In this week’s edition of Option Flows, Tony Stewart is commenting on 50k resistance and options expiry in September.

August 26

Combatant Call Option flow mirror opposing views near 50k resistance, with a large dump of Sep24 50k Calls as BTC fell towards 48k, offset by Sep 64k Strike funded Call, and a big Sep10 52+54k Call buyer at 47k support.

Non-aggressive Put flow suggests consolidation, not fear.

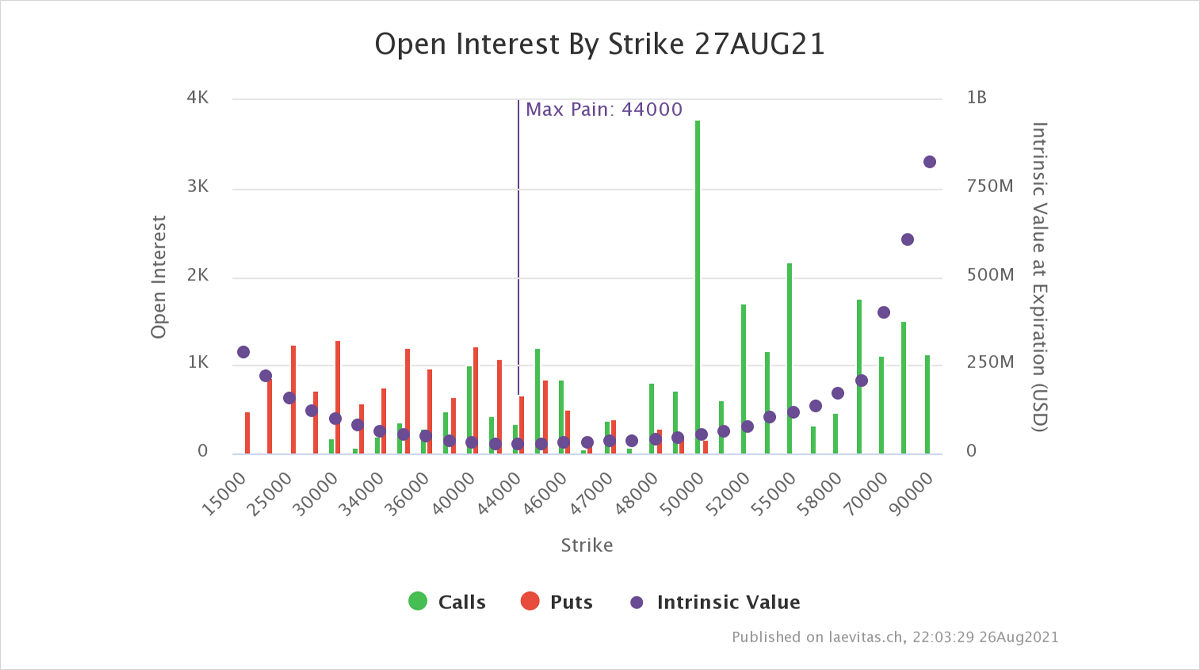

2) Looks like the Aug27th 50+52k Calls bought assertively a few days back, will expire worthless, with <12hrs to go, and there is no gamma impact at this spot level (47k) attracting the market to that strike. A buyer did add more on the first dip to 47k, but did not unwind >49k.

