The year is 1944. A proposal by economist John Maynard Keynes would eventually fail to pass at the Bretton Woods Conference, setting the stage for the US-centric international system of money as we know it today. The bancor, a supranational currency coined in the image of the French banque or (‘bank gold’), would be relegated to remaining in its conceptual form.

That is, at least till 2017. Paying homage to Keynes’ idea of a universal, neutral unit of account to clear all international commerce and keep global balance of trade in check, the Bancor Protocol was conceived with the Bancor Network Token (BNT) as a spiritual successor of sorts. Here, BNT would serve as the base pair in every token trade pair listed on the decentralised exchange (DEX) platform.

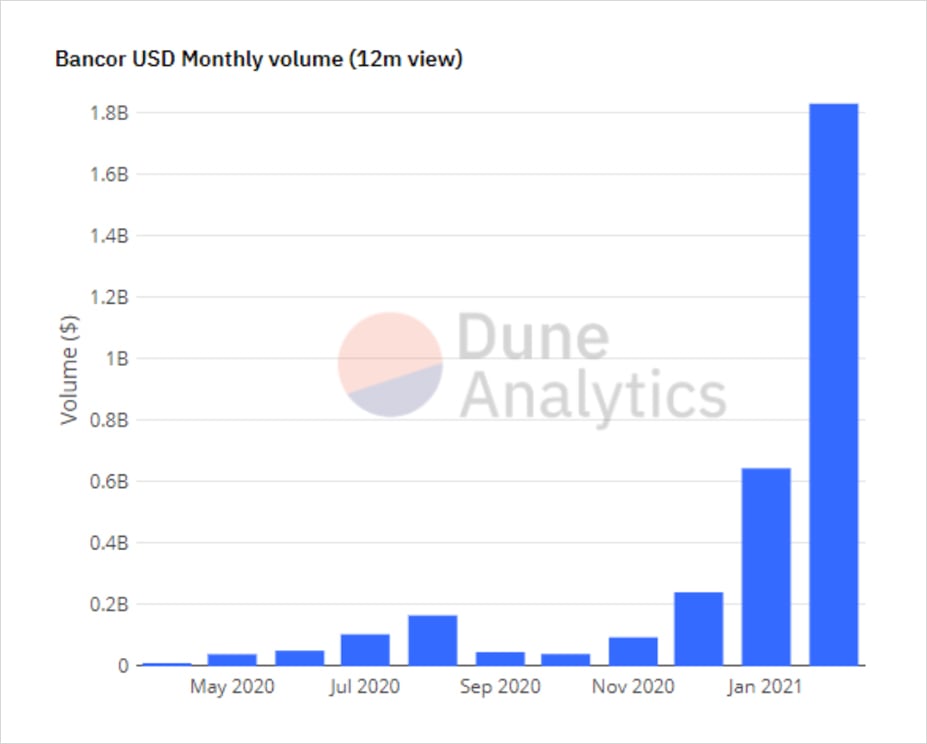

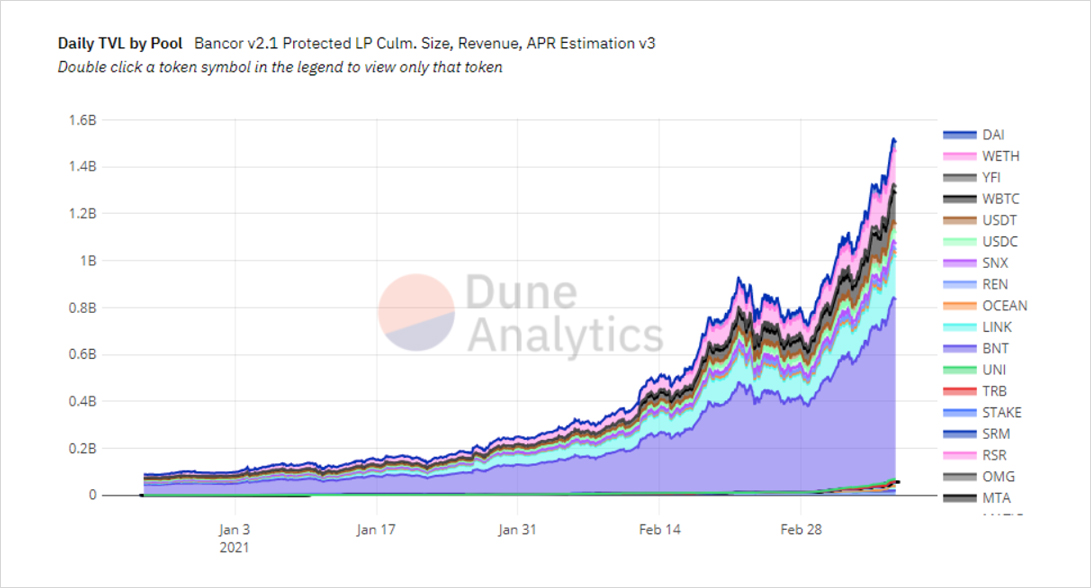

This article aims to provide a deeper dive into the design of the Bancor Protocol and how it has continued to evolve over the years. An area of particular focus would be the innovations introduced with the latest Bancor v2.1 release in October 2020, tackling existing pain points faced by DEX liquidity providers. Namely, these are impermanent loss (IL) arising from token pair price divergence, and involuntary token exposure with mandatory 2-sided liquidity staking. Bancor’s solution to these problems have resulted in a convincing unique selling proposition (USP) that market participants are beginning to notice, catalysing noteworthy levels of adoption in recent months.

Automated Market Makers

Bancor was the pioneer of the Automated Market Maker (AMM) model on Ethereum. Before AMMs, a DEX had to rely on a traditional orderbook-style matching of submitted bids and asks to execute trades. However, Bancor chose to forgo orderbooks entirely and instead used a network of on-chain liquidity pools to pair pools of tokens with one another. Users could then trade against these pooled token pairs, with prices set algorithmically based on both the size of the user’s trade and the depth of the corresponding token pools.

