In this essay, we examine the importance of funding open-source development, what funding mechanisms exist, and tradeoffs that each of them brings. Next, we apply our findings to to Bitcoin and the broader cryptocurrency landscape. We analyze how Bitcoin development has been funded in the past and how it might evolve in the future.

Invisible to most people, our modern digital infrastructure largely runs on open-source software (OSS). Just like physical infrastructure in the form of roads or bridges, this infrastructure requires maintenance in the form of upgrades, bug fixes, and other improvements.

In 2014, the world caught a brief glimpse of the potential horrors that poorly-maintained digital infrastructure poses, when Google researchers revealed a critical vulnerability in OpenSSL. OpenSSL is a popular cryptographic library that enables safe transmission of sensitive information like password- and credit card information. It is used by over 66% of web servers world-wide. The so-called “Heartbleed” bug allowed an attacker to steal information moving through OpenSSL. Shortly after, the “Shellshock” vulnerability in the popular UNIX-based command-line tool Bash allowed an attacker to gain remote access and execute arbitrary code on a victim’s computer.

The revelation of these vulnerabilities, that had been undetected for years and exploited on many occasions, was a sorely-needed wake-up call to the tech industry.

The need for funding

The fact that billions of people rely on it would suggest that we pay extra attention to our digital infrastructure. However in practice, the opposite is the case. The same qualities that make OSS so popular with users often create problems when it comes to maintenance. OSS funding has traditionally been lacking for a few reasons.

- First, it is hard to build sustainable business models around OSS development because the software itself is non-proprietary.

- The biggest alternative, donation-based funding, suffers from a tragedy-of-the-commons, where parties want to pay for a common good while others use it for free.

- It was previously impossible to monetize usage at the protocol level while preserving permissionless access. This could change with the advent of native digital payments in the form of cryptocurrency.

- Finally, there is also a lack of public awareness of the risks posed by poor maintenance. This is starting to change after Heartbleed and Shellshock.

All funding is not equal

The single most important property for infrastructure is reliability. To serve as an attractive foundation for higher-layer applications, users and businesses require strong assurances that current core functionality will be maintained and not deprecated. This can only be guaranteed if the development process itself can stay free of special interests and hold the interests of users above all else. Hence, it is crucial that the funding mechanism itself is compatible with these goals. Risks from poor governance- and funding mechanisms include:

- Concentration of power: If development is funded by just 1–2 entities, they automatically gain outsized power in the direction of development. They can fund proposals they like, and withhold funds for proposals they don’t like.

- Moral hazard: A similar problem arises when OSS is maintained by the employees of for-profit companies, especially if said company is an active user of the protocol. The developers could be incentivized to weigh the interests of their employer higher than the interest of other users, letting commercial interests drive the development direction.

- Protocol hijacking: An attacker could introduce malicious code into the protocol. For example, Project Dragonfly is rumored to be the product of pressure from Chinese authorities on Google to produce a search engine compatible with the country’s oppressive censorship regime.

- Protocol malleability: If protocols are overly malleable for changes, this opens the door for lobbyism and politics from parties who want to shape the protocol’s direction to their own benefit.

Development in Bitcoin

The Bitcoin network is also a form of digital infrastructure and must be maintained and improved. In fact, Bitcoin could require constant improvement even more urgently because it is a more attractive target to attack. For one, Bitcoin attracts powerful enemies in high places by allowing users to store wealth outside of the traditional financial system. Further, attacks are much easier to monetize than against existing OSS, because stolen coins can be sold, and attackers can bet against the price of Bitcoin in the derivatives market.

As a result, it is important that Bitcoin development has funding mechanisms that are incentive-compatible with the goals of the protocol and its users.In this essay, we will examine the support and funding models behind Bitcoin today, how funding has evolved, and what the future holds. We will also examine what the optimal structure looks like that minimizes the likelihood of these negative outcomes.

An exploration of funding mechanisms

Unpaid volunteers

It is a long established fact tUnpaid volunteers are by far the most prevalent type of contributor to open source protocols. They contribute and maintain software without direct monetary compensation for their work, but may have other motivations, including skill and/or reputation building, ideological reasons, or just passion for contribution.

