In this lecture we will cover the maximum profit or loss of a call option, for both the buyer and the seller. As with any trade, it is important to be aware of the risk you’re taking before placing the trade.

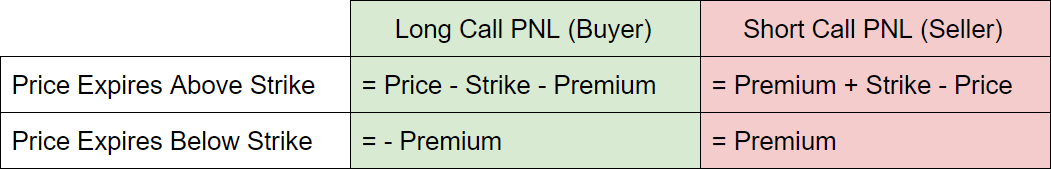

Firstly, this table shows how to calculate the profit or loss of a call option position for either the buyer or seller. For now, to keep things simple, we’ve left out the position size i.e. the contract multiplier and number of contracts.

What we are doing here to calculate the profit/loss, is calculating the value of the call option at expiry, then adjusting for the premium to give the final profit/loss. The value of a call option that expires in the money is the underlying price at expiry minus the strike price. So we could write this as:

Call Value = Price – Strike

To calculate the buyers profit/loss we then just need to subtract the premium they paid from the value of their call option at expiry. This leads to us calculating:

Call Buyer’s PNL = Call Value – Premium

As we just covered, when the call expires in the money, the call value is ‘Price – Strike’, so we can write as:

=Price – Strike – Premium

So you can see how the formula for the buyer’s PNL is derived.

The seller’s PNL is of course just the negative of this, i.e. multiplied by minus one. So the seller’s PNL can be calculated as:

= Premium – Call Value

= Premium – (Price – Strike)

= Premium + Strike – Price

So you can see how the formula for the seller’s PNL is derived.

When the call option has no value at expiry, because the price expires below the strike, you can substitute in zero for the Call Value’ to give:

Call Buyer’s PNL = Call Value – Premium

= 0 – Premium

= -Premium

And:

Call Seller’s PNL = Premium – Call Value

= Premium – 0

= Premium

PNL example

As a quick example, assume a trader buys a call option with a strike price of $50, and pays a premium of $4 per share.

What is the profit and loss for the buyer and seller if the price at expiry is $70?

We have a:

Price of $70

Strike of $50

Premium of $4

As $70 is greater than $50, the price at expiry is clearly above the strike price, so we will use the top row of formulas.

The buyer of the call option has a profit/loss of:

= Price – Strike – Premium

= 70 – 50 – 4

= $16

So the buyer has a profit of $16.

The seller of the call option has a profit/loss of:

= Premium + Strike – Price

= 4 + 50 – 70

= – $16

So the seller has a loss of $16.

Max profit/loss

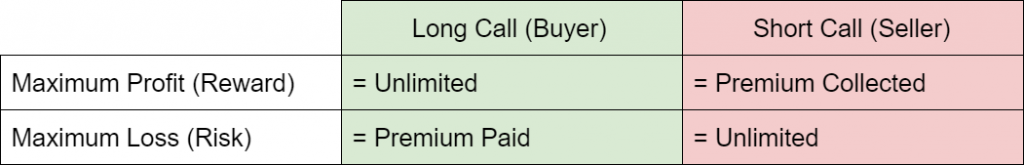

As well as just being able to calculate the profit or loss for a specific value, it’s also useful to know the maximum profit or loss of any option position you’re thinking of opening.

For the call option buyer, their profit continues to increase for every dollar increase in the underlying price. Because of this their maximum profit is theoretically unlimited. In reality of course an asset price will not go to infinity, so it is also common to refer to it as undefined. In other words it can be very large, but it’s impossible to say exactly how large.

When the call option buyer has their maximum profit, the call option seller has their maximum loss. Again this is unlimited, or undefined if you prefer. For every dollar higher the underlying price is at expiry, that’s another dollar the call seller owes to the call buyer.

Back to the call option buyer. They suffer their maximum loss when the underlying price at expiry is below the strike price of the call option. When this is the case they lose the premium they paid for the option, but nothing more.

Similarly for the call option seller, they make their maximum profit when the underlying price at expiry is below the strike price of the call option. The seller gets to keep the premium they collected, and does not have to pay anything out. Their maximum profit is equal to the premium collected.

In summary

The buyer of a call option has a fixed risk, and potentially unlimited profit.

The seller of a call option has a potentially unlimited risk, and a fixed profit.

Although the calculations here are relatively simple it is always wise to be aware of whether your option position has a fixed risk, or an undefined risk. It is also important to be aware of which direction you have risk in. For a single call option this is not difficult, but this principle will come into play much more in later sections when we start combining multiple options into a single strategy.