In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements with focus still being on the GBTC outflows and ETF inflows.

Market participants are closely watching momentum in GBTC outflows and ETF inflows, and aware of MtGox+Celsius coins.

Currently price equilibrium.

ETH Spot ETF delay has only strengthened the ETH Overwriter’s conviction.

BTC April/Feb Structure sells more Gamma.

Dvol 46.5%.

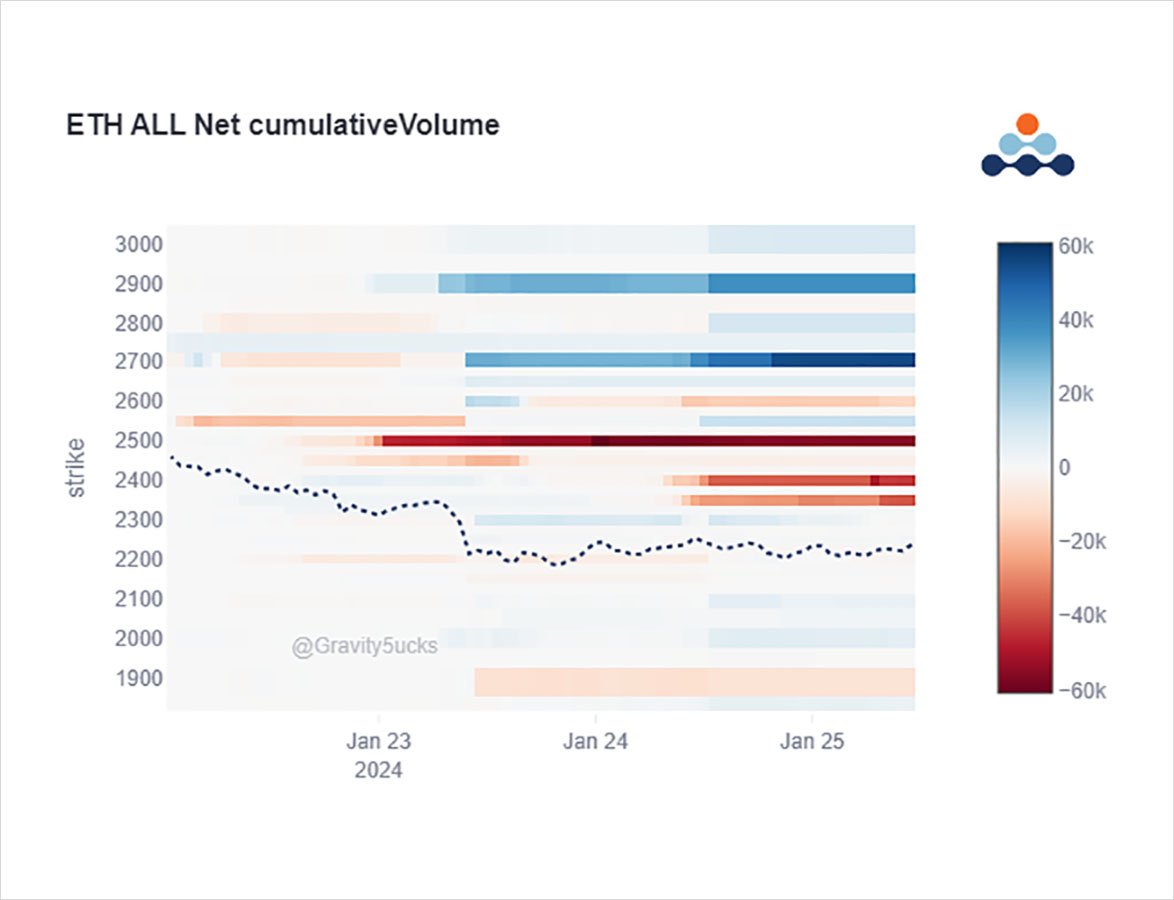

2) Most ETH Options activity has been related to the ETH overwriter – last report selling the Feb 2.7k Call – this time rolling this short closer to the ATM via the 2.4k Call.

2.5k Call sold too.

The play is to stack yield now, play short-term rangebound but medium-term bullish.

