Speculation is eating the world

This is a quest to make sense of the market and valuations today. In part one we used an Ocamm’s razor to demonstrate how soft money unleashes reflexivity; and how “minds tell markets how to move and markets tell the mind what is desirable”. In this essay I would like to discuss how the digitization of our life has sent that reflexivity and imitation into hyper-drive.

The theory of reflexivity describes how the cognitive function (World → Mind) and the manipulative (Mind → World) can interact (and sometimes interfere) with each other. In other words, the participants’ views influence the course of events, and the course of events influences the participants’ views.

Imitation mediates this process. Markets are an aggregate display of desire. Think of markets as a universal model for people to imitate. Reflexivity of assets is in fact a side-effect of mimesis.

Imitation is a form of communication. Humans are built to imitate. As stated in the first part of this essay, imitation enables reflexivity to shape the world according to our will. Humanity could not exist without imitation.

The revisionary force of reflexivity is driven by the desire, which is never-ending while satisfaction is finite. Durant wrote that “…fulfilment never satisfies; nothing is so fatal to an ideal as its realization.“(1)

These desire-driven quests make the world go round. And when discussing desire it is inevitable to mention money. Price signals which mediate human communication are expressed in money. Desire, imitation, reflexivity, and money – they are all connected.

“Everything else can satisfy only one wish; money alone is absolutely good,…because it is the abstract satisfaction of every wish.”(2) – (Arthur Schopenhauer)

Money mediates information about the price system – the market. Hayek explained that “it is more than a metaphor to describe the price system as a kind of machinery for registering change”(3). In a sense, the abstract Hayekian market is probably the first instance of bidirectional scalable information transfer.

The invention of the computer and internet caused an information revolution. We have found ourselves with the actual machinery for registering and creating change in our hands.

Optionality Is Eating The World

I first noticed the narrative of “speculation eating the world” when Arjun Balaji tweeted it. It is a play on Marc Andreessen’s “software eating the world” from the famous Wall Street Journal op-ed. Arjun’s tweet (probably) refers to an increasing number of people playing the stock market & crypto and the divergence between fundamentals and valuations.

What does it mean to speculate?

The speculation discussed in this essay refers to a practice in which money is not a means to a goal but a goal itself. A speculator, under this definition, is someone who does not directly wish to engage in shaping the world, but rather attempts to guess which way the world shapes itself next.

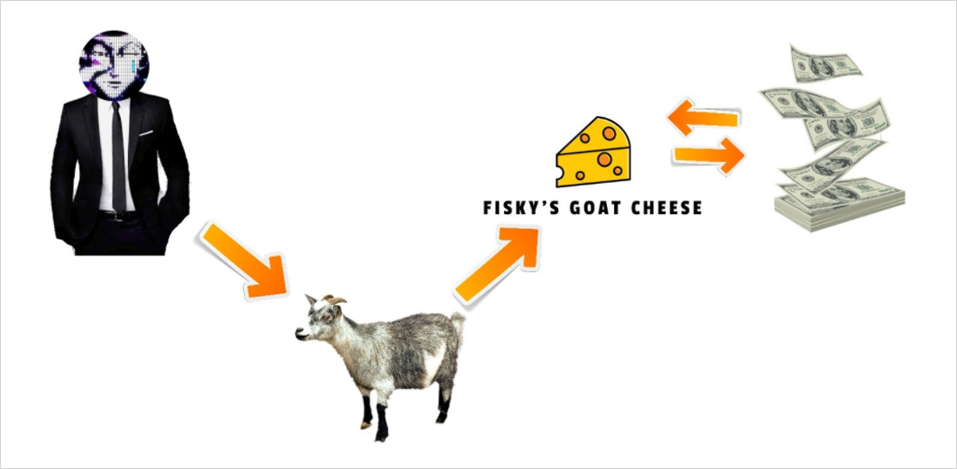

Fiskantes enters the market to buy a goat, because he wants to make goat cheese. (less a speculation/more an investment)

