Memes, markets & mimetics

What is the difference between a game and a financial system? When does a game become real finance? As software-enabled speculation eats the world, the fine line between reality and the game can blur. Mimetism and reflexivity are driving this process.

This essay aspires to introduce the reader to a couple of philosophical frameworks in a playful way, offering a different analysis of the current market situation. The results of this inquiry were surprising even to the author and it needed a fresh pair of eyes to point out that this may be describing some form of oracle attack.

This first installment describes the basics of reflexivity and mimetic theory and how they are related. The reader will hopefully think of this as a fun thought experiment that, in a greater detail, discusses why:

- Some objects are more reflexive than others.

- The amount of money in the system affects the reflexivity of financial assets.

- Memes and markets are very similar – both compile information. They are nuance-reducing machines and they are at odds with each other.

- Mind tell markets how to move, markets tells mind how to curve.

- Assets prices can be obscured by memes; and the “price becomes the news“.

- Highly reflexive assets are subject to mimesis.

I would like to begin this pondering on nature of things with this verse from Lucretius:

No single thing abides, but all things flow.

Fragment to fragment clings; the things thus grow

Until we know and name them. By degree

They melt, and are no more the things we know.

Reflexivity And Reflexive Assets

According to Soros, thinking serves two functions:

- One is to understand the world we live in; the cognitive function or a belief state of mind.

- The other is to change the situation to our advantage; manipulative function or a preference state of mind.

These two functions connect our minds and the world in opposite directions.

- In the cognitive function, reality determines participants’ views; the direction of causation flows from

World → Mind - In the manipulative function the intentions of the participants have an effect on the world. The direction of causation becomes reversed from

Mind → World

When both functions operate at the same time they can interfere or interact with each other. The participants’ views influence the course of events, and the course of events influences the participants’ views.

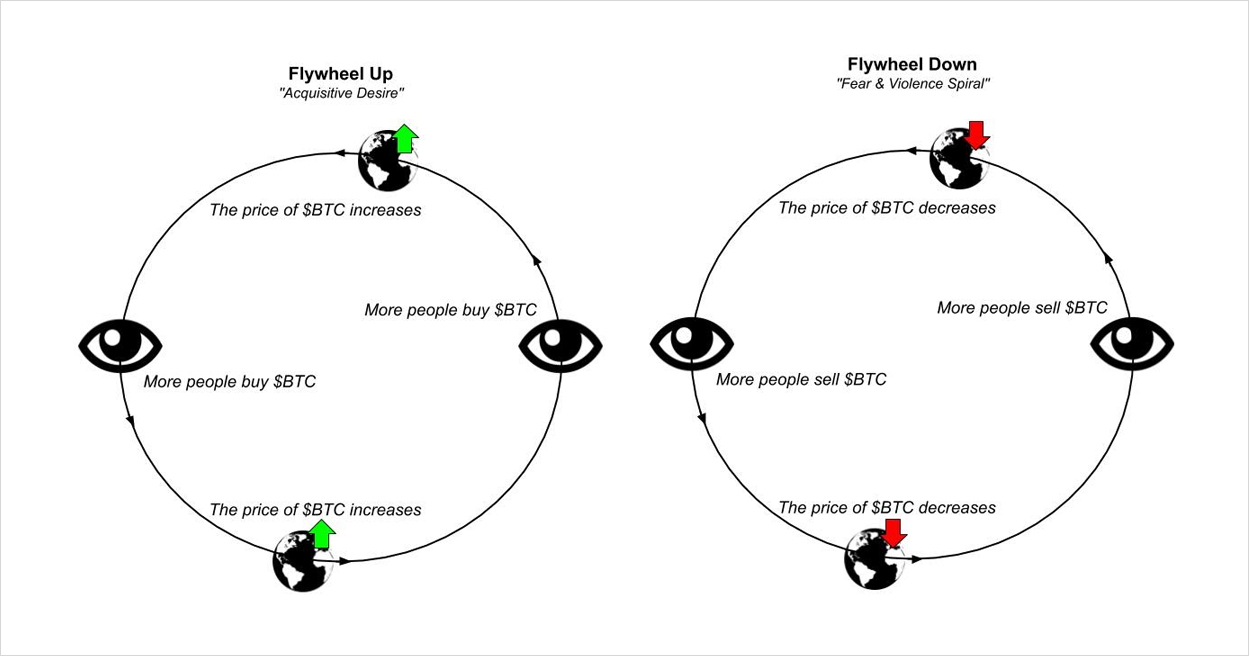

The influence is continuous and circular; that is what turns it into a feedback loop. Hence, the famous flywheel analogy. Prices drive desire, desire drives prices.

