In this week’s report, we analyze the various liquidation mechanisms employed by different native crypto derivatives exchanges and how they differ from traditional derivatives exchanges. We believe that crypto derivatives exchanges have introduced long-awaited trading innovations, that deliver significant user freedom. Nevertheless, they are not without particular risks and tradeoffs.

Liquidation in traditional markets

The Chicago Mercantile Exchange (CME) is the largest, global derivatives exchange in the world. Among various types of traditional financial instruments, it also offers BTC futures contracts. However, trading specifications of these contracts are quite different from the ones provided by native crypto derivatives exchanges.

BTC futures contracts on CME require around 40% initial margin, and trading is open only from Monday to Friday. The contract size is 5 BTC, which is roughly USD 40,000 at the moment. Users need to have a good relationship with a futures broker that is allowed to trade on CME and is comfortable clearing the product on CME.

Why is this?

Brokers must be selective regarding the clients they accept, as all trades their clients execute in the market, bring potential risk to their capital. When the trader’s equity drops below the maintenance margin, the trader will receive a margin call and will be asked to top the account to the level of the initial margin. This amount is called variation margin.

If the variation margin is not paid in time, the broker will start liquidating the trader’s position manually. Nonetheless, if the account reaches negative equity before the liquidation is finished, the trader will still be liable for the negative amount.

Failure to pay would result in bankruptcy proceedings. If that fails, the broker has to cover the negative amount from his capital.

Liquidation in crypto markets

Crypto derivatives are a new class of financial instruments and exhibit distinctive market dynamics. As a result, exchanges that were built specifically for crypto trading re-designed many processes and specifications commonly applied by the traditional exchanges.

These differences are very apparent. Unlike on CME, on native crypto derivatives exchanges, there are no brokers, and margin requirements range from 1% to 10% and are tiered based on the trader’s position size. Trading is open 24 hours a day and 7 days a week with no breaks, and the minimum contract size can be as low as 1 USD. Users are also not mandated to have any real-world reputation to access these markets, and KYC is mainly done for regulatory reasons. The denomination of margin collateral is crypto.

These changes have removed a lot of barriers of entry and made the crypto derivatives market more attractive for a more extensive customer base.

How are these efficiencies achieved?

The total market cap of all cryptocurrencies currently is more than USD 250 billion. In comparison to other asset classes, it is still relatively small. However, the volatile nature of the crypto has created an increased need for managing the risk among crypto holders and derivatives are the perfect tool for that. Demand for crypto trading has been continuously growing and has caused substantial liquidity in the crypto markets, thus sequentially driving down costs. The ease of sign up process also makes customer acquisition cheaper than in traditional financial markets. However, the lack of user reputation and smaller contract size mean that exchanges have to handle liquidations automatically.

How automated liquidation works

Losses from a trader’s position can be larger than the entire margin collateral if the market moves beyond the bankruptcy level of the account. This frequently happens in crypto markets due to high volatility.

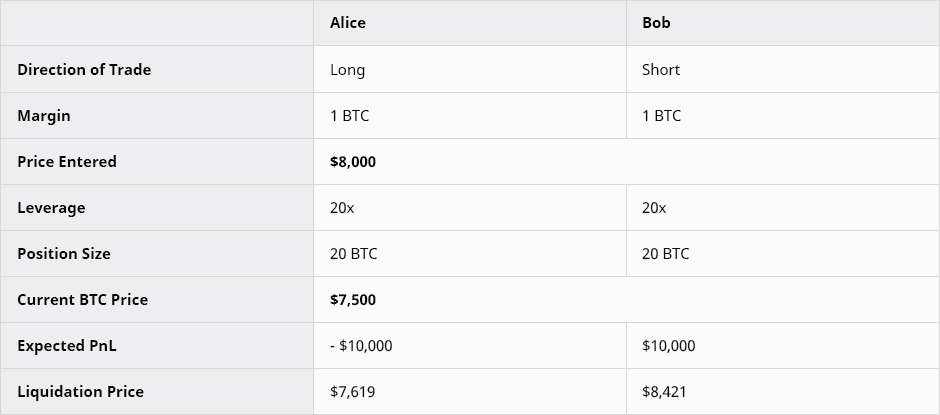

From the example above, if the BTC price moves below the liquidation price of Alice before the position can be liquidated, Alice will lose more than the collateral for the trade ($7,500). If Alice and Bob were entering into a contract directly with each other, Bob would make less profit than he expected.