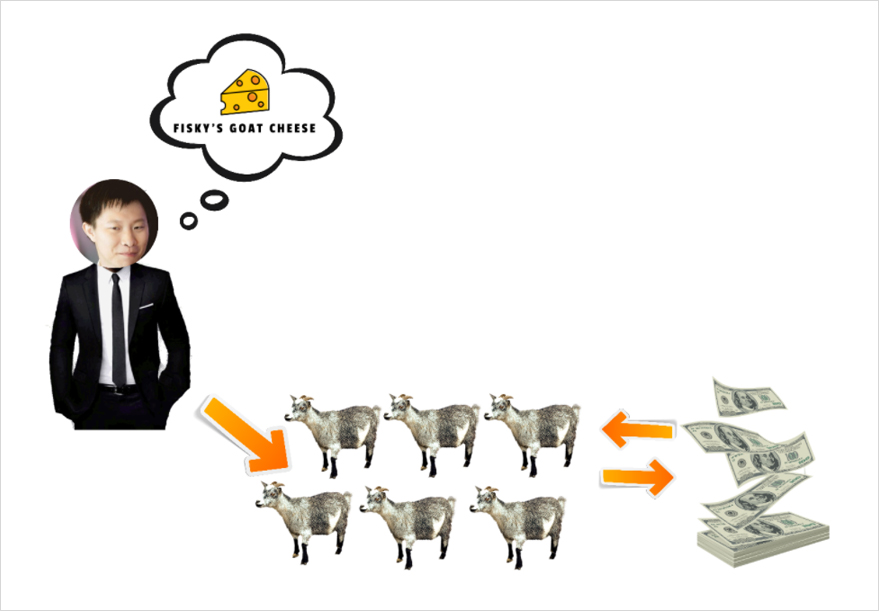

Su buys up all the goats because he suspects that a demand for Fisky’s Goat Cheese product will drive the demand for goats. (more a speculation/less an investment)

The speculator focuses on the signal and conducts their action based on the market interaction of others. Their main intent is to multiply money. Fiskantes, in the example above, also wants to make money but intends to create a product.

Thus we could describe speculation as such a transaction which does not connect directly to an output/product. Let’s dive into a trickier example:

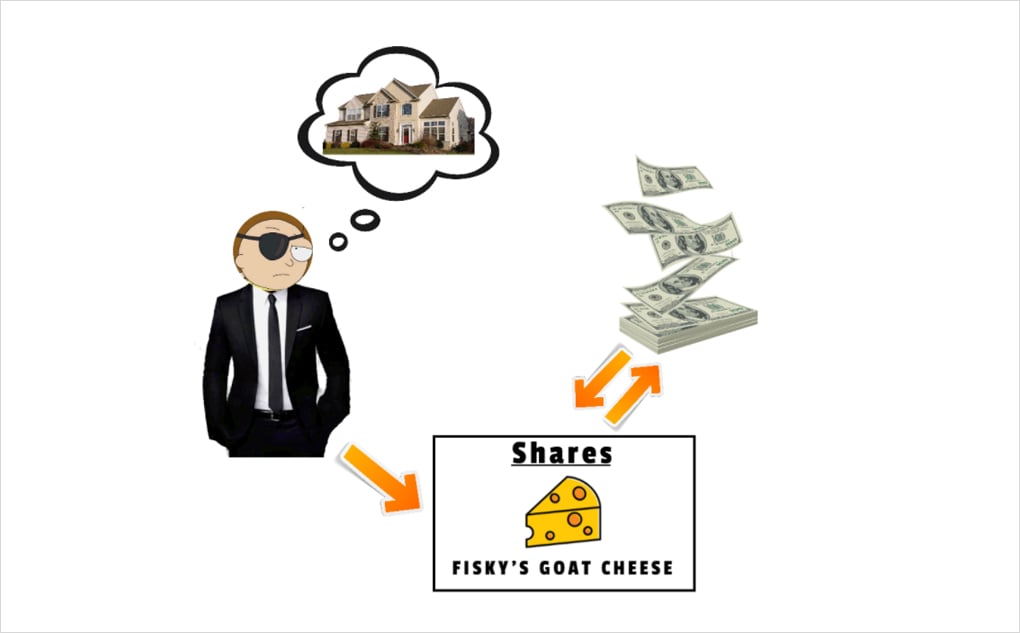

Hasu wants to buy a reasonably sized house so he looks for an investment to make money. He decides to buy a stock in Fisky’s Goat Cheese and holds.

To a larger extent this is a speculation although one would think of it as an investment. This demonstrates a false dichotomy between speculation and investment. Everyone engages in some form, and to some extent, in the act of speculation.

For the purpose of this essay I would like to frame speculation in terms of optionality. So when we say “speculation is eating the world”, we say that people prefer unlimited optionality, with money becoming more valuable than anything one could possibly do with it.(4)

People diversify by investing in $AMZN, $TSLA, $FiskyGoatCheese and other securities because the founders and people employed in those companies have given up (some of) their optionality. Obviously, just to some extent, because they could have diversified themselves.

