In this article, we will explore the dramatic improvement in liquidity for Future Spreads on Deribit, and highlight who this enhanced liquidity will benefit the most.

What is a future spread?

Most traders will be familiar with the concept of trading a single future, with a long position on that future benefitting from an increase in price, and a short position benefiting from a decrease in price. Traders may also be familiar with the fact that futures contracts with different expiry dates can have different prices, even when they have the same underlying asset.

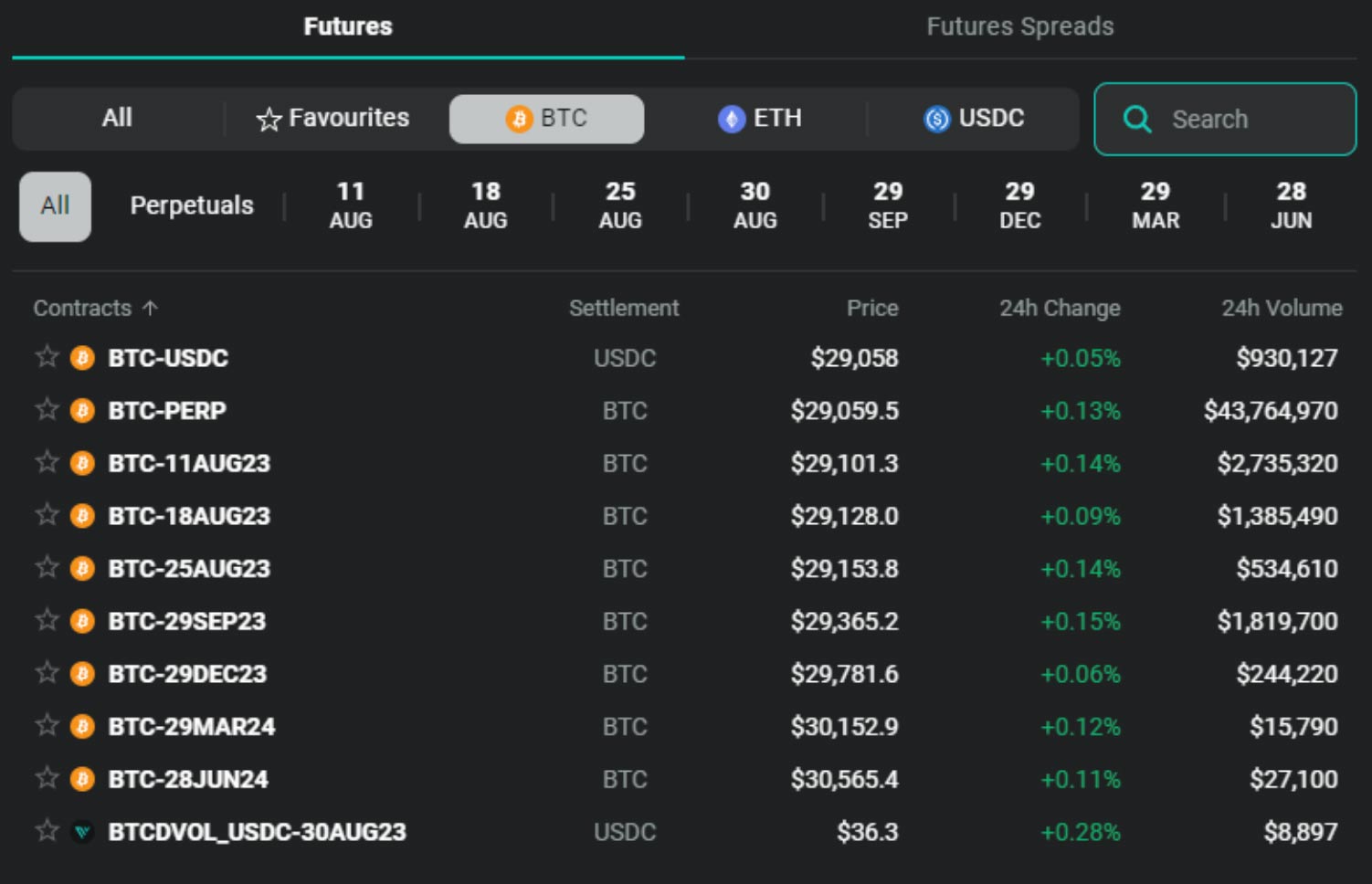

For example, Deribit offers several futures contracts on bitcoin at any given time that each expire on different dates, and the March contract will typically have a different price to the June contract. The June contract will also have a different price to the September contract etc.