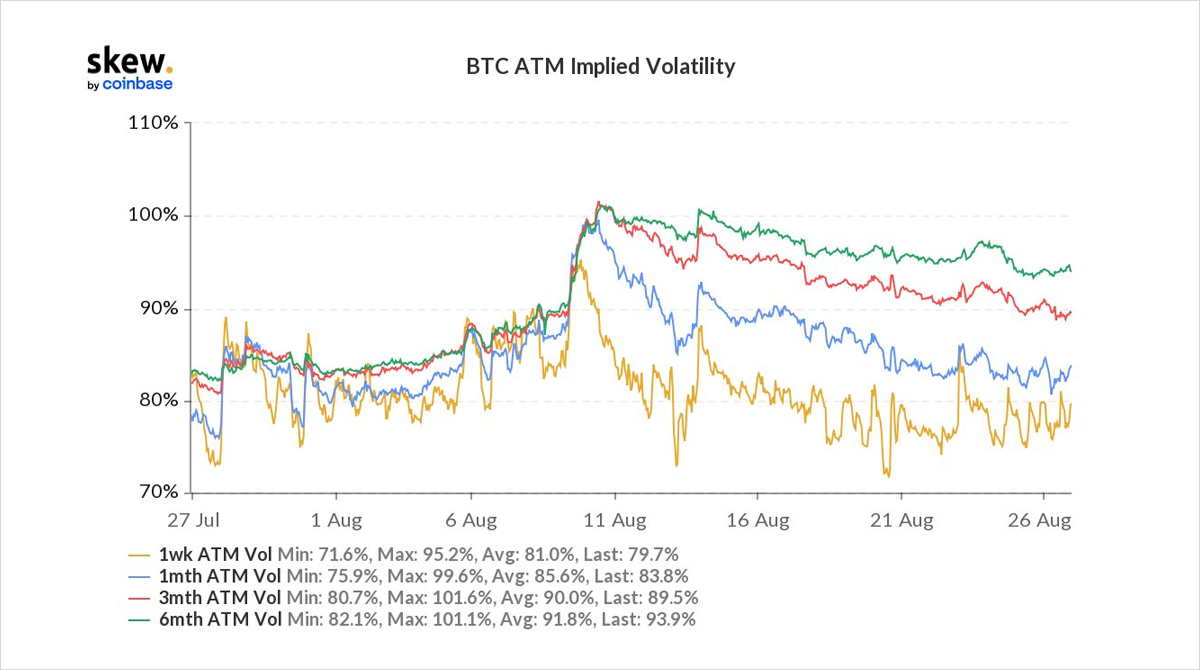

3) Despite 1m RV <70% and IV drifting lower, compounded by the large seller of Sep24 50k Calls in Asian hours, the demand for optionality has created a floor around 75-80% (1week-1month), with continued buying of Sep3-10 50-54k Calls and Sep 64k Calls funded by selling Oct 100ks.

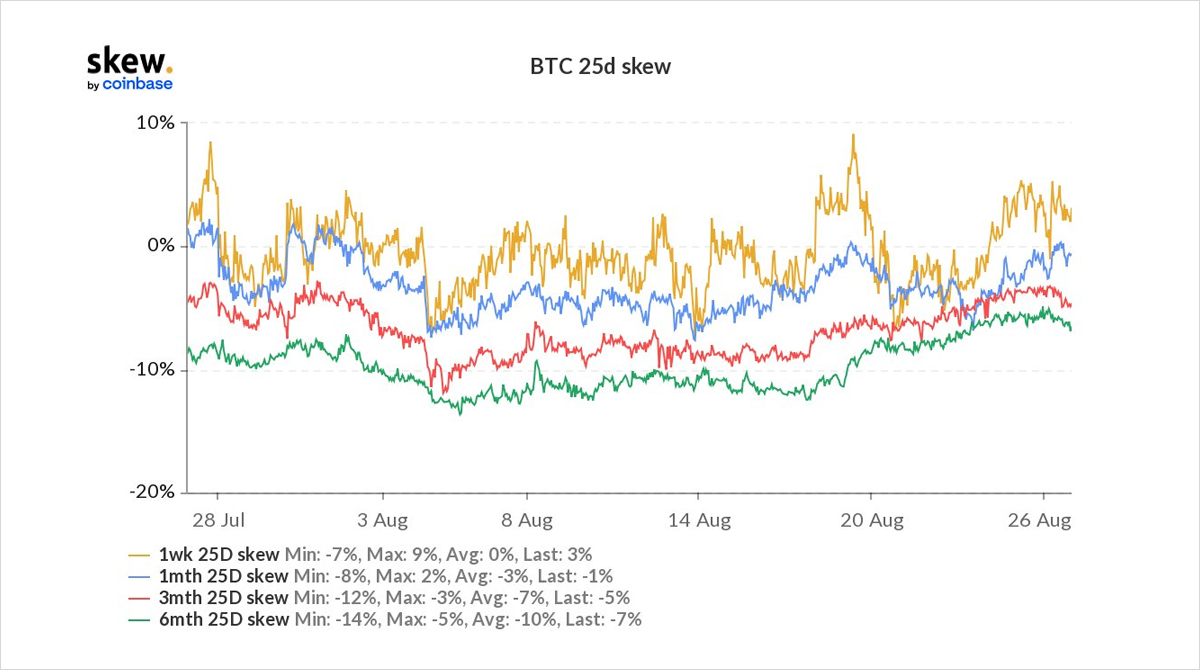

4) Skew still biased to the Calls across the curve, although slightly weakened on the spot move from 50k down to 47k as a little protection was bought near-date, but longer-dated, sellers of Puts and buyers of Calls continued in smaller size, taking advantage of funding pullback.

View Twitter thread.

AUTHOR(S)