3) Spot dump to ~38.5k/2150 allowed LPs to take advantage of Gamma, and IV reacted positively to ETH Calls bought near lows.

But as soon as Spot bounced back into the comfort zone, the excess Gamma from the Over-writer choked LPs.

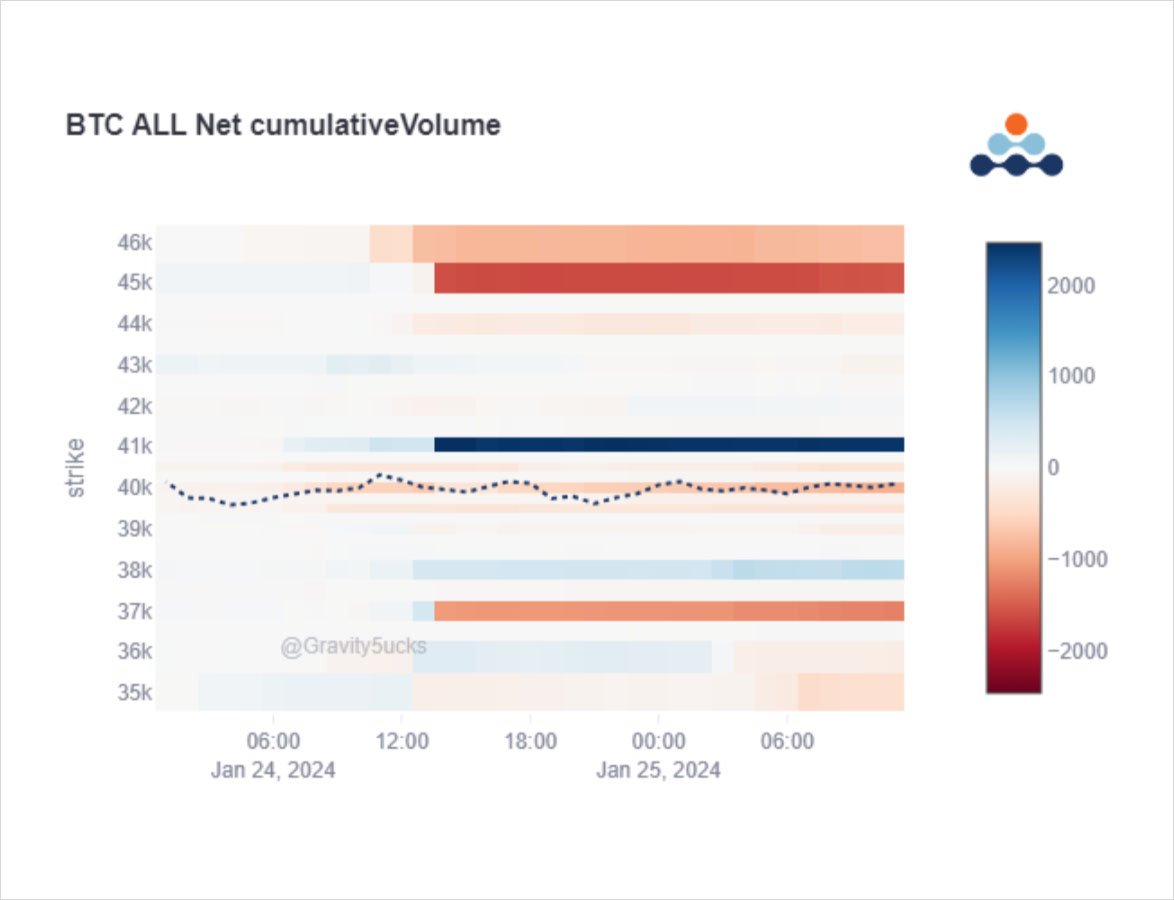

BTC Apr-Feb Strangle swap dumped BTC Gamma.

4) Most ETH Over-writer flows have taken place on DSOB, but the BTC multi-leg package was best placed on Paradigm.

The structure was to buy 1k Apr 41k Straddles to sell 1.5k Feb 37-45k Strangles.

This is long Vega (halving), short Gamma (expect rangebound now) collecting Theta.