We define liquidation as an event in which the trader’s position gets automatically reduced by the risk engine when the margin balance of the account is lower than the maintenance margin.

We then consider liquidation to be successful if the engine achieves a better price than the bankruptcy price. Otherwise, we consider it to be unsuccessful if it does not. Exchanges also do not want to liquidate positions too early, as this would frustrate their traders and might saddle them with unnecessary losses.

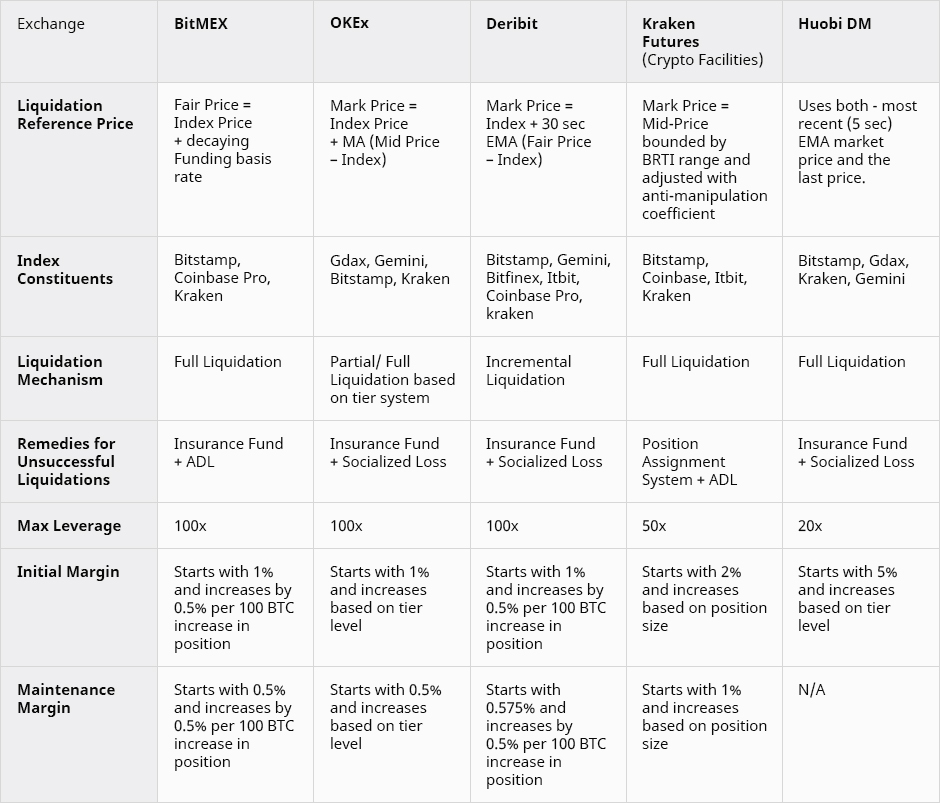

Below is a comparison table across different exchanges on how liquidations are handled:

Incremental liquidation, also known as partial liquidation. The position will be liquidated in fractional steps to avoid unnecessary reductions, on condition that partial liquidation ensures the margin balance is above the required maintenance margin level.

Full liquidation as soon as the trader’s margin balance is below the maintenance margin, the trader’s position is automatically reduced to the zero-equity point.

ADL stands for auto-deleveraging and happens when the counter party’s profitable position gets closed at the bankruptcy price of the liquidated trader.

Socialized loss is also known as a clawback. When the loss of the unsuccessfully liquidated trader’s position is proportionally distributed across all profitable traders of the contract.

Position Assignment, also known as liquidity backstops. Designated liquidity providers take over positions near bankruptcy.