One example of OSS maintained exclusively by unpaid volunteers was OpenSSL. It took the scare from Heartbleed before a group of tech companies recently started an initiative to better fund critical open-source projects. Another example is Bitcoin itself, starting with Satoshi Nakamoto himself. It was maintained entirely by volunteers until 2012, where outside sources of funding for Bitcoin developers first began to emerge.

The volunteer model has many advantages. First, the lack of funding tends to attract missionary developers who are truly passionate about the project, and maintain a long-term strategic outlook on improving the software. Second, developers in this model tends to be more collaborative and open to working with others. There are also fewer barriers to entry — any developer can learn about the software and submit pull requests.

However, there is also the risk of developer turnover, and a lack of enough developers willing to work without direct compensation. Whether it’s burnout, lack of time, or loss of motivation, developers cannot contribute indefinitely, and scaling the developer community as the software grows can be difficult. Additionally, most OSS don’t rely on formal structures or entities, operating in more of a “Bazaar” manner, with many different developers independently reviewing and submitting requests. Ethereum has come under some criticism for not having a direct, centralized development approach, with Fred Wilson believing that “the decentralized development approach that many of these projects are taking is not well suited to deadlines and ship dates.”

Patronage

Patronage is another common form of support for OSS projects. In this model, corporations and individuals can make monetary donations to non-profit organizations who then allocate funds to developers, or pay them directly.

Companies like Microsoft and Google are all large donors to the Linux Foundation, the non-profit which employs developers to work on the Linux kernel full time. Stripe also has a program dedicated to funding open source, offering stipends and support to numerous open source software spanning from machine learning to databases to infrastructure.

Sometimes, this support and funding is given with no strings attached, and sometimes there is some minor direction on what features to prioritize. Nonetheless, the common thread in all patronage models is that the donor benefits from the long term health and sustainability of the software.

The big benefit of Patronage models is that they generally align interests between donors and developers. If projects create a lot of value, companies building on them are incentivized to fund them continuously. Additionally, missionary developers now have resources and support to contribute over long periods of time. Finally, the software itself remains free of commercial interests, and there are no fees directly extracted from the software itself.

Problems arise if the number of patrons is very small. The more the continued development of a project relies on one entity, the more they can influence the direction of the project (whether that power is exercised or not.)

Still, the patronage model is an established funding model that has been successfully used in many open source software. It can be a powerful fundraising tool, aligns interests well between all stakeholders, and ensures continued maintenance over time.

For-profit companies

In this model, a for-profit company assists customers who run the OSS with installation, maintenance, support. Additionally, companies can profit from commercial applications built on top of the protocol (e.g. Gmail as an application on SMTP).

RedHat, for example, is a company that provides services, training and support for Linux. They make it easy for enterprises to interact with the Linux kernel, and speed up development and usage of the software. In Bitcoin, the for-profit company Blockstream has focused on monetizing products that leverage the Bitcoin base-chain. These include Liquid (side-chains), mining, data feeds, and more.

These commercial applications can be a powerful source of sustainable funding if they can establish themselves in the market. The company very much is interested in the long term success of the open source project, and will continue to support it and dedicated resources to it.

It’s worth mentioning that some are skeptical of how viable the commercial model is. Redhat captures far less value from its services relative to companies like Microsoft or Apple, and it’s unclear whether its success can be repeated by others. Additionally, there is a moral hazard if commercial interests overtake common interests. There could be a perverse incentive to make the open source software more monetizable by making it harder to use and get started with, or steer protocol development into a direction that benefits the more monetizable higher-layer services.

Protocol-level monetization

The crypto space has added a new funding mechanism to this list in the form of protocol-level monetization. The most prominent example is the rise of Initial Coin Offerings (ICOs).

ICOs rely on issuing scarce tokens that serve as the native unit of the network. In the original ICO model, funds would be pooled in a contract, and ownership tokens distributed proportional to the contributions. A fund disbursement schedule would be defined in a project roadmap, and token holders would then vote to released funds milestones were achieved. If the original project proposers were unable to do the work to the satisfaction of token holders, contributors could hire another team to get it done. This could be combined with some sort of a proposal system to allow token holders to weigh in on project priorities in a token-weighted manner.

