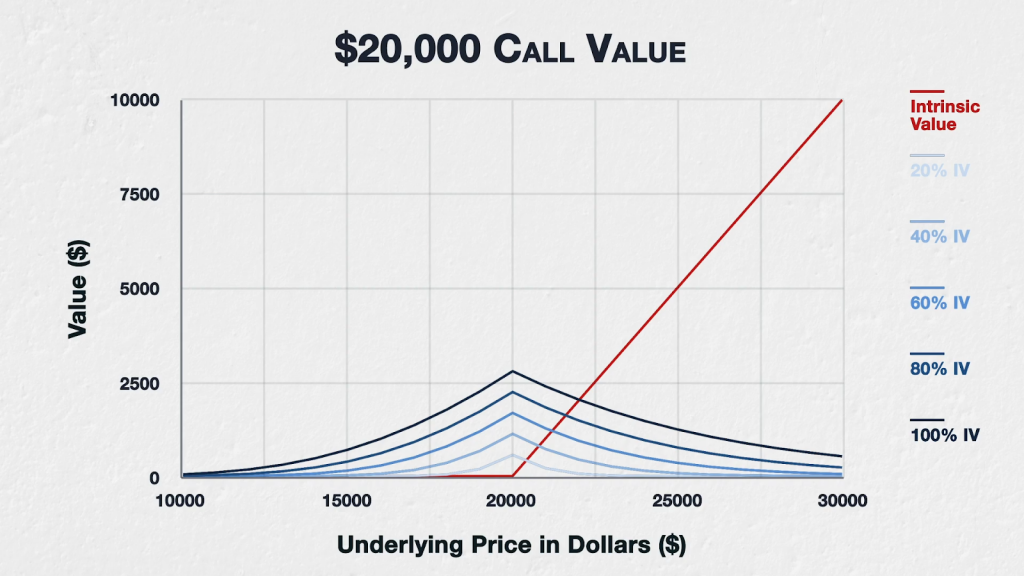

Implied volatility

Going back to the original line, we have assumed an implied volatility of 60%. This time let’s instead add some different values for implied volatility and see how this affects the extrinsic value.

All other parameters have been left the same, so the only change here is the implied volatility. As we can see, the higher the implied volatility, the more extrinsic value the option will have.

With the different values for both time to expiry, and implied volatility, the extrinsic value is still usually the highest when the underlying price is very close to the strike price. The further away from the strike the underlying price moves in either direction, the lower the extrinsic value will be.

Summary

That’s quite a few charts for one lecture, so let’s recap the important points to remember.

Intrinsic value is how far in the money the option is. Only ITM options have intrinsic value.

As long as there is some time remaining before expiration, then ITM, ATM, and OTM options all have extrinsic value. The extrinsic value is equal to the option price minus the intrinsic value.

Extrinsic value is usually highest for ATM options, decreasing in both directions away from the ATM strike.

All other things being equal, the more time to expiry, the higher the extrinsic value of the option will be.

All other things being equal, the higher the IV, the higher the extrinsic value of the option will be.