This novel approach to market-making proved to be a paradigm shift within the DEX space. Traders now had guaranteed access to on-chain liquidity with transparent, upfront pricing, doing away with the need for a counterparty. Token owners could also turn existing holdings into productive assets through liquidity provision to these DEX pools, earning returns from protocol swap fees imposed on trades that get routed through the platform.

The Bancor Network Token

The namesake Bancor token model is unique amongst existing DEXes. BNT is deeply integrated within the protocol, taking on the role as the base asset paired against ETH and every ERC-20 token (TKN) asset listed on Bancor. Trades between any given TKN A and B would route through BNT as a ‘connector’: TKN A -> BNT -> TKN B and vice versa by utilising trade pairs TKN A/BNT and TKN B/BNT.

However, this proved to be Bancor’s Achilles Heel for bootstrapping initial adoption. Token holders wanting to provide liquidity on the platform had to obtain a matching amount of BNT in order to enter any of the token pools. This required an upfront capital expense or asset reallocation by holders who could not directly pair two of their existing assets together. Without the option for single sided liquidity provisioning, market participants had little incentive to commit to the Bancor ecosystem via the purchase of BNT tokens.

Taking aim at this issue, a competitor in the form of Uniswap soon burst onto the scene in November 2018. This new AMM DEX eliminated the need for a native token altogether and allowed anyone to seed liquidity pools between any TKN and ETH. This reduced user friction and soon attracted an increasing number of liquidity providers (LPs) and traders in a positive feedback loop. Uniswap has since become a juggernaut in the DEX vertical, consistently commanding the lion’s share of trade volumes.

A Dark Horse

Despite Uniswap’s runaway success and the rise of similar competitors such as SushiSwap, the Bancor team persisted in iterating on their original product. With the Bancor v2.1 release in Oct 2020, the combination of single sided liquidity provision and IL insurance seemed to be the USP needed to make a breakthrough in the fiercely contested DEX arena. This is clearly reflected in parabolic growth metrics such as TVL and trade volumes since the protocol update.