Insurance fund is a designated reserve to cover the negative equity of unsuccessfully liquidated traders’ positions.

At the moment, the majority of crypto derivatives exchanges use adjusted index price as the liquidation reference price. Both — index and liquidation reference calculations need to be manipulation resistant so that high-magnitude outliers would not trigger undesirable liquidations. Deribit, for instance, calculates its index by continuously retrieving mid-price from its six index constituents, and excludes the highest and the lowest values. Furthermore, mark price is used as the liquidation reference price. Mark price is the index price adjusted with 30 second EMA of the difference between fair price and index. This mechanism was adopted to avoid price crashes, that were frequently observed on other exchanges that only used future price as the reference price. In one particular case on Okex, a large trader triggered a cascade of liquidations and a price crash from $7,000 to $4,600 by merely placing a market order in a very illiquid time of the day. Meanwhile, the BTC price on spot markets never went below $6,300.

Did adjustment of liquidation reference price solve the issue of falsly triggered liquidations?

May 17, 2019: 20% Flash Crash

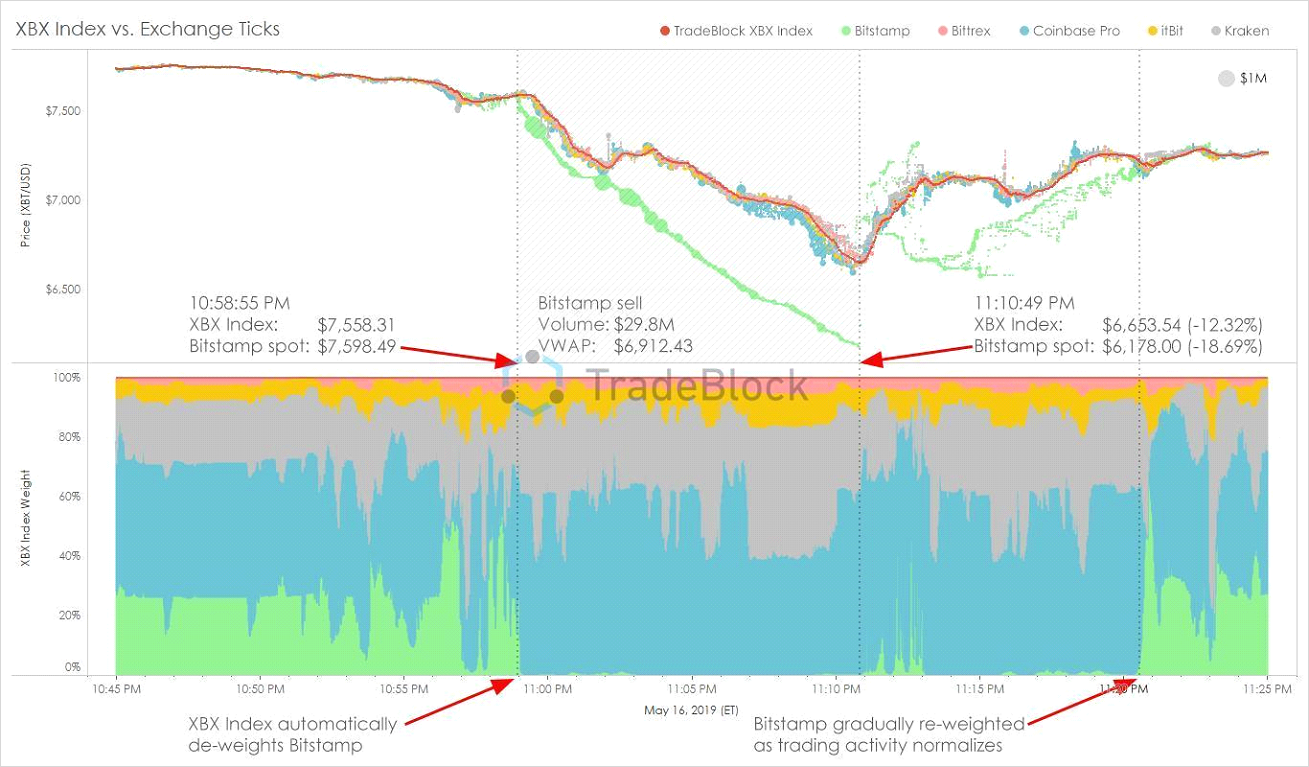

On May 17th at around 2:30 a.m. UTC, Bitstamp experienced sudden sell pressure of 4,300 BTC. This was roughly one-third of Bitstamp’s average daily volume in the preceding weeks.