This is a screenshot of the futures menu on deribit. In the Contracts column we can see the different futures contract dates, and the Price column shows the different prices for each of those contracts. For example, we can see that the bitcoin future contract that expires on the 29th of September has a mark price of $29,365.20, and the bitcoin future contract that expires on the 29th of December has a mark price of $29,781.60. In fact every future contract on the list has a different price.

The size of the difference between each of these futures contracts is also not static. It will change over time, and can be either positive or negative. The difference in price between two futures contracts can be traded using a Future Spread.

Future Spread order books

On Deribit, there are order books specifically for trading two different futures contracts in opposing directions in a single order. These are called Future Spreads.

How good is the liquidity?

To indicate just how good the liquidity has become for the Future Spreads, I took two random snapshots of the available Future Spreads and noted two statistics. The first statistic is how many of the spreads are quoted a single tick wide*, and the second statistic is for any Future Spreads that were quoted wider than one tick, what was the largest difference between the bid and ask as a percentage of the index price.

*Currently one tick is $0.50 for BTC, and $0.05 for ETH. Being quoted one tick wide means that the difference between the bid price and the ask price is as small as possible.

These were the results:

1st August 2023 at approximately 21:00

BTC:

- 22/28 order books quoted one tick wide

- Largest bid/ask spread: 0.094% of index

ETH:

- 26/28 order books quoted one tick wide

- Largest bid/ask spread: 0.032% of index

2nd August 2023 at approximately 13:00

BTC:

- 23/28 order books quoted one tick wide

- Largest bid/ask spread: 0.024% of index

ETH:

- 28/28 order books quoted one tick wide

- All spreads were only one tick wide

As we can see, the majority of the Future Spreads for both BTC and ETH are being quoted only one tick wide, and on the second snapshot 100% of the ETH Future Spreads were quoted as tightly as they possibly can be. It’s also worth noting that the resting quote sizes are typically well over $100,000 on both sides, giving traders the possibility to fill orders in either direction immediately.

Who benefits from this great double sided liquidity?

Obviously anyone wanting to speculate on the spread between two futures contracts will enjoy being able to move in and out of their positions with such ease. The combination of tight bid/ask spreads, good sized quotes, and the fee discount for trading the two futures by using a single Future Spread order book, will help to keep trading costs like slippage and fees to a minimum.

Traders speculating on the spreads themselves aren’t the only ones who benefit from this liquidity though. It is also possible to use the Future Spreads to roll a position from one future contract to another. Using the single Future Spread order book can be much more efficient than doing the same trade of buying one future and selling another in each of the individual orderbooks.

Traders rolling positions would include:

- Option traders who maintain a delta hedge on a futures contract. They may execute the initial hedge on the perpetual to get access to the largest liquidity for example, but then wish to roll that perpetual position to the dated future contract that matches the option position they are hedging.

- Cash and carry traders who want to roll their position out to the next expiry to capture some more premium.

Notice in both of these examples that the traders only have a position on one future contract at a time. They are simply using the Future Spread order book to move their position from one contract to another. This highlights how it is not necessary to be holding opposing positions on two different futures contracts for the Future Spreads to be useful.

Other benefits of Future Spreads

As we have covered, by using a Future Spread instead of executing two separate trades in the individual order books for the two different future contracts, traders get the benefit of impressive double sided liquidity. However, they also benefit from having no leg risk (both legs are executed at once), a known price for the combination of both legs, and not having to monitor and manage orders in two order books until they are both filled.

AUTHOR(S)