Summary: Volatility will likely decline into year-end as an ETF approval appears less likely ahead of the January deadlines. The realized Bitcoin volatility to VIX ratio currently stands at 3.4x while the average has been 2.4x in 2023 – hence, Bitcoin volatility is 30% too high relative to VIX volatility. This signals that Bitcoin volatility is likely to decline from here. Our base case scenario remains bullish, and buying upside exposure should be done in a relatively neutral vega way – hence buying call spreads – instead of purchasing outright calls – as we expect volatility to decline into year-end.

Analysis

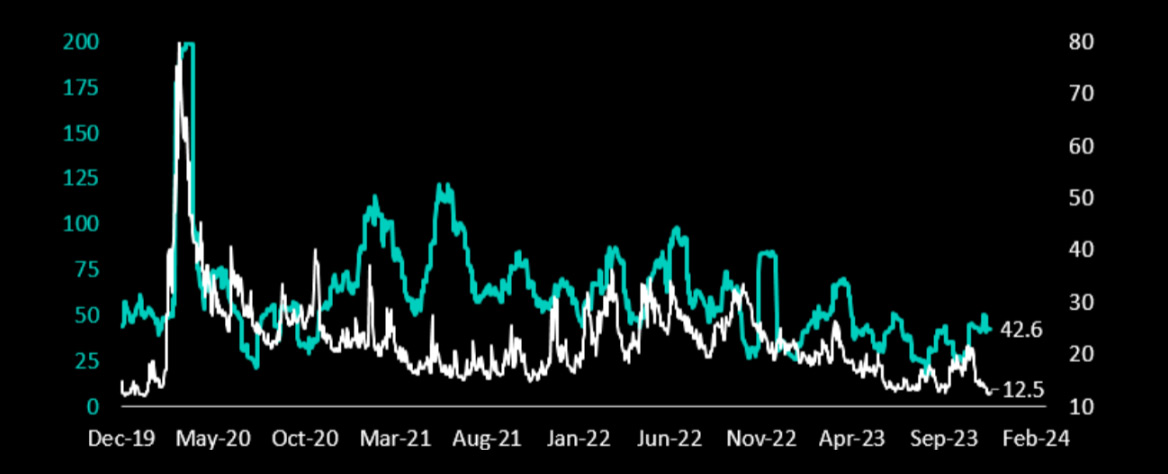

Realized and implied volatility for Bitcoin has surprisingly remained high – despite the SP500 equity market volatility – as measured by the VIX index has declined to multi-year lows. Traders might be fearful of selling volatility ahead of any potential SEC Bitcoin spot ETF approval. Still, as we pointed out during the last two to three weeks, volatility will likely decline into year-end as an ETF approval appears less likely ahead of the January deadlines.

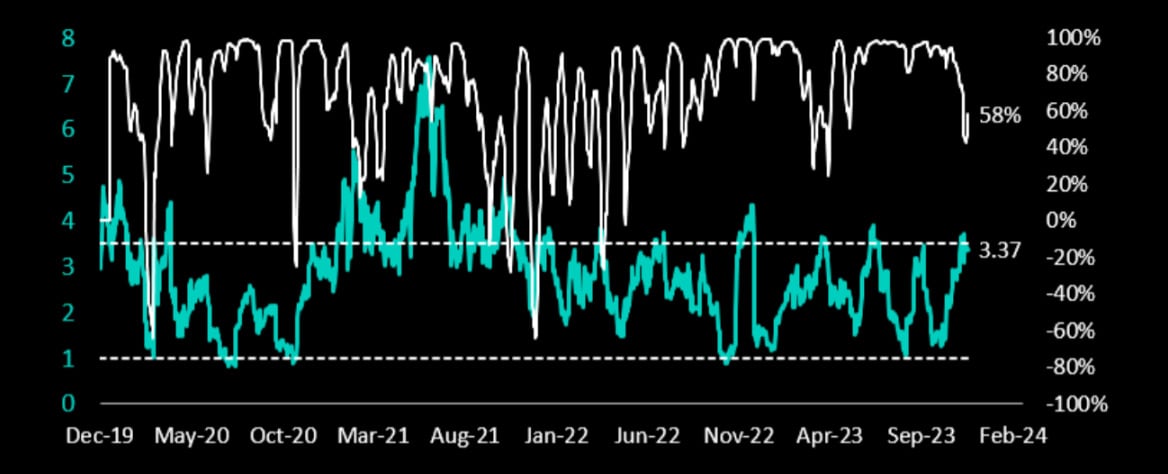

But as this ‘selling volatility’ trade through strangles has not yet worked, it does not mean it won’t work until year-end. On the contrary, the high Bitcoin volatility allows traders to enter this trade at attractive levels. At-the-money implied Bitcoin option volatility is priced at 46% for the end of December expiry, while the 30-day realized volatility trades marginally below this level at 43%. The realized Bitcoin volatility to VIX ratio currently stands at 3.4x while the average has been 2.4x in 2023 – hence, Bitcoin volatility is 30% too high relative to VIX volatility. Traders could hedge Bitcoin exposure with SP500 put options as the correlation coefficient has remained at 58% over 30 days. Traders could sell Bitcoin options as volatility appears overpriced based on the general perception of market risk.

Exhibit 1: Bitcoin 30d realized vol / VIX spread (green, LHS) vs. correlation (white, RHS)

While not every trader can trade across markets (Bitcoin vs. SP500 options), the volatility spread ratio between Bitcoin and SP500 is currently at the top of the two- year range. It signals that Bitcoin volatility is likely to decline from here. Historically, selling the vol spread at 3.5x was profitable, and buying Bitcoin vol relative to SP500 VIX vol when the ratio was near 1.0x – as in August and early October 2023 turned out to be a money maker.

Exhibit 2: Bitcoin 30d realized vol (green, LHS) vs. SP500 VIX vol (white, RHS)

A week ago, we expected Bitcoin to break above the 38,000 resistance level. Indeed, Bitcoin broke briefly above this level but failed to gather sufficient upside momentum and moved back into the 35,000 to 38,000 range. A move above 40,000 is still possible, but traders might have been less motivated to chase the upside because of the long Thanksgiving weekend.

However, when we enter December, we still expect Bitcoin to attempt another rally as prices tend to rally by +12% during the last month of the year. Previously, we have shown that Bitcoin prices tend to peak one week before Christmas, and the last FOMC meeting of the year is also on December 12/13, when we would expect the Fed to continue to remain on hold. The tail risk for this meeting would be acknowledging a potential downside from the labor market. The prospect of rate cuts could also cause a rally in Bitcoin prices. Another wild card is undoubtedly an annual inflation data point with a ‘two-handle’ as this would also raise speculation that the Fed could eventually signal rate cuts.

It also appears that the bull market continues to broaden with Bitcoin’s dominance indicator declining and network fees and altcoin blockchains increasing to the highest since summer. The key will be to monitor if those network fees are sustained.

Our base case scenario remains bullish, and buying upside exposure should be done in a relatively neutral vega way – hence buying call spreads – instead of purchasing outright calls – as we expect volatility to decline into year-end. As the Bitcoin volatility/VIX vol ratio has remained near the top of its two-year range, selling Bitcoin volatility can still be done at attractive levels.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)