Building network effects is hard. In crypto, it’s especially hard because you’re either competing against strong incumbents (exchanges, payment systems) or working with a niche market (dApps). An upstart network faces the conundrum: a small network has limited utility to prospective users, but increasing network size & utility is dependent on attracting new users.

As an example, imagine a typical new crypto exchange. There is some capital invested to provide market making, but orderbook depth is still much thinner than incumbents. The exchange attempts to market to new traders, but takers would rather trade on exchanges with deeper liquidity so they can execute trades with less slippage. Without takers, you can’t attract more market makers. Other market makers do not see trading on this new exchange to be economical and would rather provide their liquidity on other exchanges. Bootstrapping liquidity is a classic chicken & egg problem.

On the other hand, if the exchange is able to achieve attractive liquidity, network effects are built — liquidity can beget more liquidity.

Recently, crypto projects have pioneered a new mechanism to bootstrap network effects. The core concept seems simple:

Incentivize actions that increase the utility of the network via native token rewards.

I call this Token Based Network Bootstrapping. It can be applied to any application that benefits from network effects — from multiplayer games, to financial markets, to social networks. In the cases where this concept is specifically applied to incentivizing liquidity of a market, it is known as ‘Liquidity Mining’.

A False Start

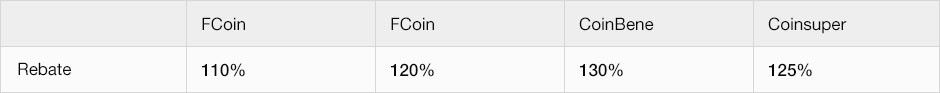

One of the first groups to utilize token based network bootstrapping were centralized exchanges, with FCoin, BitForex, ConeBene and CoinSuper being the most (in)famous ones. Their model became known as “Transaction Fee Mining”.

For this model, traders on the exchanges were rebated their transaction fees in the form of the exchange token. Often, bonuses were added on top of the full transaction fee rebate received by traders.

In other words, exchanges paid users to trade, but in a currency that was costless for them to produce.

