The crypto-derivative markets have gained significant traction over the past two years. The activities of traders in these markets are now studied in-depth by those who wish to predict future prices as well as make sense of past movements.

In this article, we focus on the phenomena of contango and backwardation and their implications on market structure.

Contango: a situation where the spot price of a commodity is lower than the futures price

Backwardation: a situation where the spot price of a commodity is higher than the futures price

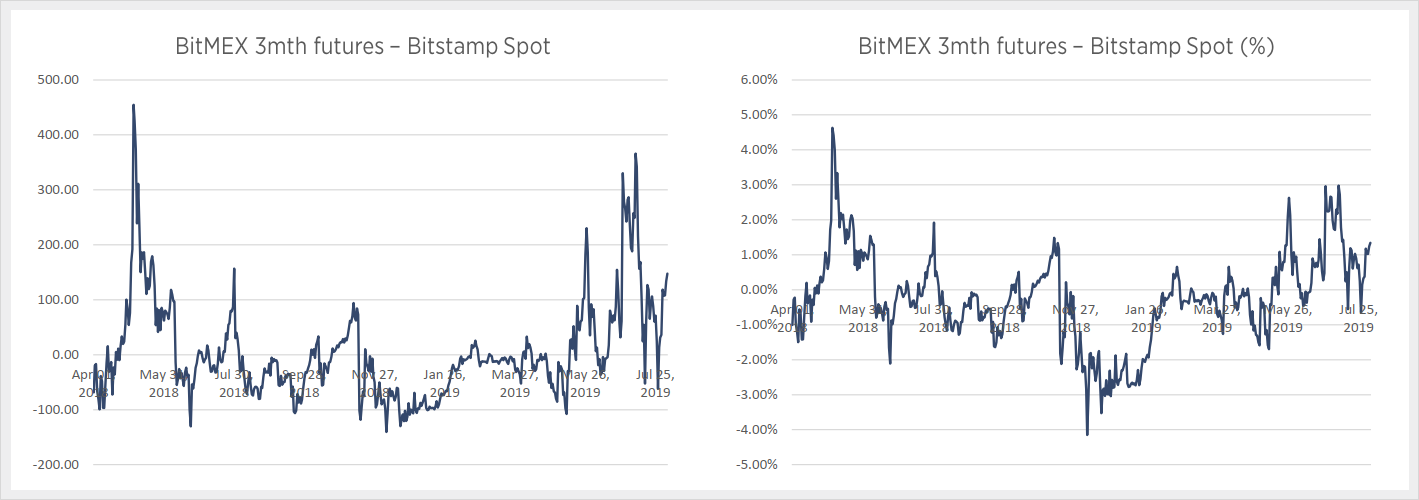

The chart above shows that since April 2018, the market has fluctuated between the periods of contango and backwardation. The difference between spot and futures prices has been ranging from roughly -3% to +3%.

What causes these fluctuations, and what conclusions can be made about the market based on this?

LONGS

The natural buyers of derivatives can be categorized into the following three categories:

- Bullish investors

As the price of Bitcoin and other crypto assets, in general, has followed a parabolic pattern, many investors wish to increase their profits by buying them on leverage. They are effectively using derivatives to borrow USD to buy more BTC with — they swap liquidation risk for the potential upside of making more if markets go up.

- BTC borrowers

With the development of the crypto loan market, (the ability to earn a yield on BTC deposited at retail platforms as well as institutional brokers), there is now a large pool of BTC being tapped based on market conditions.

The borrower profile is generally either proprietary trading firms doing futures arbitrage or credit-worthy crypto-native businesses with an ability to denominate revenue streams in BTC.

Referring to the former group, if the price is right, these participants can sell borrowed BTC for USD, and buy BTC/USD derivatives, thus locking in the BTC risk exposure, and then park the resultant USD. Indeed, it can be said that the rapid growth of the borrowing market emerged in tandem with the rapid growth of derivatives markets not as a coincidence but as a symbiosis.

SHORTS

Who are the natural sellers of derivatives?

- Hedgers

An investor who holds BTC in cold storage may find it useful to be able to short BTC/USD via a derivative margined in BTC. This requires no interface with the traditional financial system and offers privacy benefits for existing BTC while allowing to manage the market risk.

