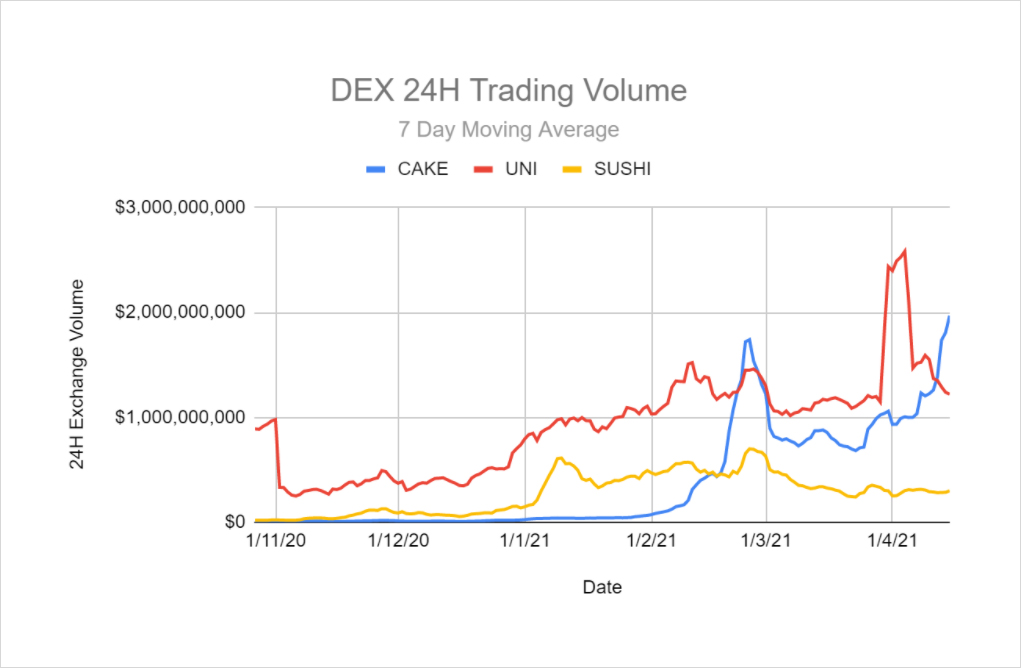

Over the past year, crypto’s flagship Automated Market Maker (AMM), Uniswap, has spawned a number of forks. PancakeSwap, which initially emerged as one of many vanilla forks on Binance Smart Chain (BSC), has recently commanded attention with its meteoric rise in trading volume and Total Value Locked (TVL). Over the past week, PancakeSwap’s average 24-hour volume surpassed Uniswap by over $1 billion and Sushiswap by $2 billion. However, PancakeSwap’s growth has been met with substantial skepticism and it’s clear that its recent traction requires more careful engagement. After examining the factors behind its impressive growth, this piece will also explore PancakeSwap’s surprisingly differentiated product suite and attempt to make sense of the path ahead for this breakfast-themed behemoth.

We will cover:

- How BSC emerged to fill a market gap

- Quantifying PancakeSwap’s traction

- The primary factors driving PancakeSwap’s success

- The main challenge facing the AMM

- [Bonus] Returns to token holders

1. How BSC emerged to fill a market gap

Ethereum’s congestion and costly gas fees have rendered it unusable for the common market participant, leaving an extraordinary gap that required filling. BSC was quick to successfully address this market need by offering gas fees over 1000x cheaper and block times over ten seconds faster. This edge stems from the fact that BSC trades decentralization for throughput: while Ethereum relies on an open and decentralized community of miners solving complex algorithms (Proof-of-Work), BSC uses a system of closed and prevetted validators (permissioned Proof-of-Staked-Authority). Whilst there is no question that BSC is significantly more centralized than Ethereum, BSC’s usage explosion is evidence that, at least in terms of adoption, the centralization tradeoff was worthwhile.

Specifically, BSC also fills the gap between the tens of millions of Binance users and DeFi; this is strategically executed by linking through Binance (one of the largest fiat on/off ramps in the world). In fact, since BSC is strictly more decentralized than Binance, it’s an upgrade from using the centralized exchange because the trade functionality is now more transparent and auditable on-chain. Furthermore, BSC benefits greatly from Binance being the world’s largest crypto custodian. This means that they can wrap any heavily traded asset listed on Binance.com and let users withdraw to BSC. This function allows tens of billions of dollars of altcoins to plug into DeFi applications on BSC, increasing both the utility of BSC applications and the altcoins that are plugged in. This increases BSC’s network effect as the more utility and assets are on the chain, the less users will need to move their assets to other chains or exchanges.

Despite not being fully decentralized, BSC still provides many of the classic benefits that public blockchains provide. Public blockchains like Ethereum create permissionless, composable and censorship resistant environments. Whilst BSC doesn’t guarantee censorship resistance, it maintains the permissionless character and composability of more decentralized blockchains, and this still allows innovation to flourish. Again, at the heart of this debate is a tradeoff: extremely high gas fees or centralization and its inherent trust assumptions. In many ways, the growth of BSC and PancakeSwap is a reinforcement of a truth that the space has known for a while: the majority (especially retail) won’t care about decentralization until they’re given a reason to. Especially with the repeated delays in Ethereum scaling solutions, BSC has offered a way for individuals to participate in many of the best features of DeFi in ways that they otherwise would not have had.

2. Quantifying PancakeSwap’s traction

From afar, it would appear that PancakeSwap has gained significant growth. But it is only after surveying the data up close that we can see just how impressive PancakeSwap’s traction has been.

