Today I dissect margin trading in both centralized and decentralized finance. I note how market participants have sought to use such offerings in the past and present, their comparative advantages and limitations, and how they are likely to evolve in the future.

Margin Trading on CeFi

If spot trading is exchanging one asset for another for immediate delivery without any leverage, then margin trading is simply spot trading except with the assets staying unsettled.

An example:

Spot

Alice buys 100 BTC from Bob at $10,000 per BTC; Bob delivers $1million in exchange for 100 BTC and trade is completed.

Margin

Alice buys 100 BTC from Bob at $10,000 per BTC; instead of delivering $1million, Bob pays some interest rate on USD for the undelivered balance and possibly receives some interest rate on the BTC.

The earliest exchange to successfully offer margin trading is Bitfinex. It allows users to supply BTC, USD, and other assets for margin traders to utilize for margin trading.

Users can transfer their funds between three wallets; Exchange being spot trading, Margin being using their funds as collateral to put on margin trades, and Funding being to supply their funds as assets for other traders to use in margin trades. Bitfinex takes 15% of the interest earned by funds in the Funding wallet as their fee.

Eventually, other spot exchanges followed suit and today margin trading on Binance, Huobi, Okex, and others is widespread. Margin trading is especially useful for spot marketmakers because they can show quotes on spot markets in a more balance sheet efficient way. Instead of having to keep large amounts of BTC and USD on every exchange, they can just keep some collateral and then trade on margin. If the positions get too big, the marketmakers can send in the short leg of the margin trade and claim, or settle, the position to receive the long asset. Essentially, a margin trade is a spot trade which remains unsettled but can be settled at any time.

Notably, all these centralized solutions continue to follow the Bitfinex framework of splitting actions across three distinct wallets. This means that if you are long BTC/USD on margin, you are paying interest on the borrowed USD but not receiving it on BTC. Conversely, if you are short BTC/USD on margin, you are paying interest on BTC but not receiving it on USD.

Why is this and where does the money go? In effect, the exchange is the actual counterparty to every trade. It is acting as an intermediary in matching lenders–the users who have placed capital in the Funding wallet, with borrowers–traders who have initiated margin trades, on a request-for-quote basis. For everyone else, they are not a party to that activity. Activity is peer-to-exchange, not peer-to-pool. In theory, unscrupulous exchanges could use funds from spot balances and lend them to their own margin traders. If they did so, then they’d in fact be competing with their own lenders for yield.

Margin Trading in DeFi

The first successful margin trading application in DeFi is dYdX on Ethereum. In contrast to the RFQ financing model of centralized exchanges, dYdX takes the approach that all assets on the platform have an interest rate for borrowing and for supplying.

In other words, there is no distinction between three different wallets. If you simply deposit ETH, USDC, or DAI to the platform, you begin accruing interest immediately. If you deposit ETH and then buy ETH/DAI, you would then begin receiving interest on the additional ETH you bought and pay it on the DAI you borrowed.