Cracking the code

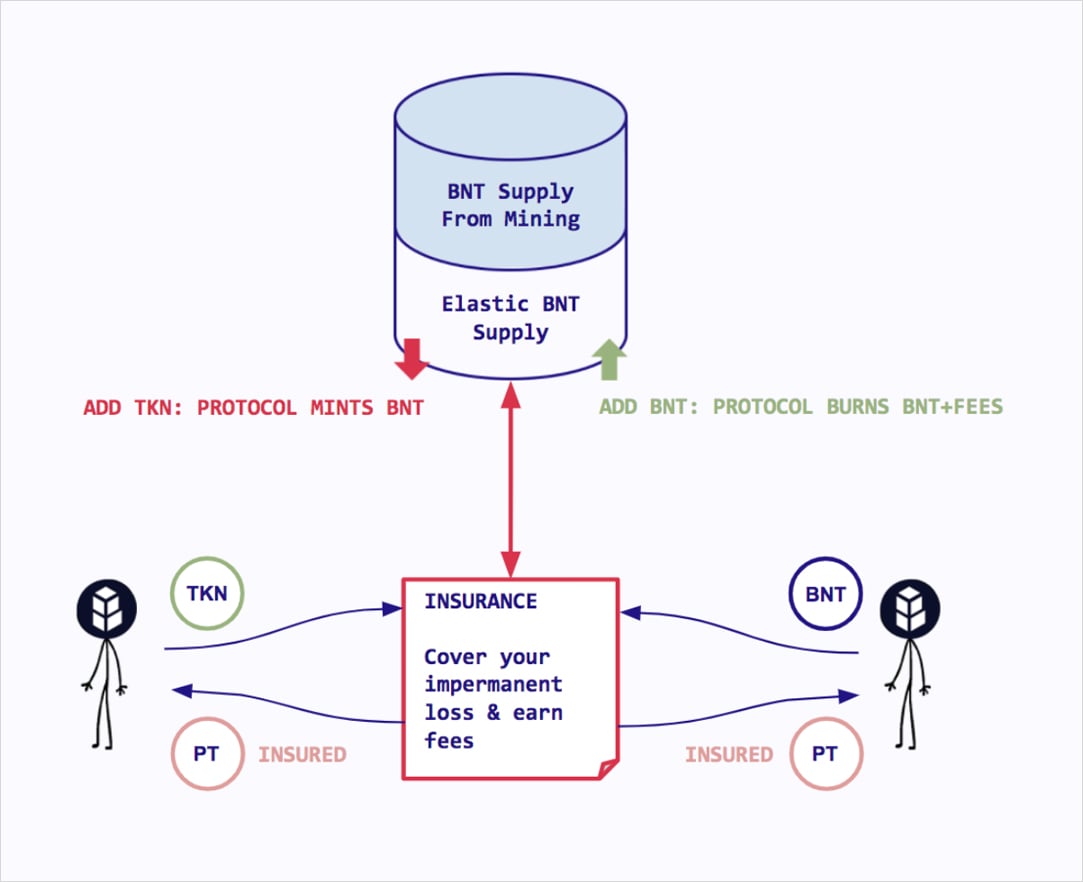

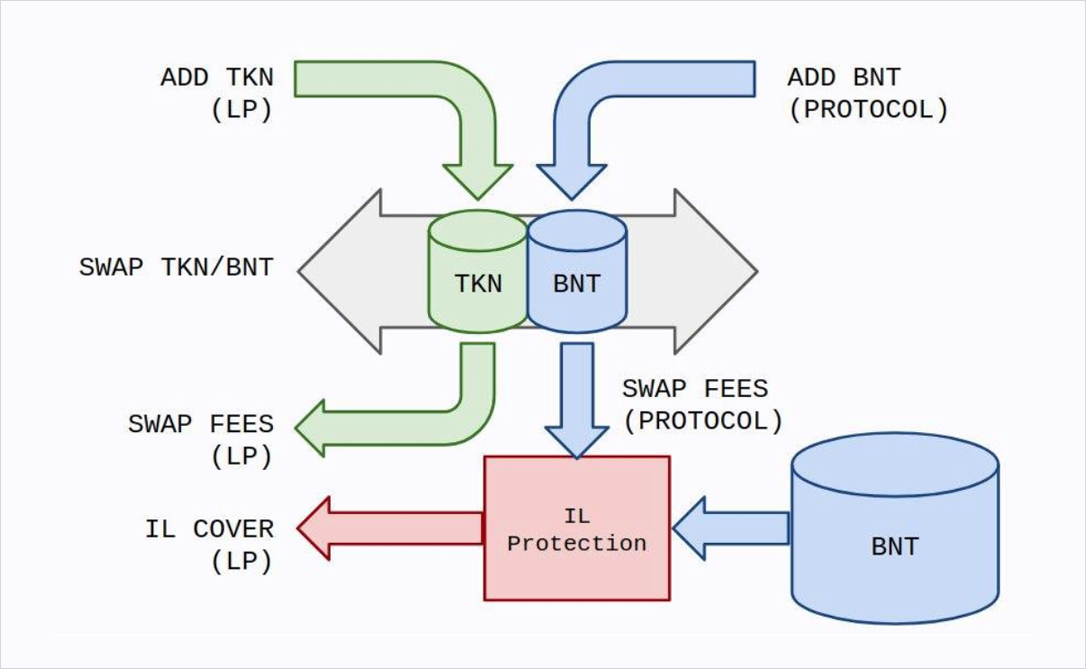

Bancor’s new model is facilitated by a new elastic BNT supply mechanism under the hood. Elastic supply refers to the protocol’s ability to mint and burn BNT as and when required. This is triggered only under certain circumstances and is made possible due to the exclusive pairing of BNT across all liquidity pools.

Single-sided liquidity provision

The elastic supply model helps onboard LPs by enabling single-sided provision for any ERC-20 token, something no other DEX can currently achieve. Upon opting to provide single-sided liquidity for a given TKN, the protocol mints a matching value of BNT into the TKN/BNT pool to provide the other side of the liquidity. This newly-minted BNT remains within the pool and will be burnt upon removal of the TKN LP’s initial deposit.

However, before the burn event occurs, there is now the possibility of single-sided provision of BNT by other participants. Any balance of protocol-minted BNT in a liquidity pool can be replaced by BNT staked from external sources, meeting demand for single-sided liquidity provision on both the TKN and BNT sides. This replacement happens via the protocol burning a corresponding amount of BNT upon receiving the user-staked BNT.

Initial liquidity matching using protocol-minted BNT is a powerful feature that overcomes the ‘chicken and egg’ issue without diluting the circulating supply of BNT. Any eventual BNT burns that occur, be it from TKN withdrawals or BNT replacement, will also include the protocol’s share of swap fees that have been accumulated from the pool. As long as trades have occurred between the mint and burn events, this results in greater BNT scarcity since the amount of BNT burnt will be larger than the original amount of BNT minted. The protocol thus automatically co-invests in itself (up to a certain limit decided via community governance) and channels earned profits back to accruing value to BNT.

Impermanent loss insurance

Most crucially, elastic BNT supply creates the possibility of protocol IL insurance. The coverage is achieved upon withdrawal of liquidity by compensating LPs with BNT for any IL experienced in the pools. Similar to single-sided liquidity provision, competitors such as Uniswap or SushiSwap are unable to natively provide such a feature. BNT used for this purpose comes first from protocol-earned swap fees (from co-invested BNT) and will only be minted as a backstop measure whenever fee reserves are insufficient.