If Fisky dedicates his time to making goat cheese, he gives up some optionality but creates potential optionality for Su, Hasu and many others. The trades in which Su and Hasu engage also create optionality for someone else and so on.

I understand the speculation is eating the world as optionality eating the world. This is manifested in an increasing number of people playing the stock market and crypto and overfinancialization(5) of the economy.

The hypothesis goes that the computer is a great enabler of optionality. In order to make some sense of the market today, we will explore the computer and the digital world and the associated optionality it has created.

Uncertainty breeds optionality. Optionality then creates more uncertainty about the outcome. Uncertainty makes optionality more valuable. And so on. The more uncertain we are the more we look around for the answers.

Infinite Possibility and Infinite Competition

Atoms of the physical world appear to be limiting in comparison to an infinitely malleable lure of bits where desire meets unlimited imitation. The computer and the internet is the enabler of mass copying and mass competition.

In the digital world of bits, the copying becomes omnipresent. Embodied in both; instant copying of files and code, and human copying the behavior (and desire) of the other.

A popular counter-narrative says that we reduced technology to information technology and describes our obsession with screen as an inward-facing retreat. Software eating the world has become a famous phrase.

Software transcends physical properties and enables creation of new worlds. It also connects distant locations in the physical world. As a result the signal in the network travels faster and so does imitation and reflexivity.

People imitating one another leads to competition. Competition is a form of validation, ensuring that one’s object of desire is truly worthy of his attention. The validation of peers mediates self-validation. We find it reassuring when people do the same thing.

The competition received an upgrade in the world of bits, becoming ever present but largely non-lethal (for now).

“…digital networks are powerful amplifiers of the existing realities…they permit endless threads of conversation, they are also amplifiers of the intense competition that exists between individuals…This consists of the permanent search for attention, since each individual seeks to be a model for others through the number of «likes» or «followers».”(6) (Antonio Machuco Rosa)

Through the interface of social media we enter a global talent show of competing strangers and acquaintances. As software has infiltrated our daily lives we began to increasingly turn inwards; glazing into a screen that has become a mirror.

Computers were used to inform people about the world until the computer became our (almost) whole world. In regards to the market; software has started off as an interface into the market. Inevitably, the software became the market and the market became software.

Introducing financial markets to social media is a mimetic trap. We receive validation not only through multiplying money but also through likes. Money is likes, and likes are money.

If Schopenhauer lived today he might have tweeted that “The digital world is…always ready to turn itself into whatever object their wandering wishes or their manifold desires may fix upon.” and; “Everything else can satisfy only one wish; the computer alone is absolutely good, …because it is the abstract satisfaction of every wish.”

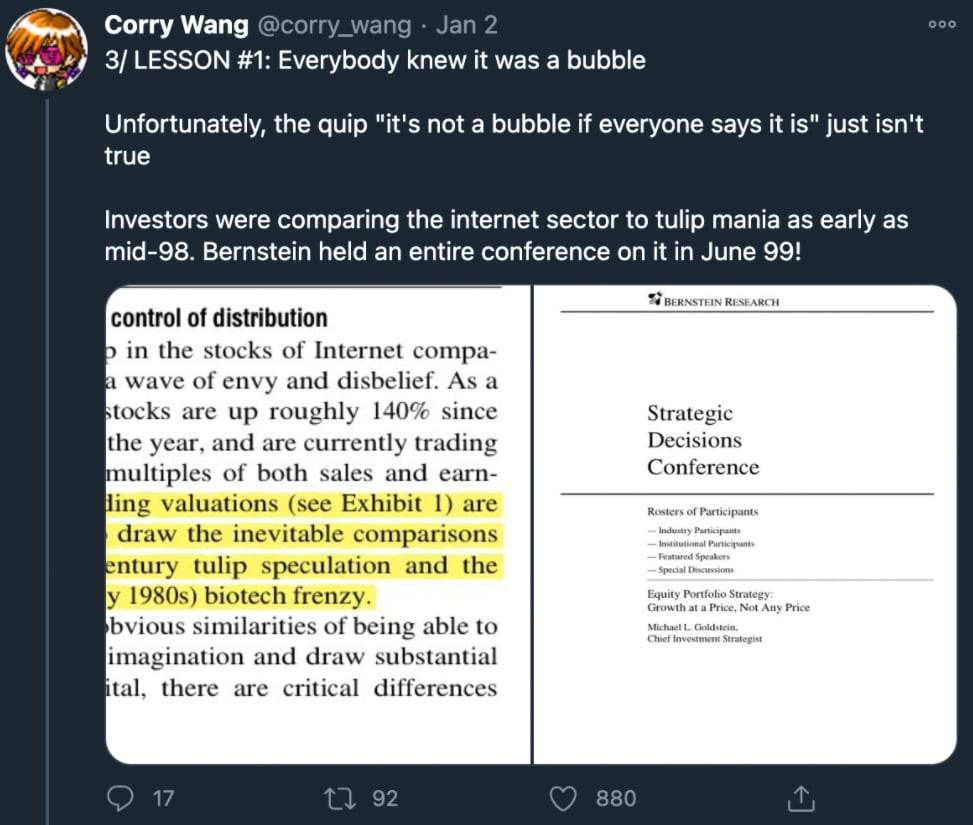

By enabling runaway imitation, reflexivity and consequent competition, the computer has also intensified our ability to create and sustain financial bubbles.

Charlie Munger has famously quoted the Lollapalooza effect, which is another name for a reflexive action turning into a financial mania. Imitation is what allows for Lollapalooza to happen:

“…Munger used open outcry auctions as an example of the Lollapalooza effect. Participants are pushed to bid by reciprocity (“I should buy because I was invited to the auction”), consistency (“I have been on record saying that I like this so I must buy it”), commitment tendency (“I am already bidding so I must continue”), and social proof (“I know that buying is good because my peers are doing it”).”(7)

Sometimes Lollapalooza can have a positive outcome. This is when madness of the crowds manages to turn itself into the wisdom of the crowds. The actual mania of the Dotcom bubble actually aided in bootstrapping the internet to life.

As markets began to exist in the digital domain, in which we could actually access the market through our screens, our capacity to create Lollapaloozas has multiplied. Digital age allows for infinite competition and infinite possibilities.

The abundance of optionality and lack of direction is a hallmark of the digital era. This means “probability and statistics are the dominant modality for making sense of the world…random walks define what the future is going to look like”(8). In such a world it is almost impossible not to copy or imitate.

The Ultimate Frontrunning Game

Competition in the digital space is different. The games we play in the world of bits seem to be infinite. Just like a video game with infinite lives. The objective of such a game becomes to keep playing, rather than win.

The modern world is more malleable (and probabilistic) than ever before. That is, our interpretation of the world is more malleable rather than the world itself changing much.

So we come back to the concept of reflexivity, with information flowing from a mind to the world interfering with information flowing the other way. The barriers between the price and the narrative are becoming less clear.

The preference function, no longer informed correctly by the belief function, is melting into a shapeless mass. Pumpamentals become the fundamentals. Price is the news. Fundamentals (may) follow the price.

We are preoccupied with numbers on the screens. Things beyond are largely unimportant to those who favor optionality.

Mark Spitznagel of Universa runs a famous tail-hedging strategy that is not about the actual positions but rather about the meta-positioning. He calls this a roundabout approach; focusing on indirect means rather than evaluating the end itself.

In such an indeterminate world we can only entertain ourselves speculating. We confuse our preference with the preference of others. The world becomes a Keynesian beauty contest; we’re trying to guess what others are guessing. And then we’re trying to guess what others are guessing about what others are guessing…

To keep playing is more important than winning.. In a world of instant and unlimited copying, the Lollapalooza is amplified. What matters is not to be the last one inside – the Lollapalooser.

When one realizes what has become of the game, timing becomes of great importance. The world turns into an ultimate frontrunning game(9). Being early translates into being right. We separate the end from the mean.

One cares less about what the signal actually means and focuses on picking up the signal before others. It is as if we are trying to interpret our own signal, changing it as we come up with a new interpretation only to change it again.

The Greatest Trade Deal In The History of Trade Deals (Maybe Ever)

The other interpretation could be that the optionality is just an illusion and all bets are but a macro bet as the world shrinks through interconnectedness. In 2008, Thiel wrote that “the extreme valuations of recent times may be an indirect measure of the narrowness of the path set before us”.

Thiel pointed out that the visions of a globalized world offer but two endings: the utopia or dystopia. The insane valuations are either a sign of utter desperation or of a blind hope that arises from the lack of alternatives. The investment meta-thesis of our age is number go up. The less cynical version is that fundamentals follow the price.