Everything that requires description beyond mere physical properties is a subject to reflexivity. Highly reflexive things require a narrative to be comprehended. Also, reflexive assets are prone to volatility as narratives tend to be whimsy.

Do you see a shoe or do you see a yeezy?

Do you see a pyramid scheme, digital gold or an alternative monetary system?

Do you see a pre-mined scam or do you see a world computer?

Let me demonstrate reflexivity in the following statements:

Bitcoin is a revolution. (highly reflexive) → We’ll see about that (expensive inquiry)

It rains outside. (not reflexive) → I can easily verify right now (cheap inquiry)

If I believe that Bitcoin is revolutionary there are costs associated with verifying that statement which include time, money and perhaps other resources. Claims about reflexive assets take time to resolve. Such inquiry is expensive as the result itself is malleable.

Whereas checking my claim about weather is relatively simple, provided that I am in a room with a window. Resolving the extent of the truthfulness of my statement does not require more than sticking my hand out of the window – it’s cheap (and also not malleable).

Memes and Markets

In a recently circulating video, Jeff Bezos defines a property of information that has a high virality potential:

- Removed nuance

- Adding emotion (preferably conflict)

The above is a recipe to create a successful meme. Memes scale information distribution.

Dawkins, who first described memes, defined them as an evolutionary aspect subject to selection-process that “conveys the idea of a unit of cultural transmission, or a unit of imitation” (via Wikipedia).

Memes have something similar with markets. Market’s output is also very succinct. It comes in the form of a price.

Both markets (in Hayekian terms) and memes compile information by removing nuances and provide us with a succinct output, a very particular message. Memes are similar to price tags. Meme and markets are nuance-reducing machines.

Given that they operate in a similar fashion and both contribute to scaling information, these forces could be in competition. Market’s outputs are subject to physical limitations (eventually). As memes are mere narratives, there is no physical boundary to a meme itself(1).

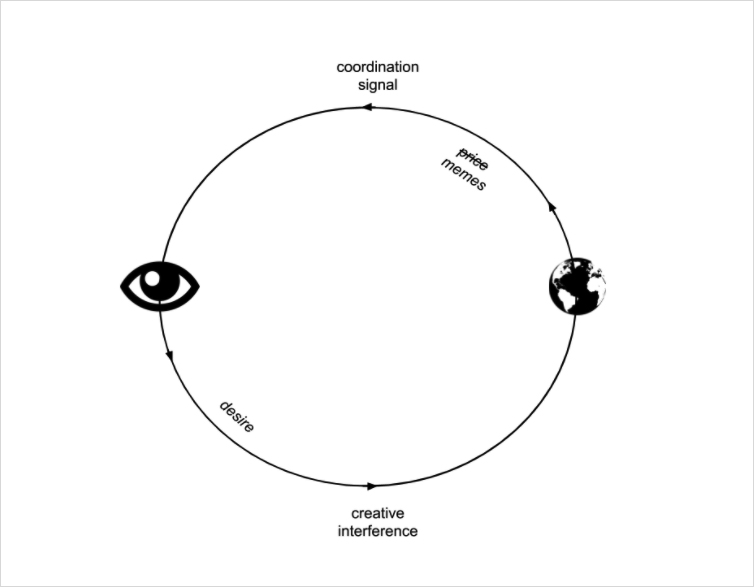

In the context of market reflexivity – prices should represent a belief state of mind, while memes belong more to the preference state of mind category as they can bend the truth or obscure the reality. As Hasu pointed out; lines become blurry in the context of oracle attacks. Distorting market prices triggers actions in the real world.

Price is a coordination data point, informing us about the true state of the world. Meme, although scaling information distribution, does not necessarily convey the true state of the world. This misinforms the feedback loop. Preference pretends to be a belief (as in true representation of what is).

When an Asset (and Its Price) Becomes a Meme

Tesla is a meme. But $TSLA has a price.

$BTC has a price. Bictoin is also a meme.

When assets’ prices become memes, or a meme becomes price, an extremely powerful Schelling point is created. The Schelling point is a result of mimesis, in other word; imitation.