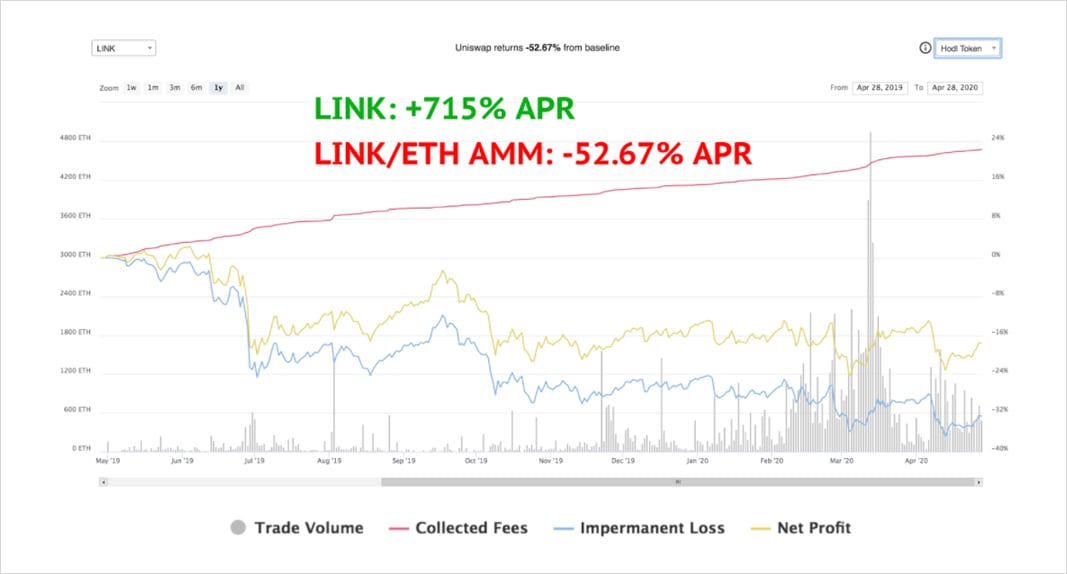

This is especially important to the long-term viability of LPs given that the IL can sometimes outweigh the profit from swap fee accrual. Taking the Chainlink token as an example, its >700% rise in value between April 2019 – 2020 caused LPs on the LINK/ETH pair to make a relative loss of >50% in value compared to holding both assets separately.

Furthermore, Bancor’s implementation has been carefully designed to avoid excessive inflation due to IL payouts. As previously mentioned, IL insurance is only ‘realised’ upon withdrawal of liquidity with no claimable payouts in-between. Since insurance payouts are backstopped by minting BNT, the cost of providing such insurance is theoretically borne by all BNT holders through dilution. In practice though, this cost has so far been fully covered by swap fee revenue returns from protocol-invested BNT.

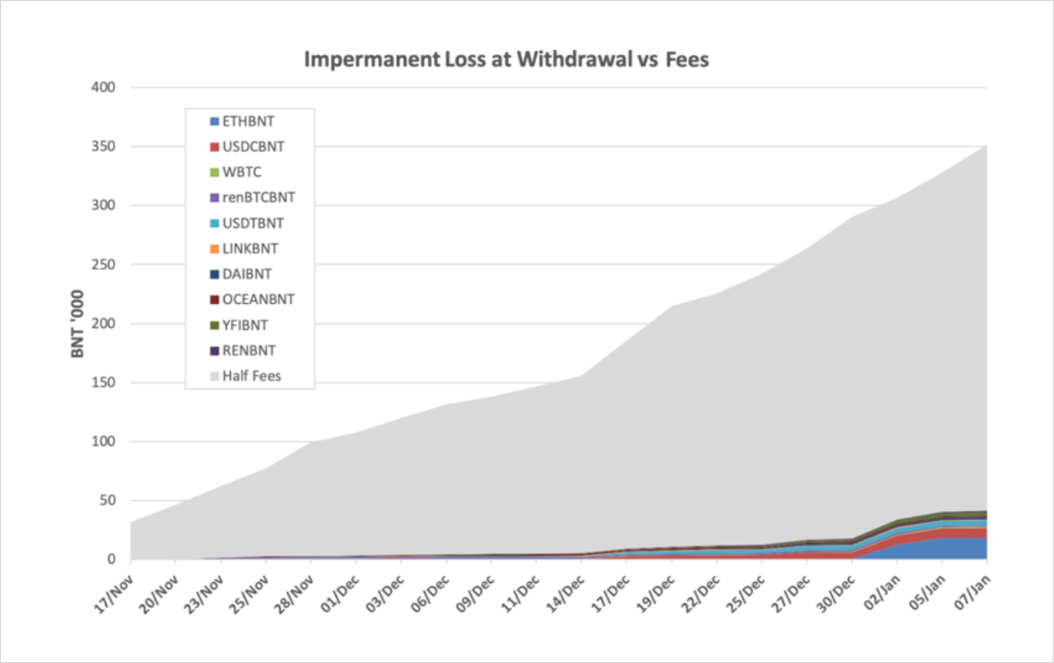

As seen from protocol activity between Nov 2020 – Jan 2021, only ~$0.07 was spent on IL compensation for every $1 earned by the protocol. Note that this aggregates all IL insurance costs and swap fee revenues in the protocol, effectively diversifying IL risk across all liquidity pools. This results in a self-sustaining provision of IL insurance for all LPs participating in the Bancor ecosystem.

