Summary: The underlying data from our market timing models still support the view that Bitcoin might be range-bound until year-end. Despite our anticipation that Fed Chair Powell would start to sound dovish at this week’s FOMC meeting, Bitcoin failed to rally. A key reason for our bullishness was that we identified constant minting of Tethers. These inflows have stopped, and that’s why Bitcoin has stopped going higher. We are still leaning towards another Bitcoin Spot ETF delay until March. The premium for the CME Bitcoin futures and perpetual futures premium is working off their excessive levels, as holding long positions without a rally is expensive.

Analysis

Last week, we noticed the divergence between Bitcoin’s relative strength indicator and its price, which showed waning momentum. Similar to a year ago when Bitcoin attempted to rally in early December and failed, we expected that prices would be capped at 45,000 and Bitcoin would be trading in a 40,000 to 45,000 range until year-end. The underlying data from our market timing models still support this view that Bitcoin might be range-bound until year-end.

Despite our anticipation that Fed Chair Powell would start to sound dovish at this week’s FOMC meeting, Bitcoin failed to rally. This indicates that Bitcoin has become tired, and the odds for another rally before January are slim – as we pointed out earlier this week.

A key reason for our bullishness was that we identified constant minting of Tethers. This was a clear indication that institutional players were moving money from fiat into crypto – the result was a Bitcoin rally that surprised almost everybody during the last two months. But minting has slowed from a $1.6bn weekly peak to just $0.4bn. These inflows have stopped, and that’s why Bitcoin has stopped going higher.

Bitcoin’s dominance has also peaked with an increased likelihood that altcoins, notably Ethereum, could outperform Bitcoin. The dominance indicator peaked at 53.8% in early December and has declined to 51.9%; a reading below 50% would certainly signal that investors should trade altcoins to increase their profit potential.

Selling the December 45,000 call to finance the January 45,000 call partially is still an attractive way to position ahead of potential Bitcoin Spot ETF approval. While we still lean towards another delay until March, there is always the possibility of an ETF being approved, as several applications appear to have amended their stance. For example, the debate around cash or in-kind settlement appears to have progressed, but we still believe that there is no market-sharing data agreement in place, which might be instrumental for the SEC to approve an ETF.

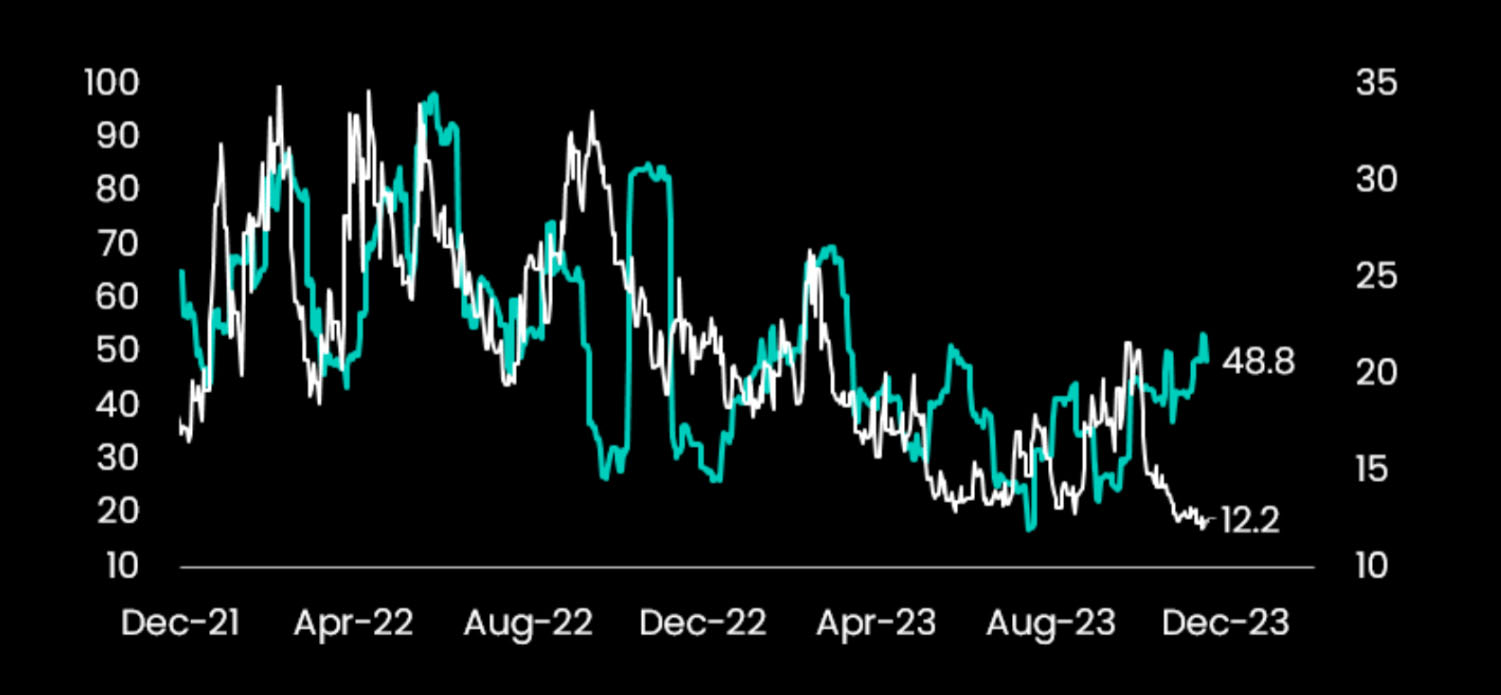

Also pointed out previously, realized volatility in Bitcoin (48.8%) trades significantly above SP500 implied volatility (12.2%). With the Christmas holidays approaching and the Fed turning dovish into next year, Bitcoin volatility will likely be lower. Traders should consider selling Bitcoin volatility in all forms over the holidays.

The premium for the CME Bitcoin futures and perpetual futures premium is working off their excessive levels, as holding long positions in the absence of a rally is expensive. Similarly, unwinding call options will dampen any upside risk as traders would rather close those call positions, and the prospect of a Bitcoin Spot ETF approval is slim for the remainder of the year.

This is the time to be patient, and ideally, we prefer to let our short (December expiry) call expire worthless and keep pressing for more upside into January.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)