Summary: It would seem unlikely that the SEC would reject the Bitcoin Spot ETF applicants on January 10, 2024, after several discussions with those applicants and adjusting their S-1 filings. By Q1 2024, we expect Bitcoin to attempt to break above the 50,000 level. The expectations for a potential Bitcoin Spot ETF approval will likely hit the market between January 8 and January 10, 2024, making the January 12 options expiry attractive from a tactical perspective. Traders appear to price in that Bitcoin prices could swing by +/- 11% until then. Below, we discuss potential trades into the SEC Bitcoin Spot approval period.

Analysis

It would seem unlikely that the SEC would reject the Bitcoin Spot ETF applicants on January 10, 2024, after several discussions with those applicants and adjusting their S-1 filings. There has been considerable time and money spent on these applications and the re-filings, with the applicants rewriting their filings according to the demands set out by the SEC. Recently, we also heard that the applicants have moved closer to the terms set out by the SEC instead of the other way around.

While the SEC had waited until the last day in previous years to provide feedback to applicants, this time, the agency appears to have made an effort to provide feedback well ahead of time to align applicants.

Our view on December 8 of an expected 40,000 to 45,000 range-bound consolidation continues to play out. A key reason is that fiat-to-crypto inflows have paused after $7 billion was pumped through Tether’s minting process during the last eight weeks.

Surprisingly, Bitcoin’s funding rate remains elevated, indicating that leveraged traders have no interest in surrendering their upside positions and instead pay the punitive funding rate. By Q1 2024, we expect Bitcoin to attempt to break above the 50,000 level. The value of our short December 45,000 calls has dropped by -50% while our long January call declined by -20%. A small win.

The expectations for a potential Bitcoin Spot ETF approval will likely hit the market between January 8 and January 10, 2024, making the January 12 options expiry attractive from a tactical perspective. Traders appear to price in that Bitcoin prices could swing by +/- 11% until then. This would appear relatively narrow for such an important event.

We are keeping in mind that Bitcoin rose from 25,000 when BlackRock filed for an ETF on June 16 and prices hovering around 43,000/44,000. As we do not expect any SEC decision before January 8, traders could sell the January 5 expiry straddle with a strike of 43,000 and buy the straddle with expiry on January 12.

However, our preferred strategy would be to close out the calendar spread after Christmas (but before the new year starts), sell a 45,000 strike call for the January 5 expiry for $1,080, and buy a 45,000 strike call for the January 12 expiry for $1,720.

Bitcoin appears to be technically capped at 43,000 despite another positive refiling from BlackRock’s Bitcoin ETF application. This is a clear sign that applicants are almost coached by the SEC, and we struggle to entertain the view that the SEC would go to great lengths only to reject them again.

The Bitcoin technical indicators scream ‘sell-off around the corner’ as reversal indicators signal that the rally has run out of steam. Still, considering that we are so close to the holiday period, where trading volumes tend to be lower, and as we enter the event risk of January, technical signals should be set aside.

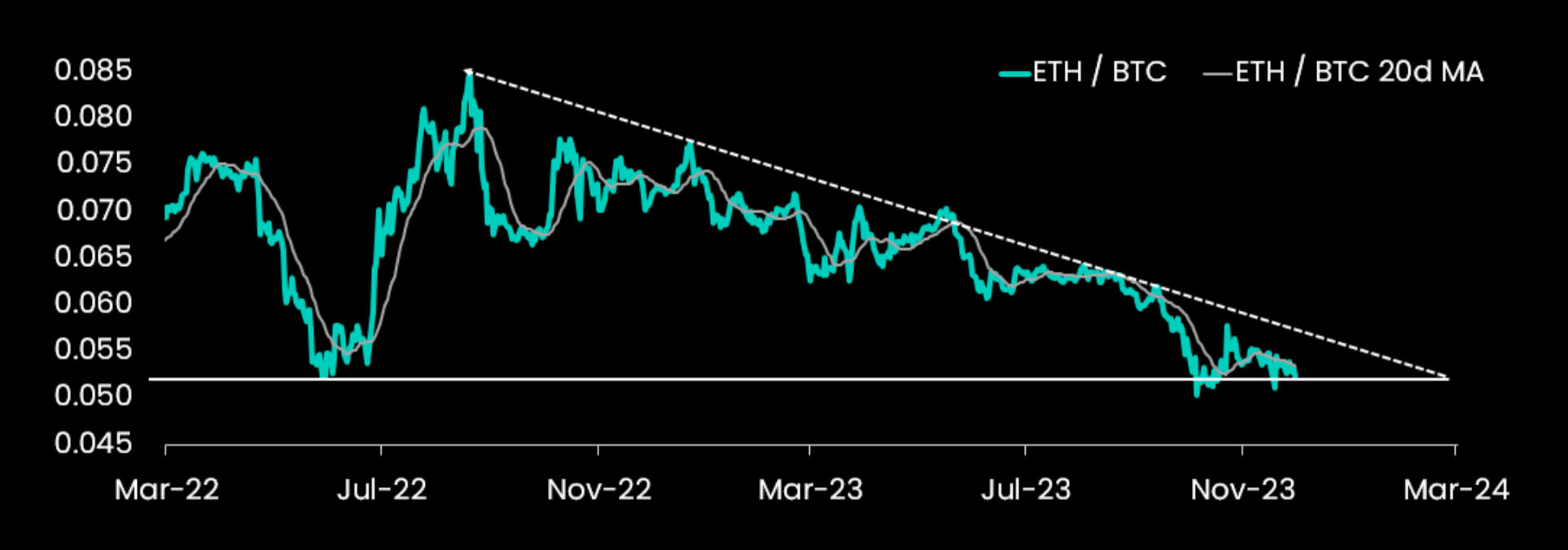

Exhibit: Ethereum/Bitcoin 30-day realized volatility spread at its lows

A key question arises if Bitcoin Spot ETFs are approved: will the SEC also approve Ethereum ETFs? This might be the case with a potential approval date of May 23, 2024. A Bitcoin ETF approval might disproportionally benefit Ethereum as the market is forward-looking. While Ethereum’s volatility tended to be higher, traders could currently buy Ether vol for the same price as Bitcoin vol.

While there is no urgency to focus on Ethereum, traders should monitor if the Ethereum/Bitcoin ratio can break out of the triangle as, historically, higher beta assets – such as Ethereum – have tended to outperform Bitcoin as the bull markets progressed.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)