A quanto is a derivative where the underlying is denominated in one asset, such as ETH, but the derivative is settled in another, such as BTC. The bitcoin quanto derivative was actually first pioneered in 2013 by a fledgling but now defunct derivatives exchange called ICBIT.

BitMEX is the most active crypto-derivative exchange in the world and settles all margin collateral only in bitcoin. It introduced a popular cryptocurrency quanto derivative in the form of the ETHUSD quanto perpetual swap in August 2018 as well as an XRPUSD quanto earlier this month.

Today, we analyze how this derivative works and what risks users should be aware of. The intrinsic non-linearity of quanto derivatives is fascinating both from a financial engineering perspective as well as a practical trading one.

The Mechanics

A perpetual swap, also known as a contract-for-difference in the traditional markets, is a derivative similar to a traditional futures contract except without expiry or settlement date. It mimics a margin-based spot market and uses a Funding Rate mechanism, a series of periodic payments between buyers and sellers of the perpetual contract to keep the traded price in line with the underlying reference price.

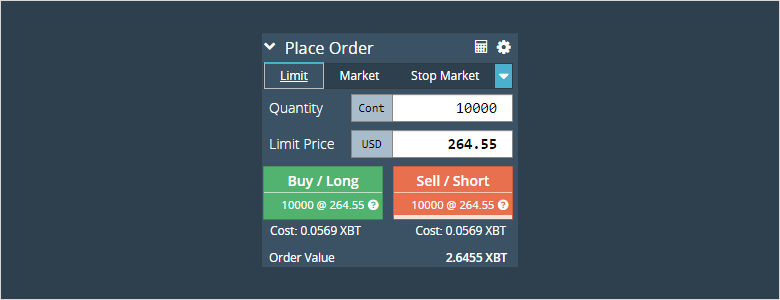

BitMEX offers perpetual swaps for bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). As BitMEX only accepts Bitcoin as collateral, the ETH and XRP products are quanto perpetual swaps. The ETHUSD quanto derivative has a fixed bitcoin multiplier of 0.000001 BTC. This allows the trader to go long or short the ETHUSD rate without ever touching ETH or USD.

Example: the value of 10,000 contracts is 10000 * 0.000001 * 264.55 BTC = 2.6455 BTC.

Source: Ethereum Series (ETH) Guide

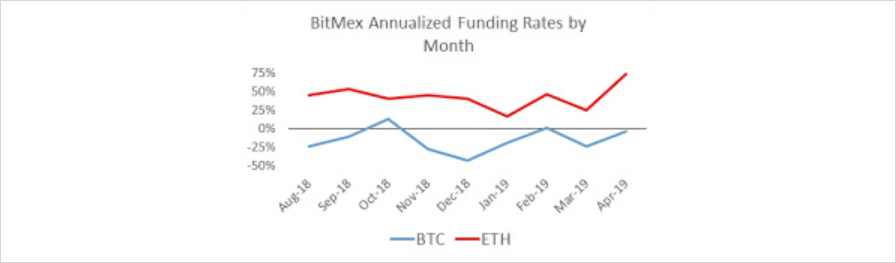

A look at the historical Funding Rate of XBTUSD and ETHUSD seemingly shows an arbitrage between the ETHUSD perpetual swap funding rate and the XBTUSD perpetual swap funding rate. Can you short ETH perps with funding yielding 50% per annum, long BTC perps with funding paying 0% per annum, long ETHBTC futures paying 5% per annum, and collect huge returns?

As we will see, the fair Funding Rate may be much higher for a quanto swap than for a normal swap because of the way that risk itself changes when prices move. This is known as a quanto adjustment, or covariance, but for the purposes of this article we will avoid the math and focus on the intuition.

