Central limit order book exchanges are venues where buyers and sellers place their bids and asks for everyone else to see and then trade against this liquidity. If they are filled on their resting orders, they are called a maker. If they trade by aggressing on the order book, they are called a taker.

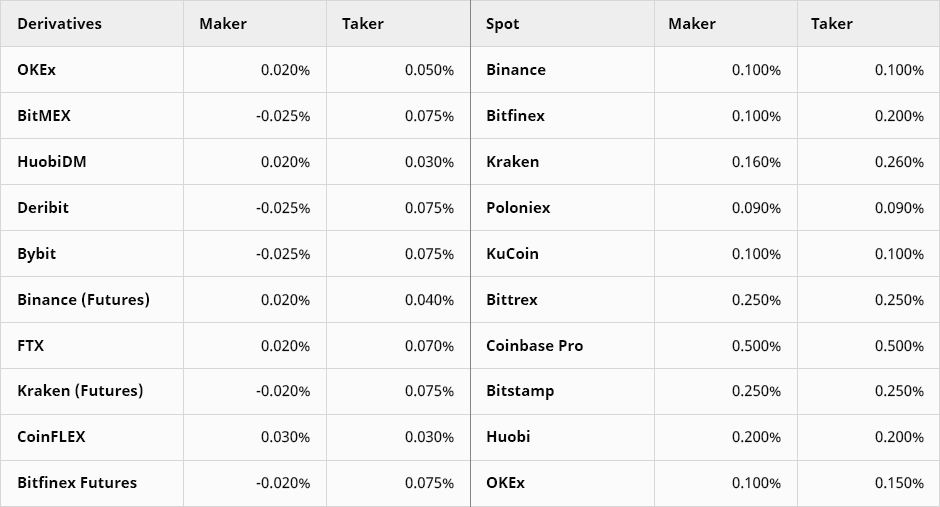

Many venues have tended toward lower maker fees than taker fees over time. Some even offer negative fees on maker trades, also known as a rebate, to encourage deeper liquidity. We see below a table of the maker and taker fees on both spot and derivative exchanges:

This market structure is not unique to crypto. In 2015, the SEC issued a memorandum analyzing the proliferation of maker-taker asymmetric pricing mechanisms in US equities markets:

Source: Memo maker-taker fees on equities exchanges

Today we analyze maker/taker fees on BTC/USD derivative markets from a user’s point of view.

Are Maker Rebates a Free Lunch?

An interesting way to begin this discussion is to ask why bother paying taker fees when you can get paid to be a maker. On BTC/USD perpetual swap markets such as Bitmex and Deribit, the fee to take is 0.075% while the rebate to make is 0.025%.

Why pay 0.075% to trade when you can earn 0.025%?

