In this second cryptocurrency option example, we’re going to sell a bitcoin call option. Unlike the previous example where we let the position expire, with today’s example we are not going to let this option expire. We will initially sell the call, let some time pass, then close the position ourselves before expiry by buying it back.

Hopefully we will manage to buy it back for a lower price than we sell it for to lock in a profit, however we will close it whether it’s currently in profit or not. We’ll be doing this to show how simple it is to close option positions early on Deribit, despite the fact that they are European options. It’s such a common misconception among beginners that they can’t be closed early, that it’s worth making sure this point is understood early, and we’ll do that by giving a specific live example of how it can be done.

Current price

As we’ll be trading bitcoin options today, let’s take a quick look at the current bitcoin price. This is a chart of the bitcoin price on Coinbase, which as we mentioned in the previous lecture, is one of the constituents of the Deribit index, which is used to settle the Deribit options and futures.

This is a four hour chart, so each candle represents four hours. Today is Tuesday the 26th January 2021, and bitcoin is trading at about $32,211 on coinbase. Bitcoin has been chopping around for a few days between roughly 30,000 and 35,000. Let’s say we have an opinion that bitcoin isn’t going to do much in the next couple of days. More specifically, we don’t think it’s going to break above $35,000. To capitalise on this view if we are correct, we’re going to sell a bitcoin call option with a strike price of $35,000, that expires in 3 days (on Friday the 29rd January).

Remember though that we’re not going to wait 3 days until the option expires on Friday. Once we’ve sold the option, we will only wait until tomorrow, then we will come back to see how the position is looking and close it.

Back to Deribit

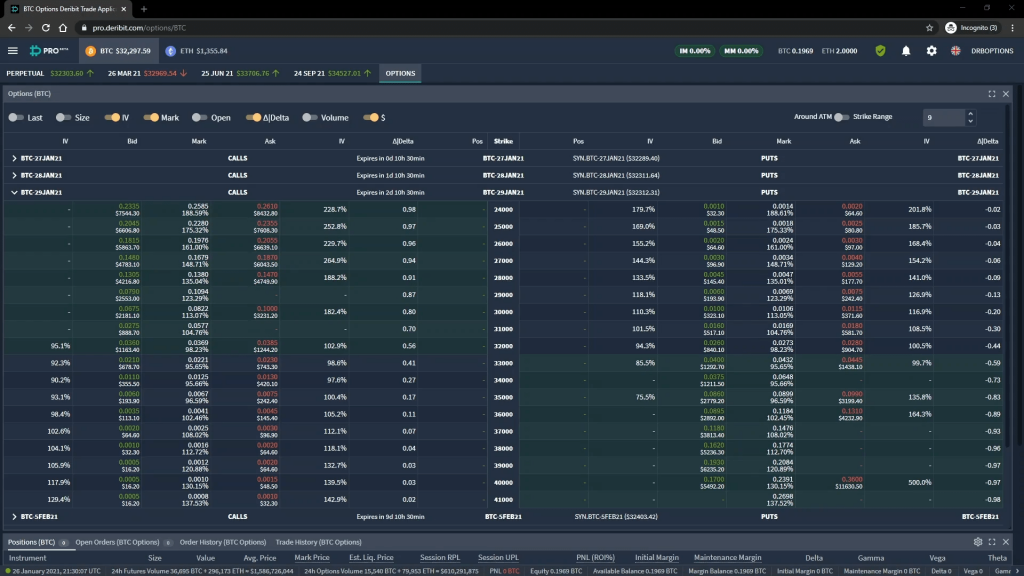

Let’s head back over to the Deribit option chain. As you can see in the top left, I have the 29th of January option chain expanded, so every option we can currently see expires on Friday at 0800 UTC. We want the $35,000 strike, which we can find in the middle column. And we want the call so we move left from here.

The current best bid is shown in the bid column in green, and the current best ask is shown in the ask column in red. These prices are an amount of bitcoin. For example a price of 0.006 means 0.006 BTC, or 0.6% of a bitcoin.