What is the difference between meme and mimetism?

Meme compiles information to provide a succinct narrative. Mimetism (imitation, which is discussed in detail later) describes the process of meme reproduction; you want something because others want it. Memes spread through mimesis.

Money Printing & Reflexivity

In terms of the market, preference state of mind acts as a creative mechanism. Belief state of mind serves a coordination tool. The assumption is that both serve their purpose and should be finely balanced for markets and society to function well.

We coordinate through price feedback and create new things by introducing our preference on status quo. When we drown the market in money we actually enable an oracle attack.

As the monetary base expands central banks are handing out claims on stuff. Markets become more liberal in defining what is desirable and valuable. In other words, the market’s outputs are distorted as the coordination signal gets weaker or less precise.

Participants start to feel free to manipulate the world around them as it becomes more malleable due to lack of a corrective signal. Memes replace price.

As the output of markets gets obscured, definitions become vague or blurry, we lose not only the ability to coordinate effectively but also the ability to truly innovate. How can one build things that are needed if we do not truly know what is needed?

More soft money in this system allows us to broaden definitions of things and the desire aspect intensifies as the number goes up. Desire and malleability are tightly connected and without any signal of ground truth they can hijack the mind.

A shoe becomes a Yeezy, $TSLA becomes more than a car manufacturer – the narrative aspect is more important than the face value. Unhinged manipulative function leads to people desiring those things that are becoming valuable on the market due to the lack of corrective signal.

When the quantity of soft money expands, people are willing to conduct more expensive inquiries around highly reflexive assets. Desire intensifies. The overpowering preference state of mind (over belief state of mind) gives market participants too much power to define what is desirable. So they allocate money into reflexive assets.

Does it matter that $TSLA is barely profitable? Is it a car company? Is it a technological company? Is it a brainchild of a genius or a madman?

Do you see a car manufacturer, scam or “the future”?

Ultimately, it is the aggregate of active observers who decides what reflexive assets will become. But physical limitations play a role. Bitcoin has abandoned its original narrative of peer-to-peer payment network because its (physical) properties, such as low transaction speed, do not allow it to support this narrative.

In terms of the markets, soft money seems to exacerbate the effects of reflexivity. In a highly reflexive environment things become valued not at what they are, but how good their memes are.

With more money the vision gets projected further into the future and few care about what is. Many (and money) care about what could be. Memes obscure reality and shape the visions of the future. Prices become memes.

Reflexive Assets as a Side Effect of Mimesis

Girard describes a human as a lifelong child that desires the toy someone else has just picked up. Man being unable to choose what to desire turns to others to find it.

Girard’s mimetic theory states that the desire is born out of the contemplation of someone else who is desiring something and who designates to the other the object of desire. The other now sees this object as desirable.

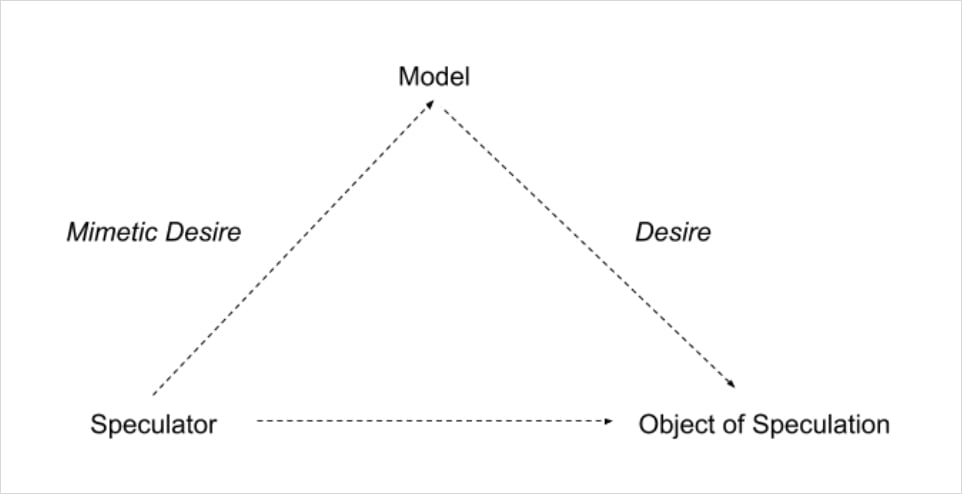

There is a triangular relationship (pictured below) between (i) the speculator (or subject) who copies (ii) the model in his desire for (iii) the object.