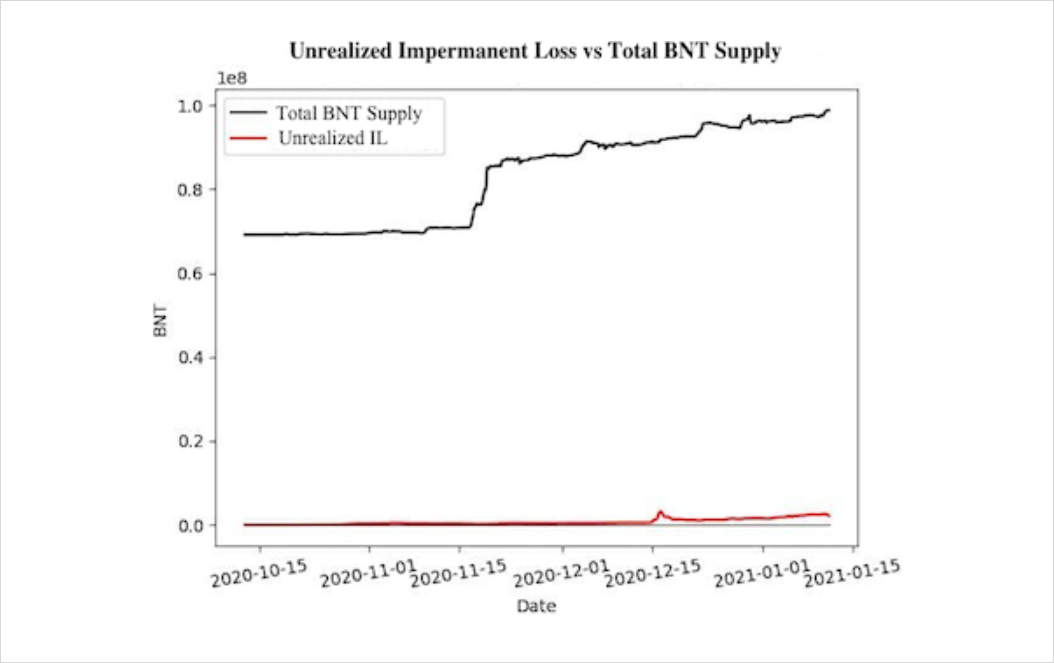

The Bancor team has modelled out the worst-case scenario for IL insurance payouts where all LPs simultaneously withdraw all liquidity, assuming 100% coverage. It is clear from the graph below that inflation arising from realising all IL coverage offered in the protocol will only account for a small fraction of the overall BNT supply. Estimates indicate that if all liquidity is withdrawn today, Bancor would only need to mint about ~4.2% of the current BNT supply for complete IL coverage. Any BNT withdrawn is further subject to a 24-hour lockup to discourage rash decision-making from LPs.

The system also incentivises LPs to commit long-term due to IL coverage being granted in a progressive manner. Added liquidity is only protected at a rate of 1% per day, i.e. LPs will have to provide liquidity for 100 days to be 100% covered for IL upon withdrawal. There is a minimum period of 30 days before IL insurance begins to take effect so no coverage will be offered if liquidity is withdrawn early.

There are currently no comparable solutions to IL mitigation offered by other DEXes in the market. SushiSwap native token distribution to LPs can serve as an indirect method of offsetting IL, but this is not a targeted solution and distribution rates are not influenced by ILs in any way. THORChain has chosen to adopt the Bancor design but IL coverage is paid out from limited protocol reserves. Purchasing options on tokens used for liquidity provision is another viable strategy but this is not beginner-friendly and is contingent on a liquid options market being available for the tokens in question.