As in the previous example, the mark price column is shown in between the bid and ask columns. The mark price is not a tradable price, but can help give you an idea of current option values. This time I have also enabled dollar prices for the bid and ask columns. This gives the dollar equivalent of the premium of the option (as calculated using the futures price). Although it is possible to see this dollar price, the premium is always actually paid or received in bitcoin.

The option order form

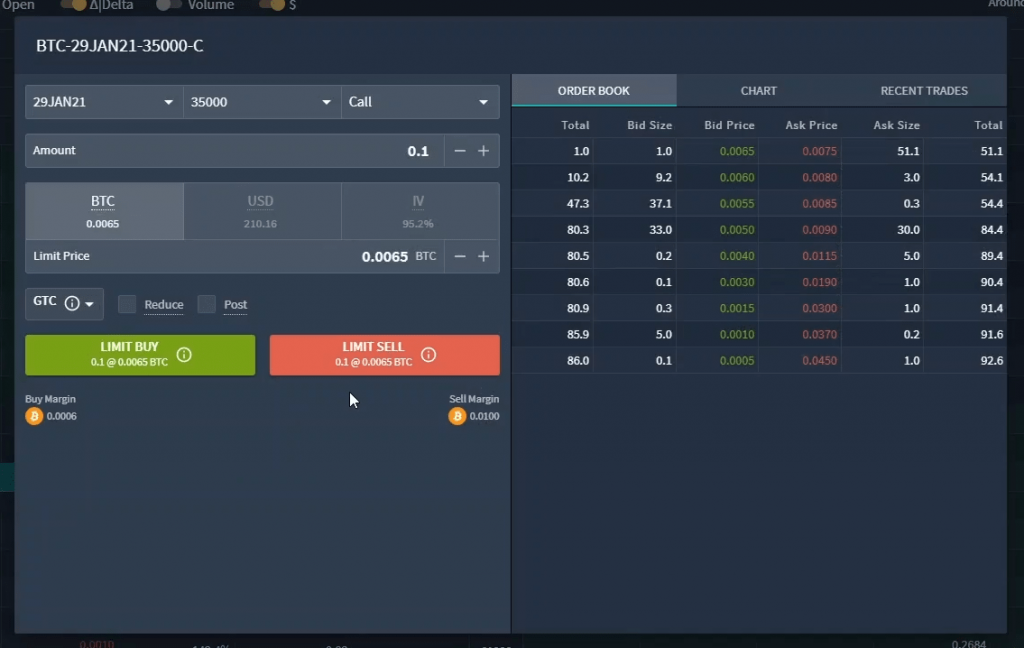

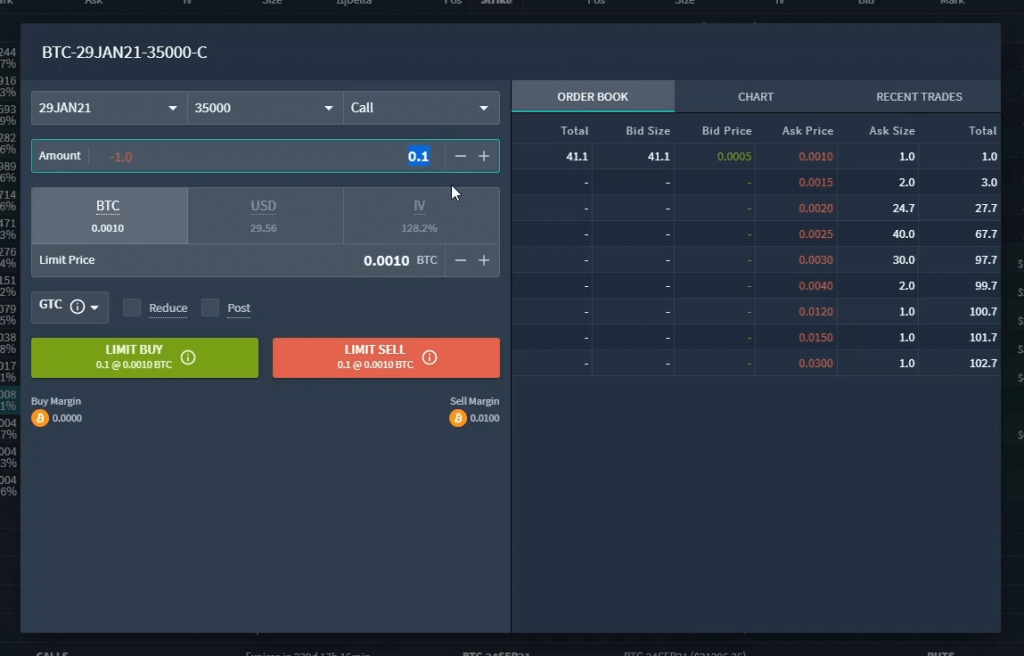

We can click the $35,000 call in the option chain, which brings up the option order form for this option. This includes the orderbook of bids and asks on the right, which is the list of other trader’s orders that we can execute against if we choose to.

