Note: This article represents my own personal views and does not constitute financial advice. Thanks to Dylan Payne and Hasu for providing guidance in writing this article.

While at the Bank of Canada, my personal research studied the infrastructure that underpins the cryptocurrency industry. In this article I discuss the concept of clearing, how crypto derivatives are cleared, the associated problems and emerging solutions. I conclude with several takeaways and questions for the reader to consider.

Crypto derivatives are financial instruments with cryptocurrencies as the underlying asset. These contracts range from standard futures and options, to bespoke instruments and crypto-native perpetual swaps. In line with traditional finance, trading volumes for crypto derivatives far exceed corresponding spot markets. During October 2020 over $400B of crypto derivatives were traded on exchanges, compared to only $125B in spot markets(1).

Unlike spot transactions, crypto derivatives can not be settled immediately. Instead, these contracts remain open until the pre-determined expiration date or the position is closed. This means a trader waiting to withdraw their coins has a very different risk profile than one holding a call option expiring in December 2021. For this reason, clearing is an important component for crypto derivatives.

What is clearing?

The primary responsibility for clearing derivatives transactions is risk management. The clearing process begins once a transaction is executed and concludes at settlement. As Pirrong (2011) outlines(2),

“Derivatives contracts are promises to pay amounts that depend on some market price (e.g., an interest rate, a commodity price) or event (e.g., a bankruptcy), and there is always the risk that the party that is obligated to make a payment under the contract will be unable to pay what it owes, i.e., it will default?”

Since each party can fail to perform on their obligations, these transactions represent counterparty credit exposures. If one’s counterparty defaults, this credit risk can manifest as significant replacement costs and losses. Following the 2008 Financial Crisis, regulatory reform mandated that most derivatives contracts were standardized and centrally cleared(3). Previously, derivatives contracts were primarily traded and cleared bilaterally. In contrast, central clearing involves an institution, such as the Options Clearing Corporation or London Clearing House, acting as a Central Counterparty (CCP). Two key functions performed by a CCP are:

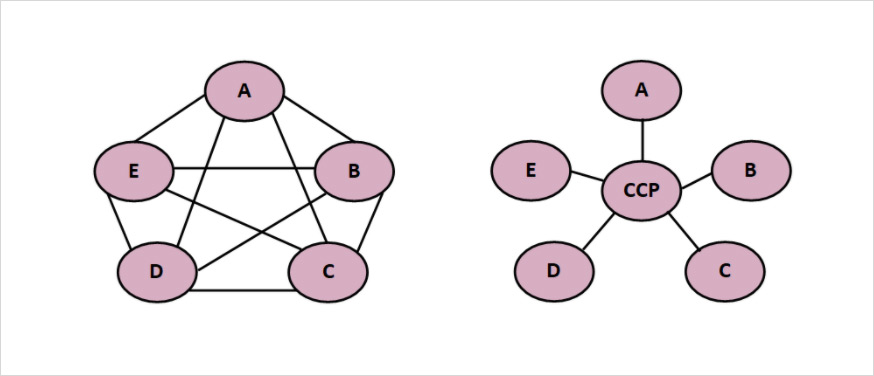

- Intermediating transactions, through the process of novation, to mitigate counterparty credit risk. This is implemented by the CCP becoming the buyer to every seller and seller to every buyer. If one party defaults, then the CCP is contractually obligated to ensure the other party is made whole. Hence, after novation each party only has a credit exposure with the CCP (Figure 1).

- Cross-margining positions to improve capital efficiency for participants. This is implemented by netting offsetting margin payments and offering relief on margin requirements for offsetting positions.

Figure 1: The red circles represent trading participants, and the edges indicate counterparty credit exposures. The left diagram represents bilateral clearing, where each participant has bilateral exposures with other participants. The right diagram represents central clearing via a CCP. In this case, all participants only have a credit exposure with the CCP. This is achieved by novation, where the CCP intermediates each transaction it clears.

