In this week’s edition of Option Flows, Tony Stewart is commenting on Fed hike expected, strong interest being accumulated in BTC upside and Ukraine desensitization.

March 19

Fed hike expected. Ukraine desensitization. Safe(r) place. IV Crush Crypto + VIX. ETH Mar25 3k Calls disciplined theta dump x17.5k. But strong interest being accumulated in BTC upside, Mar 42-45k, Apr1 42k+, Apr29 50k, buying on screens; Apr+Jun 42/45-50k Call spreads in play.

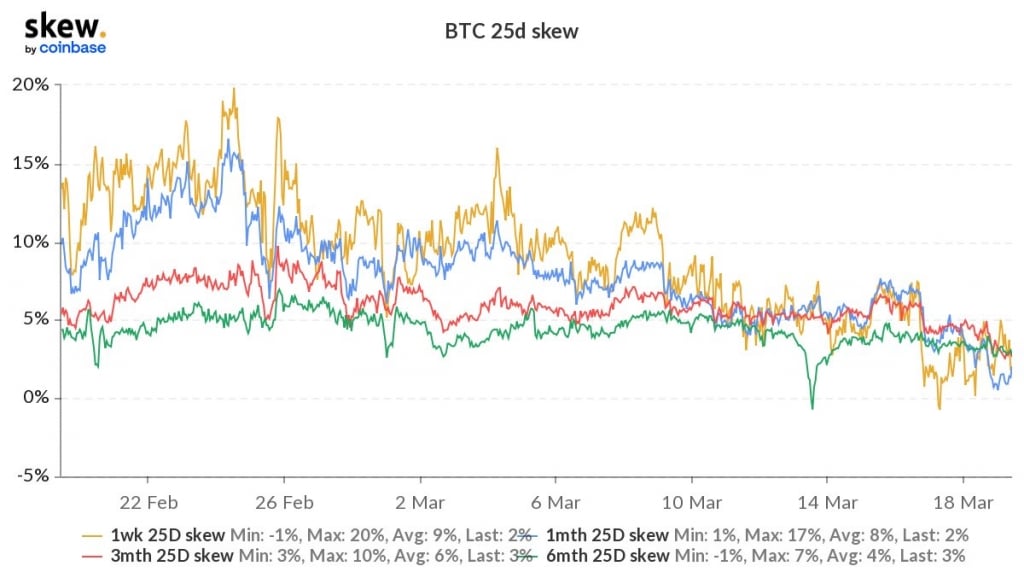

2) Markets absorbed FED tightening in its stride. Risk markets, in particular beaten-down equities, surged. Crypto rallied, but less committed. This is despite Luna rumored BTC upping to 3bn. IV crushed everywhere as fears diminished. Ukraine impact uncertain, but Skew softened.

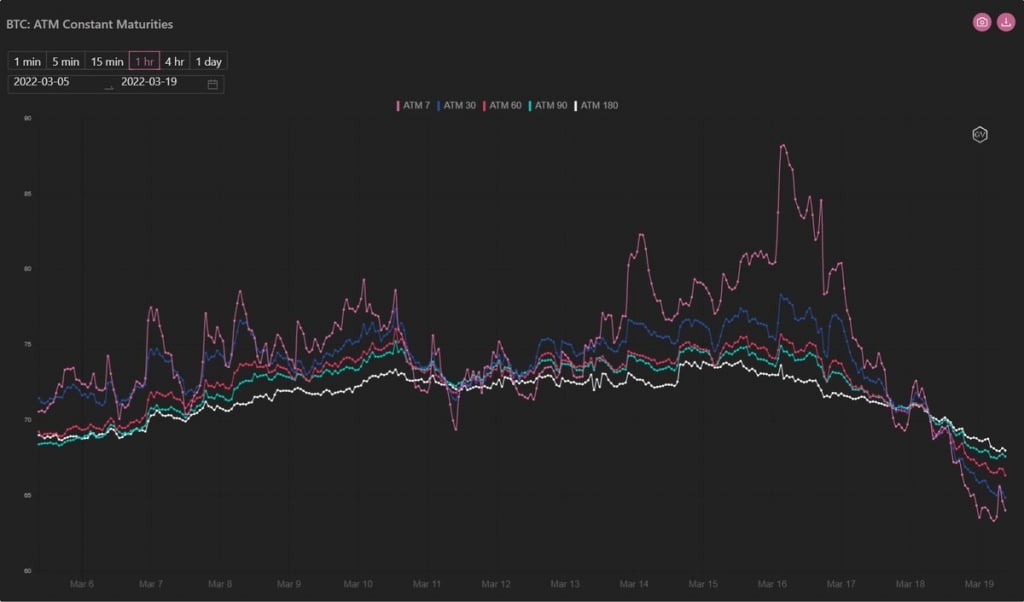

3) The IV surge >100% pre-FED implied a requirement for Spot to trade >5% with IV steady. This failed, as Crypto Spot benign. IV plunged. Disciplined seller ETH 3k Calls unwound to reduce pain depsite directionally correct. Beware buying outright Vol when high. Spreads instead.

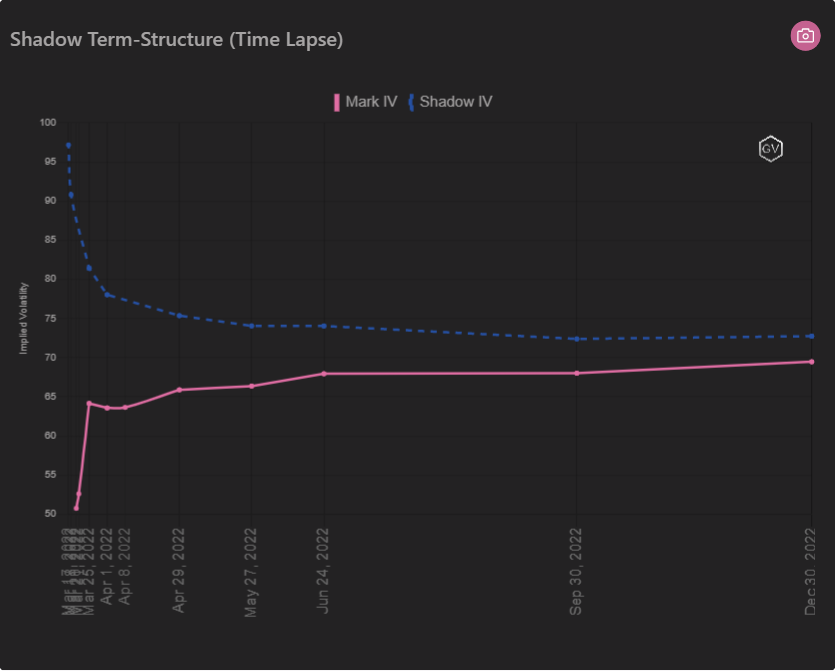

4) March maturities crushed (pink line above); some Call values haven’t appreciated despite Spot up. Further out hit too, but less dramatic. Progressive buying of Calls (Apr1 42k, Apr29 50k strikes) on a flat Call skew for upside exposure. ETH Mar hit so hard, DOVs absorbed.

5). Current IV levels, while above 6month lows, present better buying opportunities now given the environment. VIX to compare 24%, well above norm. Skew relatively flat, so views can be expressed either way without fear of inefficient trades. If in doubt, Spreads reduce Greeks.

View Twitter thread.

AUTHOR(S)