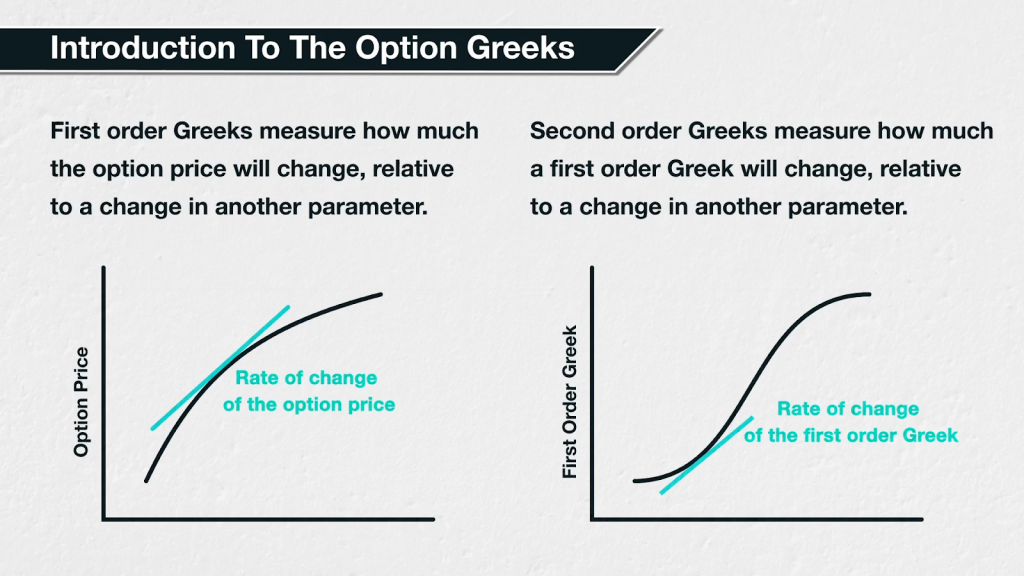

First order Greeks measure the sensitivity of an option’s price to changes in various parameters. There are also second order Greeks that measure the sensitivity of a first order Greek to changes in various parameters. In this lecture we’ll give a brief overview of each of the most commonly used Greeks, before going into more detail in a separate section for each.

First order Greeks are partial derivatives of the option price with respect to the parameter in question. So first order Greeks measure the sensitivity of the option price to various parameters. For example the Greek delta is a partial derivative of the option price with respect to the underlying price. That is it measures the sensitivity of the theoretical option price to changes in the underlying price.

‘Second order’ Greeks are partial derivatives of first order Greeks. For example, gamma is a partial derivative of delta with respect to the underlying price. This means it measures the sensitivity of the option’s delta to changes in the underlying price.

There are also higher order Greeks, however we will not be covering those in this course.

Delta

Delta is probably the most important Greek. Delta is a measure of the sensitivity of the option price to changes in the underlying asset price. More specifically, it is how much the option price is expected to change if the underlying price increases by $1.

Call options have a delta between 0 and 1

Put options have a delta between 0 and -1

Delta is positive for call options, because if the underlying price increases, the right to buy that asset at a fixed price should logically also increase in value. If you have the right to buy an asset at $10 for instance, that right should logically have a higher value if the asset is trading at $11 than if it were trading at $10. Remember a call option is just the right to buy some asset at the strike price.

Similarly, delta is negative for put options, because if the underlying price increases, the right to sell that asset at a fixed price should logically decrease in value. If you have the right to sell an asset at $10 for instance, that right should logically have a lower value if the asset is trading at $10 than if it were trading at $9. A put option of course is just the right to sell some asset at the strike price.

Examples:

An option with a delta of 0.4 means that if the underlying price increases by $1, the option price is expected to increase by $0.40.

An option with a delta of -0.65 means that if the underlying price increases by $1, the option price is expected to decrease by $0.65.

Theta

Theta is a measure of the sensitivity of the option price to the passage of time, also known as time decay. More specifically, it is the current rate at which the option is expected to lose value over 24 hours.

Theta is negative for both call and put option buyers. This is because all other things being equal, an option will lose extrinsic value as time passes. For option sellers theta is positive because the option losing value results in a profit for the sellers.

Examples:

An option with a theta of -$3.40 means that the option is currently losing value at a rate of $3.40 per day. It’s worth mentioning here that this rate is not static, so the loss in value is not linear over the life of the option.

An option with a theta of -$0.15 means that the option is currently losing value at a rate of $0.15 per day.

An option with a theta of -$220 means that the option is currently losing value at a rate of $220 per day.

Vega

Vega is a measure of the sensitivity of the option price to implied volatility. It is how much the option price is expected to change for a 1% increase in implied volatility.

Vega is positive for both puts and calls, because all other things being equal, higher implied volatility means higher prices for all options.

Examples:

An option with a vega of 4 is expected to increase in value by $4 if implied volatility increases by 1%.

An option with a vega of 0.25 is expected to increase in value by $0.25 if implied volatility increases by 1%.

Gamma

Gamma is a measure of the sensitivity of an option’s delta to changes in the underlying price. It is how much the delta is expected to change if the underlying price increases by $1. Gamma is also the only second order Greek that we will be covering today. It is a second order Greek because rather than measuring the sensitivity of the option price to the changes of a parameter, it is measuring the sensitivity of a first order Greek to the changes of a parameter.

Gamma is positive for both puts and calls. An increase in the underlying price will make call options further in the money and put options further out of the money. Both of these will result in a positive value being added to the deltas.

Examples:

If an option has a gamma of 0.01, the delta of the option is expected to increase by 0.01 if the underlying price increases by $1.

If an option has a gamma of 0.005, the delta of the option is expected to increase by 0.005 if the underlying price increases by $1.

Where to find the Greeks on Deribit

At the top of the option chain in the Deribit UI it is possible to enable/disable a delta column in the settings. This column shows the delta for every option, one column for calls and one for puts. It is possible to enable columns for the other Greeks we’ve mentioned so far as well.

If this is the first time you’ve learned about option Greeks, you probably won’t remember what each one represents yet, but we will soon fix that. In the next few sections, we will take a more detailed look at each of the Greeks we’ve just mentioned, starting with delta.