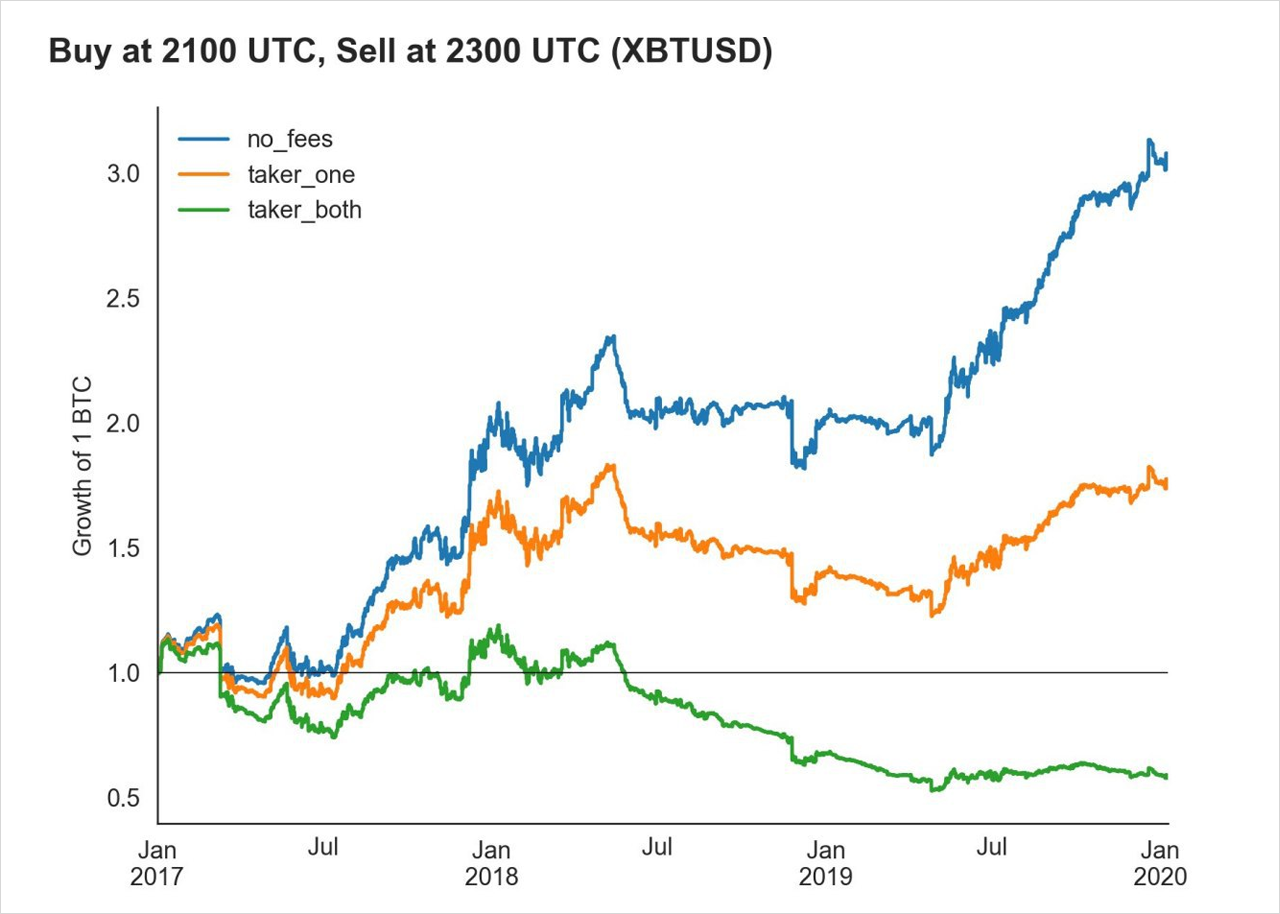

Source: Twitter

In the chart above, the performance of 1 BTC executing a buy at 21:00 UTC and sell at 23:00 UTC daily strategy is analyzed assuming no fees (blue line), one leg taker and one leg zero fee (orange line), and both legs taker (green line). Such a strategy represents a typical intraday strategy that traders might look for to generate outperformance. As we can see, executing taker fee on both legs generates significant performance deterioration and turns a profitable strategy into a losing one! So can we simply change our execution strategy from taker to maker and make money? In other words, are maker fees a free lunch?

Just as for every trade there is a buyer and seller, for every trade there is also a maker–the person resting liquidity in the order book, and a taker–the person removing liquidity from the order book. By definition, the person removing liquidity has more information than the person posting it. This is because the person removing liquidity has a reason for doing so that is currently not reflected in the sum of all markets. He may be executing a large order, he may know something about what will happen next, or he may simply be expressing a naive view. Regardless, his instantaneous willingness to remove liquidity from the order book represents information existing outside the markets and not yet reflected in those markets. Conversely, the maker may be working their order in relation to the order books on other venues, or just have a specific price in mind, but whatever the case–it is self-evident that the order itself is not aware of future intentions of the market.

Indeed, at any point in time, a large participant can come and sweep the best offer on every venue in existence. He may do so via a smart order router, via an over-the-counter voice-negotiated block trade, or just via placing a huge bid in a single venue and letting cross-exchange arbitrageurs sell into him and buy other venues. In doing so, he turns every maker order into a stale order–into ripe liquidity to be removed at a hefty profit for whoever is fast enough to do so. In an open market, makers systematically get run over by order flow.

Cost of Liquidity

Indeed, being willing to post liquidity in an order book costs time, capital, and opportunity cost. An investor who rested a bid at $3,321 per BTC instead of executing a taker order at $3,322 locked up capital but did not receive a fill. His loss, denominated in BTC, is astronomical. While a taker has the guarantee of execution, a maker is taking the risk of the market price moving infinitely away from the limit price.

