In this week’s edition of Option Flows, Tony Stewart is commenting on how the market reacted on the latest filings vs the potential BTC ETF.

Quick succession ETF managers+SEC meetings and almost immediate amendments, submitting to ‘Cash create’ Spot ETFs rather than ‘in-kind’ secures SEC demands all but guaranteeing the approval.

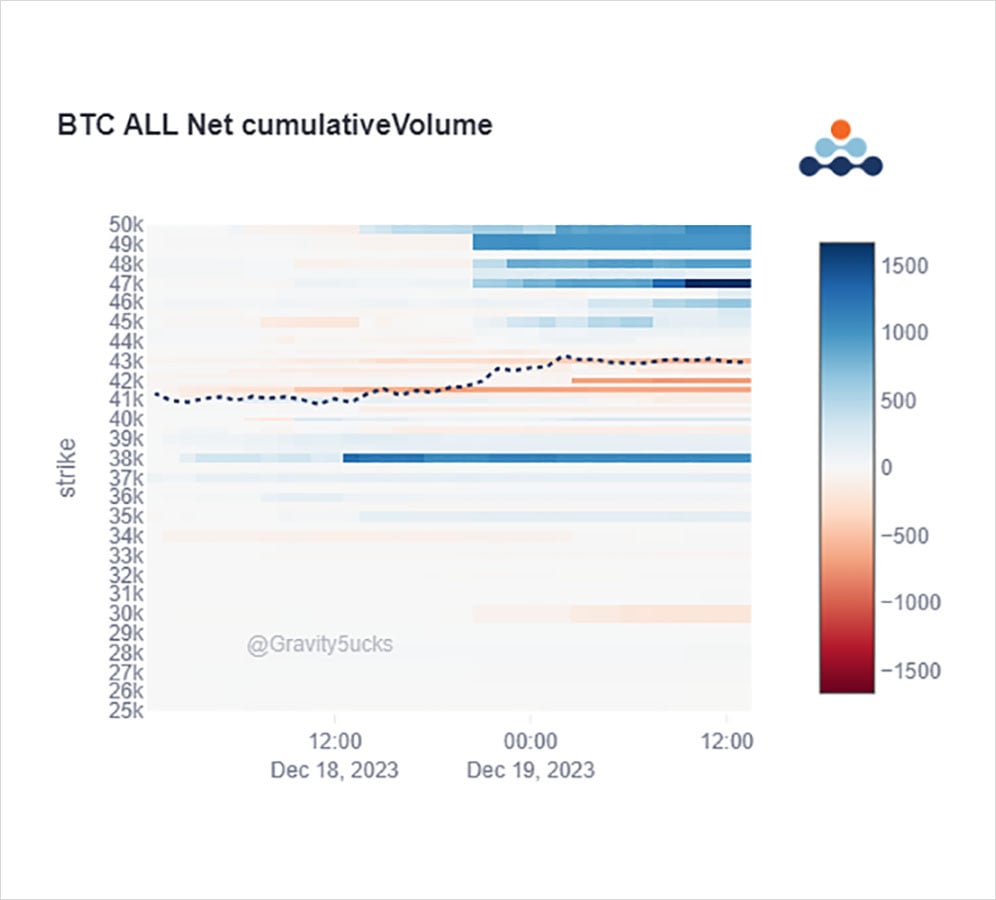

A raft of Dec OTM Calls were bought as BTC surged>43k as bets placed on imminent news.

2) Blocks and DSOB purchases of low-premium bets via Dec29 46-50k Calls triggered by what appears to be seasonal handshakes between the ETF parties and the SEC relating to BTC Spot ETF ‘Cash’ construction.

One opposing trade as Dec 38k Puts bought >1k for end-of-year protection.

3) Conspicuous that all these Call purchases were imminent bets/punts/underexposure via the Dec29 expiry.