In practice, most ICO models today have originators receiving most all of the proceeds as well as a large part of the token treasury. Broadly speaking, there are fewer checkpoints and milestone-based structures than originally intended, resulting in shorter term thinking among token projects.

On the plus side, ICOs have raised billions of dollars in aggregate funding. Relative to previous efforts to monetize open source technologies, this has given developers huge amounts of resources to develop the protocol. Additionally, this funding model often gives a strong mandate to a single company or group of developers, which can lead to efficient decision making and iteration.

Though they’ve attracted much interest to date, the current crop of ICOs comes with significant problems.

- When developers receive the rewards immediately upon launch of the network, there can be a lack of motivation to develop and maintain the software they were paid for in the first place. Some token projects like Zcash look to alleviate this issue with a protocol-level developer tax that vests over time. The tax may be implemented in the form of inflation — a component of the issuance schedule that is automatically set aside to pay for development — or via a fee levied on a per-transaction basis. Vesting can ensure a longer-term alignment of incentives, as the value of the rewards becomes conditional on the healthy operation of the blockchain.

- Fundraising via ICO often concentrates power with a few developers, making it difficult for outside parties to make meaningful contributions. Further, there is little incentive for a volunteer to work on a project for free while others are getting paid.

- Finally, a central company or foundation is an easy target for controversy or legal scrutiny. Tezos, a 2017 ICO that raised over $200m, had a year-long controversy over control of the funds. Telegram, which conducted a multi-billion dollar raise in 2018, is currently being targeted by the SEC for conducting unregistered securities offerings to investors.

In summary, protocol-level monetization has been a popular method of funding open source crypto projects, but the long term viability is still unclear. It remains to be seen how useful many of the issued assets will be, and whether regulatory hurdles will prevent them from being used in the future.

Bitcoin developer funding in the past

Bitcoin development and support has come a long way since the genesis block in 2009. For the early years it was maintained exclusively by Satoshi and a small handful of other volunteers. When Bitcoin started to gain usage and developed a market price, it also started to attract outside developers.

By 2012, investors and outside contributors started to recognize the need for more organized support, which led them to create the Bitcoin Foundation. Its self-proclaimed mission was to “standardize, protect, and promote the use of Bitcoin cryptographic money for users worldwide”, and its founding members included Gavin Andresen, Charlie Shrem, Mark Karpeles, and Roger Ver. For a while, it played a prominent role in the ecosystem, even supporting multiple core developers like Gavin Andreesen and Wladmir van der Laan. By 2015, however, the Foundation had run out of funding.

At this low point, the MIT Digital Currency Initiative (DCI) stepped in to support Bitcoin. Launched in 2015 under the umbrella of the MIT Media lab, the DCI picked up the support of Andreesen, van der Laan, and Cory Fields. In 2016, they announced a $900,000 Bitcoin Developer fund that attracted donations from several large exchanges. Developers operating under support from the DCI have been responsible for 14% of all Bitcoin Core commits since April 2015.

Over time, other types of organizations with an explicit focus on supporting Bitcoin began to emerge. A group of developers, including Gregory Maxwell, Pieter Wuile, and Matt Corallo founded Blockstream with a mission to improve Bitcoin Core and build ancillary businesses like data services and sidechains. Blockstream has raised $90m in venture funding, and its employees have made many major contributions to Bitcoin, from BIPs and research on SegWit, to Confidential transactions, the cryptographic library libsecp256k1, Lightning, and many more.

In 2014, Alex Morcos and Suhas Daftuar created Chaincode Labs as another major non-profit organizations dedicated to supporting Bitcoin. Chaincode focuses on the development, review, testing, and maintenance of the Bitcoin software and has trained many aspiring developers in their residency programs. Contributions of Chaincode-supported developers include fee estimation algorithms, the Fibre network, and BetterHash.

One interesting dynamic in Bitcoin funding is how large holders can be incentivized to ‘give back’ to the protocol by supporting active development. Continued health and maintenance of the protocol is beneficial towards Bitcoin’s long term price, financially benefiting owners of Bitcoin. In this way, a ‘donation’ to Bitcoin support and development can be viewed as an investment to benefit one’s own Bitcoin holdings. This dynamic is distinct from donating to projects like Wikipedia, where the resulting benefit to the donator is much more diffuse.

