So far in this section, we have only discussed the theta of a single option at a time, but most option traders are likely to have positions/portfolios consisting of more than one option contract at a time, and they will want to know the theta of their entire portfolio. They will also want to know how their total theta will evolve as time passes, or as other parameters change, such as the underlying price. All of this information will help them gauge how their options will be affected by the passage of time.

Just like we discussed in section 8 with respect to delta, you can also sum the theta of each individual option in the portfolio to get the total theta.

Multi leg example – bear put spread

Let’s look at a simple multi leg option position, a bear put spread. This position consists of purchasing one put option, then selling another put option with a lower strike price, but both with the same expiration date.

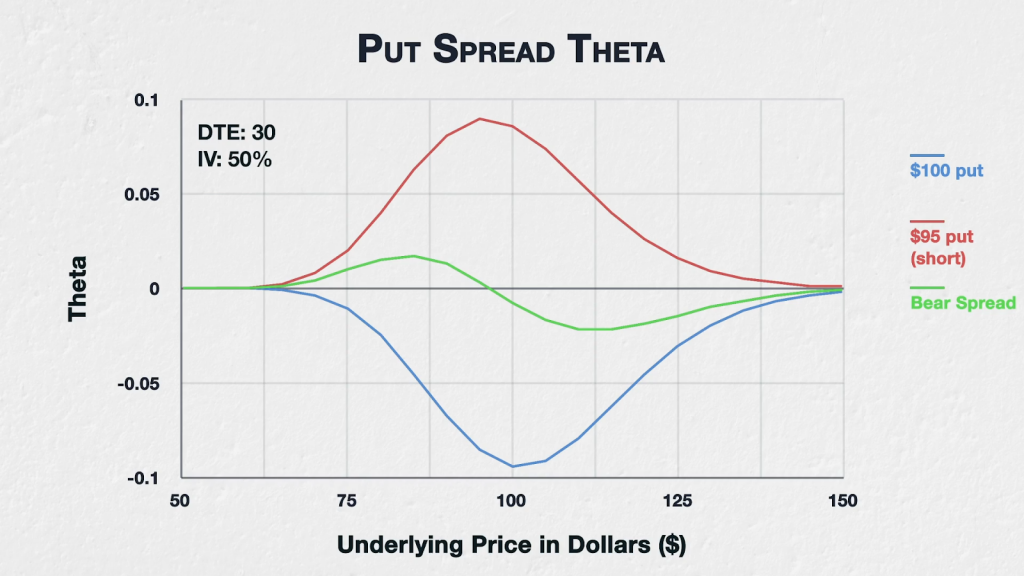

This chart shows the theta of a $100/$95 bear put spread (in green), and of the two individual options that combine to create this spread. The $100 put option (in blue) is purchased, and therefore gives us negative theta, meaning it loses value as time passes. However, the $95 put option (in red) is sold, and therefore gives us positive theta, meaning we gain from this option’s loss in value as time passes.

The put spread line is simply the sum of the theta for the $95 put short and $100 put long. Whether the theta is positive or negative for the spread, depends on where the underlying price is in relation to the strike prices.

Starting on the far left, with the underlying price down at $50-60, both options are so far ITM that they both have hardly any extrinsic value to lose. Theta is therefore very small for both individual options, and also the spread as a whole.

Moving right to the $65-$95 area, both options are still ITM, but do have some extrinsic value. If we take the underlying price of $85 as an example, the short $95 put has a theta of 0.0632, and the long $100 put has a theta of -0.0461, which means the spread has a total theta of 0.0171. The theta is positive, meaning if the underlying price is sitting there, the spread will currently gain value as time passes.

Moving further to the right to the area over $100, both options are now OTM and also have some extrinsic value. If we take the underlying price of $115 as an example, the short $95 put has a theta of 0.0409, and the long $100 put has a theta of -0.0634, which means the spread has a total theta of -0.0225. The theta is negative, meaning if the underlying price is sitting there, the spread will currently lose value as time passes.

Then finally to the far right of the chart, both options are now deep OTM and have very little extrinsic value to lose. Theta is therefore very small for both individual options, and also the spread as a whole.

We’ve used a vertical spread here, but the same holds true for other spreads, ratios, and any other option combination you can think of. Underlying price movement, implied volatility, and time, will all still have an effect on the theta of multi leg option strategies, just as they do for individual options. To get the total theta for all the legs combined, we can simply sum the theta for all the individual legs.

Notice also, that even though the passage of time still has an effect on the spread, because the theta of each leg partially cancel each other out, the magnitude of the effect of time is considerably less than for either of the individual options. This behaviour of reducing the effect of certain greeks, can make certain option spreads more attractive than naked options in certain circumstances. More to come on that theme in later sections.

Position size and theta

To keep things simple we have so far assumed a position size of one. This will rarely be the case in practice so you will often need to know the theta for positions that vary in size.

To calculate the theta of a position size that does not equal one, we simply multiply by the position size to give the total theta of the position.

The bitcoin options on Deribit have a contract multiplier of one, meaning each option contract represents a notional position of one bitcoin. With this in mind let’s look at a few examples of calculating the total theta, taking into account the position sizes.

For example if you purchase 5 bitcoin call options with a theta of -0.08 each, the total theta of your position is -$0.40. This is calculated as:

5 * -0.08 = -$0.40

This means you would expect the position to lose $0.40 over the next day if all else remains equal.

If you purchase 10 calls with a theta of -0.15, and purchase 10 put options with a theta of -0.12, the total theta of your position is -$2.70. This is calculated as:

(10 * -0.15) + (10 * -0.12)

= -$1.50 – $1.20

= -$2.70

This means you would expect the position to lose $2.70 over the next day if all else remains equal.

And finally if you purchase 10 puts with a theta of -0.1, and sell 10 put options with a theta of -0.12, the total theta of your position is $0.20. This is calculated as:

(10 * -0.1) + (-10 * -0.12)

= -$1.00 + $1.20

= $0.20

Remember we have sold the second leg of puts here, so the position size is -10, rather than just 10. This gives us positive theta for that leg, and the total position also now has positive theta. This means you would expect the position to gain $0.20 over the next day if all else remains equal.

Summary

The theta of a multi leg option strategy is equal to the sum of each of the thetas for the individual options it contains. Remember to also adjust for the position size by multiplying the theta of the option by the position size.