In this lecture we will cover the maximum profit or loss of a bitcoin call option, measured in bitcoin, for both the buyer and the seller. It’s particularly important to be aware of how this differs to the calculations given in lecture 3.7.

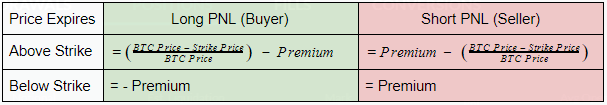

Firstly, this table shows how to calculate the profit or loss of a bitcoin call option position for either the buyer or seller. To keep things simple, we’ve left out the position size i.e. the number of contracts. To adjust for that you would just multiply by the number of contracts afterwards.

If you’re mathematically minded, you may be able to see that this section of the formulas:

(BTC Price – Strike Price)/BTC Price

Will tend towards 1 as BTC Price gets larger, given that the strike price never changes. And in turn this will help you see where the maximum profit/loss formulas come from.

Max profit/loss

It’s always useful to know the maximum potential profit or loss of any option position you’re thinking of opening.

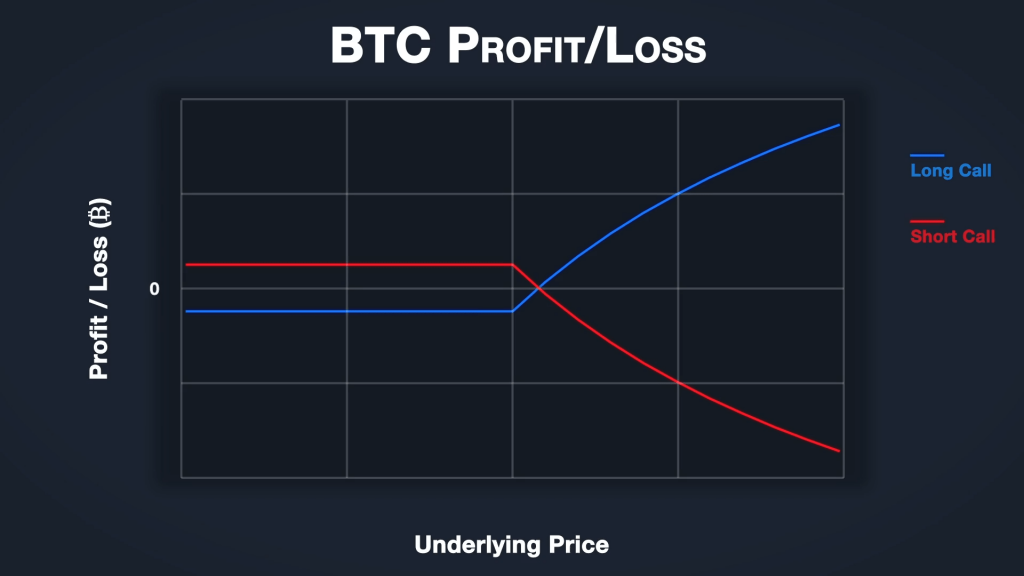

Here we can see the bitcoin profit and loss chart for a bitcoin call option. The buyer’s PNL is in blue, and the seller’s PNL is in red. The distance between the lines and the x axis for prices below the strike price, is equal to the premium paid. And the PNL lines for prices above the strike price are calculated using the profit or loss formulas we just looked at.

You could be forgiven for thinking the maximum profit for the buyer, and maximum loss for the seller, is unlimited here, just like with the dollar call options in section 3. However, as we touched on in the previous lecture, this is not the case. Due to the curve in the payoff lines, the maximum profit for the bitcoin call option buyer is capped at 1 bitcoin (minus the premium paid). The bitcoin call option seller’s loss therefore is also capped at 1 bitcoin (minus the premium collected).

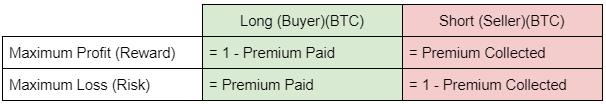

This results in these maximum BTC profit/loss formulas:

It’s worth noting again that if measured in dollars, these formulas for maximum profit or loss would be the same as the ones given in lecture 3.7.

It’s because we are measuring things in bitcoin here (the base currency) that they are different.

For the bitcoin call option buyer, their profit continues to increase for every dollar increase in the underlying bitcoin price. Every time the bitcoin price increases by a dollar though, that means that less bitcoin is needed to pay that $1 profit.

This is because as the bitcoin price changes, so does the value of $x when measured in BTC. For example when the bitcoin price is at $10,000, $1,000 is 0.1BTC (1000/10000). However, when the bitcoin price is at $20,000, $1,000 is 0.05BTC (1000/20000).

The result of this ever smaller amount of bitcoin required to pay each subsequent $1 increase in profit, is that the maximum profit for the buyer, and the maximum loss for the seller, is capped at 1 bitcoin (minus the premium).

The call option buyer will suffer their maximum loss when the underlying price at expiry is below the strike price of the call option. When this is the case they lose the premium they paid for the option, but nothing more.

Similarly for the call option seller, they make their maximum profit when the underlying price at expiry is below the strike price of the call option. The seller gets to keep the premium they collected, and does not have to pay anything out. Their maximum profit is equal to the premium collected.

In summary

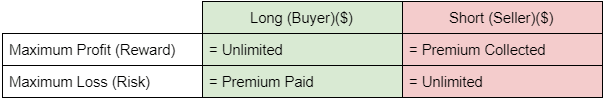

The buyer of a cryptocurrency call option on Deribit has a fixed risk. Their maximum profit measured in dollars is still unlimited, but when measured in bitcoin is capped at 1 minus the premium paid.

The seller of a cryptocurrency call option on Deribit has a fixed profit. They also have potentially unlimited dollar risk, but measured in bitcoin this risk is capped at 1 minus the premium collected.

While the calculations in dollar terms are the same as section 3, when measured in bitcoin they are quite different. This difference is important to familiarise yourself with if you are used to using dollars as collateral for options on things like stocks or commodities, and are making the move over to cryptocurrency options for the first time.