Source: Clark Moody & Lowstrife

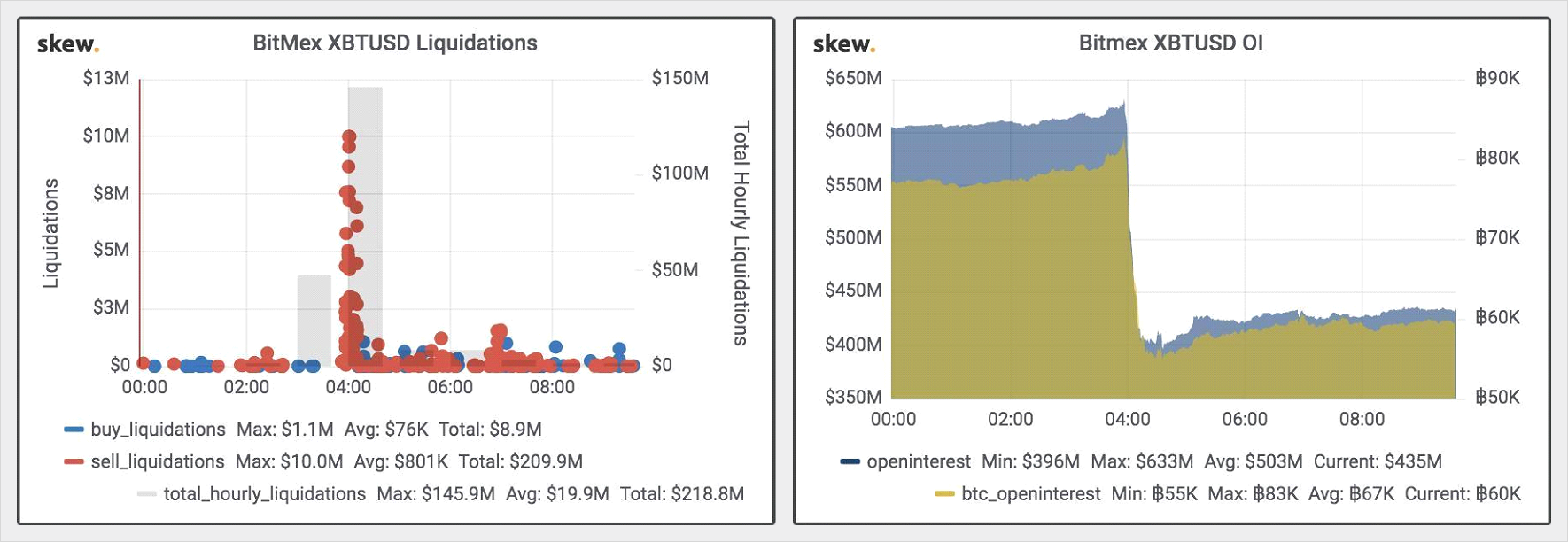

On BitMEX more than $230 million of positions got closed, causing open interest to decrease from $630 million to $400 million.

Bitstamp, at the time, formed half of the BitMEX index. However, BitMEX itself had a volume and open interest a magnitude higher than its underlying spot exchanges.

Traders took note of this and built a significant short position on Bitstamp, sequentially moving the price down on BitMEX and triggering liquidations on the long positions of others.

A rapid market selling of $30 million of BTC on one venue triggered $230 million of liquidations on another. This shows the lucrative nature of such trigger events.

Source: Skew

What were the defenses, and why did they fail?

Under no trading constraints, arbitrageurs could buy bids on Bitstamp and simultaneously sell on other exchanges like Coinbase Pro, Kraken, and Bitfinex at higher prices. That would blunt the price impact of a massive sell on one exchange by redistributing the liquidity across exchanges that were not affected.