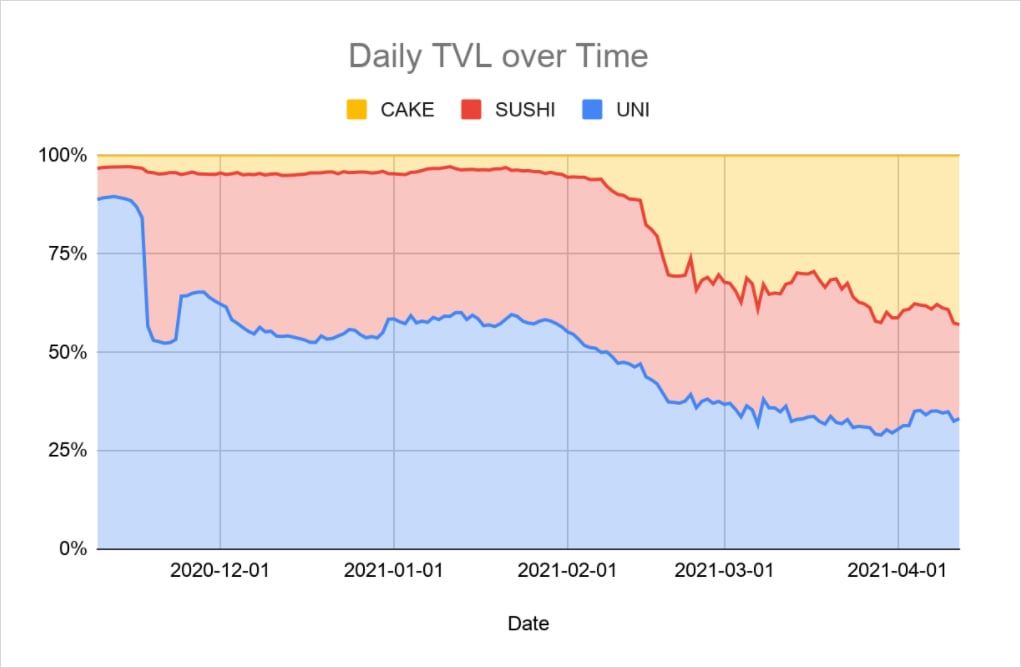

For AMMs, TVL is a direct representation of liquidity. Deeper liquidity is able to serve greater trading volume which attracts even more liquidity. The graph below illustrates how PancakeSwap’s liquidity has grown significantly in comparison to Sushiswap and Uniswap. However, total TVL has also been increasing across all AMMs as DeFi attracts more users. The difference is that the increase in BSC’s TVL is skewed towards new retail participants with distinct behaviour from Ethereum-based users. In terms of transaction volume, PancakeSwap’s 24-hour transaction volume continues to compete with Uniswaps, with its daily transaction volume outpacing Uniswap’s for the past week.