The Nikkei Quanto Future

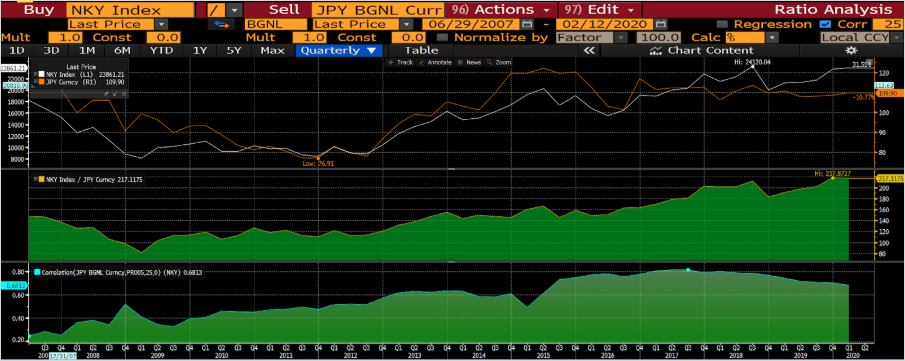

The most famous quanto derivative in traditional markets is the Nikkei 225 Index Future on the Chicago Mercantile Exchange. Nikkei 225 (NKY) is the most commonly traded equity index product on the Japanese stock market and its futures trade simultaneously across three exchanges: Osaka (OSE), Singapore (SGX), and Chicago (CME). In Osaka and Singapore they trade primarily in Japanese Yen margin while in Chicago they primarily trade in USD margin. The OSE multiplier is 1000 JPY, the SGX multiplier is 500 JPY, while the CME multiplier is 5 USD.

The correlation between USD/JPY and NKY is typically quite positive due to few macroeconomic reasons:

- JPY is a risk-off safe haven currency that gains when stocks fall.

- Japan exporters, and hence Japanese stocks, become more globally competitive as JPY weakens.

We see that the quanto future trades at a persistent premium to the JPY-based future. Why is this?

The most intuitive way to understand this is to imagine you are simultaneously short the quanto and long the normal future. If the Nikkei market gaps up 50%, you will have losses on your quanto future and gains on your normal future. If USD/JPY is instantaneously up 25% as well, then it would mean that your quanto losses hurt much more than your normal future gains–and hence, you would require some premium from the market to undertake such a risk.

Alternatively, one can imagine the converse: again you are short the quanto and long the normal future. USD/JPY goes up 25%; now the economic risk of your short quanto is much higher than the economic risk of your long normal because $5 per point is worth more in JPY than it was before. To rebalance your Nikkei delta, or risk, to be flat–you must buy more Nikkei futures. If the Nikkei itself jumped instantaneously, then you will end up buying at the high price. If USD/JPY then jumped back to what it was originally and so did the Nikkei, you’d have to sell back the deltas that you just bought–thereby negative scalping.

This process of constantly negative scalping delta in an attempt to remain delta-neutral is not a bug but an intrinsic property of quanto risk.

ETH Quanto

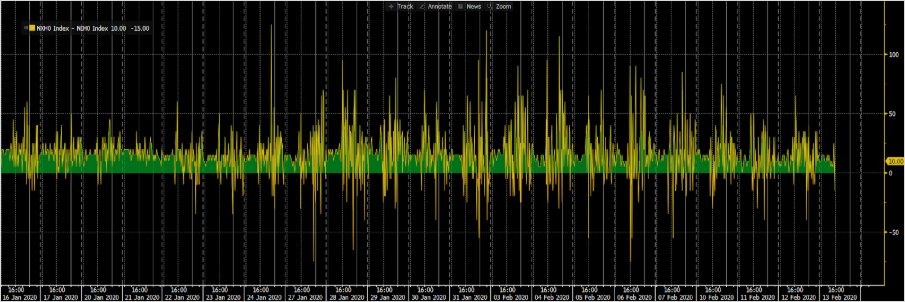

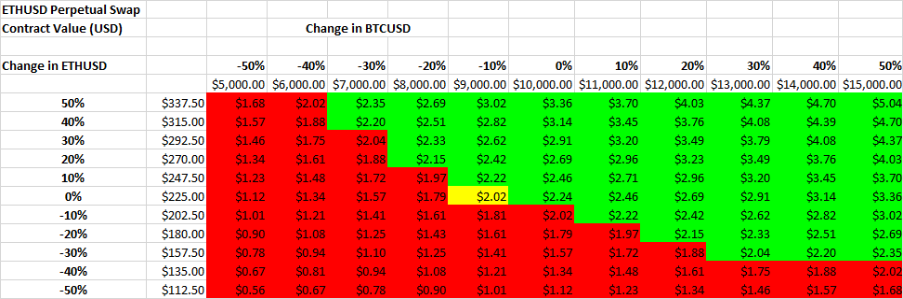

Coming back to the ETH quanto itself, we see that similar to the Nikkei example earlier, the value in USD declines substantially when BTC/USD itself declines–and vice versa. This is because the notional value of ETHUSD swap contracts depends on the BTC/USD price:

When BTC goes up, the payout of the quanto itself goes up because the value of the multiplier goes up in USD. Hence, a short quanto position always carries tremendous risk to any trader given the very high realized correlations.

