In this week’s edition of Option Flows, Tony Stewart is commenting on the market still being uncertain, and the realized Vol drifting lower due to several factors.

December 1

November behind us, but the market is still afraid of aftershocks.

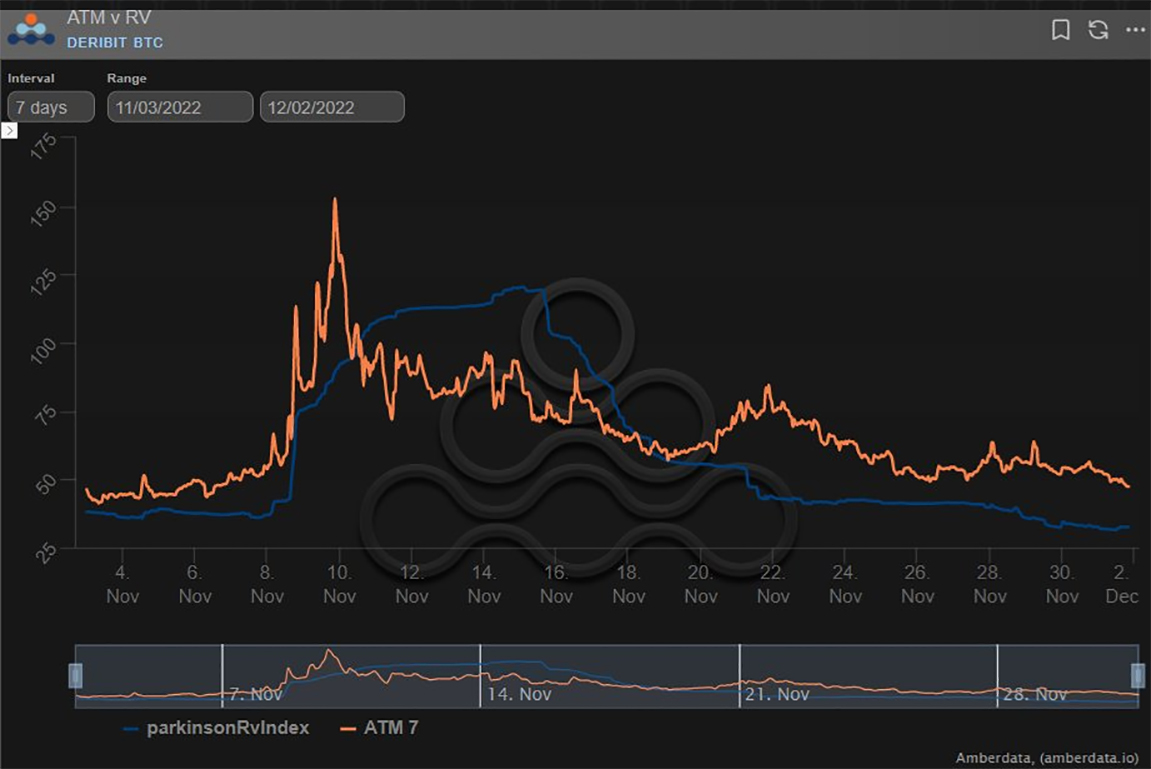