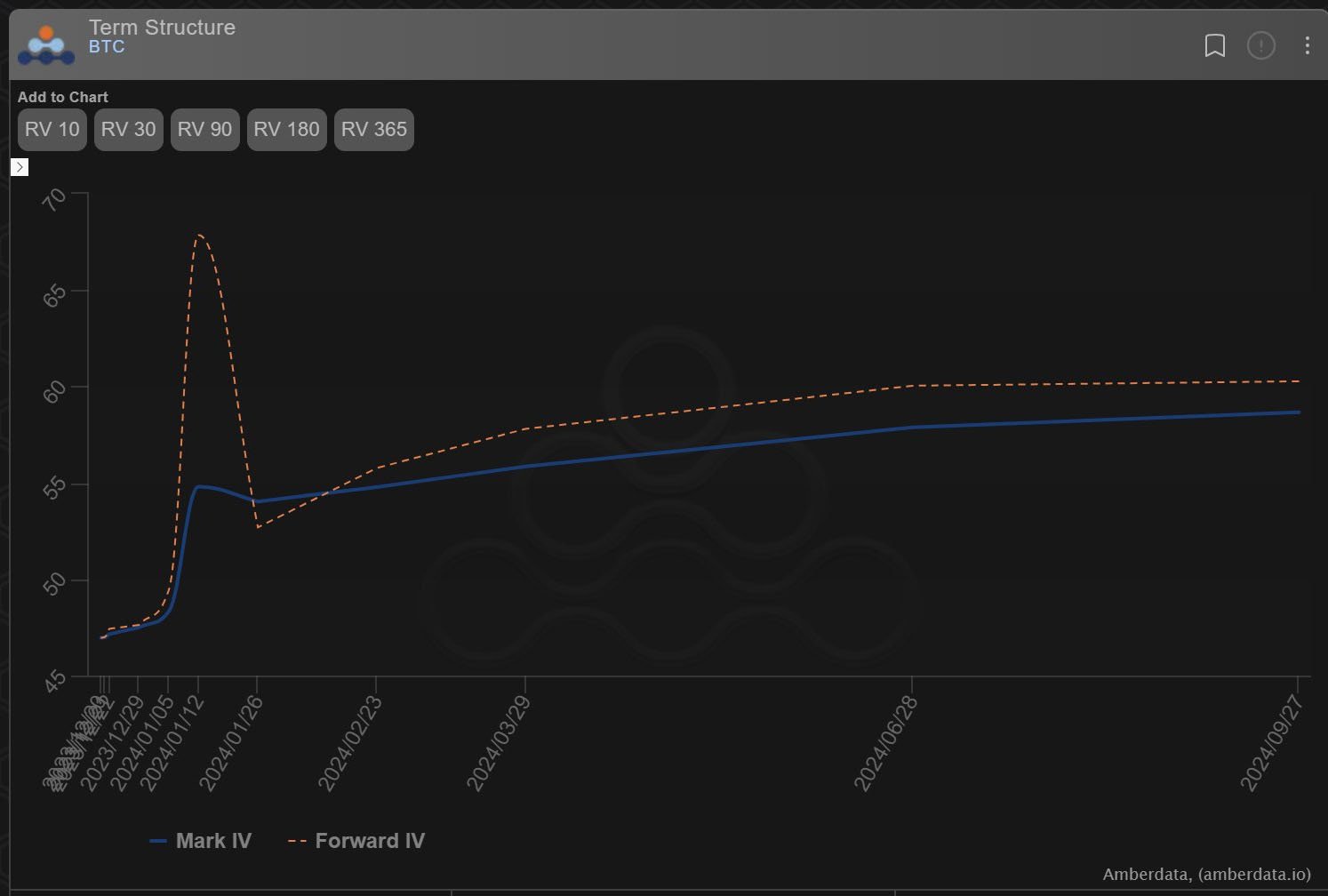

Funds already have in place their bets in Dec in case of an early surprise, and then Jan-Jun exposure via Calls(+spreads).

The Options market is still pricing in Jan8-10th.

View Twitter thread.

AUTHOR(S)