In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements with large moves across the whole market.

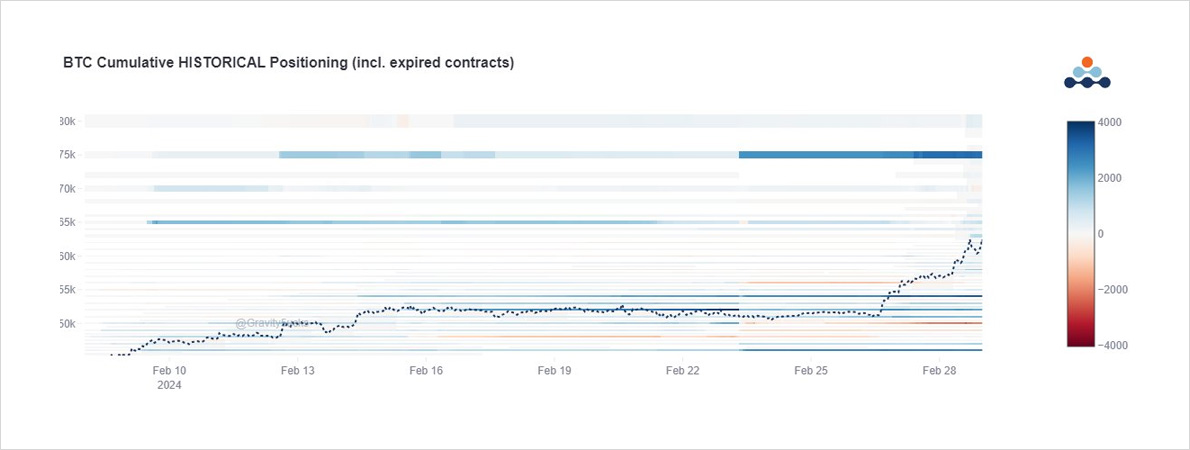

When 3 weeks ago a large purchase of Apr+Jun+Sep+Dec 65k+ Calls was made, it was interpreted as a Halving play.

But ETF flows, sentiment, and FOMO induced a 35% Spot rally and now the 65k+ Calls are potent.

Under-exposed scrambled to buy Calls into yesterday’s blowoff-top.

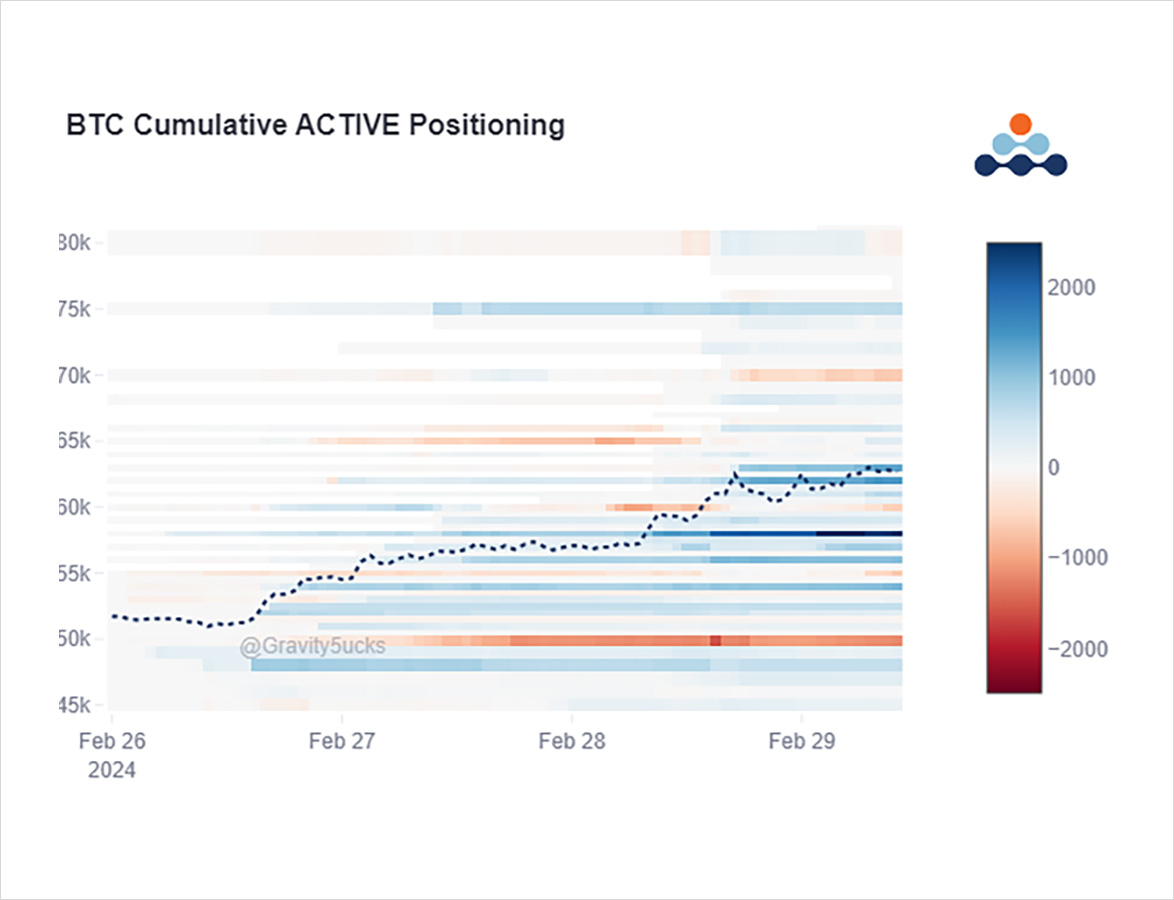

2) Disbelief at the extent of this week’s rally told via Option flows: At first buying Calls, then unwinding and hedging at 57.5k, FOMOing back in >58k, TP nr 60k, some rolling up exposure, hedging as 60k support tested, and then under-exposed lifting Mar 65-80k Calls b4 a flush.