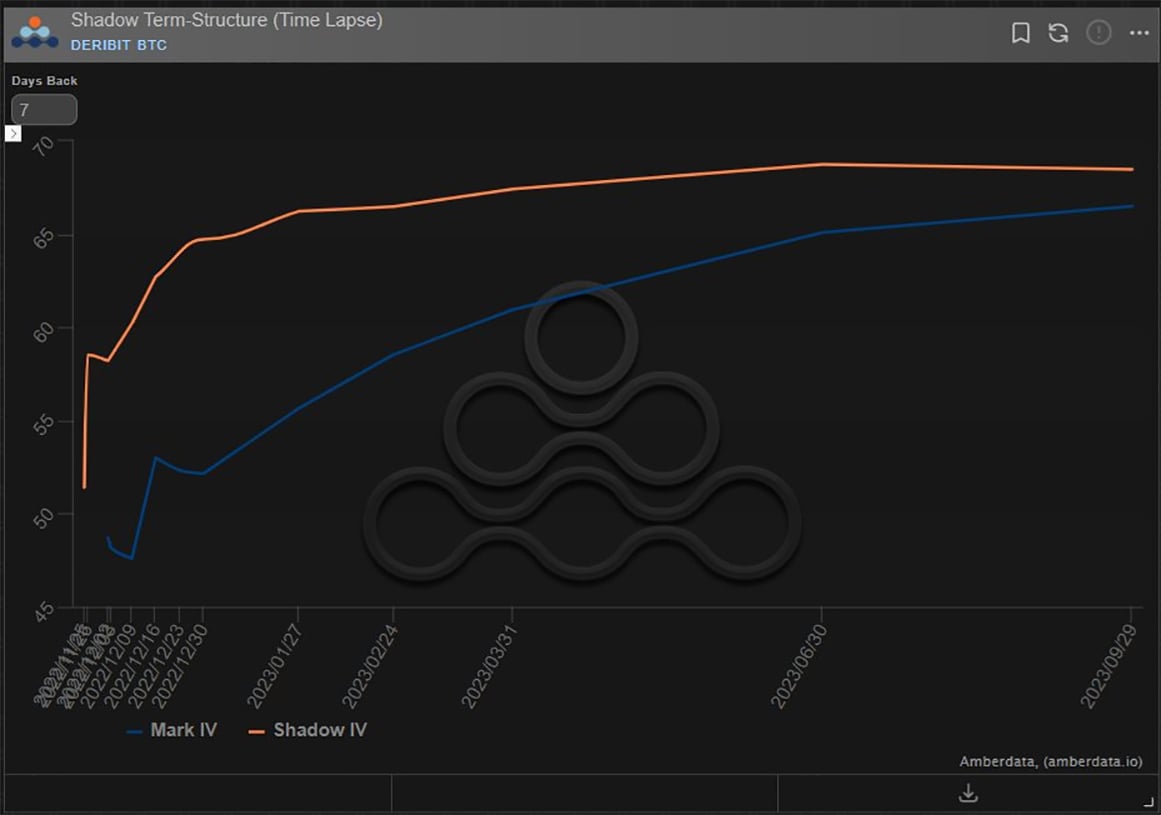

As a result, Implied Vol continues to be priced at a premium to Realized Vol.

Realized Vol drifting lower due to participants either de-sensitized to news and/or licking wounds and unprepared to hard commit.