Given the heightened volatility of prices seen amongst various cryptoassets, IL insurance would help to ease a major concern holding back more users from becoming an LP. With protocol-guaranteed IL coverage in place, all LP positions will only be exposed to potential upside over time as swap fees are collected.

The liquidity black hole

It is worth reiterating that IL insurance and single-sided liquidity also applies to BNT liquidity provision. This synergises well with Bancor’s ongoing liquidity mining incentives since BNT rewards can be directly staked back into the liquidity pools. The incentive of compounding rewards for BNT stakers helps to reinforce the depth of the protocol’s liquidity pools while doubling as a supply sink, minimising the ‘farm and dump’ phenomenon. As of March 2021, 78% of BNT rewards to LPs have been re-staked.

This also helps to eventually increase the overall size of the pools due to the protocol BNT co-investment limit. As new single-sided BNT supplied to pools replaces existing BNT minted by the protocol, more space for TKN liquidity opens up. The symbiosis at play here is evident where token holders are rewarded for their efforts in contributing to the overall functioning strength of the platform.

Additionally, liquidity in Bancor is highly concentrated because each TKN will only ever have 1 pool on the platform – TKN/BNT. Uniswap’s V2’s introduction of TKN/TKN pairs tends to lead to the fragmentation of available TKN liquidity into shallower pools (e.g. TKN/ETH, TKN/USDT, TKN/USDC, etc). Deeper liquidity gives rise to higher trade volumes from lower slippage, accruing higher fees to staked BNT holders, which then makes BNT even more attractive for purchase and staking back into the protocol.

The Bancor Vortex

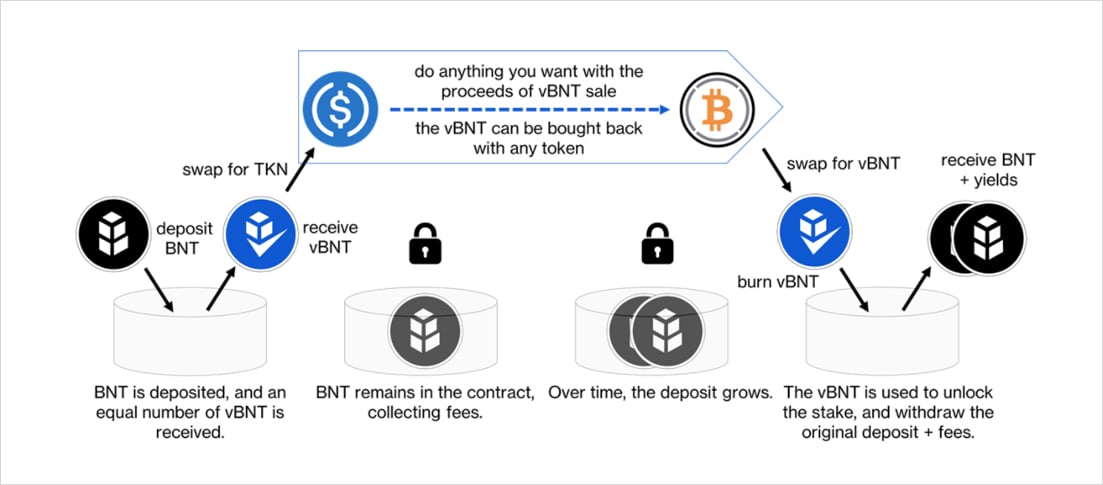

Bancor’s latest product, the Bancor Vortex, then takes BNT utility and capital efficiency to the next level by unlocking a whole new realm of possible use cases for the vBNT token. As a quick recap, vBNT is Bancor’s governance token and is minted upon single-sided BNT liquidity provision, doubling up as an LP token representing % ownership of the pool. With the Vortex, a BNT/vBNT liquidity pool is created which allows BNT stakers to swap their vBNT for more BNT. This is effectively an interest- and liquidation-free means of leverage capped at 1.0x. Additional BNT obtained can then be swapped for any supported TKN or deposited back into the protocol as a form of leveraged yield farming.