3) The 62k to 64k surge was so quick, and with high leverage across the whole system, that when sales hit the market a cascade sent BTC down to 59k in 15mins, and some Alts (also massively leveraged) dropped 50% on some exchanges before promptly bouncing as BTC jumped to 61.5k.

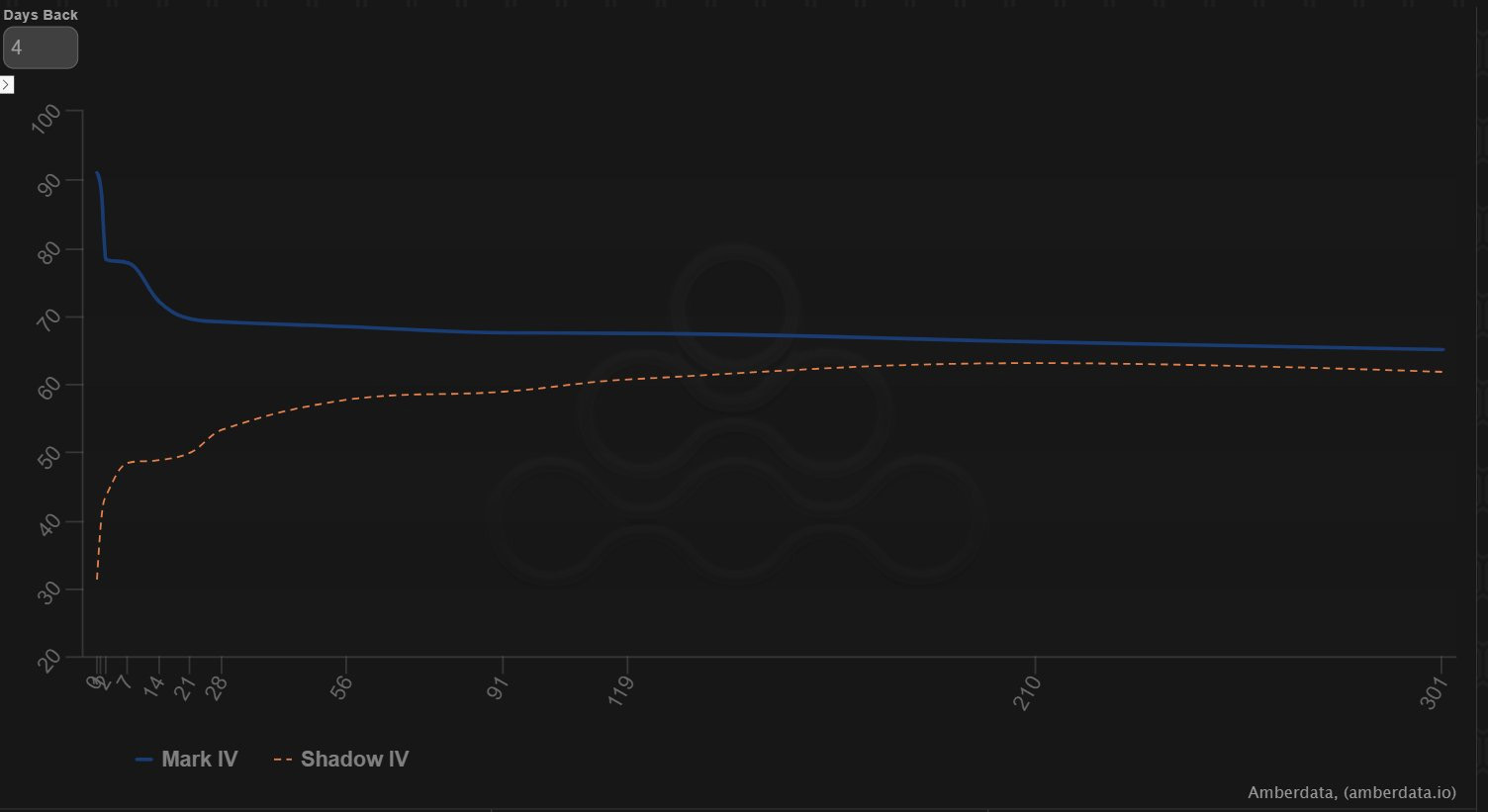

4) IVs had been pushing higher throughout the week, and Term-structure finally went into backwardation as the fronts pumped as a reaction to increased RV, continuation of near-dated buying, and the final surge of Calls bought as new-highs looked within reach of an explosive move.

5) Despite the large moves, the giant Call holder in Apr-Dec has not noticeably reacted. The blue positions still dominate the big picture. Since when these Calls were bought, Spot has rallied ~35%, IV has rallied ~20%, forwards rallied, Delta+Gamma has increased. Conviction.

View Twitter thread.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)