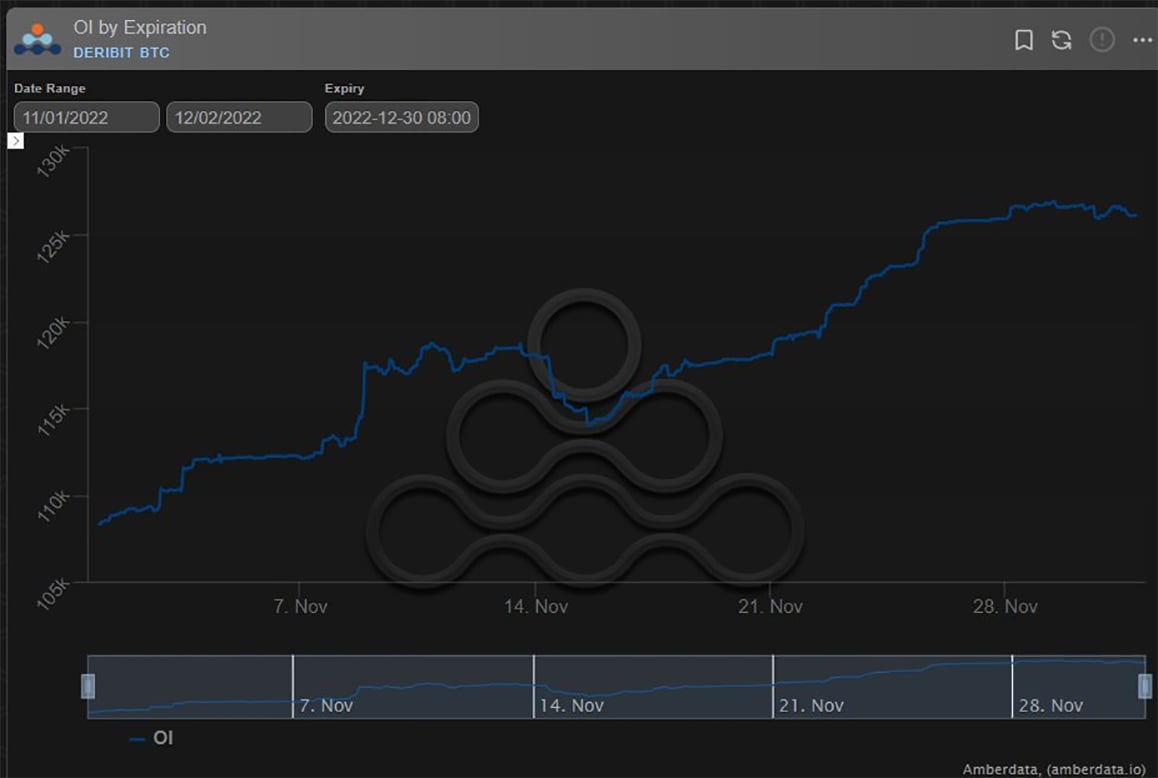

2) In the time after FTX we saw risk-reduction and short-covering such that Open Interest fell.

With Dec30 having the largest OI, it is reassuring to see that the OI trend is now increasing again.

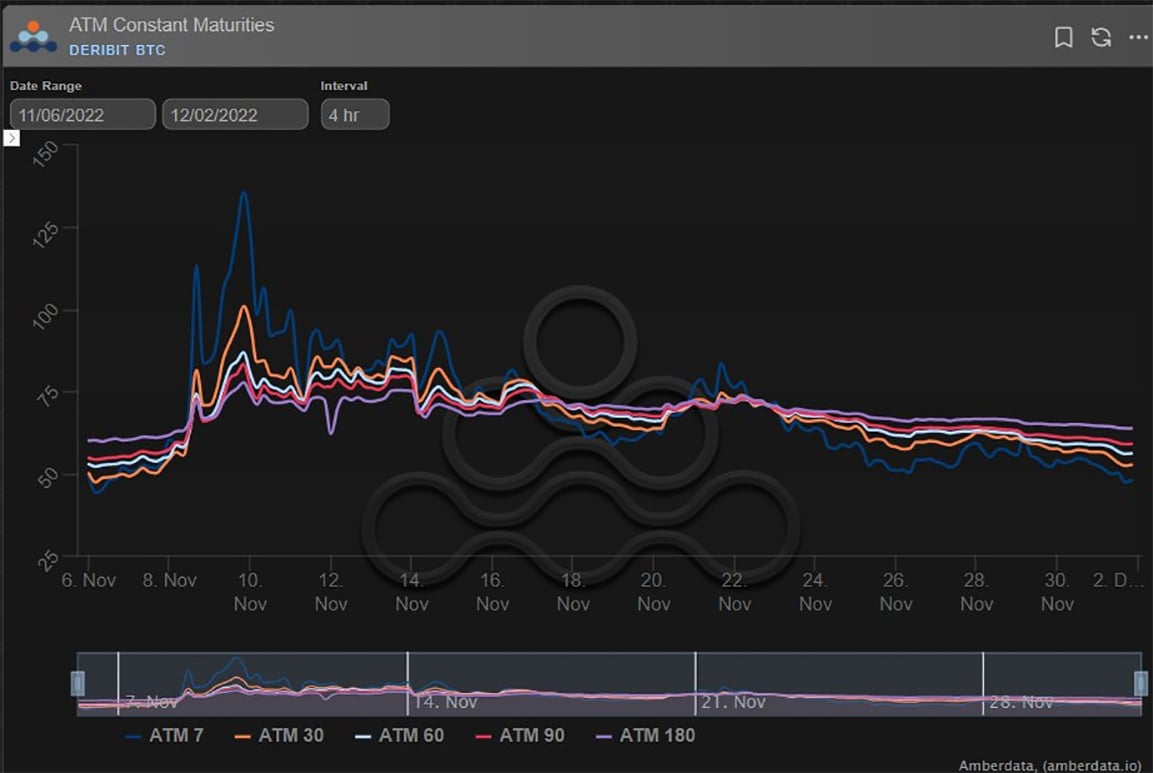

Option flows have been steady with some sub-1month bounce Calls bought in BTC+ETH.