We imitate the desire of someone else, but as soon as we both desire the same object it leads to a conflict since the desirable object exists in subjective(2) scarcity. Thus, imitative nature of desire leads to conflict.

People polarize around objects of desire. Once the subject realizes that he is imitated in his desire, his desire deepens, triggering a reflexive cycle. A conflict is a natural conclusion.

The collective guilt boiling under the surface requires a sacrifice – a scapegoat, to resolve the conflict. According to Girard, people have to be reconciled against the scapegoat they all kill together in an act that unites them(3).

Desire, born not out of necessity but insecurity, awakens greed. It is not a coincidence that many interpret greed as a driving force behind markets(4) or the market being a system that tames destructive greed in a productive way.

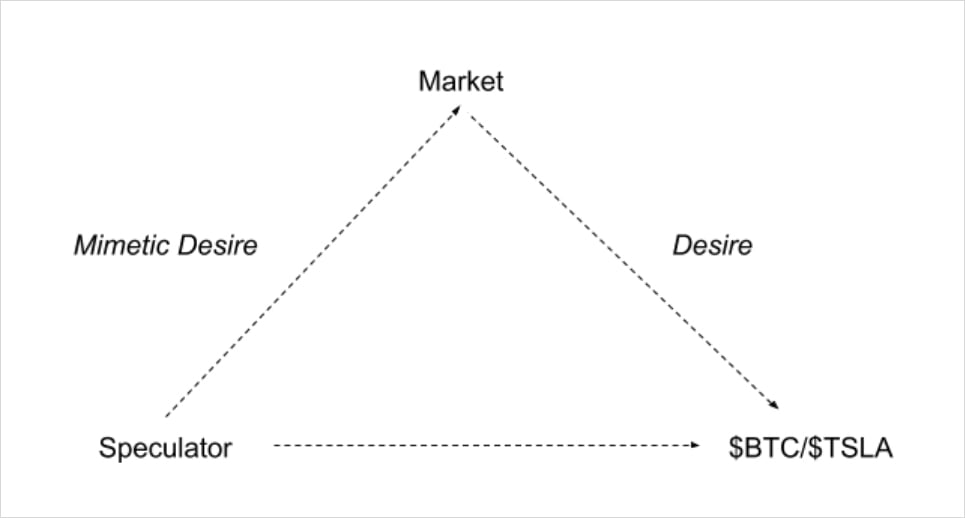

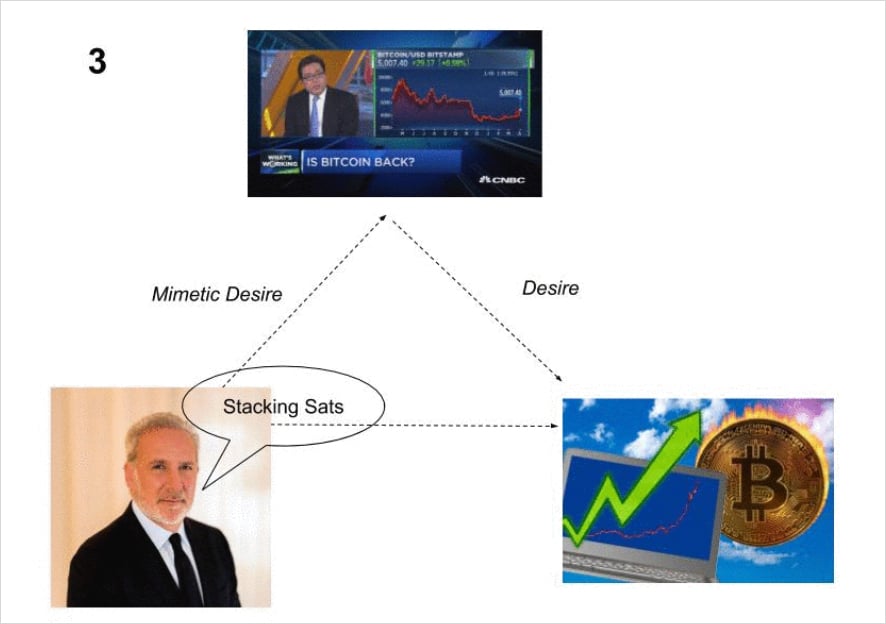

How does the mimesis reflect in the markets?