Imagine if an exchange started which charged makers 0.075% while rebating takers 0.025%. Who in their right mind would post liquidity? Everyone would rush to be a taker and no one would want to take on adverse selection risk and get charged for it. Order books would empty and takers would quickly find themselves with no liquidity to trade against. The exchange would shut down immediately.

The only way such a fee structure would be sustainable is if the exchange was non-lit–aka dark. The exchange would need to filter takers by the nature of their order flow and makers would show different prices to different takers. They would have to go account by account and analyze how the market tends to move after each client trades and then show this data to the makers. In turn, the makers have to carefully monitor all fills and tell the exchange which takers they want to see flow from and which takers they do not. This is, as it happens, exactly how foreign exchange market structure currently works: takers trade mostly for free and makers pay ECNs–electronic crossing networks, but ECNs help makers monitor order flow quality and different accounts see different prices. Electronic streaming OTC BTC/USD prices from brokers are analogous to this in that commissions are zero for clients but brokers will show variable pricing based on their ability to monetize that flow. If you are a client who trades based on technical analysis, you likely have no ability to predict the direction of the next tick so you may be shown as tight as $5 wide in BTC/USD pricing from these brokers. The euphemism for such order flow is that it is uncorrelated. Conversely, if you are aggregating multiple brokers at once to execute 500 BTC blocks for sharp clients, you might be shown $20 wide at best.

We can think of the gap between maker and taker fees as an equalization of the playing field between makers and takers, or a handicap. The higher the volatility of the underlying asset being traded, the higher we might expect this gap needs to be. In a game of skill like golf or chess, the higher the skill gap between players, the larger the handicap needs to be for an even-odds bet to be amenable to both players.

Profitable Makers

A profitable maker would need to invest substantially in technology to loss-mitigate against adverse selection on bad fills and compete for good fills. They might pay for intercontinental lease lines, FPGA-encoded logic, and other forms of low-latency technology. They might also pay to hire an engineering and quant trading team to optimize infrastructure and trading logic to get an edge on the competition.

While a taker can simply trade without any technology, a maker has to compete with other makers via such investments. This heavy cost lends itself to economies of scale. For this reason, makers tend toward oligopolistic market structures where a handful of market-making firms do a majority of the profitable maker activity. These firms do ultimately earn high enough profits to cover the high costs and have some left over, but it is by no means easy.

In markets with a higher tick size, the spread between the bid and the ask expressed as a percentage of the underlying asset, makers can earn additional profits from being able to scalp that spread. In the past, a broker might say that a stock is trading at $95 bid / $100 ask and then collect the $5 spread if he had a simultaneous buyer and seller. Over time, tick sizes have decreased dramatically to cut into these marketmaker profits: the word decimalization refers to this very trend. Matt Levine notes that ever-decreasing tick sizes on bond liquidity have generated complaints from makers and wonders if infinitesimal tick sizes are sustainable.

On exchanges like Bitmex and Deribit for BTC/USD, the tick size is $0.5 which is only 0.006%. This is a very low figure compared to the daily volatility of 4%. Hence, it makes no sense to work a simultaneous bid and ask hoping to scalp the tick and open oneself up to be run over for twenty ticks. Tick sizes have remained small in general in crypto trading perhaps because makers have not been able to dictate and standardize the terms of trading to the market. While makers in traditional markets have been powerful incumbents such as investment banks, in crypto a maker is often simply a natural person.

Conclusion

Coming back to the original example, the price which occurred at 21:00 UTC and 23:00 UTC may have printed on either the bid or the ask, but for you to have received that fill as a maker, you would have had to forego gains and accrue losses in a vast array of other scenarios. Let’s say the market was 8,500/8,500.5 and you placed a limit bid at 8,500 — you chase the market up as a maker and finally get filled at 8520. Then when you go to sell, the market is 8505.5/8506 and you work an offer at 8506. You then chase the market down to 8490 until you are finally filled as a maker. The free lunch was never there in the first place because someone may have gotten the maker fill at 8500 and 8506 that you desired, but they put in a significant amount of work to acquire that fill.

Maker-taker fee structures are a natural evolution and inscribe cost of liquidity into the fee protocol. Traders should carefully analyze their performance and make conservative assumptions about their ability to achieve maker fees while dealing on last price.

AUTHOR(S)