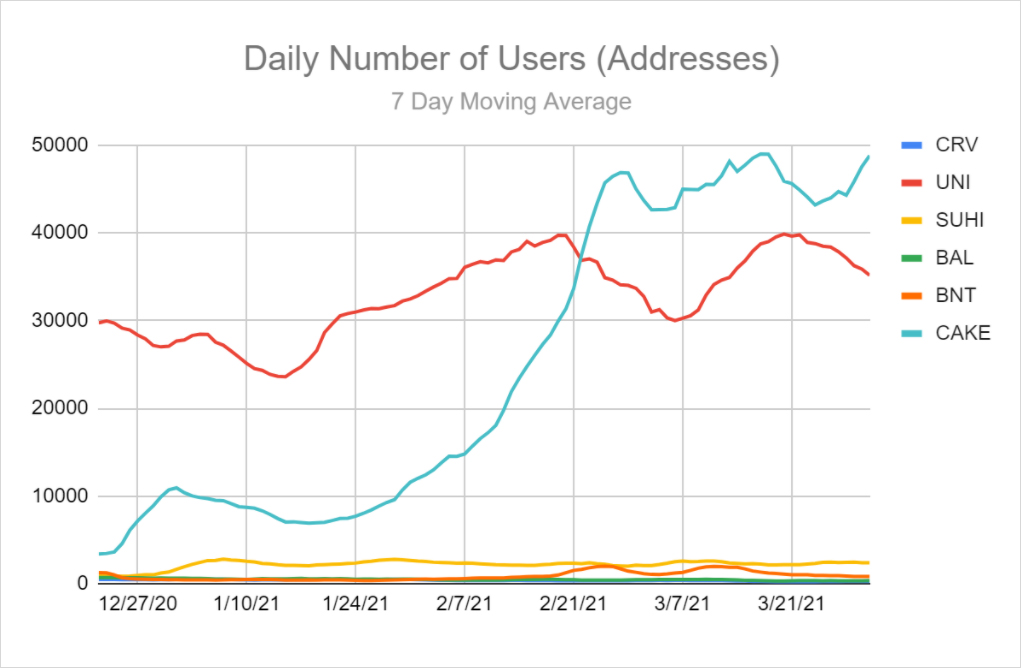

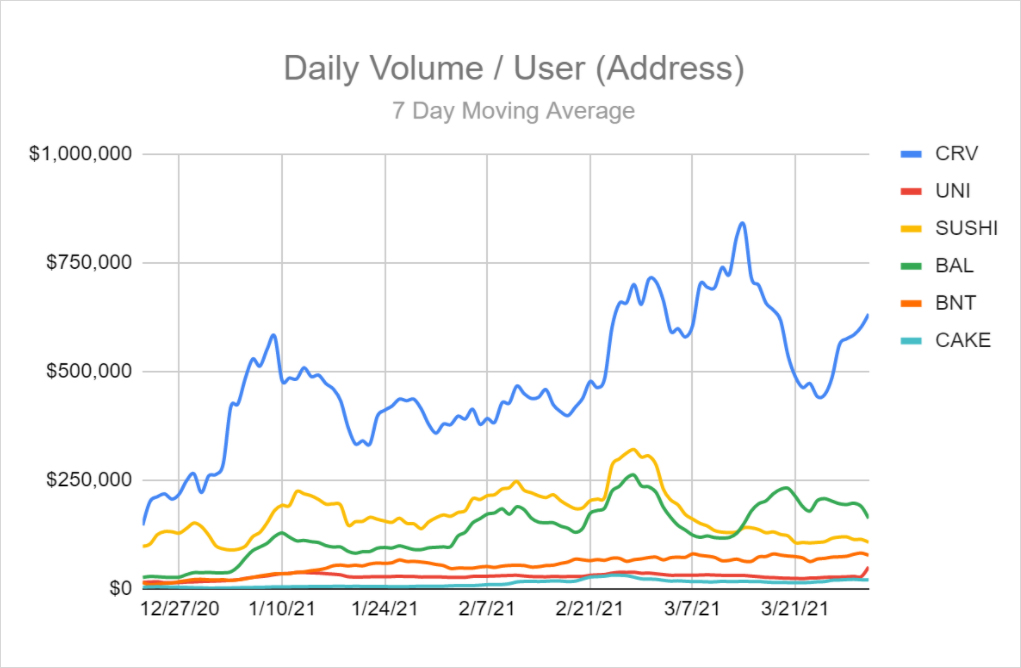

On-chain data shows that the number of PancakeSwap daily users has been increasing and has even surpassed Uniswap’s daily users. This is due to PancakeSwap targeting both retail users who have been priced out of Ethereum as well as native DeFi users who want to trade/invest/arbitrage with lower fees. Similarly, the ratio of daily transaction volume to the number of users is comparatively lower than that of Ethereum-based AMMs. This supports the observation that BSC users skew towards retail who, on average, make smaller-sized trades. Our previous research, summarized in this thread, invalidated the common charge that PancakeSwap’s volume was largely due to fake activity or bots. Instead it pointed to an emerging retail audience.

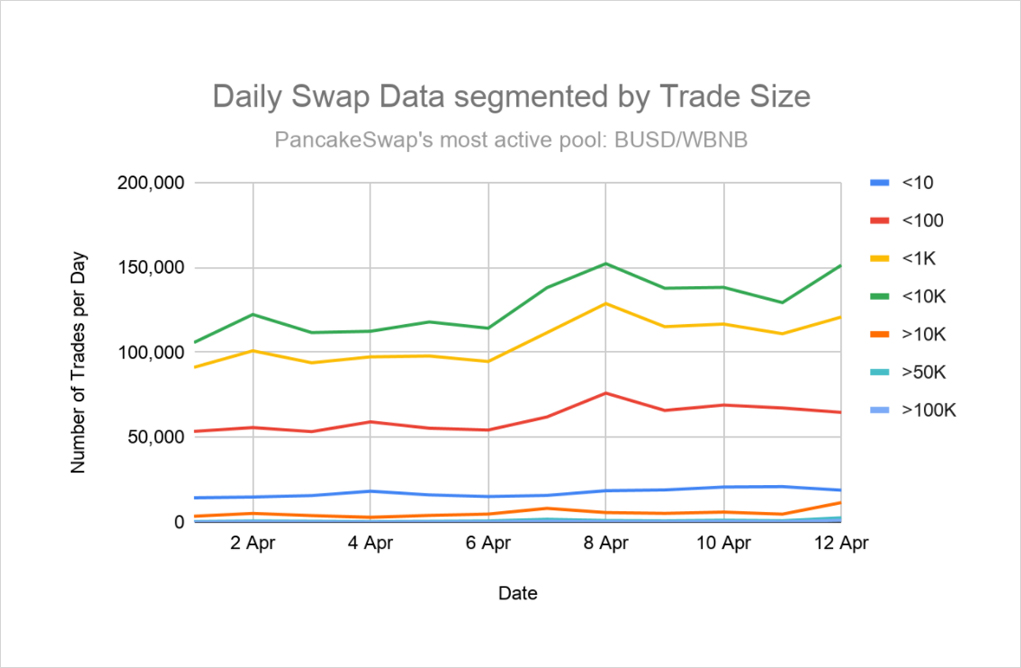

Trade size data across all their pools also suggest a more retail audience. The graph below shows that the majority of BSC transactions are under $10,000 in size. Across all these pools, there were more transactions under $1 than there were greater than $50,000.