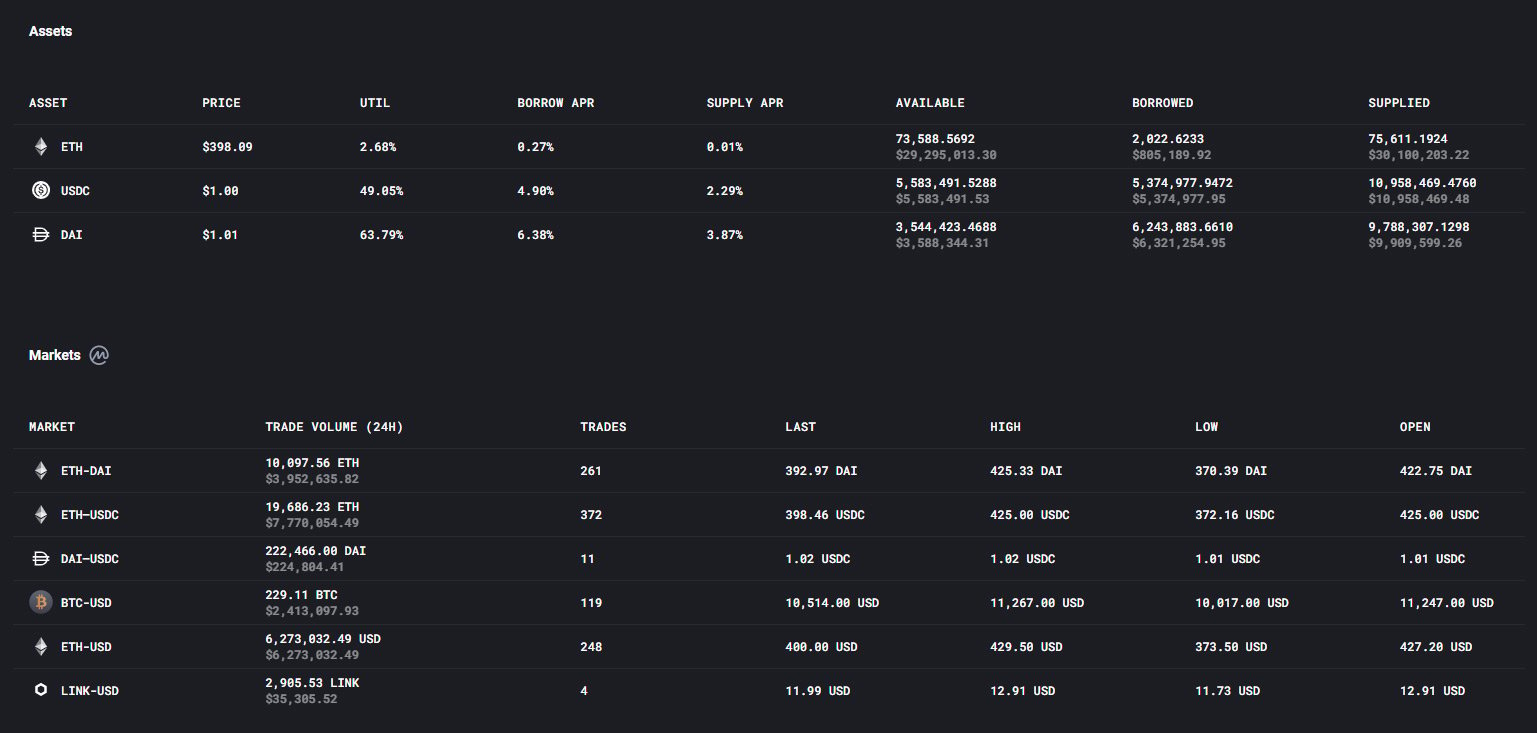

In the above screenshot, we see that the interest rates are:

ETH: 0.01 % supply, 0.27% borrow

USDC: 2.29% supply, 4.90% borrow

DAI: 3.87% supply, 6.38% borrow

Unlike the RFQ approach to rates where there is theoretically no bid-ask spread, because all assets are eligible for interest there will always be a spread. For instance, on ETH there is a large amount supplied but very little demand to borrow it. Consequently, a small amount of interest must be spread across a large pool of suppliers.

The advantages of this pool-to-pool style of margin trading are myriad:

- You can use your supplied assets to initiate your own margin trades while still getting paid interest. There is no need to move funds into a Funding wallet where they must remain unencumbered for you to receive yield.

- You can verify that you are getting paid the correct amount of interest by the protocol and that nothing has been taken from you.

- Perhaps most importantly, if you are bearish while the rest of the market is bullish (aka the market is willing to pay a high interest rate to borrow USDC and DAI against ETH), then you will receive the appropriate amount of interest for being willing to short ETH/USDC and ETH/DAI. In contrast, a margin short on a centralized exchange for the same pair would only incur you interest but not pay you any.

- Does not require account sign-up or sharing of user personal information with other parties.

The disadvantages:

- The assets must be available in the protocol or nearby. Without a centralized party to facilitate the initial liquidity or on an adhoc basis, there is a chicken or the egg problem. Composability is likely important to be able to access the assets sitting on other DeFi protocols and make them available for margin traders.

- Relatedly, rates can fluctuate drastically based on utilization. A few big trades can quickly push up rates for existing borrowers.

- Liquidations are more expensive, as positions get liquidated into currently a less liquid spot market.

If the trend of users migrating to DeFi continues, it is possible to imagine that soon DeFi spot markets are on par with or more liquid than CeFi ones. Then margin traders may see DeFi margin trading as an increasingly viable alternative to CeFi–which in turn may compel CeFi exchanges to add DeFi liquidity into their own financial markets. Under this world, disparate CeFi markets become spokes to connect to DeFi underlying markets and users can decide which level they ultimately prefer for interacting with liquidity.

in Trading on CeFi

If spot tra

in Trading on CeFi

If spot tra

in Trading on CeFi

If spot tra

in Trading on CeFi

If spot tra

in Trading on CeFi

If spot tra

in Trading on CeFi

If spot tra

AUTHOR(S)