In this week’s edition of Option Flows, Tony Stewart is commenting on the lastest news and market movements.

BTC Option flows far more focussed on post-halving upside than Middle-East tensions, with bullish Jun95k, Dec100k, Mar200k Calls outweighing bearish Apr 60-63k+May62-66k Puts.

ETH more worrisome: Calls sold, Jun Put spreads bought.

As Iran launched, BTC Puts TPd. ETH were not.

2) Early in the week $15m premium was spent on Post-Halving BTC OTM Calls.

As attention and chatter turned to the Middle East, plays were made to the downside.

But in hindsight, BTC downside plays were very under-utilized with BTC at 71k and IV sell-off ahead of the weekend.

Delta equivalent of ~9k BTC. IV ~110%, exp in 25days.

3) Those that did purchase BTC Puts (Apr 57-63k, May 62-66k) reaped rewards as BTC plummeted to 60k.

Much of those Puts were proactively TP’d, despite apparent poor DSOB ITM-Put pricing.

Liquidity+depth is always there.

BTC Spot bounced to 65k, now 64k as I write this.

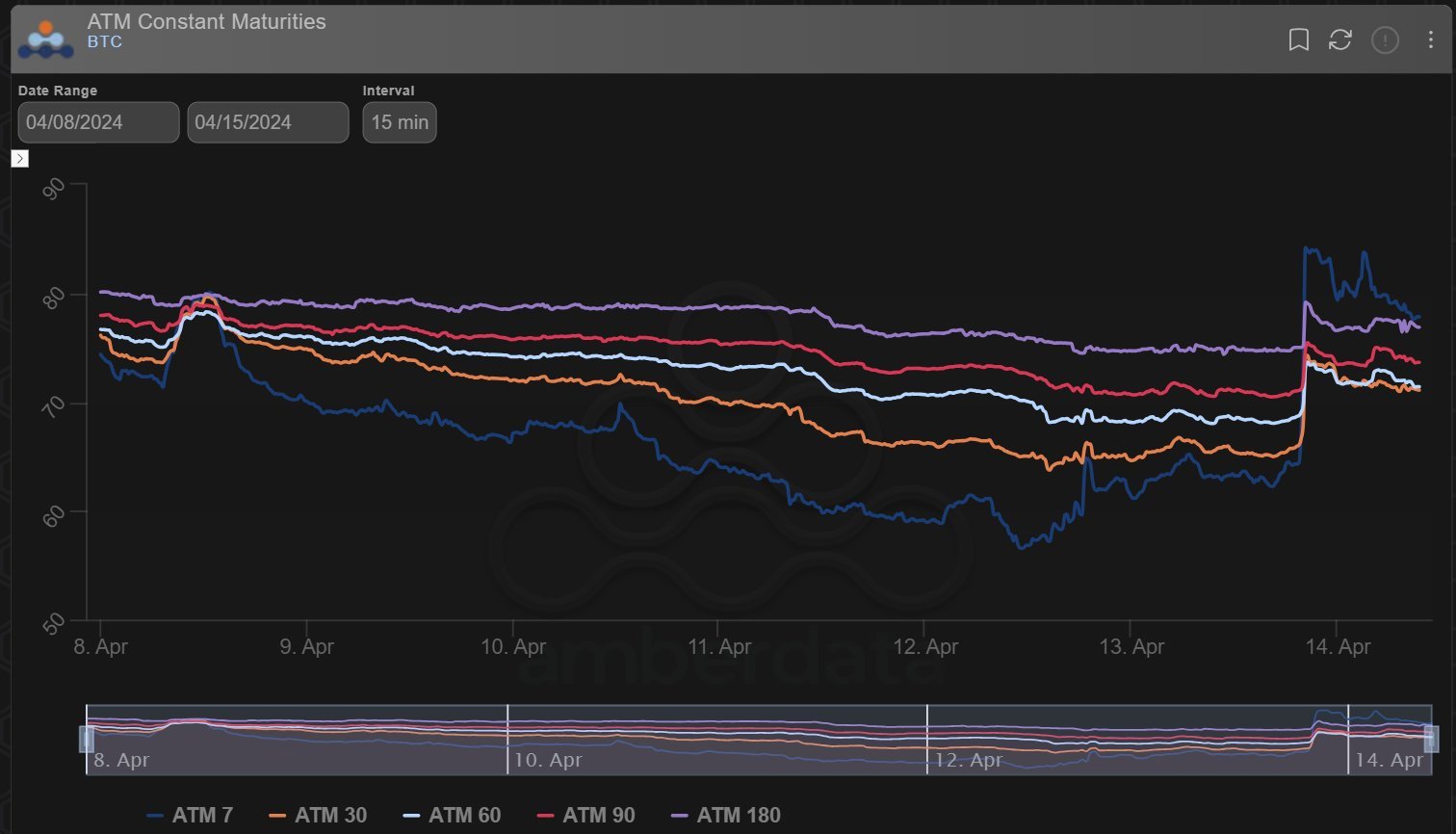

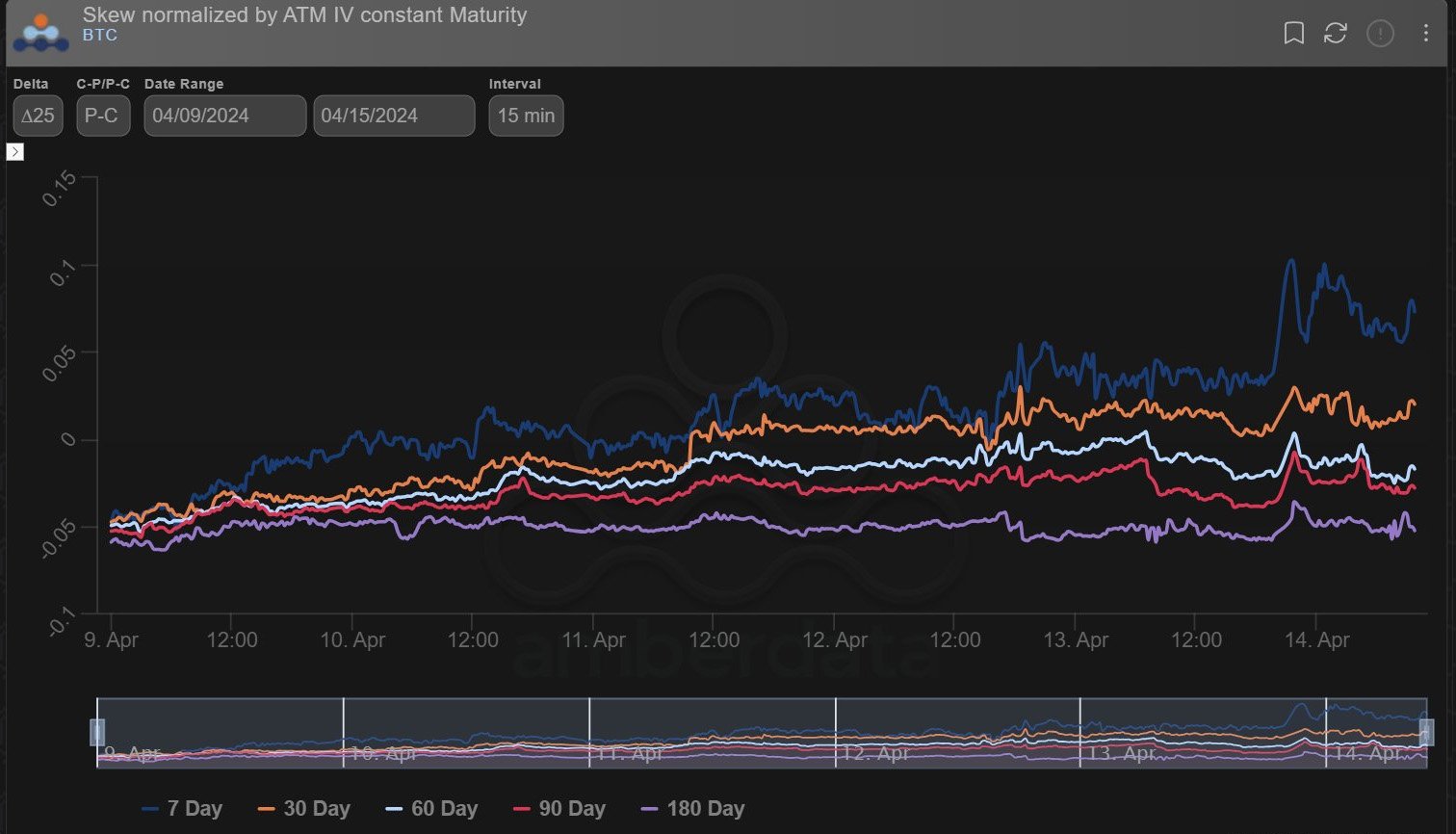

BTCSkew:

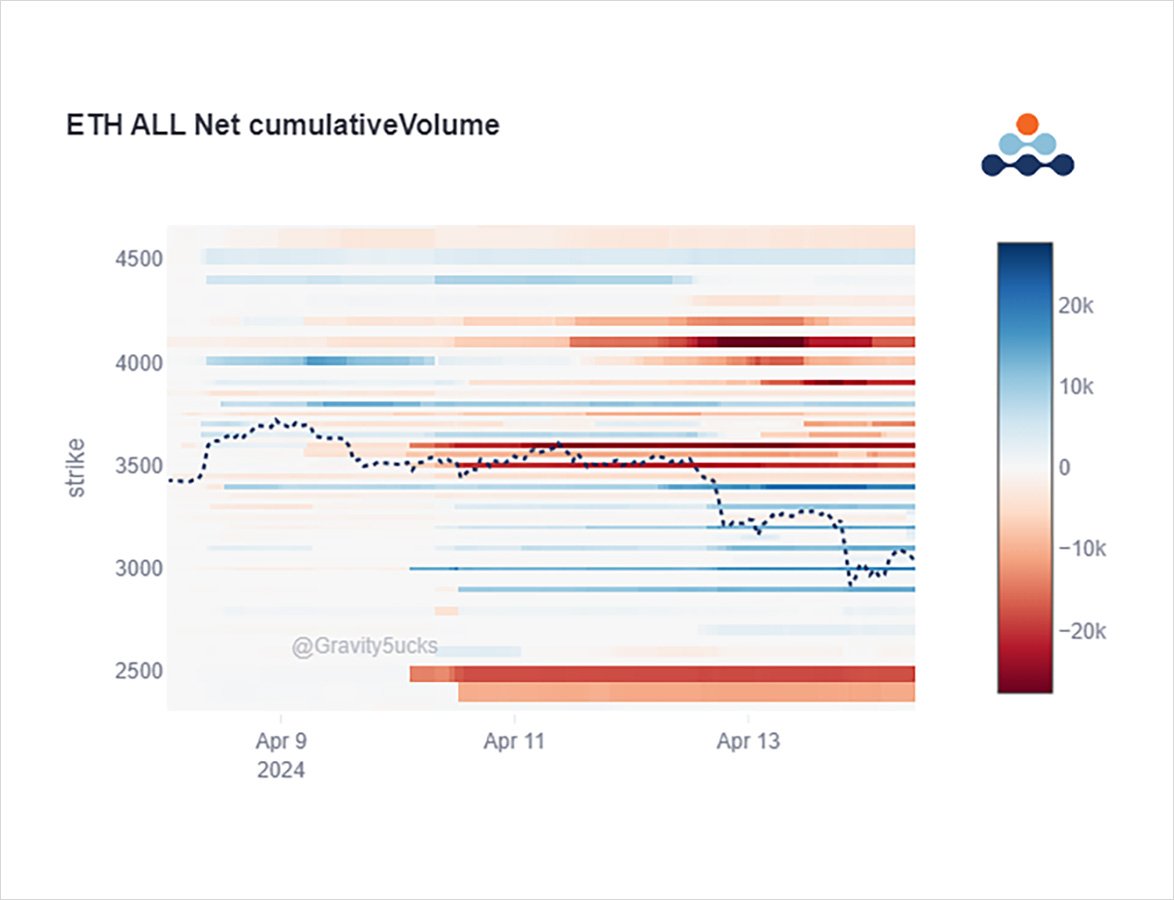

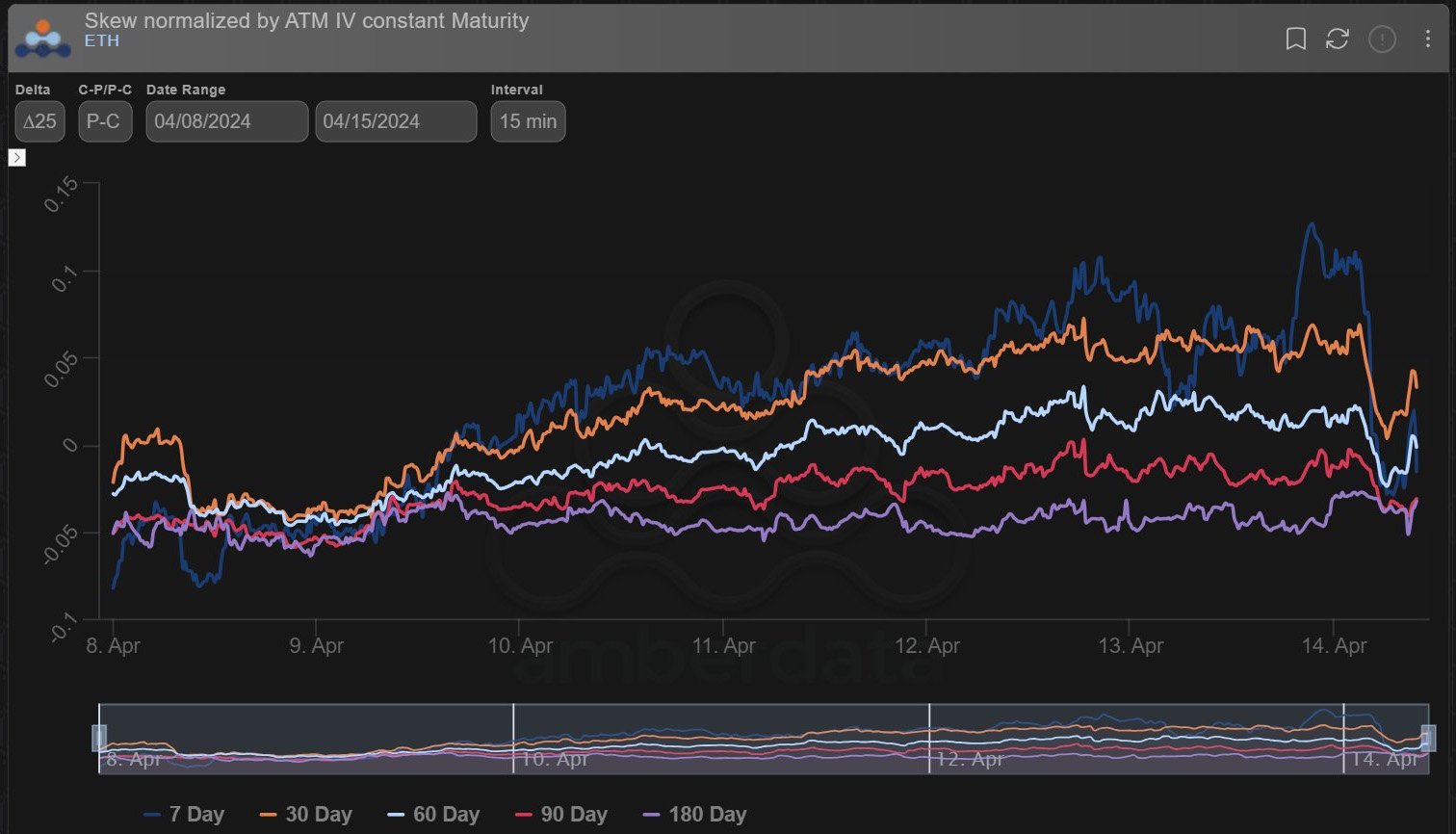

4) Meanwhile on ETH, while perhaps not predicting an imminent sell-off, a large structure sold ETH Apr 3.5+3.6k Calls to fund buying of Jun ~3k-2.5k Put spreads x30k & followed by some rolling of short-Apr over-write Calls to May, and excess May 4k+ Call selling, performed early.

5) The question surrounding the 23rd May ETH ETF continue to be debated, but it has seemed for a few weeks now that any opportunity to take yield by selling Calls vs long underlying ETH has been taken.

Using premium to buy Put spreads, protecting AUM from <3k was more vigorous.

6) Interestingly there was no unwind of this structure as ETH plummeted from 3.7k to 2.8k which seemed to confirm this trade as protective of an underlying AUM…or ofc expecting further downside.

Other unwinds were also not forthcoming.

ETH bounced to >3k at the time of writing.

7) 1-week Options surged >100% and Dvol pumped to >80% on little weekend volumes, but obviously on the back of realized moves and forced short-covering of options when required.

We now await localized and global responses to tensions in the Middle East and for ‘trad-fi’ catchup.

View Twitter thread.

AUTHOR(S)