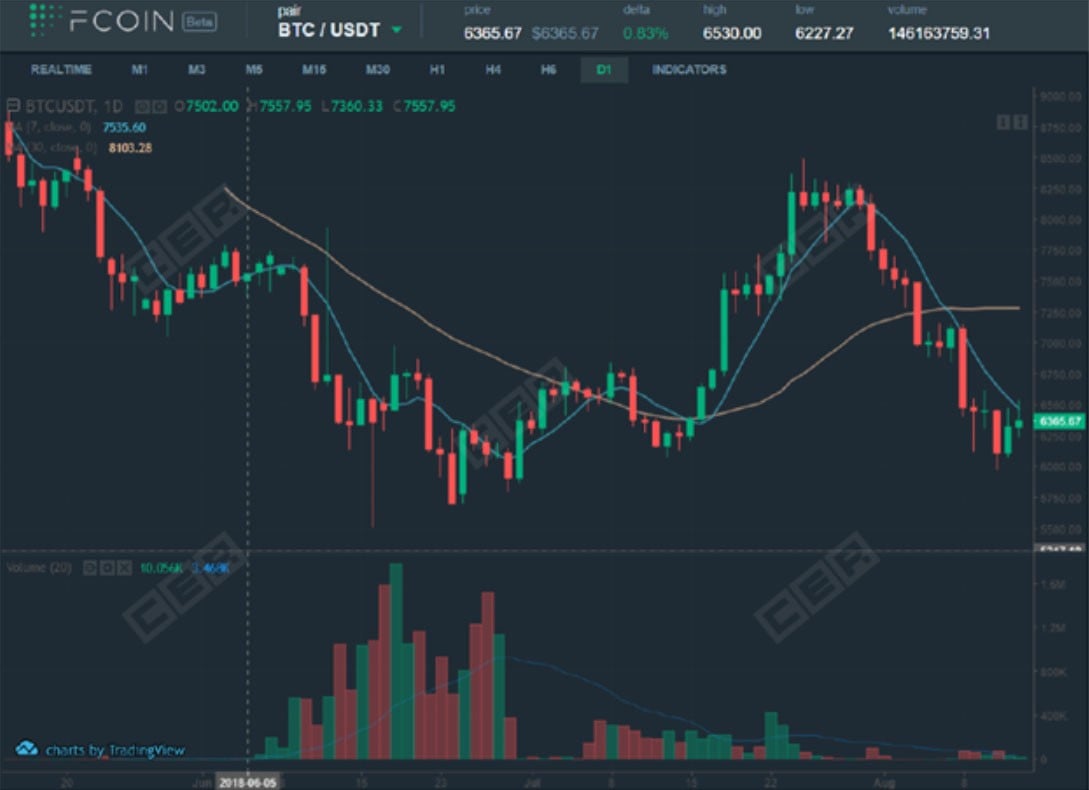

Volumes exploded. FCoin launched their transaction fee mining program in early June — the volumes before this program are almost undetectable compared to the volumes immediately after.

Source: CER

However, these schemes really only gave a false illusion of massively increased liquidity because the incentives mainly drove wash trading as opposed to the provisioning of order book depth & legitimate taker flow. Research from CER examined trade volume patterns, unique visitors, and web traffic to demonstrate that volumes were artificially inflated. This worked out poorly for the exchanges as they both failed to increase real trade volumes & liquidity, as well as wasted money by essentially paying for wash trading.

The failure of transaction fee mining and the subsequent failure of these exchanges resulted in much skepticism towards token based network bootstrapping. However, the problem wasn’t so much with rewarding users for certain actions, but knowing which actions to reward.

Can a better bootstrapping model be designed?

For these centralized exchanges, a better model would involve:

- Providing real orderbook depth — compensating limit orders by taking into account both time on the books, and volume transacted.

- Attracting real taker flow — this can result from both better order book depth and a partial rebate of trading fees via exchange tokens.

- Avoiding exploitation — Do not make it economical to wash trade and “game the system”.

While we have not yet seen this improved model applied for centralized exchanges, we have seen variations of liquidity mining successfully applied to DeFi applications. The most notable example is the SNX incentivized sETH:ETH uniswap pool. A crucial component of the Synthetix ecosystem is a liquid venue to trade into and out of Synthetix synths (sBTC, sETH, sUSD, etc.). Since a liquid market for synths and commonly traded crypto assets failed to naturally materialize, the Synthetix foundation decided to direct a portion of the SNX token inflation towards liquidity providers of the sETH:ETH Uniswap pool.

The program was a massive success with the sETH:ETH pool growing to at one point $24M. During this time it was by far the largest pool on Uniswap and counted towards ⅓ of total Uniswap liquidity. Bootstrapping one side of the market (liquidity provisioning) naturally attracted the other side of the market — traders that buy and sell into this pool. The foundation & community has since reduced the rewards allocated to this incentive program by 95%, however, the sETH pool still remains the largest pool on Uniswap V1 (excluding scam project HEX).

By utilizing seigniorage, Synthetix was essentially able to utilize the future earnings of the network, embodied in the present economic value of its token, in order to increase present network utility. In addition, a secondary incentive to participate in these network building activities is created, as those that do not participate are diluted in their share of the network tokens. Think of it as a nicer way of taxing free-riders.

From this lens, we can see that token based network bootstrapping is actually very similar to the traditional startup financing model. In both cases, a project can use the speculative future value of its cash flows in order to finance subsidization of network utility building actions & user growth.

Conclusion

Token Based Network Bootstrapping provided a clear avenue to solve the chicken & egg problem in the Synthetix example, and it has not gone unnoticed. Multiple DeFi projects are currently running, or plan to run similar incentive programs. These include Balancer, Curve, Thorchain, Bancor, Kava, Compound, and Mstable. Given the explosion of projects and the power of this network bootstrapping model, it’s possible that we will see a tremendous flight of liquidity & activity to the DeFi space. Furthermore, given that many of these projects are in competition with each other, an “incentive war” with projects one upping each other with token rewards may even be on the horizon. As a result, the users could be the real winners.

AUTHOR(S)