It’s time for our first live example of a cryptocurrency option trade. There will be many more examples later in the course that focus more on reasons for taking a trade and how the positions behave over time, including the Greeks. However, as many people will be new to crypto options in general, and new to Deribit specifically, we will spend a little extra time covering how to actually use the website in these first 4 Deribit examples (2 in this section, and 2 more in section 6).

In this first example we are going to buy a bitcoin call option live on the Deribit website. We will take a look at the Deribit option chain, locating the option, using the option order form, and placing the trade. We will then look at our potential profit at expiration, taking into account the premium we pay and the strike price, and we will then let the option expire. Once the option has expired we will analyse how the position performed and calculate how much profit/loss was actually made.

Current price

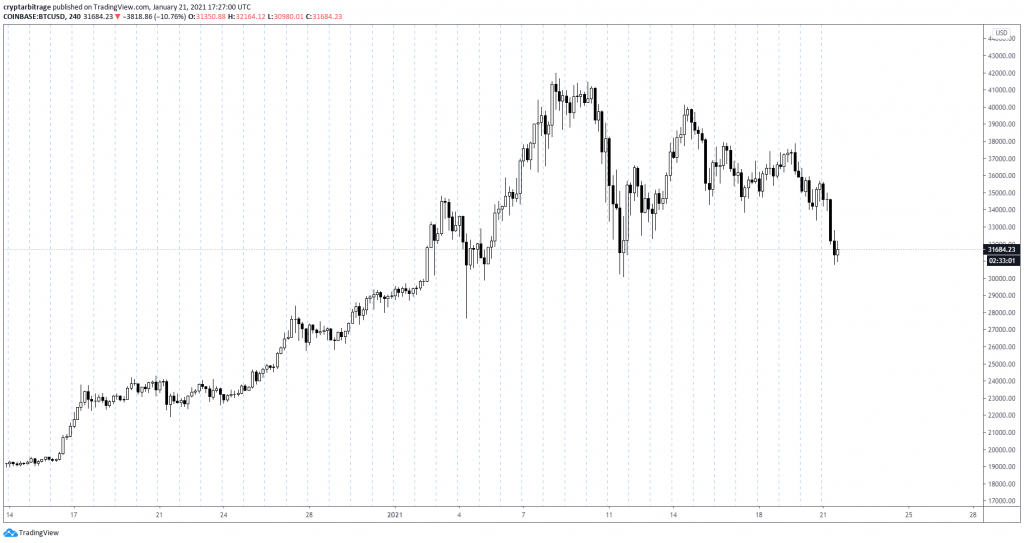

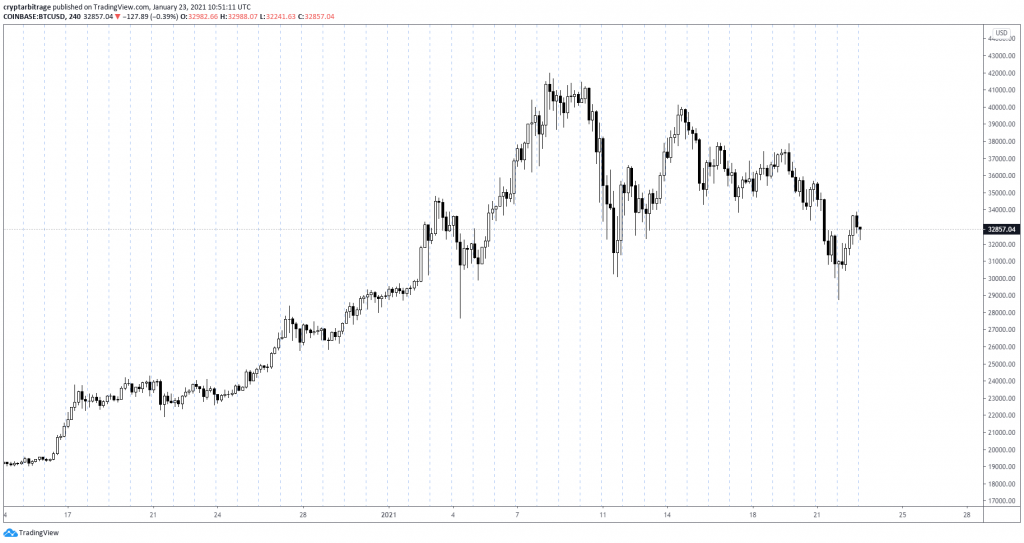

As we’ll be trading bitcoin options today, let’s take a quick look at the current bitcoin price. This is a chart of the bitcoin price on Coinbase, which is a well known exchange where people can buy bitcoin. Coinbase is also one of the constituents of the Deribit index, which is used to settle the Deribit options and futures.

