When people talk about cycles in the cryptocurrency industry, they usually begin with some cylicality in the nature of price, most often described by the stock-to-flow model used by other commodities. However, the cyclicality that is often missed is that of the average user in crypto who comes in for Bitcoin and goes along the risk spectrum to find “the next Bitcoin,” eventually returning to the idea that Bitcoin is the best of cryptos.

My own journey started on a similar path, where I entered crypto learning about Bitcoin before moving to Bitcoin Cash and finally back to Bitcoin. It was easy to see why Bitcoin was the only asset that people looked to own. In 2017, when most assets had gaping liquidity issues, Bitcoin was flush with volume. In 2018 when most other assets drew down 90%, Bitcoin’s drawdown was not as severe. But what about today?

In this essay I’ll be highlighting some of the largest market structure changes to the Bitcoin narrative and why the playing field has leveled tremendously.

Derivatives

We love commenting about derivatives, and we cannot ignore their importance for Bitcoin maximalism in 2018 and beyond. Contrary to popular belief, the most important factor for Bitcoin’s success may not have been immaculate conception or security guarantees, but rather the fact that the derivatives market favored Bitcoin in a very interesting but often overlooked way, basically forcing maximalism onto the market.

When BitMEX’s perpetual swap came to dominance in 2018 it provided traders with a unique way to trade the market by collateralizing, profiting/losing, and trading all products in Bitcoin. The swap became the most liquid product on the market by a significant margin and soon BitMEX was leading the overwhelming majority of price discovery. At the same time, we saw Bitcoin dominance double as funds, venture groups, and crypto companies were actively hedging out their risk by trading on coin-margined BTC BitMEX.

This dominance in liquidity, volume, and uptime, made BitMEX the home of derivatives trading early on and allowed them to enter a new market: ALT/BTC. When the ETHUSD Quanto went live in May of 2018, we saw a precipitous decline in the price of ETH, in part because for the first time, traders could trade ETHUSD collateralized in BTC (before, only ETHBTC was offered). What most traders failed to realize was that this was the first step into becoming maximalists unintentionally as all P&L was denominated in BTC.

It didn’t matter what contract you were trading: being a Bitcoin-denominated exchange meant that everyone was in pursuit of one thing: Bitcoin. The reason why Bitcoin held up the best in 2018 was not purely that it was lindy or had the most value, but rather that it was the most widely traded, liquid product, and the product of choice to trade on BitMEX. The argument is in some ways circular but liquidity and volume beget liquidity and volume, and the best traders and funds will always aim to go where there is already a market made and counterparty-risk decreased.

In sum, as the entire market shifted towards coin-margined swaps, so too did the entire market shift towards Bitcoin being the king. In a lot of ways, 2017/2018 can never happen again, and there’s a strong argument that Bitcoin dominance has forever peaked as there are now a wide range of structured products that people can trade in almost any base currency. In other words, the market’s adoption of massive fiat railways has curbed the need to use Bitcoin as the only asset and has even opened up the possibility of dethroning king BTC.

Onramps

Perhaps second to fiat-margined derivatives, fiat onramps directly into crypto markets have allowed the world to bypass one of Bitcoin’s main unintentional value propositions: the middle layer between fiat and crypto. As the crypto market has ballooned in size, so has the accessibility of crypto spot markets. In the US alone, users can onboard more than a dozen exchanges to trade spot crypto markets in a relatively short amount of time. In addition to the expansion of readily available markets, there has also been a massive shift towards spot volumes trading against fiat (mostly USD) as opposed to Bitcoin pairs.