- Miners

A miner who has invested significant capital into ASIC (application-specific integrated circuit) mining must continuously hedge the downside risk of the BTC price collapsing below the break-even costs of mining. Selling derivatives looks attractive as a risk management tool to lock in a certain price of BTC for future expected mining emissions.

- Arbitrage Traders

Trading firms require BTC collateral to market-make various Altcoin/BTC pairs as well as trade on BTC-margined derivatives exchanges. These firms are usually dollar-denominated and will short BTC/USD derivatives to lock in the dollar value of their overall trading portfolio at all times. Moreover, when the market enters contango, they may find it attractive to buy BTC for USD, and sell derivatives to lock in an attractive yield on USD.

CONTANGO

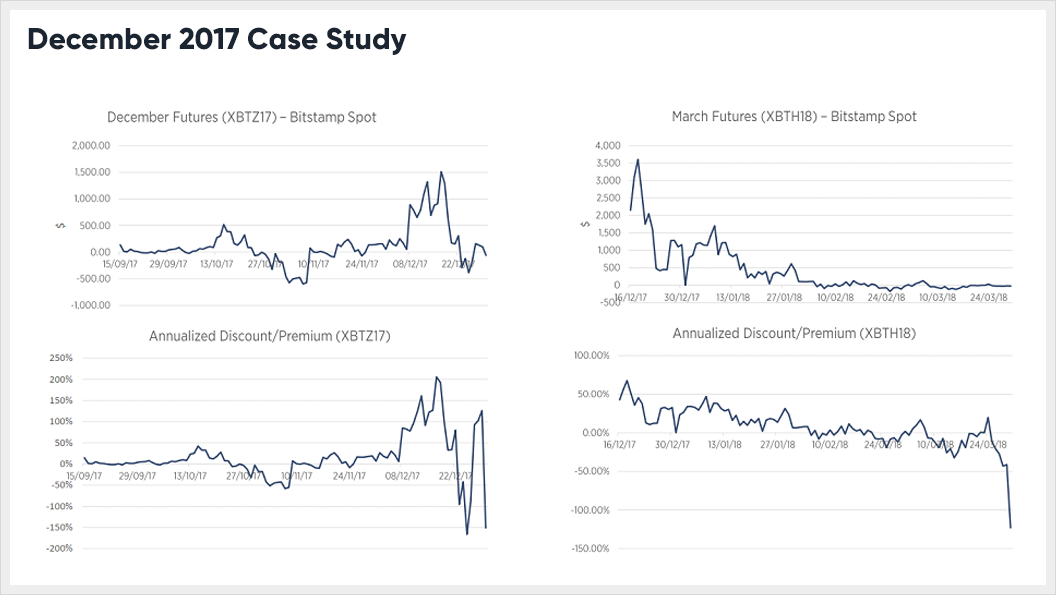

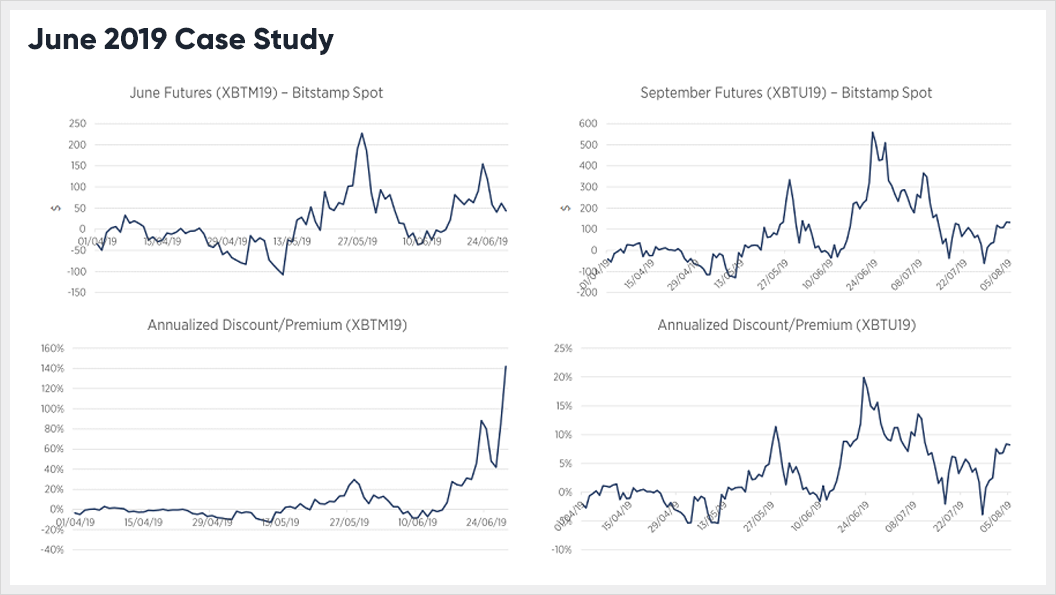

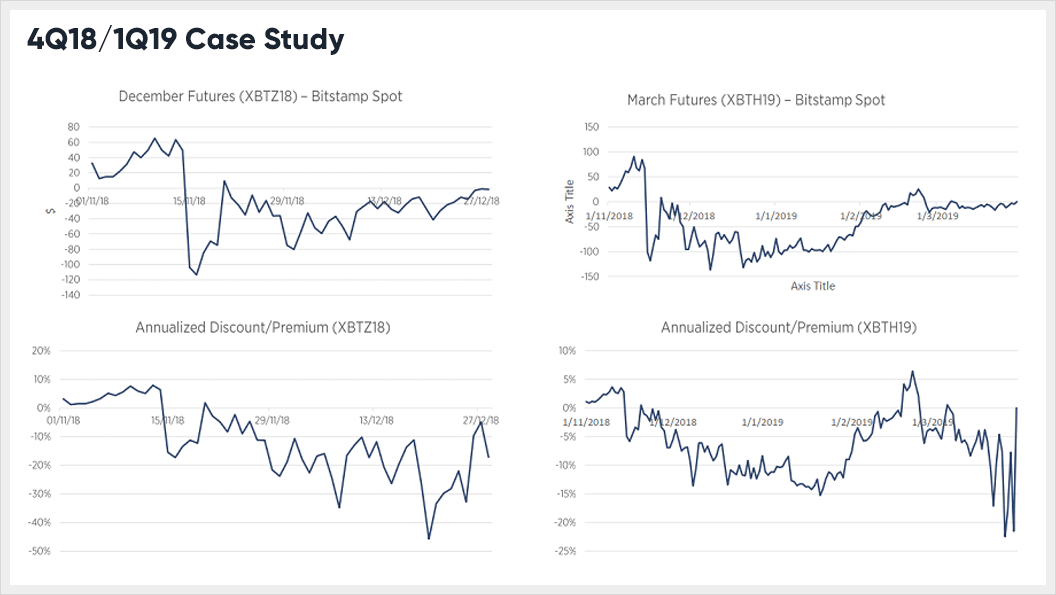

The phenomenon of high contango occurs during parabolic moves partly because the increase in the value of BTC means that bullish investors now have more buying power to buy more BTC/USD derivatives. In other words, the value of capital for leveraged longs is growing linear to BTC/USD price, while the value of capital for arbitrageurs grows at a fixed rate over time linear to the level of contango itself. This can be seen in the graph above showing the December 2017 case study where the pool of arbitrage trader capital quickly proved insufficient to satisfy the demand from bullish investors.

Contango can also occur when bullish investors are increasing leverage, but spot markets are filled with sellers taking profit from lower price levels. This often leads observers to wonder if the leveraged traders will win or if the spot sellers will win.

BACKWARDATION

For backwardation to occur, it generally involves bullish investors losing the value of their capital and losing interest in buying BTCUSD on leverage — usually through large and sudden market downturns that trigger liquidations. It also requires a certain level of fear from hedgers and miners to maintain their hedges even when the market is paying them to unwind their positions. Empirically, backwardation has signalled long-term buying opportunities.

Conclusion

Contrary to the idea that crypto-derivatives are purely speculative, they also serve important functions for long-term investors and businesses within the space. We can expect this trend to continue and the insights from the derivatives markets to become more meaningful.

AUTHOR(S)