This is a four hour chart, so each candle represents four hours. Although there are vertical lines here to denote ‘sessions’, bitcoin doesn’t have sessions in the same sense as our previous examples on SLV. Bitcoin, and indeed all cryptocurrencies, are running 24 hours a day. Most crypto native trading platforms are also open for business 24 hours a day.

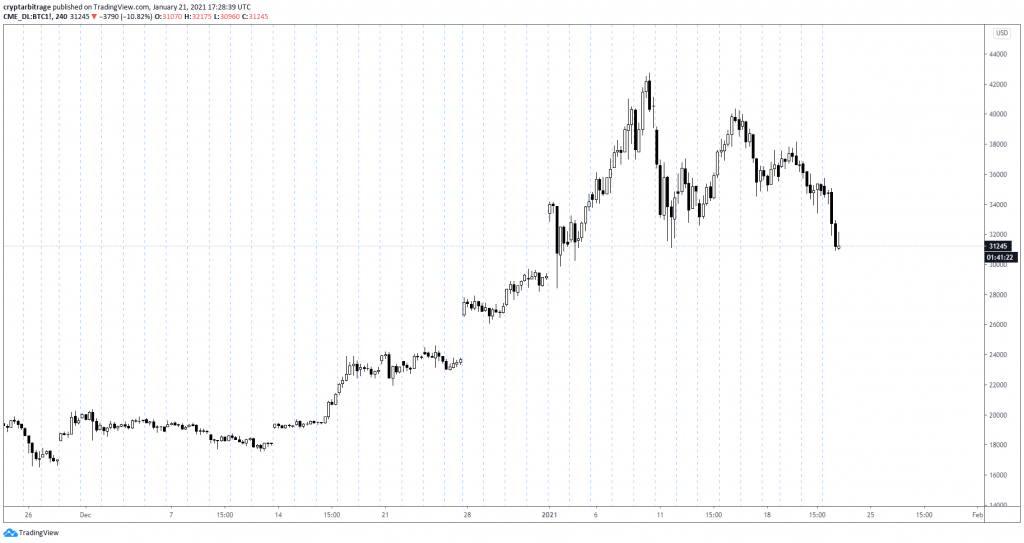

Coinbase for example is open 24/7, and this is also the reason you don’t see any gaps between the bars on this chart. However there are some venues like the CME that offer bitcoin futures that are not open at the weekend. At these venues you can see gaps over the weekend while their market is closed. You can see some examples on this chart of a CME bitcoin futures contract.

Back to the Coinbase chart for now. Today is Thursday the 21st January 2021, and bitcoin is trading at about $31,684 on Coinbase. As you can see the price has dropped quite significantly so far today, but let’s say we have an opinion that this decrease in price is going to be very short lived, and that price will bounce back significantly, similar to what happened back here on the 11th and the 4th. To capitalise on this if it does happen, we’re going to buy a bitcoin call option that expires in 2 days (on Saturday the 23rd January) with a strike price of $33,000.

Back to Deribit

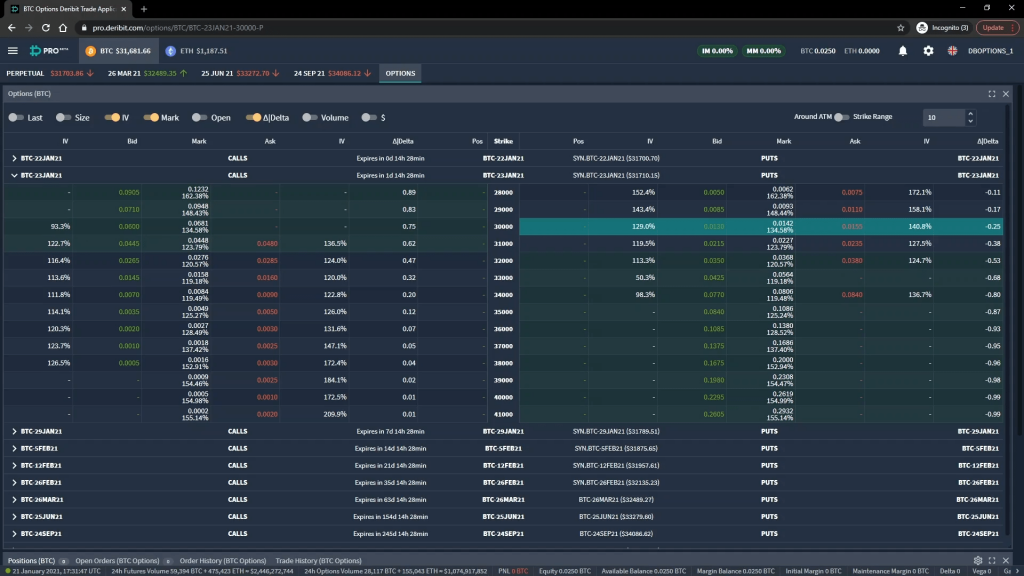

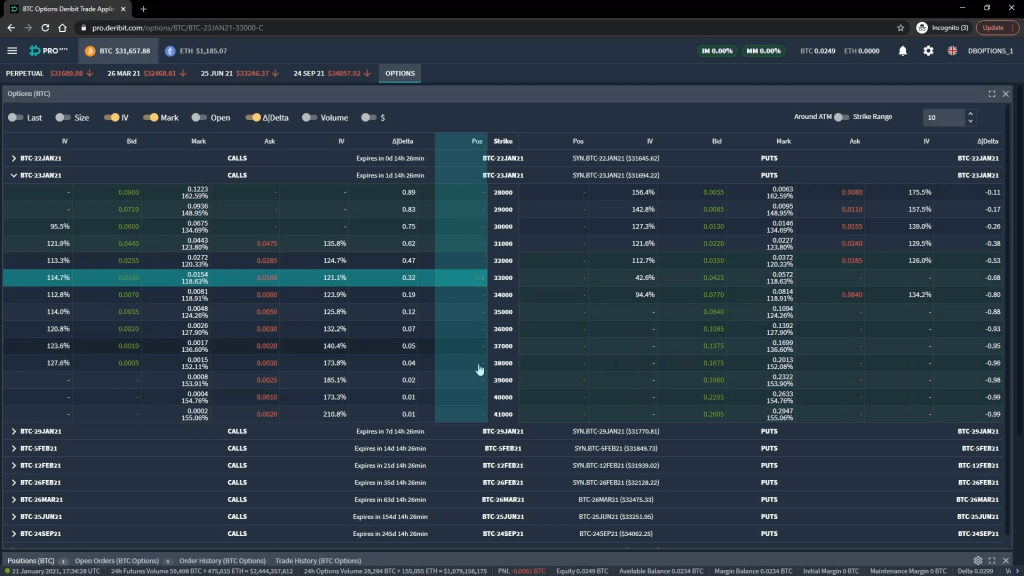

Let’s head back over to the Deribit option chain. You should recognise the layout of this page from lecture 2.6 where we looked at the basic structure of option chains. As a brief recap, we have strike prices in the middle column, with call options to the left, and put options to the right.

As you can see in the top left, I have the 23rd of January option chain expanded, so every option we can currently see expires on Saturday at 0800 UTC. We want the $33,000 strike, which we can find in the middle column. And we want the call so we move left from here.

The current best bid is shown in the bid column in green, and the current best ask is shown in the ask column in red. These prices shown are an amount of bitcoin. For example a price of 0.016 means 0.016 BTC, or 1.6% of a bitcoin.

You may also notice a third price listed in between the bid and ask columns. This is the mark price column which I personally always have shown. The mark price is what Deribit risk management is currently valuing each option at for margining purposes. The mark price is not a tradable price, but can help give you an idea of current option values.

The option order form

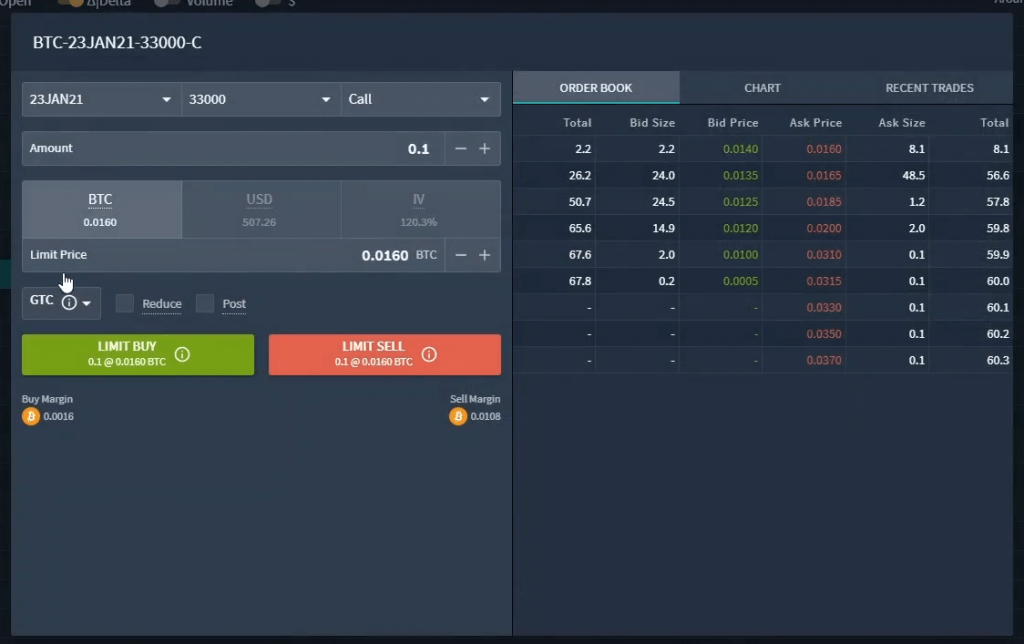

In the option chain we can only see the best bid and best ask, but to see all the bids and asks, we can click on the option we want to view. This brings up the option order form for this option, which includes the orderbook of bids and asks on the right. If you’re coming over from traditional exchanges, you may or may not be that familiar with seeing the full order book for every product, but on cryptocurrency exchanges this is the norm.

We can see a list of each bid in green along with how many contracts are available at each price. These are other traders’ limit orders to buy this option, so if we wanted to immediately sell this option we could sell into these orders if we wanted to.

And in red we can see the list of asks along with how many contracts are available at each price. These are other traders’ limit orders to sell this option, so if we wanted to immediately buy this option we could buy into these orders if we wanted to.

On the left hand side, is the order form. This is where we fill in our order details, and then execute our trade. At the top we have the details of the current option that we are looking at.

BTC stands for bitcoin.

23JAN21 is the date this option expires.

33000 is the strike price, and

C stands for call option.

So we know we’re looking at the $33,000 bitcoin call option that expires on 23rd January 2021.

Just under this, some of these details appear again but in dropdown menu form. If we wanted to we can adjust which option we are looking at with these, but we’ll stick with the one we are on for now.

Next is the ‘Amount’ field. This is where we enter the quantity for our order. For example if we wanted to purchase 10 contracts, we would enter a value of 10 here. For this example we’re actually going to use the minimum size possible for the bitcoin options on Deribit, which is 0.1.

What this means is that if the price of bitcoin is above our strike price of $33,000 when the option expires, we will receive profit equivalent to if we had bought 0.1 bitcoin at $33,000. Remember from lecture 3.8 where we purchased a call option on SLV. Our 1 option represented 100 shares of SLV, i.e. the contract multiplier was 100. For the cryptocurrency options on Deribit the contract multiplier is just 1, so there is no similar multiplication needed. 1 bitcoin option represents a notional position of 1 bitcoin, and therefore with a position size of 0.1, we have a notional size of 0.1 bitcoin.

With the quantity selected (0.1 in this case), we can move onto selecting the limit price of our order. This is how much we will pay for the option, and it is the amount per full contract, i.e. per quantity of 1. So because our quantity is 0.1, the total we will pay will be 0.1 multiplied by this price. If we were instead purchasing with a quantity of 5, the total we paid would be this limit price multiplied by 5.

We want our buy order to execute immediately so we will use the price of the current best ask, which is 0.016 BTC.

There are a few other settings available here that allow us to change the behaviour of our order, but because we don’t actually need to use any of these at the moment, and to attempt to avoid information overload with this first example, we will leave these for other examples.

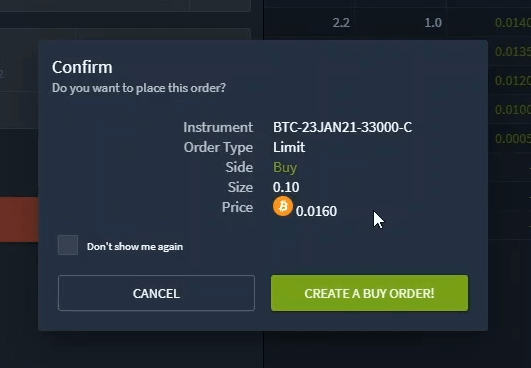

Order confirmation

We have successfully set our quantity of 0.1 and price of 0.016 BTC, so let’s click the BUY button. This will bring up the order confirmation screen, where we can check everything has been entered correctly. Everything is correct here, so I will click the BUY button to create the buy order.

There was an order already in the order book at the price we selected so our order executes immediately, as expected. The pop up in the top right of the screen lets us know the order was filled.

Trade placed

We are now long the $33,000 call option, with a position size of 0.1, and we paid 0.0016 BTC. Remember the price of 0.016 BTC was for 1 full contract. As we only bought with a quantity of 0.1, we only pay 10% of this, which is 0.0016 (plus fees, which we will look at later).

If we look back at the option chain again, I’ve enabled the position column. This shows any positions that are currently open, and we can see our long position of 0.1 in this column here.

Closing early

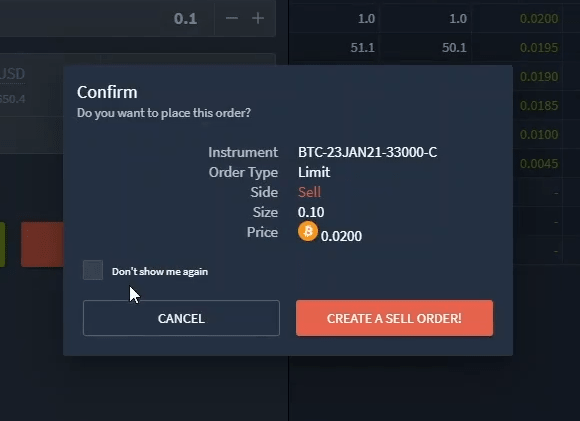

Before we analyse potential outcomes for this trade and calculate the breakeven point, it’s worth pointing out that despite the options on Deribit being European style, we are perfectly free to close this trade whenever we like. To do this we just need to do the opposite of what we did to open the trade.

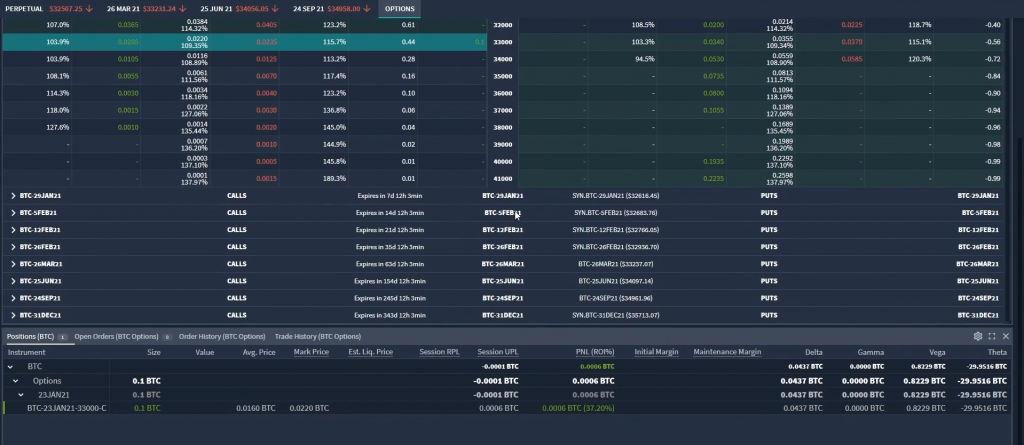

I’ve come back into the account here a couple of hours after placing the trade to see how it’s doing. Scrolling down to the positions table we can see it’s in a bit of profit as the price of bitcoin has increased since we purchased the call option.

We are going to hold this until expiry as we said initially, but if we did want to close it, we would bring up the order form for the exact same option. We would then enter the same quantity and our chosen price (in this case 0.02 BTC), and as we are currently long this option, we would instead execute a sell order to close our position. We would do this by clicking the SELL button, checking the details in the confirmation pop up, then clicking SELL again.

We are going to leave this open as I said, but as many new traders mistakenly believe they need to hold these options until they expire, it’s worth pointing out how simple it actually is to close them early. And unlike traditional markets, the options on Deribit trade 24/7 so you can literally do this any time you like.

What could happen

Time to take a look at what could happen at expiry. Let’s remind ourselves of the option parameters we have for this position.

-The underlying asset is bitcoin

-The option type is call

-The expiry date is 23rd January 2021

-The strike price is $33,000

-The option price (or premium) is 0.016 BTC per contract

As this is a real world example we will include the fees in our calculations. The fees for placing our trade were 0.0003 BTC per contract. We will cover where you can check this later.

This extra 0.0003 BTC takes our total cost up to 0.0163 BTC per contract. As we have purchased 0.1 contracts, our total cost is 0.00163 BTC. The per contract amount will help us calculate the breakeven, and the total amount paid will help us calculate the possible profit/loss.

PNL Chart

Given all the parameters we just covered, this is the PNL chart at expiry for this option position.

For any price of bitcoin below our strike price of $33,000, we will make the maximum possible loss. This maximum loss is limited to the premium we paid, plus the fees. We paid a premium of 0.016 BTC per contract, and the fees were 0.0003 BTC per contract. This gives us a total cost per contract of 0.0163 BTC. As the contract multiplier is 1 and we purchased 0.1 contracts, this equates to a total maximum loss of 0.00163 BTC.

If bitcoin is any price above our strike price of $33,000 at expiry, we can calculate our profit/loss using the formula from lecture 4.2:

=(((BTC Price – Strike Price)/BTC Price) – Premium)*Position Size

Except instead of just using the premium paid per contract, we can use our total cost per contract including the fee. We’ve also added on the position size multiplier, which is just the number of contracts (in this case 0.1).

The profit/loss line increasing to the right of our strike price is just this same formula plotted for each underlying price of bitcoin at expiry.

PNL Example

As an example, if the price of bitcoin moves back up to $38,000 at expiry, we can calculate our profit as:

=(((38000 – 33000)/38000) – 0.0163)*0.1 = 0.01152789 BTC

As we paid a total of 0.00163 BTC for the option, this would represent just over a 700% return on our investment (0.01152789/0.00163 = 7.07232806), even though the price of bitcoin would only have increased a little over 15%. Short term, out of the money options like this can return large multiples when they do pay off. The catch of course though is that you need to be very accurate on both the direction and the timing for it to pay off.

Breakeven

In lecture 4.3, we gave the formula for the breakeven point of a cryptocurrency call option as:

Cryptocurrency Call Option Breakeven = Strike Price/(1 – Premium)

As with the profit calculations, instead of using just the premium paid, we will use the total cost including fees, which is 0.0163 BTC per contract. The breakeven point is then calculated as:

= 33000/(1 – 0.0163) = $33,546.81

This is the point at which the profit/loss line crosses the x axis.

What actually happened

Now we’ve had a quick look at what could happen, let’s jump forward and find out what actually did happen. Here we have the same 4 hour price chart of bitcoin we looked at just before placing the trade. Except now of course, it is two days later on Saturday 23rd January 2021, and our option has expired.