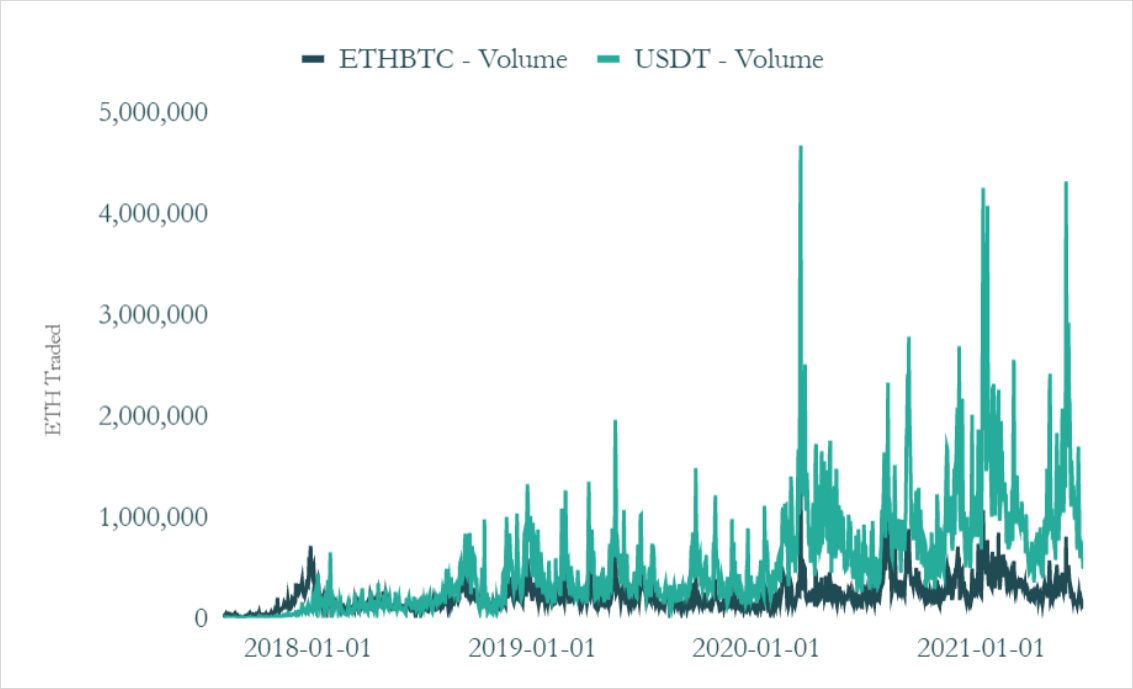

Take for example the ETHBTC vs ETHUSD pairs on Binance spot markets. Over the course of the past two years, the ETH spot markets have completely diverged as the fiat onramps have completely dwarfed the Bitcoin trading pairs. Bitcoin’s functionality as a major gateway into crypto has been dismantled as more markets are created and liquidity has moved towards fiat spot markets for coins. A quick glance at the volume divergence between DOGEUSDT and BTCUSDT on Binance also bears out this trend, as DOGE has been able to consistently notch more volume than Bitcoin in the past few weeks.

In addition to the onramps, the crypto markets have also benefited from institutional adoption of assets. Grayscale, Purpose ETF, CME futures markets, and Bitwise have all lent their hands towards large scale players entering the space—yet these products don’t just cater towards Bitcoin anymore. Since the CME announced ETH futures and Grayscale added the ETHE trust, Ethereum has made up roughly 20% of both futures and trust size in crypto. The narrative of Bitcoin as the only institutional crypto asset has been suppressed fully and institutions have begun to explore the possibility for other cryptos (namely ETH) to be a part of ETF applications and corporate treasury purchases.

DeFi & the Future of Crypto

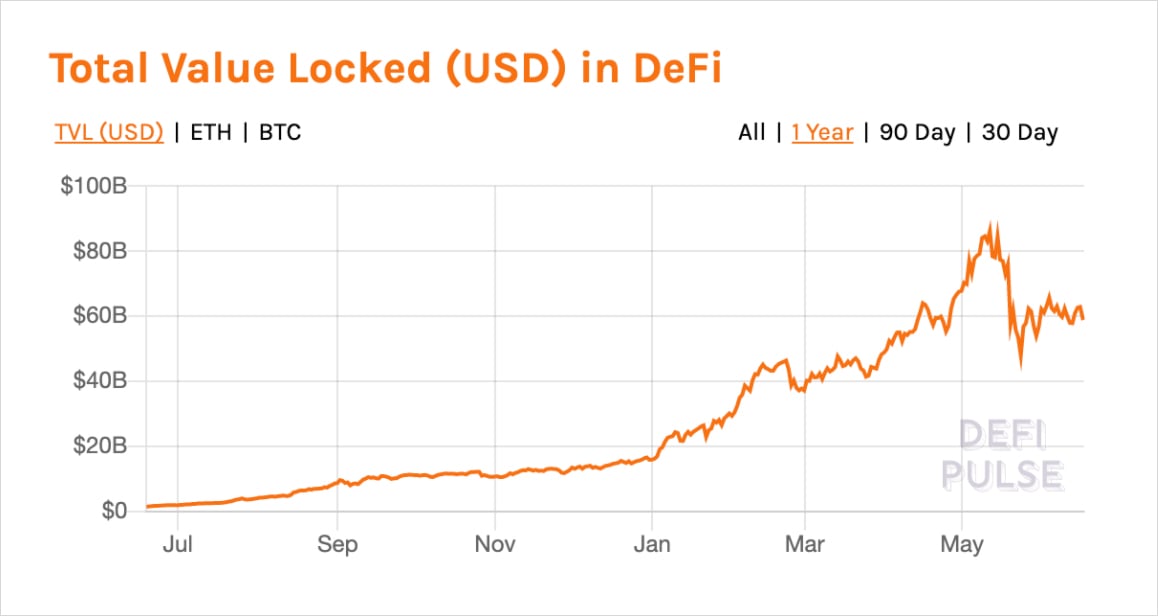

Likely the most important long term driver of crypto valuations, DeFi stands as the most valuable future outlook of crypto. A year ago the concept of DeFi was nowhere near as readily understood as we know it to be today but the proliferation of liquidity mining / yield farming has propelled DeFi to become the darling child of the industry. In the span of a year we saw the amount of value in DeFi (Total Value Locked) move up more than 100x from $700 million to $91 billion and counting.

As it stands there are more than a half dozen layer 1 blockchains worth more than $1 billion looking to eat up Ethereum’s moat. What this rapid expansion shows is not only the value accrual of DeFi in the short-term but also the collective outlook of the ecosystem in the long run. While Bitcoiners have claimed that DeFi will eventually be built on top of Bitcoin, the reality is that Bitcoin’s architecture simply cannot support much DeFi functionality that already exists on Ethereum. What’s missing in this future view of crypto is Bitcoin’s role as the industry leader and where Bitcoin will find it’s value-add to the DeFi ecosystem.

Conclusion

In a market where the largest assets trade at high volatility, it’s difficult to withstand regime change even for the best of assets. Bitcoin stands alone as the most lindy asset with the most acolytes, yet when digging into why, we’re challenged with the question of true support versus structural forces that enabled Bitcoin to retain its supremacy. In the wake of the derivatives market expansion, addition of onramps, and birth of DeFi, Bitcoin’s dominance as the premiere cryptocurrency has fallen off and likely will never retain its old position as the one true cryptocurrency.

AUTHOR(S)