In lecture 7.4, we covered intrinsic and extrinsic value. Intrinsic value is how far ITM the option is, and this calculation is the same regardless of how much time remains until the option expires.

Extrinsic value is equal to the option price minus the intrinsic value of the option, so it is any extra value the option has on top of it’s intrinsic value. Extrinsic value can vary greatly, and is affected by:

-Where the strike price is in relation to the current price

-Volatility, and crucially for this section…

-How much time is left before the option expires

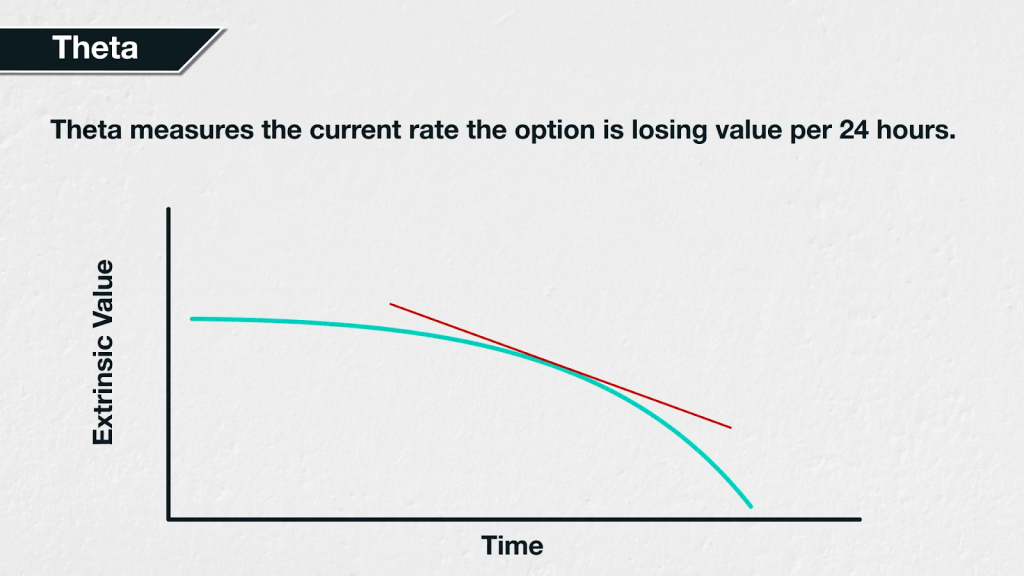

At the moment an option expires, the extrinsic value will have reduced to zero, leaving only the intrinsic value remaining (if any). While an option has some time left before expiration though, it will still have some extrinsic value. Theta measures how quickly this extrinsic value is expected to decrease as time passes.

Theta definition

An option’s theta then (also known as time decay), is a measure of how the option price is expected to change with the passage of time. Specifically, how much the option price is expected to change in one day, assuming all other parameters remain constant.

If this chart represents the extrinsic value of an option over time, at any point in time we could take a tangent from this curve, and theta would describe the angle or steepness of this line. In other words how quickly the extrinsic value is moving down in that moment.

The steeper this tangent, the higher theta is, and the faster the option is losing extrinsic value.

Theta is always negative for option buyers, meaning their option will lose value as time passes. All other things being equal, an option will lose extrinsic value as time passes, until eventually at the moment of expiration all the extrinsic value is gone. The rate at which it loses value is nonlinear, as we will see later in this section.

For option sellers, their theta is positive, meaning option sellers gain as time passes. This is because when the option they have sold loses value, this results in a profit for them.

This is true for both puts and calls, so:

The buyer of a call option has a negative theta.

The buyer of a put option also has a negative theta.

The seller of a call option has a positive theta.

The seller of a put option also has a positive theta.

Of course, any gain for the option seller is a loss for the option buyer, and vice versa.

For example:

An option with a theta of -12.55 is expected to lose $12.55 of value over the next day.

An option with a theta of -0.08 is expected to lose $0.08 of value over the next day.

An option with a theta of -1.85 is expected to lose $1.85 of value over the next day.

Assuming all other things remain equal, any trader who is long these options is currently losing value at the rate specified by the theta per 24 hours. Any trader who is short those same options, is currently gaining value at the rate specified by the theta per 24 hours. There is no extra transaction in the trader’s account for theta, it is simply reflected in the option’s price over time.

Theta is stated as a dollar amount, i.e. the amount of dollars the option price is currently decreasing by per 24 hours, assuming all else remains constant. Even on the Deribit platform, where the option premiums are paid and received in amounts of cryptocurrency, the Greeks are quoted in their dollar amounts, as calculated by the black scholes option pricing model.

Summary

An option’s theta tells you the rate at which the option is currently losing value per 24 hours. This is assuming that everything else, like the underlying price and implied volatility, remains the same.

Option buyers have negative theta, meaning they will lose value as time passes. Option sellers have positive theta, meaning the loss in value of the option they have sold represents a gain for them.

As with delta that we learned about in the previous section, theta is not static over the lifetime of the option. While an option’s theta is a measure of the sensitivity of the option price to time, theta itself has sensitivity to various parameters. We will cover these throughout the rest of section 9.