3) But with the IV>RV 15%+ premium and the long US holiday weekend, even short-dated Calls bot when Spot was 16k have barely increased in value at 17k, as Theta and Vol have taken their toll.

4) Call buying has been the dominant flow, but not in huge volumes which would give some indication of exuberant sentiment, as quite simply business is not back to normal.

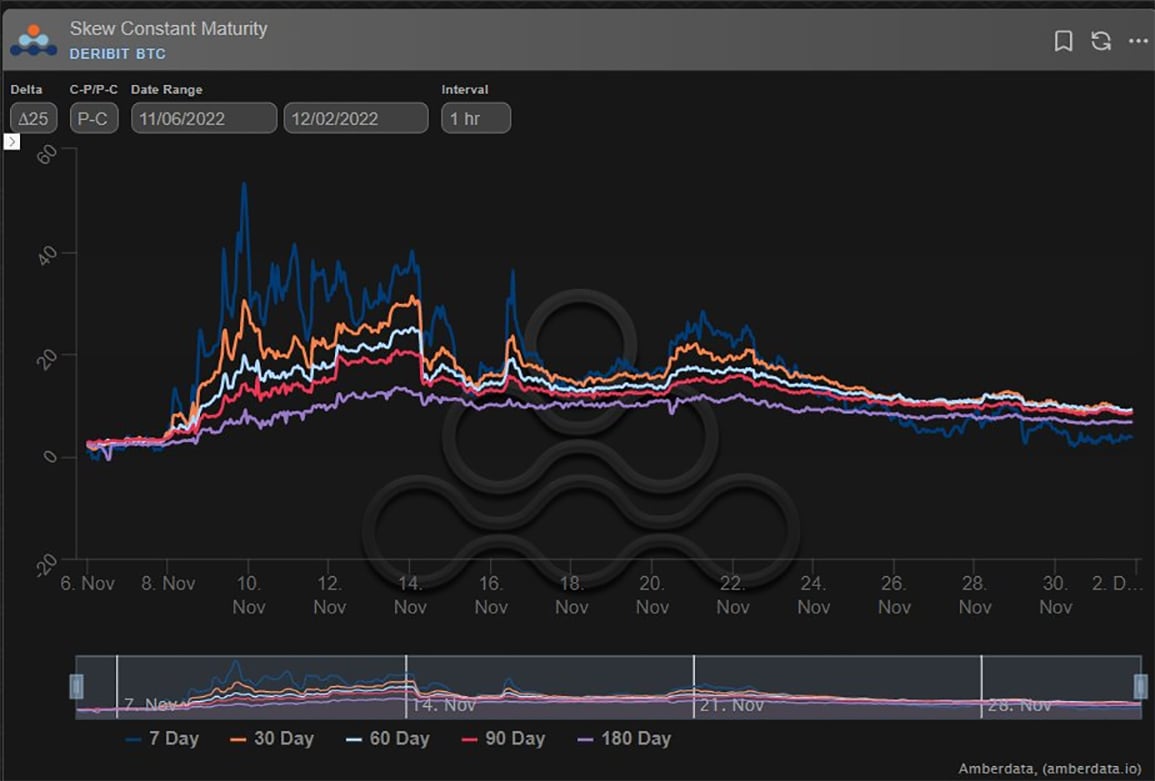

However, Skew has retraced back from elevated fear levels, and IV while at a premium is chasing RV lower.

5) Expressing a directional view from Spot lows via Options was the smart play, but also shows the difficulty in choosing a correct strategy.

Long Vol books suffering a post-apocalyptic state created by a Crypto Cefi meltdown but losing out to inert 7-day BTC RV 32%, ETH 52%.

6) This is forcing some 1-week puke of IV+Theta to fund longer-dated positions. Selling of the 17k straddle and the surrounding strikes has built momentum.

Below shows the dump at the front end, with a noticeable blip on Dec16 which some are attributing to FOMC+CPI that week.

View Twitter thread.

AUTHOR(S)