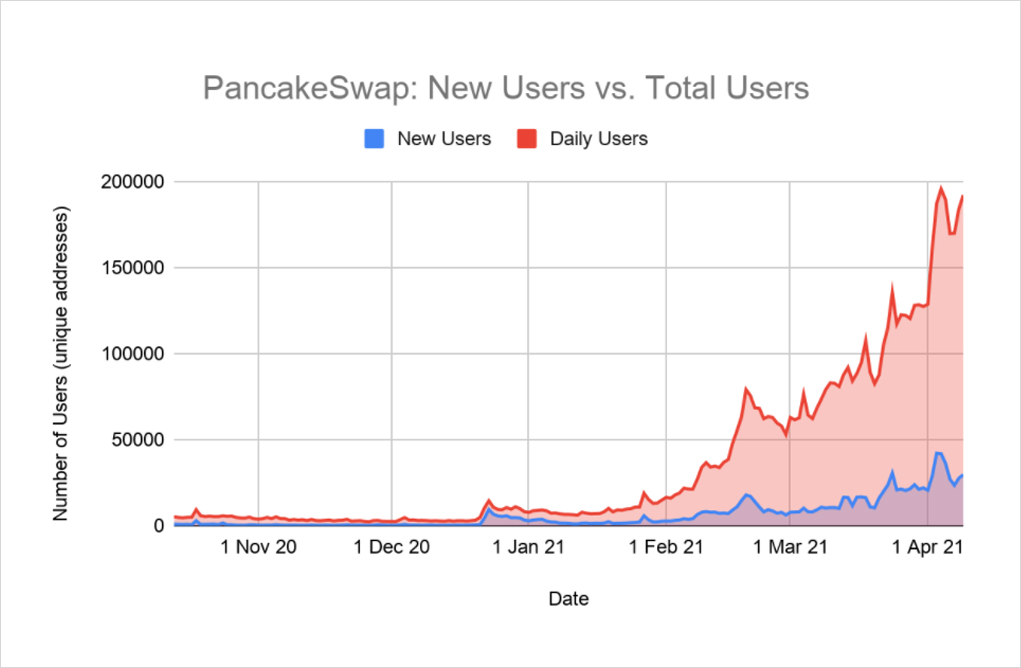

Further, the retention rate of new PancakeSwap users implies an increase in the quality of new users from February onwards. Both the number of new users and total users per day is growing but the gap between new users and total users is increasing, suggesting that more new users are compounding into recurring users. This indicates improved retention/user stickiness and that spikes in activity are not just a short term anomaly. Given PancakeSwap’s high yields, customer stickiness and high trading volumes are some of the most important factors to justify their cost of high CAKE inflation (discussed below).

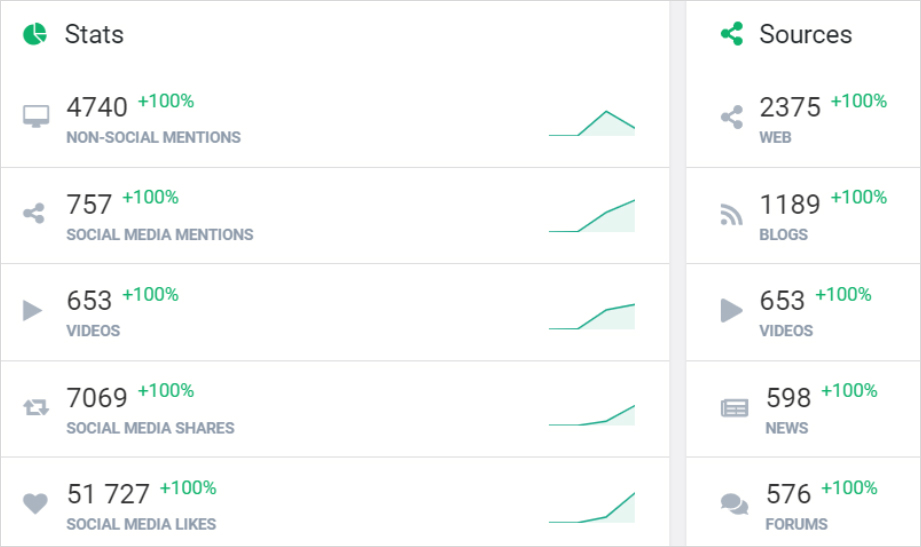

To supplement this data, we also surveyed the community and found that traction and engagement was very real. This attention came from a new segment of users who were less ideological and experienced than Ethereum participants. To add colour, the #pancakeswap hashtag has amassed over 1.8M views on TikTok, 1.5K videos from 541 different YouTube channels. Anecdotally, we have also observed communities across Asia (specifically: Philippines, Thailand), South America (Brazil, Argentina, Venezuela), and North America who are exclusively using BSC and PancakeSwap.

Source: Brand24, generated over a 3 month period (Jan – March)

3. The primary factors driving PancakeSwap’s success

Clearly, then, PancakeSwap’s traction is real and undeniable. But how and why has this protocol, which started off as a simple breakfast-themed fork, achieved such immense success?

a) PancakeSwap leverages an aggressive token emission schedule to bootstrap its growth and fend off competitors.

PancakeSwap’s native token, CAKE, follows an infinite mint and burn token mechanism; it’s an inflationary token with no hard cap but can turn deflationary if burns outpace emissions (an approach similar to EIP-1559 which relies on economic growth to offset protocol inflation). This design allows the platform to incentivise a deep pool of liquidity, which has proven essential to the health of the AMM.

In the beginning, triple digit annual percentage yields (APYs) enticed liquidity providers (LPs) to bootstrap the supply side. Those rewards ultimately increased TVL and kicked off a reflexive flywheel whereby appreciation in the token price led to even higher APYs and more TVL. Once the platform accumulated deep liquidity across different token pairs, it quickly became the dominant decentralized exchange on BSC.

PancakeSwap’s aggressively inflationary approach has been one of many primary factors driving up their TVL. Other incumbent Layer 1 AMMs will find it difficult to compete on BSC unless they start minting tokens specifically for BSC rewards, and even this could kick off an unsustainable incentive war. For example, without any rewards allocated to Sushiswap’s BSC launch, the high-flying Ethereum DEX has seen its liquidity pale in comparison to that of PancakeSwap. In addition, PancakeSwap also hosted a reverse Syrup Pool which incentivised Ethereum-based Sushiswap users to convert their ERC-20 SUSHI tokens to BEP-20 tokens and earn CAKE. Similarly, PancakeSwap also hosted farms to lure SUSHI-ETH LPs to migrate to BSC and earn higher yields alongside lower transaction fees. (In the beginning, these APYs were as high as 160% and have since settled around 60% with 14M TVL in the pool.) By positioning itself as the leading AMM for Ethereum-bridged liquidity on BSC, PancakeSwap also strengthens its role in the ecosystem by maintaining the best liquidity for BEP-20 token pairs.

Despite this traction, it is important to note that the aggressive inflation schedule is only one of many driving factors to PancakeSwap’s success. There have been many other AMMs with aggressive inflation that did not see the same level of success.

b) PancakeSwap is not just an AMM; it’s building a full product stack that enhances the growth of PancakeSwap’s main product.

People who write off the project as an Ethereum copy-cat lacking in innovation are missing some of the important ways in which PancakeSwap has expanded beyond its Uniswap-fork roots. To elaborate, the project has been captivating a distinct community, expanding their product suite and building synergistic DeFi primitives on top of their AMM.