Central Counterparties rely on safeguards to manage their credit exposures with clearing members. From the outset, stringent membership requirements reduce the likelihood that participants bring undue risk to the CCP. Their first line of defense is the margin pledged by members for each position. As Duffie (2011) outlines, initial margin requirements are set such that the likelihood that the CCP incurs a loss while unwinding a defaulted position is very small(4). Key factors in setting initial margin requirements are:

- the realized volatility of the contract

- the size of the position relative to the average daily trading volume

- the current and expected future liquidity in the market

Periodically, variation margin is exchanged as the position is marked to market. Maintenance margin refers to the minimum amount of margin required to keep the position open. Collateral represents the assets pledged as margin and may be subject to a haircut. The reduced value as collateral reflects the volatility and liquidity of the asset pledged. Position limits aim to ensure sufficient market depth will be present to unwind a position upon default(5). Together, membership requirements, a robust margin methodology, prudent collateral haircuts and position limits safeguard the CCP from its credit exposures.

In the event of default, the CCP can auction the participant’s portfolio to others clearing members. For example, as Lehman Brothers defaulted its portfolio of interest rate swaps was auctioned by the London Clearing House without incurring losses that exceed the margin Lehman had pledged. If significant losses are incurred, the CCP has a default waterfall in place. The default waterfall is a protocol for mutualizing risk across clearing members and the CCP. The first layer of the waterfall is the defaulting member’s margin and guaranty (default) fund contributions. Once exhausted, capital pledged to the guaranty fund by the other members and the CCP absorb the remaining losses. This protocol is essential for the viability of a CCP, as it is designed to ensure a CCP can withstand the default of its two largest members.

How are crypto derivatives cleared?

Crypto exchanges are solely responsible for clearing the derivatives traded on their respective platform. Therefore, clearing is highly fragmented since each venue operates independently. This means each exchange sets their own margin methodology, monitors the collateralization of users’ positions and cannot coordinate with other exchanges in the event of default. Unlike traditional finance, crypto exchanges are accustomed to frequently dealing with positions and traders in default (Figure 2). Three contributing factors to frequent liquidations for crypto derivatives are the relative inexperience of participants, the accessibility of high leverage and the high price volatility of the underlying assets. Mechanically, once the difference between the unrealized loss and margin pledged exceeds the maintenance margin required, the position is taken over by the exchange and liquidated(6).

Figure 2: Tweets indicating long positions were liquidated on ByBit and Binance.

Each exchange has safeguards in place to augment their liquidation engine. FTX has a backstop liquidity provider program where participants are ready to internalize positions in liquidation and hedge the exposure at other venues. Deribit utilizes incremental liquidations to bring positions back above their maintenance margin requirement. BitMEX uses five criteria to guide its liquidation engine. Each approach helps to minimize the market impact of liquidations. An exchange’s insurance fund is designated to absorb losses if a position is liquidated below its bankruptcy price. If the insurance fund is exhausted, then the final line of defense is auto-deleveraging (ADL). This process liquidates bankrupt positions by closing out offsetting positions held by profitable traders. As participants typically employ strategies across venues, experiencing ADL is very disruptive and costly.

For crypto derivatives traded over the counter (OTC), transactions are cleared bilaterally. This is typically implemented with unsecured bilateral credit lines, which are settled periodically. To protect themselves, OTC dealers analyze their counterparties’ credit worthiness and limit their exposure. Nonetheless, unless a crypto derivative position is fully collateralized, at least one party will have an unsecured credit exposure.

What are the problems?

Our industry’s approach to clearing derivatives differs markedly from traditional markets. Due to offering high leverage, combined with limited financial and legal recourse, this difference is driven by necessity. Since exchanges are ultimately responsible for liquidating positions, the foremost problem is that all users have a credit exposure with their exchange. If the exchange is unable to unwind liquidated positions, then the user may be exposed to ADL or socialized losses despite managing their own risk prudently.

March 12th exemplified that high leverage and fragmented liquidity exacerbates the problem of cascading liquidations. This problem leads to price dislocations between venues since exchanges can only liquidate positions on their own platform. In contrast, traditional markets have centralized clearing which permits auctioning off the portfolio of members in default. During the price decline, if BitMEX had the ability to auction its aggregated long position in liquidation(7) then the market impact would have likely been smaller(8).