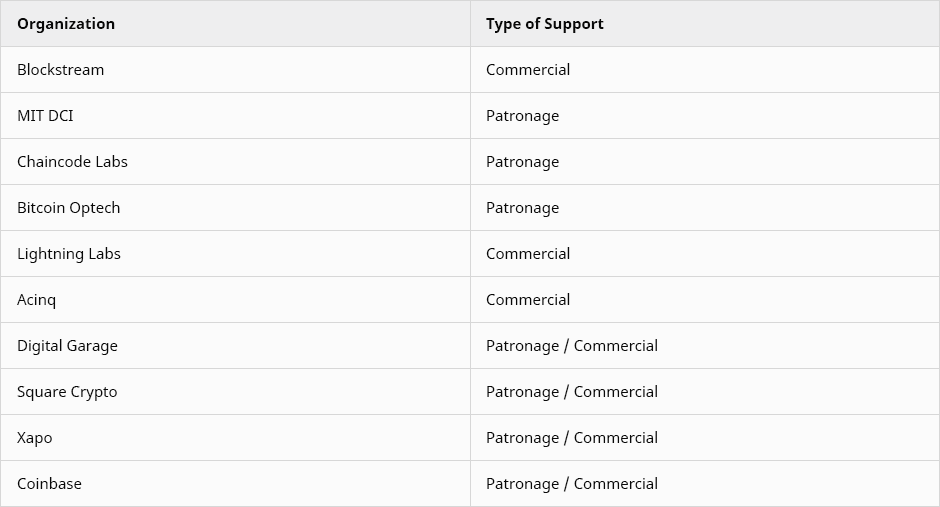

In addition to the previously mentioned examples, many other organizations directly or indirectly support core development and maintenance of Bitcoin today. Bitcoin-focused companies like Xapo, Bitmain, and Coinbase have core businesses which depend on the health of Bitcoin, and have in the past supported developers to focus on improving and maintaining the protocol. Bitcoin Optech, a non-profit founded in 2018, does valuable work on facilitating adoption of Bitcoin scaling techniques, including SegWit, transaction batching, fee estimation, coin selection, and the Lightning Network. Hardcore.Fund is another non-profit aimed at supporting bitcoin developers, with Luke Dashjr and Ben Woosley among the current beneficiaries. The fin-tech company Square has recently announced Square Crypto, which now employs 6 developers focused on Bitcoin and the Lightning network.

Overall, the scope and quality of resources dedicated to improving Bitcoin has come a long way since inception. There are organizations of every kind, from non-profits to academia to large tech companies, with an explicit mandate of contributing to Bitcoin. The strong variety of contributors ensures that no single organization has excess influence on the protocol, and is a sign of the healthy maturation of Bitcoin from a niche open-source software to important digital infrastructure that can be relied upon by millions.

*This is not an exhaustive list. Many developers are self funded, contribute part-time, or work for other organizations.

The future of funding in Bitcoin

If Bitcoin continues to grow, the amount of companies and individuals that interact and rely on it as critical infrastructure will increase further. As this happens, we expect the amount of attention and resources dedicated to Bitcoin development to increase as well.

At the same time, we are currently witnessing the birth of a separate ecosystem of higher layers on Bitcoin, most notably the Lightning Network. In the past years, organizations such Lightning Labs, Radar, and Acinq have raised venture funding and started developing the Lightning protocol and build businesses around it.

If Bitcoin geo-political importance grows, it is possible that governments and central banks will hold direct stakes in Bitcoin’s success, whether through local mining infrastructure or holding coins. As a result, we could see them contribute resources to ensure continued development and support of Bitcoin. This brings in an additional threat model to Bitcoin — that governments could one day try to influence the direction of Bitcoin development via monetary incentives.

Finally, we expect that funding will eventually expand past software engineers. Square Crypto recently made the first step in hiring the the product manager Steve Lee (former Google), and is looking to hire a designer as well.

AUTHOR(S)