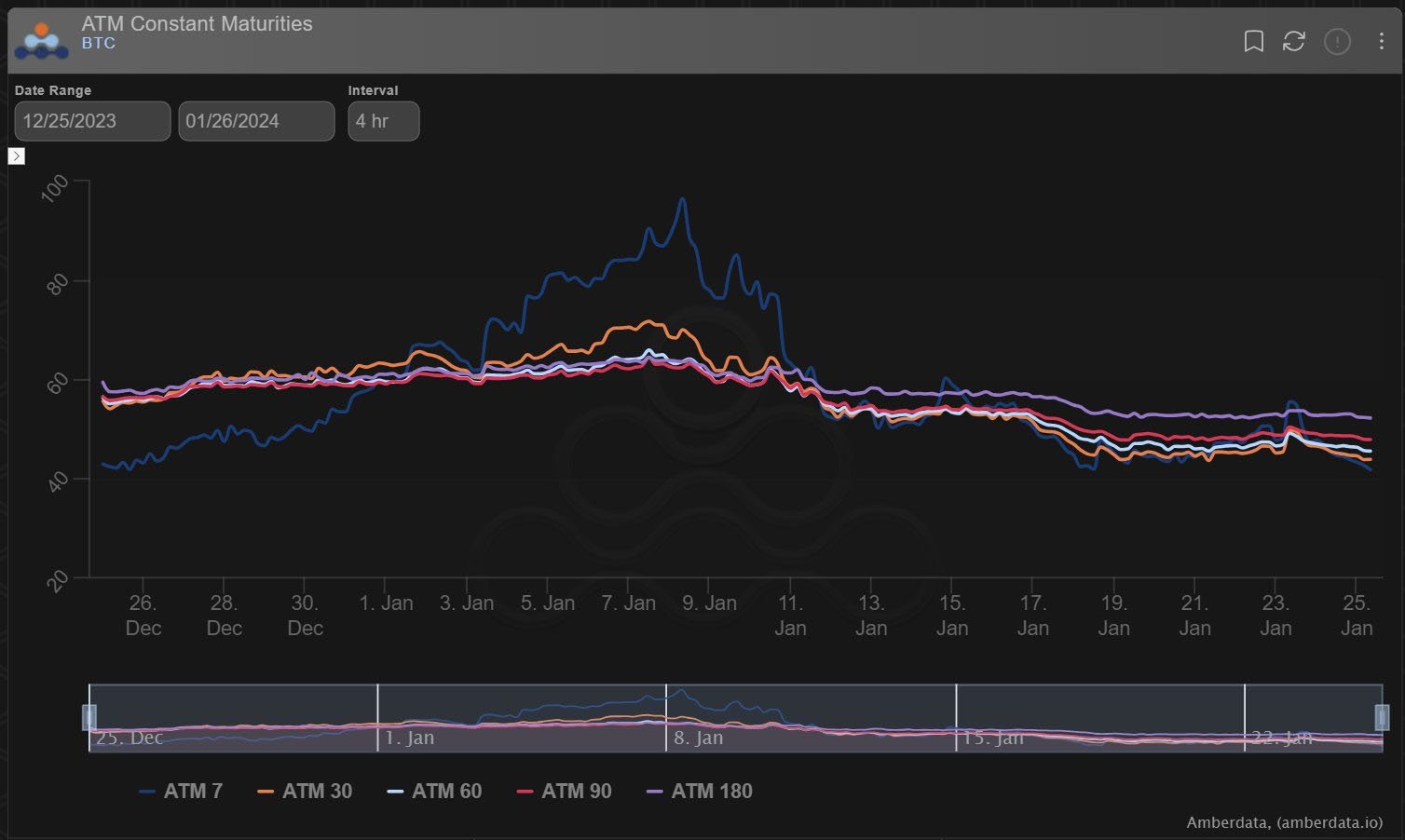

5) The monthly chart below shows the increase in IV due to ETF anticipation, and the retrace as news was confirmed and pullback in Spot.

The pauses for clarification on whether GBTC or the newly launched ETFs would dominate have resulted in inactivity during APAC+Euro sessions.

View Twitter thread.

AUTHOR(S)