In reality, nobody had sufficient fiat balance on Bitstamp to absorb the selling pressure. Crypto arbitrage is a strategy that largely depends on efficient management of working capital, and arbitrage traders do not hold large amounts of fiat on exchanges waiting for sudden crashes. Moreover, the average confirmation time for BTC transactions have been increasing, thus limiting arbitrageurs’ ability to transfer the coins from Bitstamp to other exchanges quickly enough to be able to sell them. Moreover, even if they did, they still would not be able to transfer the USD back to Bitstamp fast enough to do a new cycle.

As robust brokerage offerings were not easily obtainable and arbitrageurs were not able to trade the mispricing, consequently, crypto derivatives markets were affected. Two solutions already existing today could have helped: leveraged spot trading, and federated transfer of BTC across exchanges.

If the second BitMEX index constituent had been Bitfinex (spot exchange providing up to 3x leverage), arbitrageurs would have been able to quickly buy up the selling pressure by using their coin collateral, and the attack would have been ineffective. Furthermore, if more exchanges had been on Liquid Network, arbitrageurs would have been able to transfer BTC between their different exchange accounts instantly.

Arbitrageurs have an essential role in ensuring market efficiency. Therefore, it is critical that exchanges design systems adjusted to their needs.

Potential Improvements in Liquidation Mechanisms

Crypto trading is rapidly evolving, and various exchanges have already implemented meaningful liquidation adjustments.

Constructing a More Robust Price Index

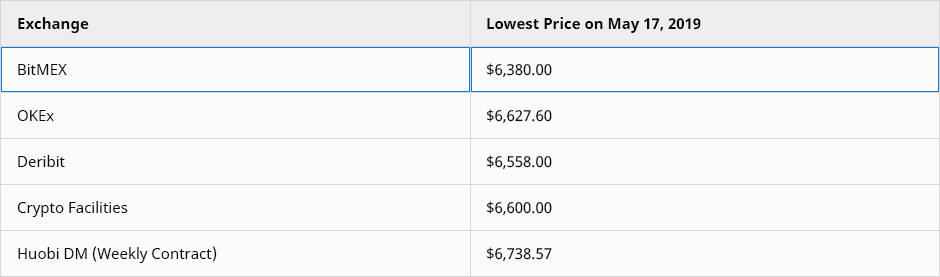

We compare the lowest price of BTC perpetual contract reached on different exchanges during the period of the flash crash:

In contrast, the lowest price reached on major Bitcoin index price providers:

During the flash crash, the lowest price of BitMEX XBT perpetual contract was:

- $251 or 3.78% lower than the average lowest price of 4 other sample derivatives exchanges

- $267 or 4.01% lower than the average lowest price of 3 sample institutional-grade Bitcoin indexes

This shows that more index constituents and adjustments for outliers can significantly improve an exchange’s defense against market manipulations. Moreover, third-party index providers continuously implement more advanced index calculations to ensure manipulation resistance.

With a higher number of index constituents, it becomes possible to determine and exclude the outliers. This is a relatively simple method; however, it significantly increases the cost of market manipulation. In our sample, this is done by Deribit and OKEx. And as it can be seen, all exchanges which excluded Bitstamp or had anti-manipulation measurements incorporated in their index calculation saw significantly fewer liquidations and hence protected users’ capital.

The chart below illustrates the difference between the lowest price on the TradeBlock XBX Index and Bitstamp on May 17, 2019.

Source: TradeBlock

Incremental vs. Full Liquidation

Users benefit greatly from incremental liquidation vs. full liquidation. Under incremental liquidation, the chance of liquidation cascades, where one liquidation triggers another, decreases drastically. This makes the reward from trigger attacks much lower, as now a $30 million sell order on Bitstamp could only trigger a fraction of the $230 million closed positions that were triggered under full liquidation.