Markets are an aggregate display of desire. Think of markets as a universal model (in the triangle) for people to imitate. Reflexivity of assets is in fact an epiphenomenon of mimesis.

Consider a perspective from Manias and Mimesis on how a startup becomes a decacorn(5):

- Someone has an obviously insane idea, like selling Basic to computer hobbyists in 1975 or selling books on the Internet in 1994.

- They wildly oversell this idea to investors and early employees—it’s quite common for startups to produce sales projections in their early stages, but rare for them to hit their initial numbers.

- The combination of investor money and talent makes the idea a little less crazy, albeit still ambitious.

- On the basis of this track record, the founder raises more money and recruits more talent.

- Over time, either reality converges on these wild expectations, as the expectations get toned down and reality catches up—or exaggeration becomes the only possible way to keep the company alive, and founders ratchet up self- and other-deception until it reaches the breaking point.

Each step is informed by the market. Investors want in because others are in. Mimesis-enabled reflexivity helps ideas come to life. Reflexivity is a good thing as it helps to transform our environment. The problem is when the desire equilibrium gets distorted.

The Desire Equilibrium

Eric Weinstein has expanded on the Theory of Reflexivity by describing the opposing momentum represented by two sets of equations going back and forth, hinting at similarity to the description of Einstein’s Gravitational Field Theory.

Wheeler’s interpretation of Einstein:

Matter tells space how to curve, space tells matter how to move.

Weinstein’s Interpretation of Soros:

Minds tell markets how to move, markets tell the mind how to curve.

The question that Weinstein asks; “What would it be that is curving?” The answer: mimesis. Unpacking these “equations” in Girardian terms:

Minds tell markets how to move, markets tell the mind what is desirable (what to want).

The manipulating function lets agents interact with the market, therefore causing the market to change its behavior. Cognitive function, operating in reverse, causes the agents to change their mind, creating a feedback loop between belief state of the mind and preference state of the mind.

Imagine the desire equilibrium as two equations going back and forth(6):

Speculators tell the market what is individually desirable (particular asset), essentially ‘minds tell markets how to move’ (preference state of mind).

Market gives feedback to an individual on what to desire (via asset’s price). ‘Markets tell the mind what is desirable’ (belief state of mind).

The individual then modifies his original desire and now feeds this modified desire into the market. The cycle continues in an infinite loop. The imitation mediates these feedback loops.

This equilibrium should remain a fine balancing act so that the market does not become a deceitful mirror. Usually when things go too far we experience a market crash, we find a scapegoat to blame (e.g. the banks), the market corrects and the new cycle starts again.

Reflexivity works both directions, untangling on the way down. Market crashes might offer a moment of clarity. But a clear picture is too much bare as it cannot be that we are all at fault. To stabilize at a new equilibrium, a community finds a scapegoat to cleanse itself of sins and moves on.

Prices inform us about the true state of the world, usually at a point when things hit physical barriers and the reality (belief) confronts the narrative (preference). There are barriers to malleability and the community should be informed in time.

These days the price signal has become weaker. Narratives, or memes, are taking over as it becomes almost physically impossible to run out of cash. Thus, preference stay of mind remains misinformed, entangled in an escalating mimesis.

The price becomes the news and an end itself. The world becomes desperately indefinite in nature. Reflexivity becomes dominant in a world that lacks intent. Everyone has joined the imitation dance.

In an indefinite world, people actually prefer unlimited optionality; money is more valuable than anything you could possibly do with it. Only in a definite future is money a means to an end, not the end itself.(7)

Speculation is eating the world.

(1) That is why communism as an idea is unlikely to die out while implementation fails repeatedly.

(2) The mimetic conflict does not arise from needs and explicit scarcity but rather from wants that will earn envy of others.

(3) One cannot live in a state of perpetual violence, they need to create an order that supports permanent communities.

(4) Will and Ariel Durant wrote in their The Lessons of History (1968) that ‘insecurity is a mother of greed’.

(5) Also Tony Sheng did a great job in his essay, describing the role of reflexivity in “turning speculators into users”.

(6) Locked in what should be a perpetual state of violence mitigation.

(7) Peter Thiel, Zero To One.

AUTHOR(S)