Thiel predicted either intensification or rollback in globalization in the aftermath of the impending crisis. Separating the political agenda of globalism from globalization, the actual globalization did not reverse.

The term of globalization can be understood as homogeneity and copying things. Although it seems that the political agenda has been put on hold, the world did not stop to globalize or to copy (imitate).

On the contrary. The copying has intensified. To this day, the statement “that the greatest investments of our time remain those most highly levered to genuine globalization”(10) remains a valid and successful investment thesis.

The longer the Great Boom of post-2008 continues with $TSLA and $AMZN reaching new all time highs, the greater the urgency to ditch the Old Economy. The optimism of the markets perpetuates itself in two (conflicting) major beliefs of The New Economy.

The first is the technological salvation delivered by the genius of Musk, Bezos and other great entrepreneurs. The second is the great redistribution via consumption of the Welfare State 2.0 disseminated through the memes of Modern Monetary Theory (MMT) and Universal Basic Income (UBI).

Thiel, a sophisticated upgrade over Tyler Durden(11), expected that the financial crisis of 2008 would destroy “the ideological scaffolding” upon which the bubble was built12. Ironically, we have actually doubled-down. It seems we are obstinately heading one way.

The money printer goes brrr like never before. China pushes full steam ahead. Web 2 is in a process of being replaced by Web 3. We ditched hedge funds for passive investment strategies(13).

The same bubbles, new names. Imitation and copying knows no boundaries in the globalized world of bits. All bets are but a one bet.

As the path in front of us becomes narrower, The Wall Street is replaced by Twitter and Reddit. The fruits of over-financialization of our age are no longer to be reserved for bankers in Zegna suits.

Software is unleashing a beast, the Scylla of bubbles, all of them being rolled into one giant monster. The last foolish attempt at a breakthrough.

“Those investors who limit themselves to what seems normal and reasonable in light of human history are unprepared for the age of miracle and wonder in which they now find themselves. The twentieth century was great and terrible, and the twenty-first century promises to be far greater and more terrible. Classic investment strategies no longer work in a world where ordinary economic cycles are broken.”(14) – (Peter Thiel)

Conventional wisdom does not help. Perhaps it is true, we might live in a new paradigm where bubbles are mathematically impossible. The world does not care about what is, it mainly cares what could be; with revisionary forces constantly at work, the things that can become something are of greater value than things that are something. Can anyone escape the flywheel?

This explains Thiel’s “the greater positive difference in valuation between financing rounds of a startup, the greater the undervaluation” hypothesis. Fundamentals follow the price. In the digital era, the power of reflexivity becomes unstoppable and Lollapalooza could indeed turn a car company into the world’s biggest sustainable energy and automation company.

In such interpretation – we run the simulation. Markets inhabit the digital construct that we run ourselves in our own computers. Computer, like money, has become an abstraction of every wish because it is a proxy to things our hearts desire. The digital allows us to bend reality according to our will more than ever.

“For the policymaker as for the investor, the challenge is to find a way between the Scylla of outdated wisdom and the Charybdis of nihilistic cleverness.”(15) – (Peter Thiel)

In a world in which it seems there are so many options on the surface yet underneath there are very few there is no wonder people prefer money and optionality. But some monies are better than others and some visions are more outrageous than others.

For us to get a sense of what might be coming is to imagine that the Dotcom bubble actually happened in a globally interconnected digital world of mass imitation. The most outrageous plans will be the winning ones.

It is just not worth placing the opposing bet as markets and the world of finance cannot compute apocalypse.

(1) Will Durant, The Story of Philosophy

(2) Arthur Schopenhauer, Parerga and Paralipomena: A Collection of Philosophical Essays

(3) F.A. Hayek, The Use of Knowledge in Society

(4) Peter Thiel, Zero to One

(5) Excessive reliance on finance over production

(6) Link

(7) Link

(8) Peter Thiel, Zero to One

(9) Credit to @Fiskantes for bringing this up

(10) Peter Thiel, The Optimistic Thought Experiment

(11) Durden is only a permabear. Thiel is a macro-permabear and a micro-bull

(12) Peter Thiel, The Optimistic Thought Experiment

(13) When everyone does the same thing, it stops working. Link

(14) Peter Thiel, The Optimistic Thought Experiment

(15) Peter Thiel, The Optimistic Thought Experiment

AUTHOR(S)