Summary: We warned last week that Bitcoin would likely consolidate for the rest of the year within the 40,000 to 45,000 range. Bitcoin tends to decline into Christmas, such as last year, and the decline was even more likely with more institutional players involved. While no news nor associated economic data release caused the Bitcoin to sell off on Monday, the unwinding appears to have primarily occurred within the spot market AND subsequently within the TradeFi futures markets – NOT within the crypto native perpetual futures market.

Analysis

After weeks of being excessively bullish (here, here, here), we warned last week (here) that Bitcoin would likely consolidate for the rest of the year within the 40,000 to 45,000 range. Our market structure analysis indicated that leveraged long positions were stretched, and the panic buying ahead of the critical macroeconomic events, such as the CPI data release and the FOMC meeting, combined with the upcoming Christmas holidays, could cause traders to close positions.

We also noted that Bitcoin tends to decline into Christmas – such as last year, and with more institutional players involved, the decline was even more likely. The positioning on the CME Bitcoin futures indicated a very bullish position that is unlikely to be carried over the Christmas holidays as the futures traded at a significant premium to the spot market. Another negative factor was the technical divergence between a rising Bitcoin price and a lack of follow-through from technical indicators, signaling that a correction could occur as momentum waned.

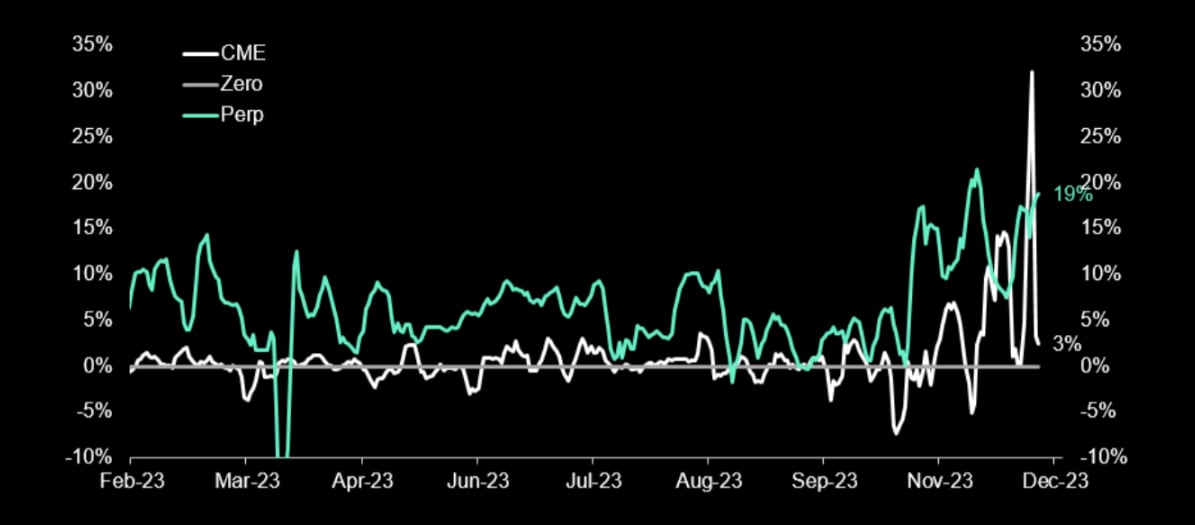

Exhibit 1: CME Bitcoin futures premium over spot (5-day average)

Our suggested trade was to sell the December Bitcoin calls with a strike level of 45,000 and buy the same one for the January expiry. While the time value made the January calls more expensive, we are only concerned with the January period and thought it was prudent to hedge out the December period. For that, we were able to lower our call premium significantly.

In an ideal case, Bitcoin would stay below the strike level on the expiry date of December 29 and expire worthless, leaving us with a cheapened upside call for any potential SEC Bitcoin Spot ETF approval in January.

The price for the December 29 expiry, 45,000 strike Bitcoin call option has declined from $1,350 to just $750, while the January one has declined from $2,950 to $2,100. With implied volatility expected to decrease over the holidays and 45,000 potentially being out of reach for the next three weeks, patience is the name of the game. Instead of buying back the December call after Monday’s seven percent correction, we suggest being patient.

Exhibit 2: Bitcoin found support near 40,000

While no news nor associated economic data release caused the Bitcoin to sell off on Monday, the unwinding appears to have primarily occurred within the spot market AND subsequently within the TradeFi futures markets – NOT within the crypto native perpetual futures market. This fits our explanation that TradeFi traders set tight stop loss levels (43,000) to lock in profits, and those were easily triggered.

While 7% is hardly a correction to write home to your friends, this volatility shortly before the holidays will prevent TradeFi traders from loading up on their risk limits again this year despite a potential bullish outcome from this week’s US inflation report and from Fed Chair Powell’s FOMC press conference where his hawkish stance will continue to be challenged. As we pointed out, Powell had turned mildly dovish in October, which helped facilitate the rally in November and early December.

Nevertheless, we expect this week’s favorable macro outcomes will strongly incentivize Bitcoin to start rising out of the gate on January 1, 2024. Undoubtedly, this year’s +165% Bitcoin rally will facilitate many cheerful conversations around the Christmas tree.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)