We can see the point in time we bought the call option on the 21st. After moving down once more, the price did indeed bounce and begin to move higher. Unfortunately for our $33,000 call option, it did not move quite far or fast enough to get above our strike price.

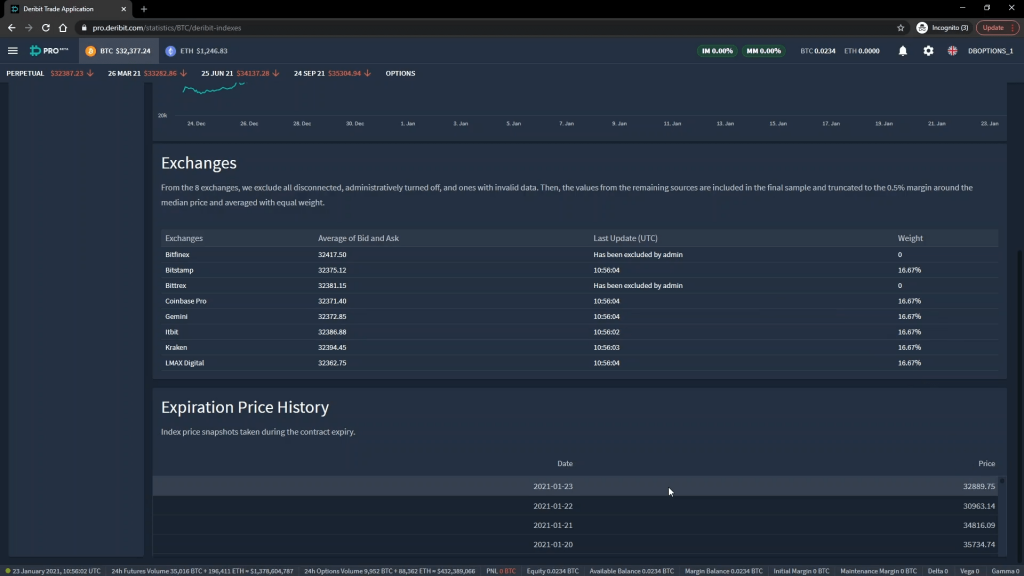

The options on Deribit expire at 0800 UTC, and settle on a 30 minute TWAP of the index leading into expiry. We can check the delivery price for the 23rd by going to the indexes page, then scrolling down to the delivery price log. As you can see here, options that expired on the 23rd were settled using a bitcoin price of $32,889.75, which is just below our strike price of $33,000.

This means the option has zero value at expiry, resulting in the maximum possible loss for this trade of 0.00163 BTC.

The Transaction Log

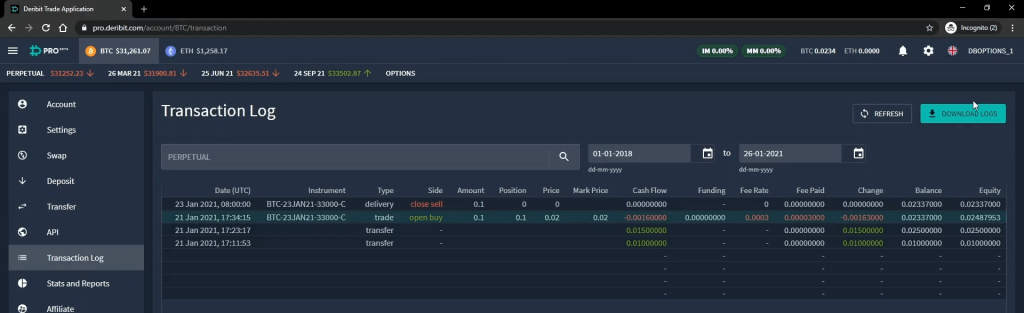

As the Deribit platform will be new to many of you, it’s worth taking a quick look at how this appears in the transaction log. If we go to the menu, and click ‘Transaction Log’, we have access to every transaction in the account.

We can see the transaction where we initially purchased the option. The option details can be seen in the instrument column. It was a buy order to open the position. The position size was 0.1, and we can see the total change to our account in the ‘Change’ column which was -0.00163.

In the row above we have the expiry of the option. If the option had some value, this is where we would receive the value of the option back into our balance. As the option had no value at expiry though, nothing was received.