Beyond the issue of counterparty credit risk, capital efficiency is a major problem for traders. Presently, participants must break up their balance sheet when trading across venues. Since each exchange clears positions independently, participants cannot obtain margin relief through netting offsetting exposures across exchanges. For example, despite a market maker holding hedged positions across two venues, it must collateralize each leg. This means traders must manage liquidation risk on each venue, as fully collateralizing both legs is highly capital intensive. This risk is exacerbated during period of high volatility, as blockchains are typically congested and slow the transfer of capital between exchanges.

Smaller problems have arisen historically but are less prevalent today. For example, CCPs impose limits on position size to reduce the likelihood of experiencing losses while unwinding positions in default. During June 2018, one trader amassed a $400M long position on OKEx that accounted for a large share of trading volume. During liquidation, OKEx imposed $9M in socialized losses on its users(9). As another example, long positions in Bitcoin perpetual swaps were collateralized with Bitcoin and had strong reflexivity as price declined. This is because the value of one’s position, as well as the collateral used as margin, declined together. This problem has also materialized in altcoin markets, such as the CLAM flash crash in May 2019(10). Recently, the industry has shifted towards margining derivatives with stablecoins rather than Bitcoin to address this problem.

What solutions are emerging?

Solving the problem of clearing crypto derivatives safely and efficiently is a huge opportunity. As mentioned, the market size of crypto derivatives far exceeds corresponding spot markets. Moreover, large pools of capital on the sidelines are constrained by investing mandates. Many investors have cited concerns surrounding the security of exchanges and corresponding counterparty risk(11). Despite RenTech indicating it can trade crypto derivatives, it deliberately limited itself to cash-settled futures on the CME(12). Solving the problem of clearing crypto derivatives will likely help these constrained investors access to new pools of liquidity.

The four classes of emerging solutions are:

- Adjacent clearing institutions for regulated trading venues: This class includes CME Clearing and BAKKT Warehouse, which are subject to stringent regulatory requirements for operating a Designated Clearing Organization.

- Custodial clearing platforms: Firms like Copper and ZeroHash clear transactions across venues and OTC participants through their existing custodial solutions.

- Non-custodial clearing platforms: Institutions, such as X-Margin and LN Clear, leverage technology like zero-knowledge proofs and the Lightening Network to allow users to retain custody of their assets during the clearing process.

- Prime brokers: This final class has received ample media attention over the past year. Major industry participants – such as BitGo, B2C2, Coinbase and Genesis – have announced their efforts to adapt a prime brokerage solution for crypto. The purported benefit of prime brokers is offering cross-margining to traders. This means that traders can utilize one pool of collateral and trade across many venues and participants, clearing through the prime broker as an intermediary.

Notably, there are limitations for each approach. These limitations arise because the proposed clearing solutions address credit risk or improve capital efficiency, but not both. Adjacent clearing institutions adequately mitigate credit risk but do not address capital efficiency for strategies spanning multiple venues. To my knowledge, the custodial and non-custodial clearing institutions have not developed a protocol for handling significant undercollateralization and default. For example, X-Margin’s legal FAQ states a counterparty’s inability to pay for their liabilities must be resolved through legal action(13). Given the global nature of crypto trading, legal recourse is unlikely to yield a favourable resolution and delayed settlement can be extremely costly. Lastly, traders will still have a credit exposure with crypto-native prime brokers instead of the exchanges. As with exchanges, this exposure may extend to the prime brokers’ other clients. If a client defaults and their assets are not sufficiently segregated, then losses may be borne by other clients. Moreover, since prime brokers typically extend credit for trading, their clients face liquidity risk as their funding may be constrained precisely when they need it. As the adage goes, risk may transform but it does not disappear from the system entirely.

What does the future hold?

The landscape for clearing crypto derivatives is likely to look significantly different as the industry matures. Mirroring custody, the responsibility of clearing is likely to be stripped away from exchanges and OTC dealers. The existing approach of fragmented clearing cannot adequately address credit risk and contributes significant drag on participants’ capital efficiency. As mentioned, improving clearing will likely broaden the accessibility to liquidity and trading opportunities for investors constrained by their mandates and fiduciary responsibilities. Maybe one day RenTech will be trading Binance futures, albeit likely intermediated through a clearing institution.