As we want to sell this $35,000 call option, it is the current bids that we are interested in. The current best bid for this option is an order to buy 1 contract for a price of 0.0065 BTC. For today’s example we will sell into this order with a quantity also of 1, meaning we will be short this call option with a notional size of 1 bitcoin.

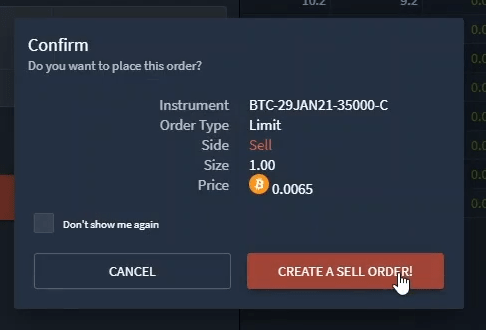

Once we’ve entered the ‘Amount’ of 1, and checked the price is correct, we can click the SELL button. This will bring up the order confirmation screen, where we can check everything has been entered correctly. Everything is correct here, so I will click the SELL button to create the sell order.

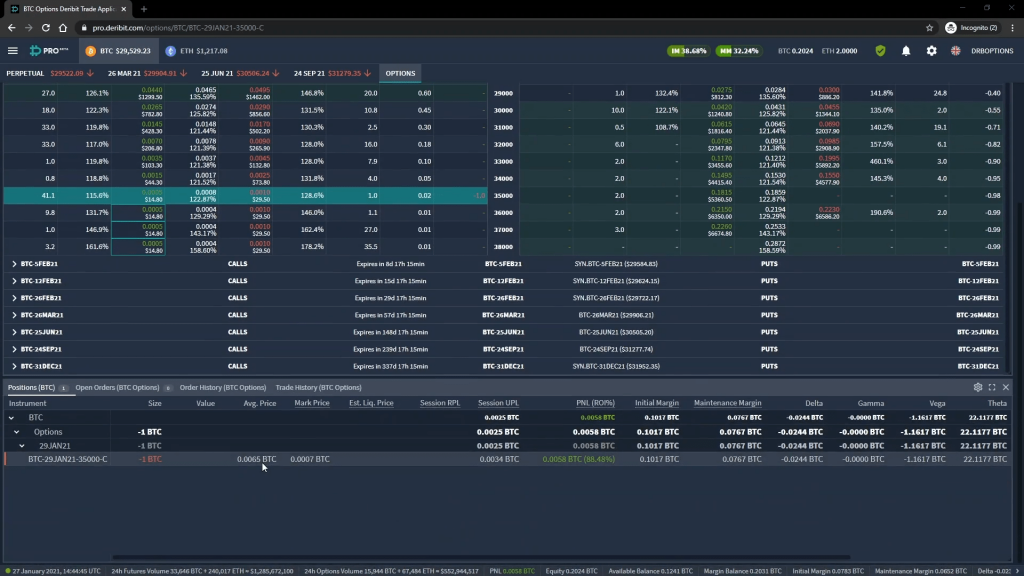

There was a buy order already in the order book at the price we selected so our order executes immediately, as expected. The pop up in the top right of the screen lets us know the order was filled. And we can also scroll down to the positions table to see our short call sitting in the account.

