In the next few lectures, we will give a brief overview of the Black Scholes Merton option pricing model. While for the majority it’s not necessary to know all of the mathematics of the model, it is still useful to have a basic understanding of what this model is. Whether or not you make calculations with it yourself, if you are trading options you will come into contact with figures that have been calculated using Black Scholes. On the Deribit platform for example, Black Scholes is the model that is used to calculate the implied volatility figures you can see in the option chain. It is also what is used to calculate the Greeks.

What is a mathematical model?

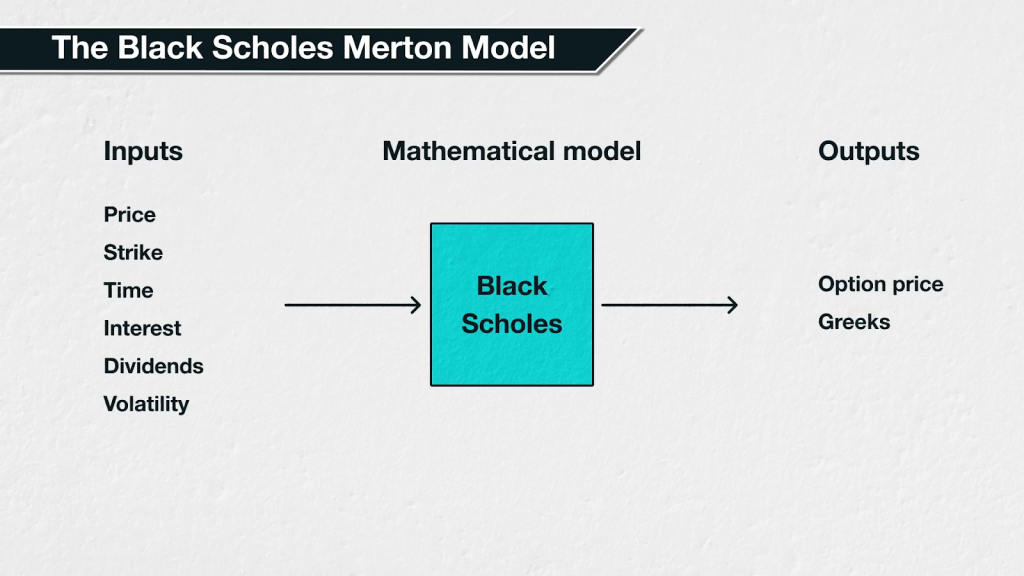

A mathematical model is an attempt to translate the behaviour of some system into mathematical language. By doing so, it can allow for better understanding of the system, more powerful analysis, as well as testing the effect of changes. In very basic terms, we give the model some inputs, and then it gives us something useful as an output.

The Black Scholes Merton model

One area where modelling is often used is finance. The Black Scholes Merton (BSM) model, often shortened to just Black Scholes, is a mathematical model for pricing European option contracts. It was first published in 1973, but is still used to this day.

The model has five inputs, and several useful outputs. The main output of course being the option price. You will recognise the inputs from previous sections. The five inputs are:

-Underlying price

-Strike price

-Days to expiration (which can include fractions of a day)

-Risk free interest rate

-Implied volatility

It is also possible to adapt the calculations to take account of dividends, allowing for a 6th input of the dividend yield, so you may see this input as well in any black scholes calculators you use.

Any change to these input parameters, will of course lead to a change in the option price outputs. Assuming all the other parameters are left the same:

Underlying price

Increasing the underlying price will increase the price of call options and decrease the price of put options. With a higher underlying price, a right to buy the asset at a fixed price will logically have more value, and a right to sell the asset will have less value.

Strike price

Increasing the strike price will decrease the price of call options and increase the price of put options. This has the opposite effect to moving the underlying price. For call options, the price at which the call option holder has the right to buy will help determine the option’s value. The higher the price they have the right to purchase the asset for, the lower the value of that right.

Similarly for put options, the price at which the put option holder has the right to sell will help determine the options value. The higher the price they have the right to sell the asset for, the higher the value of that right.

DTE

Decreasing the time until expiration will decrease the price of both call and put options. With less time remaining for price movements to happen, there is less time for all options to become ITM, or deeper ITM. This decreases their value.

Interest rate

Increasing the interest rate will increase the price of call options and decrease the price of put options. The higher the risk free rate, the more the underlying price is assumed to drift. This will have the effect of increasing the value of calls, and decreasing the value of puts.

IV

Increasing the implied volatility will increase the price of both call and put options. With higher volatility, all options have the chance to be further ITM at expiry, thus increasing their value.

By entering each of these parameters into the model, the black scholes model will give us the fair value of a call and a put at the strike price entered. The model also gives us values for the option Greeks, which we will cover in later sections individually.

Alternative option pricing models

Though we will only be discussing the Black Scholes model in this section, and using Black Scholes throughout this course, it is not the only option pricing model that exists. For example it is possible to use binomial or trinomial trees to model option prices.

None of these models are perfect, and each will have limitations. There are some important assumptions used in the Black Scholes model which we will cover in the next lecture.