With that said, prioritizing capital efficiency over mitigating credit risk is putting the cart before the horse. In the event of undercollateralization or default, on the scale of March 12th or worse, how will replacement costs and losses be dealt with? If such an event occurs, all previous capital efficiency benefits are thrown out the window when one incurs ADL or steep socialized losses. Recall the traditional approach of a CCP utilizing a default waterfall. This approach has proven effective at mutualizing risk and sharing losses among the clearing members and the CCP. The waterfall helps ensure viability of the CCP if one or more clearing member defaults on their obligations. Without a similar protocol, I do not believe any institution can credibly clear crypto derivatives at scale.

Regardless of form, the clearing solution that emerges is likely to gain significant market share. As Pirrong (2011) argues, clearing is subject to strong network effects. There is a positive feedback loop since netting opportunities increase as a clearing institutions’ market share increases. Despite these benefits, getting many trading firms, exchanges and custodians to coalesce around a single platform will be no easy feat. Mirroring TradFi and DeFi, the buy-in of the users will likely be driven by sharing in the equity ownership of the platform. Surprisingly, this approach is not currently adopted by any emerging solution. Moreover, this approach is key for incentivizing use of the clearing platform and internalizing the risk participants bring to it.

With this perspective in mind, several challenging questions are raised:

- As an industry we must ask ourselves if increasing crypto derivatives trading is a net positive? Are we coming full circle and rebuilding the same type of institutions that inspired Satoshi to build Bitcoin? Do derivatives indexed to Bitcoin undermine its scarcity?

- How can we mitigate credit risk and improve capital efficiency without compromising our ethos of decentralization? Developing a crypto-native CCP seems inevitable but how can we reconcile with promoting centralization for decentralized currencies?

I personally do not know these answers, but I look forward to reading a diverse set of insights and feedback. As the future unfolds, I am confident we will reach a desirable outcome for the crypto industry – or at least I keep telling myself that since I resigned from the Bank and cashed in my pension for Bitcoin.

(1) Referenced data provided by Skew Analytics.

(2) Pirrong, Craig. 2011. “The Economics of Central Clearing: Theory and Practice? ISDA Discussion Paper 2011-01.

(3) The major reforms were the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States and the European Market Infrastructure Regulation (EMIR) in Europe.

(4) Duffie, Darrell. 2011. “How Big Banks Fail and What to do About It? Economic Books, Princeton University Press.

(5) In 2018, Nasdaq’s clearinghouse for Nordic commodities experienced a trader in default. After auctioning off the positions, the losses exceeded the trader’s margin pledged by $125M. A contributing factor was that the trader’s positions represented a large share of relatively illiquid markets. More stringent position limits and conservative estimates of liquidity likely would have reduced the impact of unwinding the positions. For more information, see: Bell, Sarah and Henry Holden. 2018. “Two Defaults at CCPs, 10 Years Apart? BIS Quarterly Review, December 2018.

(6) For a more detailed description of the liquidation mechanisms of exchanges, see: Hasu, Su Zhu and Arthur. 2019. “Crypto Derivatives Exchanges: Liquidation Pioneers? Deribit Insights.

(7) BitMEX blog post “BitMEX Insurance Fund: Your Questions Answered?

(8) Kyle Samani made a similar argument for a Request For Quote (RFQ) system for large liquidations. The backstop liquidity provider program at FTX functions similarly. Nonetheless, no current system exists for effectively porting positions in liquidation across venues. For more information, see: Samani, Kyle. 2020. “March 12: The Day Crypto Market Structure Broke (Part 2)? Multicoin Capital blog post.

(9) OKEx blog post “Regarding the Forced Liquidation Incident on Jul 31, 2018?

(10) Poloniex blog post “Overview of BTC Margin Lending Pool Losses?

(11) Acuiti, Bitstamp and CME. 2020. “Institutional Adoption of Digital Asset Trading?

(12) Chaparro, Frank. April 18, 2020. “$75 Billion Hedge Fund Renaissance Technologies is Eying the Bitcoin Futures Market? The Block.

(13) See the Market Volatility tab here.

AUTHOR(S)