The instrument is listed in the left column. Here it’s BTC-29JAN21-35000-C, which means the currency is bitcoin, the expiry date is the 29th January 2021, the strike price is $35,000, and the option type is call. Next to this we have the size, which is minus one. The reason this is a negative number is because we are short this option. If we had instead purchased the option, it would be a positive number here.

What could happen

Even though we’re going to close this option early, let’s take a quick look at the PNL chart for this option if we were to hold until expiry.

We have all the option parameters I just mentioned:

-The underlying asset is bitcoin

-The option type is call

-The expiry date is 29th January 2021

-The strike price is $35,000

-The option price (or premium) is 0.0065 BTC per contract

The fee was also 0.0003 BTC so we will use 0.0062 BTC as the total collected.

PNL Chart

Given all the parameters we just covered, this is the PNL chart at expiry for this option position.

For any price of bitcoin below our strike price of $35,000, we would make the maximum possible profit. This maximum profit is limited to the premium we collected, minus the fees. We collected a premium of 0.0065 BTC per contract, and the fees were 0.0003 BTC per contract. This gives us a total credit per contract of 0.0062 BTC. As the contract multiplier is 1 and we sold 1 contract, this is a total maximum profit of 0.0062 BTC.

If bitcoin was any price above our strike price of $35,000 at expiry, we could calculate our profit/loss using the formula from lecture 4.2:

=(Premium – ((BTC Price – Strike Price)/BTC Price))*Position Size

Except instead of just using the premium collected per contract, we can use our total credit per contract including the fee. We’ve also added on the position size multiplier, which is just the number of contracts (and in this case is simply 1).

The profit/loss line decreasing to the right of our strike price is just this same formula plotted for each underlying price of bitcoin at expiry.

PNL Example

As an example, if the price of bitcoin moved back up to $37,000 at expiry, we could calculate our profit as:

=(0.0062 – ((37000 – 35000)/37000))*1

= -0.04785405 BTC

Notice how this loss is far larger than the credit we collected. As we covered in lecture 4.5, the maximum loss of a short call option is capped when measured in bitcoin, however it is still possible to lose far more than was collected in premium. This is especially important to remember if you plan to sell more call options than the amount of bitcoin you own.

Selling call options against the bitcoin you do own is called a covered call, which is a popular strategy that will be covered in detail later in the course.

Breakeven

In lecture 4.3, we gave the formula for the breakeven point of a cryptocurrency call option as:

Cryptocurrency Call Option Breakeven = Strike Price/(1 – Premium)

As with the profit calculations, instead of using just the premium paid, we will use the total credit including fees, which is 0.0062 BTC per contract. The breakeven point is then calculated as:

= 35000/(1 – 0.0062) = $35,218.35

This is the point at which the profit/loss line crosses the x axis.

What actually happened

So that’s what could happen if we allowed the option to expire. However, we don’t want to hold this one to expiry, we want to close this option early instead.

Here we have the same 4 hour price chart of bitcoin we looked at just before placing the trade. Except now of course, it’s a day later on 27th January 2021.

We can see the point in time when we sold the option yesterday. Since then the price has decreased steadily. As we are short a call, this is good for our position. Let’s jump back over to Deribit to see how good, and to close the option position.

Closing the trade

Our short option position can be seen here in the option chain. And if we scroll down we can also see it in the positions table.

We are currently short this option with a quantity of 1. To close this early, we just need to buy back the exact same option also with a quantity of 1. So we will be executing a buy order for the amount of 1.