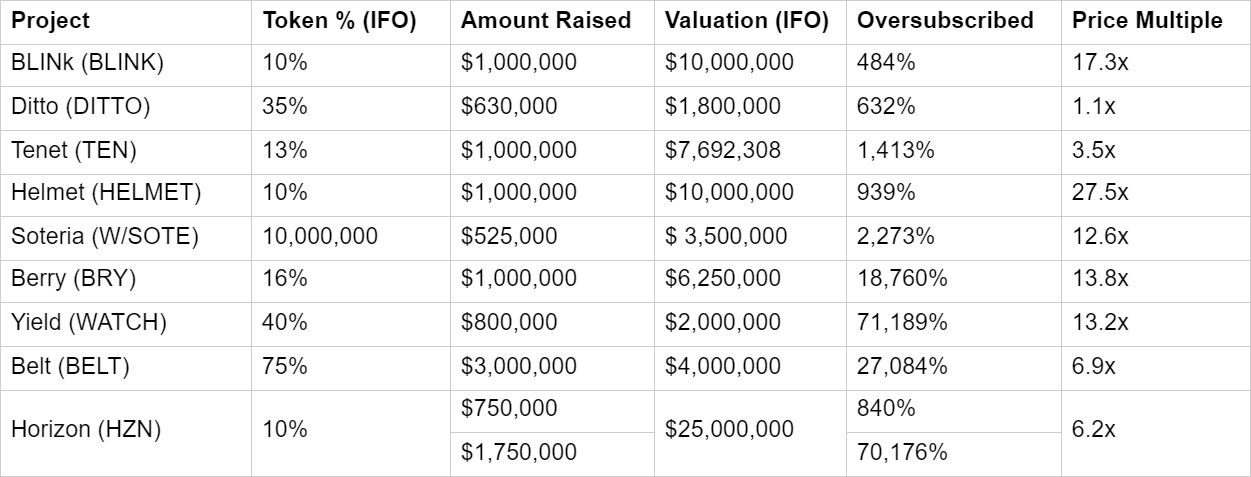

Their token launch mechanism, dubbed Initial-Farm-Offering (IFO), is a prime example of a fundraising design that ties into PancakeSwap’s main AMM primitive. The IFO process allows users to participate in “pre-sales” of new projects using their CAKE-BNB LP tokens. This benefits PancakeSwap since users must be providing liquidity in order to participate. Similarly, new projects get access to a launchpad to raise funds and directly bootstrap their initial liquidity. This also benefits CAKE holders as all the CAKE (half the funds raised) from the LP tokens are burned as a deflationary mechanism. On top of this, the IFOs are becoming increasingly oversubscribed, indicating the heightened demand for IFO projects and the marketing value of launching through PancakeSwap.

Aside from traditional yield farming — where LP tokens are staked for rewards — the platform also introduces Syrup Pools that allow CAKE to be staked to earn more CAKE/other tokens. This increases the eagerness for community projects to partner and launch Syrup Pools because they can leverage PancakeSwap’s superior reach and market attention. Moreover, CAKE’s single-sided APY staking not only takes supply off the market, but it also dilutes non-stakers. This immediately forces “usage” of the token as stakers feel like they’re getting immediate value from staking whilst punished for not staking. These Syrup Pools have also amassed over 2 billion in TVL across 50 pools, making up approximately 30% of the total TVL. One second order effect is that it has even spawned active yield aggregators like Pancake Bunny and AutoFarm, which rely in part on CAKE emissions and compounding for their yield strategies.

Meanwhile, PancakeSwap continues to build a vibrant community around their products with NFTs and gamified features such as lotteries. On NFTs, users are incentivised to buy them to create a profile so that they can participate in IFOs and other activities. They are also rewarded with collectible NFTs for participating in different IFOs and competitions. As of April 16th 2021, over 123,211 NFT profiles have been created with each profile costing 1.5 CAKE (~$24) to set up. As for the lotteries, they are run 4 times per day with each lottery ticket costing 1 CAKE. The total number of unique addresses that participated over the past month was 38,419. Meanwhile, the 2-week retention rate of lottery participants is around 10%, which is similar to the overall platform retention rate. However, the lottery participants had a higher retention rate when it came to trading behaviours (around 40%) and were also more engaged across all PancakeSwap activities. This is key evidence that PancakeSwap sees real retail engagement, since it isn’t profitable for wash traders and arbitrageurs to participate in these NFTs or lotteries.

Another gamification example was the recent social trading battle where teams competed to win CAKE, NFT collectibles and other gamified achievements. This amassed over 53,000 users who all burned CAKE to set up a profile, buy an NFT and register for a team to get involved. Use of team-themed instagram filters and other discussions on team-specific telegram channels gave a strong indication of how well it captured the retail audience.

These supplementary products have been able to drive attention and engagement for PancakeSwap to a different level arguably beyond what Uniswap and Sushiswap have seen. This community traction is likely to compound as they build out other roadmap features such as: gamified rewards, lending/borrowing, margin trading, binary options, fixed-term staking and referrals.

4. The main challenge facing PancakeSwap: unsustainable emissions

PancakeSwap’s rise to dominance has been swift, but it will still face challenges in the weeks and months ahead. Whilst emissions have been core to PancakeSwap’s success, these emissions are also akin to dilutive equity finance; it’s analogous to how companies can use cash from their balance sheet to pay for user acquisition (referral bonuses, new user subsidies etc.). In both the traditional and DeFi scenario, incentives need to be focussed and strategic in order to reward the actions that generate long term value and network effects. In PancakeSwap’s case, the adoption enabled through yields and other incentives must outweigh the cost of dilution.

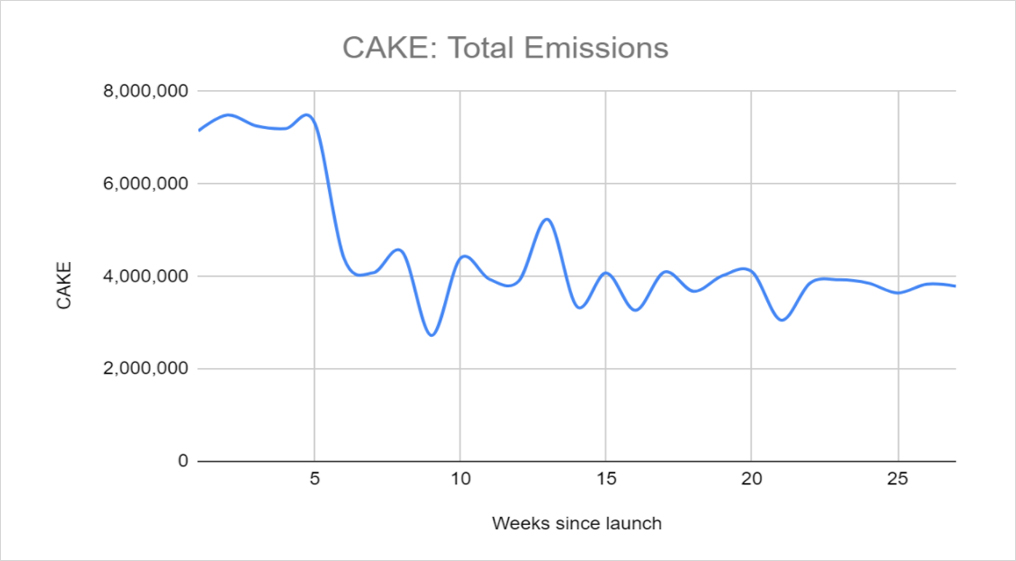

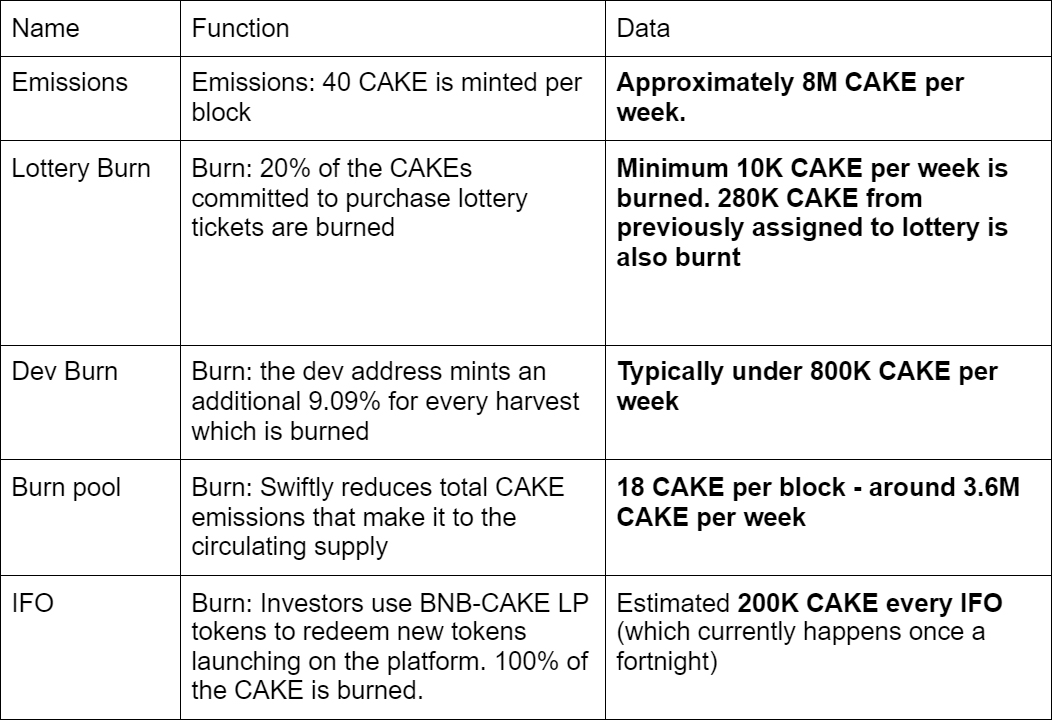

Currently, 8,064,000 CAKE tokens are minted per week with the majority immediately burned through “Burn Pools”; this works to limit the amount of CAKE that enters the circulating supply. To counter these inflationary effects, the platform incorporates several deflationary measures to burn CAKE and balance total emissions (see burn breakdown in Appendix A). Overtime, CAKE block rewards that have made it into circulating supply have been lowered from 7 million to around 4 million per week.

So, what’s next? How can PancakeSwap manage their inflation and Liquidity Mining (LM) expenditure?

We’ve identified some approaches:

- Rely purely on deflationary pressures so burns exceed supply minted

- Set a long term LM budget, allocate % of total supply towards it and cap the supply

- Mint CAKE on a per-program basis

- Set a monthly/quarterly LM budget and mint supply accordingly

The first approach is PancakeSwap’s current configuration but their deflationary pressures have made negligible impact on the supply inflation. The second (and most traditional) approach doesn’t align well with the fast moving nature of the space and will likely result in over/under allocation of supply. The third approach is the most flexible/adaptable but could be bottlenecked or difficult to effectively coordinate over decentralized governance. The fourth approach is a reasonable middle ground.

More specifically, combining monthly/quarterly LM budgets with more effective deflationary pressures could prove to be a better path forward. To elaborate, it’s hard to know how much future inflation is required, but the team and core community members should have a strong sense on how to plan in the near term. In fact, this unpredictability explains why some projects (e.g. Yearn, Synthetix) needed to redesign their supply schedule and mint more tokens; their treasury did not have enough to fund protocol development and other incentive programs. If uncertainty is the only certainty, protocols in general should build flexible monetary policy around this rather than arbitrarily locking themselves to rigid supply schedules.