Eventually, the underlying BNT position (plus accumulated fees) can be unlocked by simply buying back the initial amount of vBNT through the same Vortex pool. A caveat to keep in mind here is that any debt from using the Vortex as incremental leverage is denominated in BNT. If the value of BNT rises, the outstanding debt value will also increase accordingly (in $ terms).

In the near future, the protocol will implement additional swap fees and channel this towards purchasing and burning vBNT. This provides consistent upwards price pressure to counteract the effects of vBNT holders swapping their tokens for BNT.

Take a moment now to consider the implications of this design on the circulating supply of BNT. In its current form, additional utility granted to BNT liquidity providers helps to encourage more participants to stake BNT. Once the protocol vBNT buyback is implemented, it also essentially acts as a one-way bridge that deposits BNT into the Vortex, gradually pulling in more BNT over time.

Things get even more interesting when projecting the long-term effects of this continued buyback activity. The overall supply of vBNT in existence decreases compared to the BNT that created it, resulting in the hypothetical situation where the value of 1 vBNT > 1 BNT. This creates an arbitrage opportunity where anyone can purchase BNT, deposit into any liquidity pool to mint vBNT at a 1:1 ratio, and sell to the Vortex to obtain more BNT than originally purchased. With principal and profits in hand, the arbitrageur would have no incentive to return to the protocol to redeem deposited BNT, leaving it in the pool for good. This is yet another way that the Vortex could pull externally circulating BNT into the protocol and buff up its liquidity reserves.

In the short-term, this effect might not be realised due to vBNT holders being incentivised to swap their vBNT for BNT whenever the Vortex price peg trends towards 1:1. The closer this exchange rate is to parity, the less risk users take on when creating a Vortex-enabled leveraged position. Any situation where 1 vBNT > 1 BNT also leads to the protocol effectively ‘paying’ existing vBNT holders to take on leverage. Either way, more positions opened using BNT helps to create ‘sticky’ liquidity and attract more BNT into the Bancor system.

Potential drawbacks

It is prudent to include a discussion on the potential limitations of the Bancor model. The core features in v2.1 are ultimately subject to a governance whitelisting process where only approved tokens can benefit from single-sided liquidity provision and IL insurance, putting a cap on potential growth. Liquidity mining rewards for any liquidity pool have to also receive the same governance approval and must be renewed after 12 weeks.

Newly launched projects that have yet to establish themselves are unlikely to receive this whitelisting approval. As a result, there is no incentive for these projects to add liquidity to Bancor given the additional inconvenience of acquiring BNT to do so.

Stablecoin pools have also been found to contribute significantly to Bancor’s IL insurance cost. The stronger the market trends in any one direction, the higher the price deviation on any stablecoin/BNT pair.

The Road Ahead

With the foundation for an all-encompassing AMM in place, Bancor now looks to the future with optimism. In face of fierce competition for market dominance, the Bancor team has continued to venture boldly into unchartered territories within the DEX design space, differentiating their product offering and seeking ways to add value to the industry. Market leaders Uniswap & SushiSwap could be given a good run for their money with Bancor’s suite of upcoming products:

- Origin Pools: Bancor’s alternative to SushiSwap’s Onsen program via the incentivised listing of newer projects on Bancor, with single sided IL protection.

- Shadow Token stablecoin pools: Bancor’s own stablecoin swapping pool to attract TVL and challenge Curve as the primary stablecoin swapping DEX

- Layer 2 scaling: Bancor is likely to be the pioneer DEX launching on Arbitrum’s mainnet scheduled for release in Q2 2021

- Cross-chain expansion: A Polkadot bridge is being worked on as a first step towards a multi-chain future using BNT to route cross-chain swaps

- Additional improvements in on-chain governance (gasless voting) and UI overhauls as finishing touches for a complete makeover since Bancor v2.

Just as Keynes’ vision of the bancor aimed to revitalise traditional finance and rebuild the world economy, perhaps we might just see Bancor revolutionise decentralised finance – establishing itself as the central clearinghouse of the ever-growing DeFi ecosystem.

AUTHOR(S)