There are various forms of incremental liquidation. Deribit gradually liquidates positions in steps of 12.5% of the position and halts the liquidation protocol as soon as margin balance is higher than the maintenance margin. This prevents the trader’s position from full liquidation in case of a price wick, after which the market instantly recovers. Due to this, Deribit has never had to socialize losses in three years of operation.

OKEx has also switched to a partial liquidation mechanism which has showed promising results. Depending on the position’s size and the tier level, position will be either reduced to the lowest tier or fully liquidated. Since the introduction of this liquidation mechanism, they have had no socialized losses despite high volatility on their platform.

It is important to note, that the concept of full liquidations does not exist in traditional finance markets. Brokers will manually reduce a client’s position to the point at which their balance is above the maintenance margin, but will not close their entire position. We see no valid reason for exchanges to continue using full liquidations and believe that incremental liquidations should become the standard of the industry.

Trading Curb and Circuit Breaker

On many equities and futures markets, large sudden price spikes can trigger a trading curb. Each exchange calculates the acceptable price change and sets price limits at which trading should be halted. These limits are known as circuit breakers, and if the price suddenly exceeds these limits, trading will be stopped. Exchange in this period is in a cool-off mode, and users can place and cancel orders as they wish. After this period is over, trading is resumed. These limits have been introduced to avoid massive sell-offs.

If Bitstamp or BitMex had used a circuit breaker mechanism, trading would have been halted, and traders had more time to process market information, and cancel or open orders accordingly, thus lessening the impact of the sell-off on Bitstamp.