The PancakeSwap team and community could propose monthly or quarterly LM emissions budgets and get them passed by governance or an elected council. By doing this, they could ensure they spend less token holder value on wasteful liquidity while further incentivising more useful liquidity. On the topic of token holder value, we’ve also included some bonus analysis in the appendix that analyzes the fully diluted price-to-earnings ratio of PancakeSwap vs other AMMs.

Conclusion

Whilst PancakeSwap’s growth has been impressive, it is ultimately bound to BSC, the success of which depends on managing tradeoffs between throughput and decentralization. However, the undeniable growth of BSC highlights how more centralized products can achieve faster retail adoption than their decentralized counterparts. As more people participate in blockchain technology, each marginal builder and user will be less ideological than the last. Developers will choose to optimize for different factors at different points in time, whether network scalability or security through decentralization. At present, PancakeSwap has much of the retail active users and attention, but this could shift as BSC runs into scaling problems with data storage just as Ethereum is running into scaling problems with the delay of EIP 1559 and the likely liquidity fragmentation that will result from Layer 2 adoption.

In the near term, PancakeSwap’s success is both reliant on and symbiotic with the success of BSC; as PancakeSwap drives more traction to BSC, the ecosystem starts creating a network effect for PancakeSwap to feed off. But what does the future hold for PancakeSwap? Will Binance ever be forced to shut down and bring BSC with it? Will PancakeSwap, against critics, establish itself as a respectable AMM? More importantly, could BSC continue to coexist with Ethereum and capture a completely different segment?

Of course, it’s impossible to know the answer to these questions. However, it’s clear that PancakeSwap has established itself beyond a simple fork and that there is a path forward for it to become more broadly accepted by the community. Sushiswap, which also started as a vampire fork, has shown there’s a place for projects that have evolved through product differentiation and innovation. PancakeSwap has been and continues to expand its product suite to target a completely new flavour of participants, many of whom haven’t even used Ethereum before. Ultimately, projects that have brought more users to the space deserve credit for what they’ve built and how they’ve optimized to serve market gaps. In the short term, what remains is for the broader community to recognise the value PancakeSwap is bringing to the whole ecosystem, both in terms of innovation and allowing more people to experience DeFi.