We can bring up the order form for this option by clicking on it in the option chain. Due to the decrease in the bitcoin price, and the passage of some time, this call option’s value has dropped quite significantly.

We want to buy this option back so it is the asks that we are concerned with. The best ask is currently for a price of 0.001 BTC. As we initially sold the option for 0.0065 BTC (minus fees), this will represent a nice little profit for us, so lets buy the option back for this price.

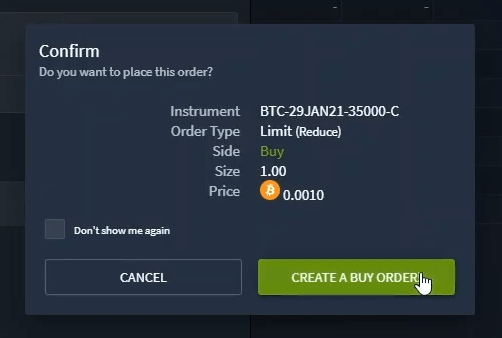

To do this we just enter our amount of 1, and our price of 0.001 BTC, then click the BUY button. This brings up the order confirmation screen for us to check. Everything looks good so let’s click the BUY button.

There was a sell order already in the order book at the price we selected so our order executes immediately, as expected, and we get the pop up in the top right showing the execution. If we scroll down to the positions table we can see that the option has been closed and we no longer have any positions open in this account. What happens between now and expiry is no longer relevant to us, as we have completely closed the option position.

The Transaction Log

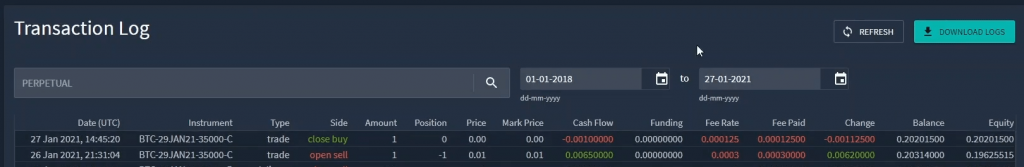

If we go to the menu, and click ‘Transaction Log’, we have access to every transaction in the account.

We can see the transaction where we initially sold the option here. The option details can be seen in the instrument column. It was a sell order to open the position. The amount was 1, but as this is a short, the position size was negative 1, and we can see the total change to our account in the ‘Change’ column which was 0.0062 BTC including the fee. As this is a positive amount in green, this means our cash balance was increased by this amount, because we are paid a premium for selling the option.

In the row above is the transaction where we close this position by buying the option back. The same option details can be seen in the instrument column. It was a buy order to close the position. The amount was 1, but this time it reduces our position to zero. And again in the ‘Change’ column we can see the change to our balance. This time we paid 0.001 BTC to buy the option back. With the fee included this totals a 0.001125 BTC reduction to our cash balance.

So our opening sell transaction generated a 0.0062 BTC credit, and our closing buy transaction generated a debit of 0.001125 BTC. This means the trade made a profit of:

0.0062 – 0.001125 = 0.005075 BTC

That’s it, this trade is complete. What happens to the value of this option at expiry has no effect on our account.

Outro

Hopefully these first two cryptocurrency examples have helped you see how the topics discussed in section 4 apply in the real world. They should also have helped highlight that despite some differences with the collateral and the resulting calculations, the process of trading cryptocurrency options has many similarities with trading more traditional options that use dollars (or some other fiat currency) as collateral. So despite the little bit of extra knowledge required, making the jump over from traditional options doesn’t have to be difficult.

Deribit also has a test website (test.deribit.com) where you can try out all of their products in a test environment without risking any of your funds. It is highly recommended to get up to speed on the testnet and then progress to the live site once you’re comfortable with how things work.

The next and last part of this section is a quiz to test how much you’ve remembered so far, but feel free to search back if you need to refresh your knowledge. After that we will move onto put options.

To complete this section you must take the quiz below: