Over the course of the past few months we have seen a massive collapse in implied volatility. The drop in volatilities happened not just in the front maturities, but along the whole curve (all maturities). Browsing my timeline on crypto twitter (CT) it seemed that many market participants were surprised to see a move of this magnitude. In this article, I’ll highlight some of the events that unfolded over the past few months and give a breakdown on how Implied volatility (IV) and Realized volatility (RV) come about.

As many readers may not be familiar with all the concepts in this article, I’ll first cover some basics. The price of an option in the Black-Scholes-Merton Model (BSM) is dependent on the following five parameters: strike (K), underlying price (S), time to maturity (τ), interest rate (i) and implied volatility (σ). Given that the first four factors are deterministic (are externally predetermined) and can be hedged, the only non-deterministic variable is implied volatility. This is why option traders often refer to the price of an option not in notional value (premium) but instead as implied volatility(e.g. “The 25-Mar 22 50,000 Call trades at 65%”).

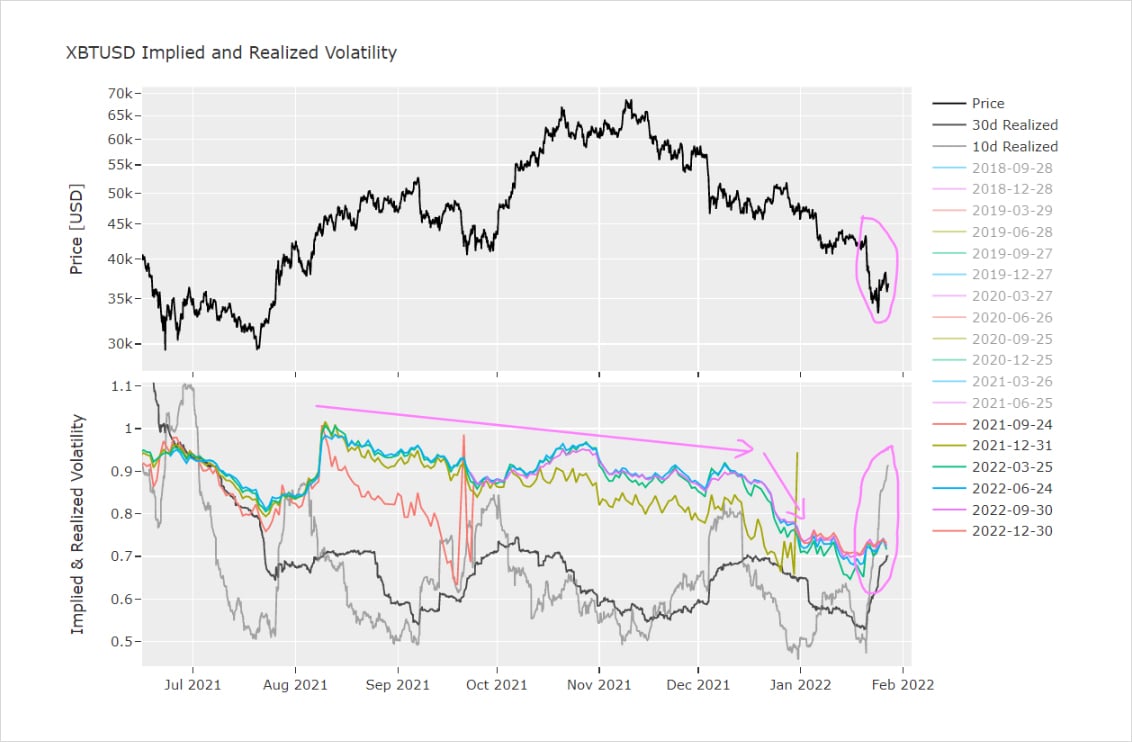

- The following plot shows the BTC price (top chart), at-the-money implied volatilities of quarterly options and 10-day and 30-day realized volatilities (bottom chart).

- We can see that vols have already been drifting lower since the local high around Aug21 but the really big move occurred around and after the Dec21 expiry

There is an extreme difference between implied volatility and realized volatility throughout the time period from Aug21 to Jan22.

When noticing large differences between implied volatility (IV) and realized volatility (RV), it brings the question: what makes IVs move? Some thoughts regarding the assessment whether IV is cheap or rich (expensive) could be:

- We could look at the current implied volatility (IV) and compare it to realized volatility (RV). This however can be quite misleading, because RV is by definition a lagging indicator since it looks into the past. Past price action is not a predictor of future price action. The recent selloff is the best example with 10-day RV spiking up to 90%, as can be observed in the chart above (pink circle on the right).

- To look at the matter in a different angle, we could look at the payoffs of a specific option structure and see what kind of move it implies, think: “The monthly straddle costs 5000$, is $5,000a good price move expectation until expiry?” However, this approach isolates only one specific strategy (here: holding until expiration and not delta hedging) and therefore oversimplifies the matter. Even if a $5,000 price move occurs, if it is slow enough (i.e. with a lower RV than IV), a dealer who is short these straddles still could be in the money by continuously delta hedging, despite the underlying moving much more than $5,000.

- A next step would be to make an assumption about where IV might be trading in the future. If someone is willing to pay more for the mentioned straddle (in IV terms) than we paid for it, we don’t need to hold it into expiry. We could just sell it at the market. In this case RV would be basically irrelevant.

The third point was probably the case beginning in August 2021. IVs moved from 80% to 100%. Options in general during that time period increased significantly in price, despite RV stalling out at 70%. The rally in option prices at the time was driven by very strong call buying flow. Market participants piled into call options in big size in order to get leverage and participate in the consecutive rally that took BTC from $30,000 to $50,000 in a short time span. The interesting point is though: a dealer, who sold short these front month options and consecutively delta hedged her portfolio until expiry still collected time decay (theta).

This example highlights an important point: Different market participants might have different hedging strategies and market views and thus each market participant has their own assumptions of “fair value” for an option or option structure. The directional player might see call options as an attractive way to get cheap leverage, while the vol seller might like to sell this volatility in order to collect time value decay. This leads to the conclusion that what moves IV in the first place is supply and demand (regardless of the RV of the underlying).

A tale of order flow

This is why there is value in keeping track of open interest and market participants and dealers positioning. Getting back to the Aug21 example, at this time the market was overall already fairly vega short (i.e. volatility sellers were already short). The people, willing to sell aggressively volatility, had already deployed their risk. There were simply not enough sellers left to satisfy the strong call buying demand in the market. Hence dealers needed to adjust their offers in order to be able to quote option prices. In hindsight, it’s clear that a lot of risk capital was “locked up” in the large Dec21 expiry. After an expiry all open positions are settled, which generally frees up(a lot of capital. The larger the expiry, the larger the effect. This is a major contributor to the collapse in IVs around the Dec21 expiry. Players with large vol short positions now received dry powder to redeploy into the market.

Another contributor to the lack of positioning is also the lack of major price changes (we can assume that a call buyer or put buyer is usually expecting the underlying price to move). Unlike Aug21, when the majority of players were interested in getting long exposure and leverage, now the majority of players seemed interested in selling volatility (and/or utilizing yield collecting strategies, such as covered call selling). Option sellers are in control.

This trend is also visible in the plethora of newly created decentralized options protocols. Market participants are seeking yield on their assets, this interest is growing in particular after the “up only” environment was running out of steam (e.g. think Solana went from $1 to $200 or Avax from $3 to $140). There are plenty of options protocols that offer yield collecting strategies such as call selling option vaults. These vaults quite often advertise a specific “return” on their assets, by selling optionality. A major risk behind this is that a lot of these vaults don’t display the risks IVs of the options vault and thus leave the user unaware of the downside risks. Rather only the premium or implicit “apy”, although there is no sure “apy”. More on this in another article.

Forecasting realized volatility

Surrendering to the fact that option prices are primarily driven by supply and demand, let’s isolate a specific strategy: buying or selling options (volatility) and continuously delta hedging until expiry. This specific strategy aims to capitalize on the difference between IV and RV. When IV is trading below expected RV over the lifetime of the option, then it should be a profitable strategy to buy the option and continuously delta hedge the position until expiration. Vice versa, if IV is trading above expected RV, it should be a profitable strategy to sell the option and continuously delta until expiration.

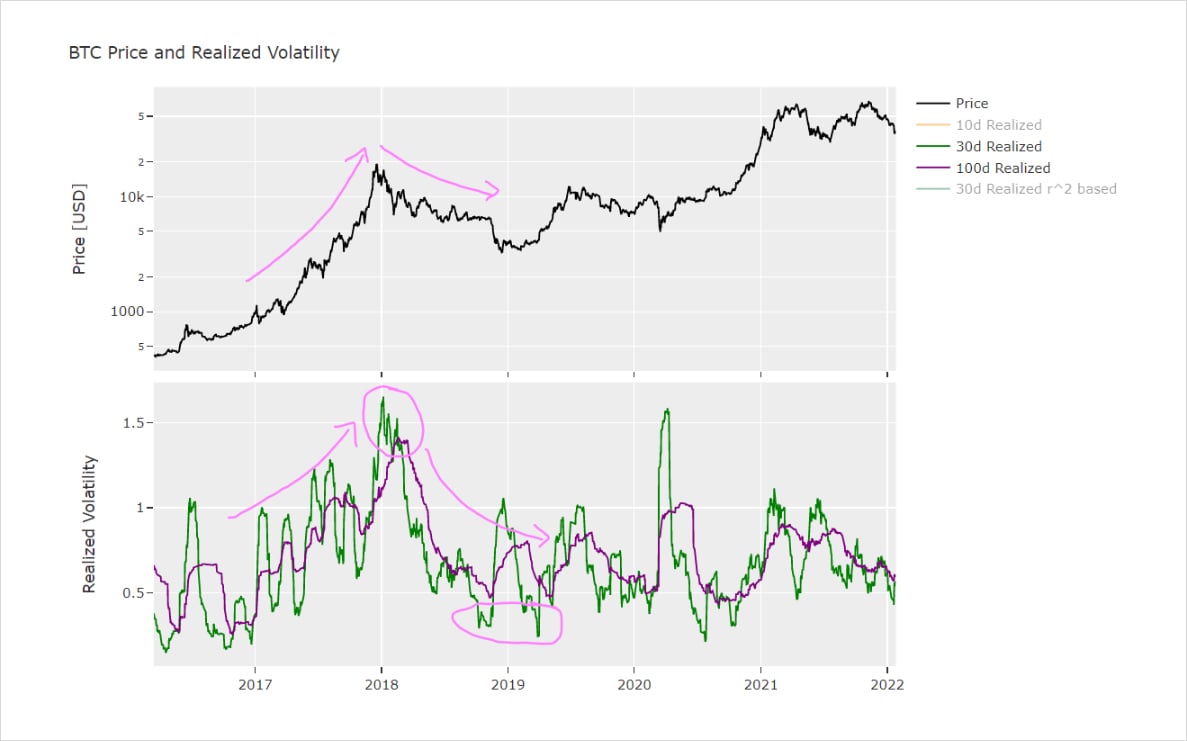

The next question then is: what drives realized volatility? To simplify, I like to look at the 30-day realized volatility, since it reflects the lifetime of a rolling 1-month to expiry option. Realized volatility increases by definition when we see big price moves over a short time period. The bigger the price moves, the higher the volatility. Let’s take a look at the BTC price chart (log scale, because otherwise we cannot see anything) and rolling 30-day realized volatility. The following points are notable:

- RV increased gradually during the 2017 bull market and parabolic price action.

- RV peaked in the Dec21 initial crash, but got absolutely crushed during the 2018 bear market.

- If we pay attention to the price path, we can see that RV usually spikes in particular during large sell-offs. Which makes sense, because they appear usually after larger markups in markups in price. I.e. very large price movements in a short time period. Also very deep sell-offs are often liquidation driven, fueling the magnitude of price movement.

Capital movements driving volatility

In 2017 new market participants were flocking fiat into the crypto market. Everyone hoped for generational wealth and that their next pet-coin becomes the next Ethereum. The ICO hype was extreme and saw big and fast capital movements across many different crypto assets. Price moves were wild and markups extreme. Realized volatility picked up and peaked when the bubble eventually popped in 2018 during the heavy sell-off. After the dust started to settle down, the market entered a stage of depression. Appetite for new position began to slow down and price moves decreased. 30-day realized volatility dropped as low as 18%.It is this change in the perception of value for market participants that leads to changes (or lack thereof in this case) of positioning. These in turn lead to price movements, which result in volatility. Whenever the market really gets hot, it usually brings along volatility. If the market gets cold and uninteresting (directionless or range-bound), we rather see a drop in capital movements and a drop in volatility.

Trading volatility

The beautiful thing about options is that there are many different ways to use them. They can be used to trade volatility (e.g. implied volatility vs. realized volatility). They can be applied to utilize leverage, to hedge, to collect yield or to create any other non-linear payoffs. Options can create huge convexity in the book, which basically translates to “explosive potential”, but they can also take that away if risk is not managed carefully.

AUTHOR(S)