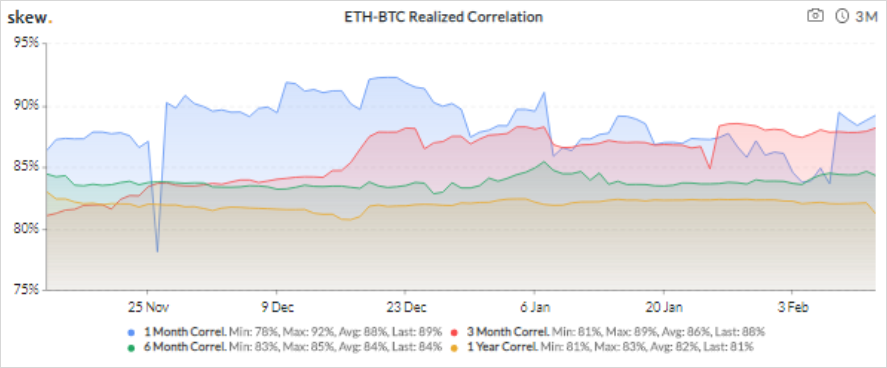

The correlation between ETH/USD and BTC/USD has been over 80% the past year and shows no signs of dissipating. Therefore, being short the quanto means having our losses magnified when prices go up and our wins minimized when prices go down.

How much might this be worth? The formula for the theoretical value of the quanto adjustment is also known as the covariance:

Covariance(ETHUSD, BTCUSD) = correlation(BTCUSD, ETHUSD) * volatility(BTCUSD) * volatility(ETHUSD)

Plugging in some reasonable values of 85% * 80% * 80% yields 54.4%! Now it is starting to make sense why the market is happy to pay us “exorbitant” funding for this position.

Instantaneous Bankruptcy Risk

Quanto perp swaps actually subject traders to instantaneous and unpredictable bankruptcy risk. Suppose a trader shorts 1 ETH @ 200 while BTC/USD is 10,000 and believes his liquidation price is 300. If ETH/USD goes to 250 and BTC/USD goes up to 12,500 at the same time, he will find that he is already liquidated because the size of his position is exploding with the BTC price itself.

Traders could use quantos to take a view on the covariance. If they believe that correlation will be muted over the next few days and markets will be quiet in general, they may want to short quanto to receive funding. Conversely, if they believe that both BTC and ETH will rally together very quickly, they may want to long quanto and be happy paying quanto adjustment.

Takeaways

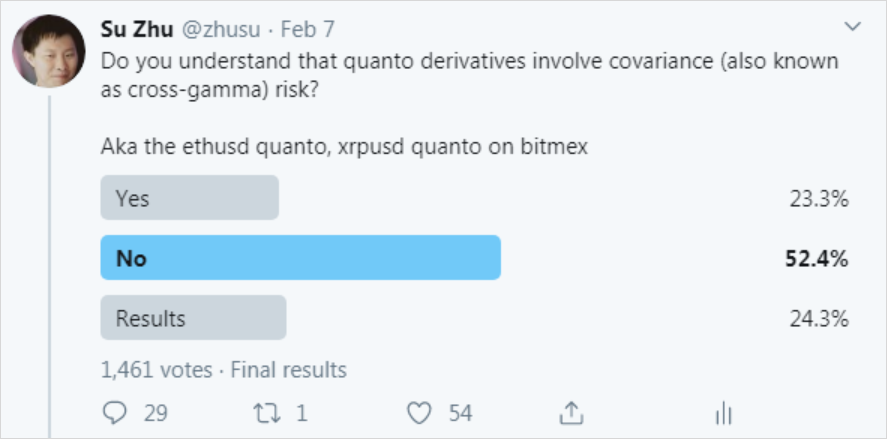

Quanto derivatives are not new products in financial markets but are likely to be new to most cryptocurrency traders. BitMEX has allowed the everyday trader easy exposure to new assets by offering quanto perpetual swap markets but also forces investors to have a view on the future movements of ETH and XRP and the covariance between each asset and the underlying BTC.

If the results of this poll are any indication, traders may not yet be aware of the risks they are actually taking when they trade these exotic derivatives. If they wish to trade ETH/USD and XRP/USD and not deal with quanto risks, they’d likely be better served on exchanges where they can deposit one of the native currencies of the pair they are trading: e.g. ETH for ETH/USD and XRP for XRP/USD.

AUTHOR(S)