Appendix

A. Main burn mechanisms

B. Returns to token holders

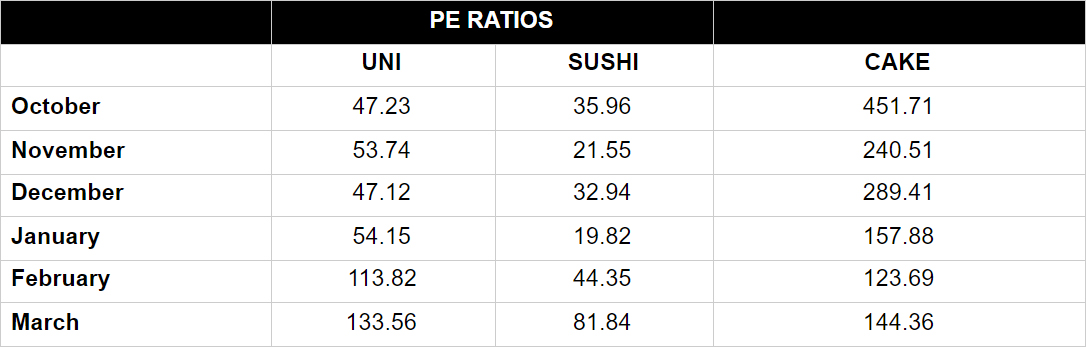

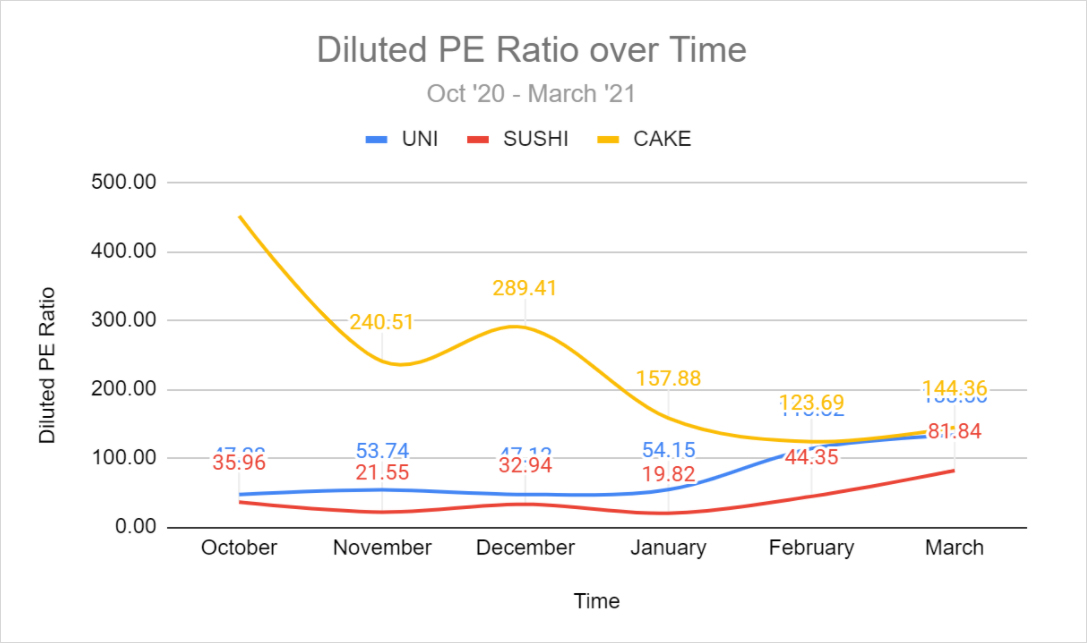

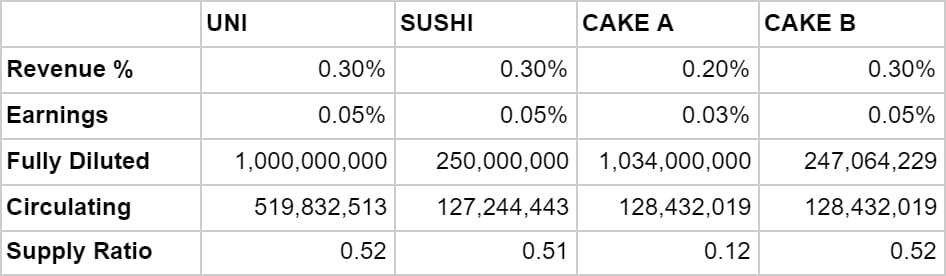

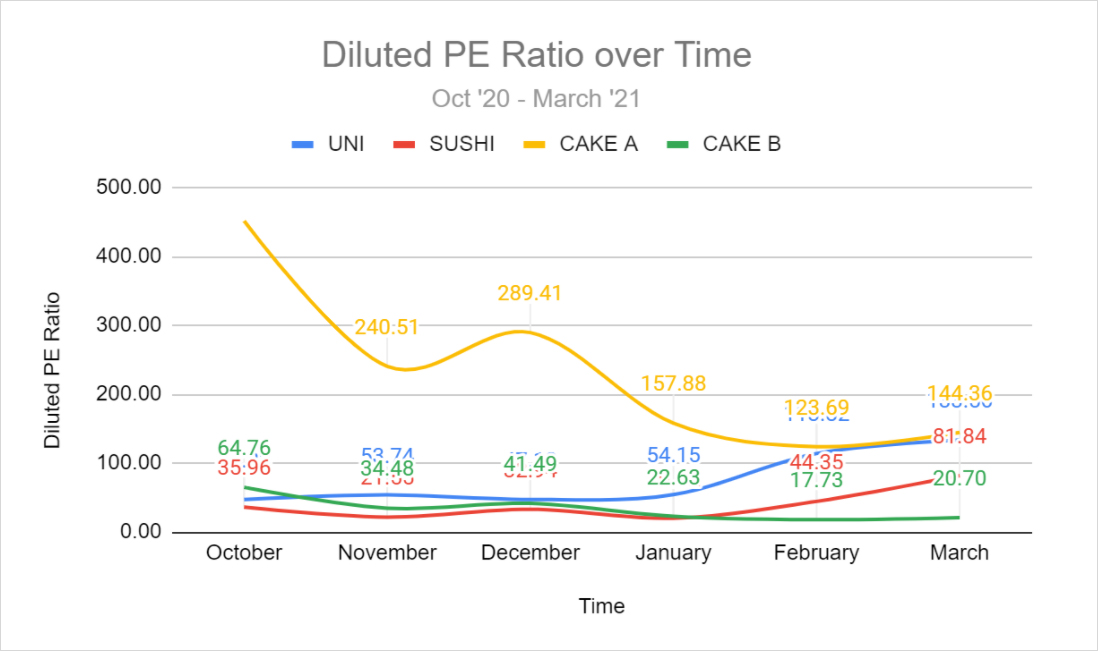

With emissions and token holder value at the forefront of our minds, we conducted an exercise where we looked at CAKE’s current returns to token holders using fully diluted price-to-earnings (PE) ratios and compared it to Uniswap and Sushiswap. We also modelled a scenario to visualize CAKE’s PE ratios if they had followed Sushiswap’s supply schedule and fee structure (30bps trading fee, 5bps to treasury).

Using returns to treasury as a proxy for future returns to token holders, the graphs below plot PancakeSwap’s current fully diluted PE values against other AMMs.

Note: the current fee structure and returns to CAKE holders was calculated from the 0.2% trading fee of which 0.03% is directed to the treasury. Revenue was not adjusted for inflation.

Given PancakeSwap’s unlimited mint, we extrapolated its current emissions to the end of 2025 as its fully diluted supply. The analysis shows that they have been lowering their PE ratios overtime and matched Uniswaps ratio in February. Despite taking lower trading and treasury fees by 10 bps and 2 bps less, PancakeSwap still achieved a similar PE ratio to Uniswap in March. Uniswap’s PE ratio increase from January – March is attributed to its token price appreciating (from $9 to $30) which indicates that it is more quickly accruing a speculative premium.

Now, let’s model a scenario where PancakeSwap has a capped supply at around 250 million and follows SushiSwaps fee structure (increased trading fees by 10bps and fees to treasury by 2 bps). For context, the SUSHI token was also designed with infinite inflation but a 250 million hard cap was introduced through governance. The current emission rate is 30 SUSHI per block at ~13 seconds per block (Ethereum) which is approximately 5 times less than CAKE’s emission schedule (160 per 4 blocks over ~12 seconds).

This analysis indicates that if PancakeSwap had introduced a capped supply at around 250 million instead of 1 billion (2025 estimate), they would have a much more favourable fully diluted PE ratio. However, supply caps should not be arbitrarily introduced to improve these ratios. Whilst inflation wasn’t directly factored into this model, flexibility in emissions is likely a key factor that will enable PancakeSwap to build its moat. On the other hand, increasing trading and treasury fees to match Sushiswap’s fee structure is an option to increase revenue/earnings without changing the product. This could be viewed positively as it increases returns to token holders while still being competitive with other AMMs. However, it also takes away revenue from LPs which are the main drivers of TVL.

On a similar note, Uniswap and Sushiswap also have the power to increase their total supply and emissions schedule through governance. It is not uncommon to see DeFi projects change their supply schedule to match financing needs of the project (e.g. YFI). As such, emissions, as part of tokenomics, just make up one part of a confluence of factors that contribute to a project’s success.

AUTHOR(S)