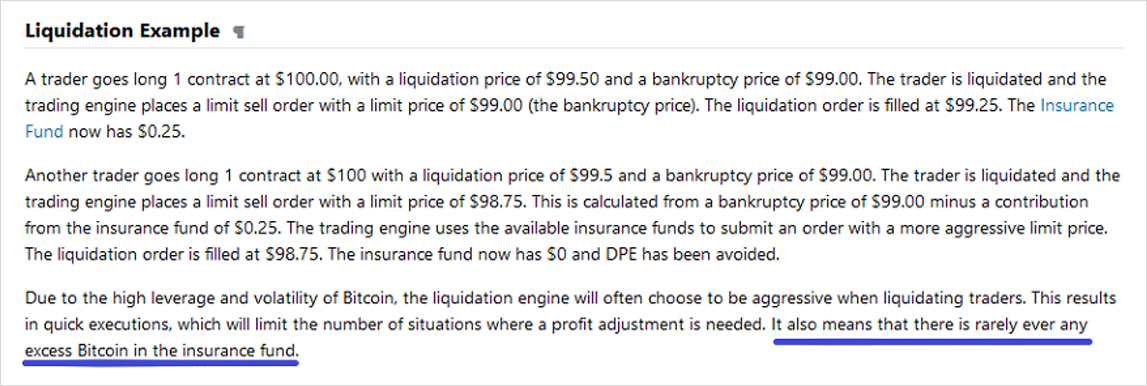

Insurance funds

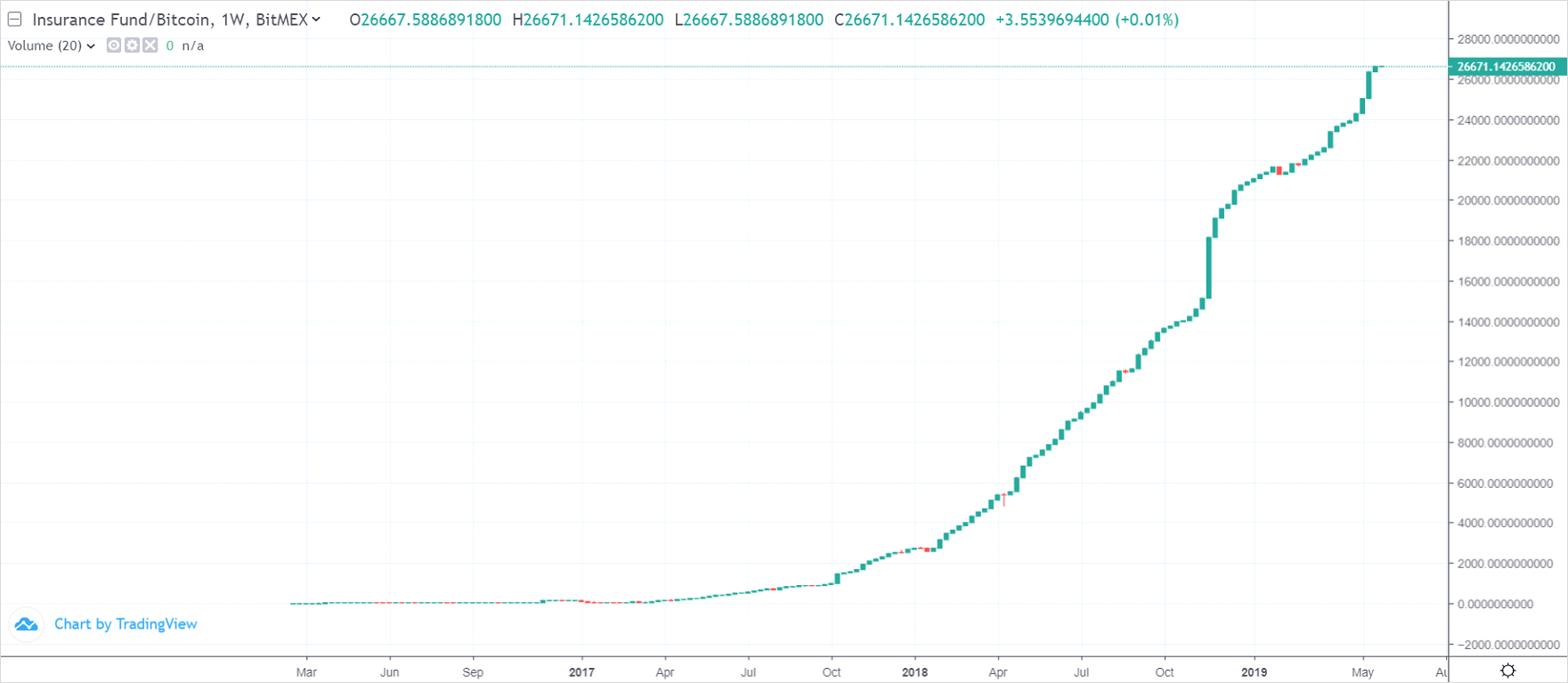

Insurance funds give large position holders a certainty of payout. However, there is an uncertainty of how these funds are managed. As insurance funds are exchange owned, they might be used as another revenue stream, rather than an insurance mechanism for traders. An example of this is the BitMEX insurance fund. Its large size was deemed as necessary to enable payouts during high volatility. Nonetheless, on May 17th, the BitMEX insurance fund increased by 750 BTC — one of its best days ever.

However, there are alternatives to the insurance fund system, such as a position assignment system also known as a liquidity backstop system. In this case, designated market makers take over positions of the liquidated trader at the bankruptcy price point. Even though this strategy is not as secure as an insurance fund and its success can vary depending on the state of the market, it can be used as an extra layer in liquidation process, thus making it more customer-friendly.

Even though a sizeable insurance fund adds a layer of safety, too excessive insurance funds can be a sign of a too aggressive liquidation mechanism. Under an exchange-owned insurance fund, the exchange may no longer be incentivized to pursue innovations such as partial liquidations or more manipulation resistant price index. When BitMEX first invented its insurance fund, it predicted that it would have “rarely ever any excess Bitcoin in the insurance fund.” Observing the chart of the insurance fund, we can safely say there is excess today.

Source: BitMEX

Conclusion

Cryptocurrency is a disruptive technology that has also rapidly changed the trading environment. Highly innovative and successful businesses have been created. These exchanges succeed in addressing the needs of users and have lowered the barriers of entry for larger customer group than exchanges of traditional finance markets. Derivatives trading can now be seamless, global, and uninterrupted.

Market participants are becoming more sophisticated and are demanding a high level of service. In crypto, just like in traditional finance markets, customers vote with their money. Exchanges that will align their interests with users’ will prosper.

AUTHOR(S)