In this week’s edition of Option Flows, Tony Stewart is commenting on the market movement pre and post BTC Spot ETF approval.

Finally, after a test run the day prior, BTC Spot ETF was approved.

Expectations so telegraphed that BTC reaction was underwhelming, and all the tension wound-up in Jan12 longs dissipated, IV crushed.

Attention rotated to ETH, Spot surging, and 50k Feb Call spreads bought.

2) On the announcement and BTC underreaction, MMs promptly marked Jan12 down 25% in one quick adjustment.

Some longs quickly exited, but many are holding awaiting signals from the ETF capital inflows.

With mixed flows, tomorrow’s ‘ETF expiry’ IV has fizzled out to losing 50%.

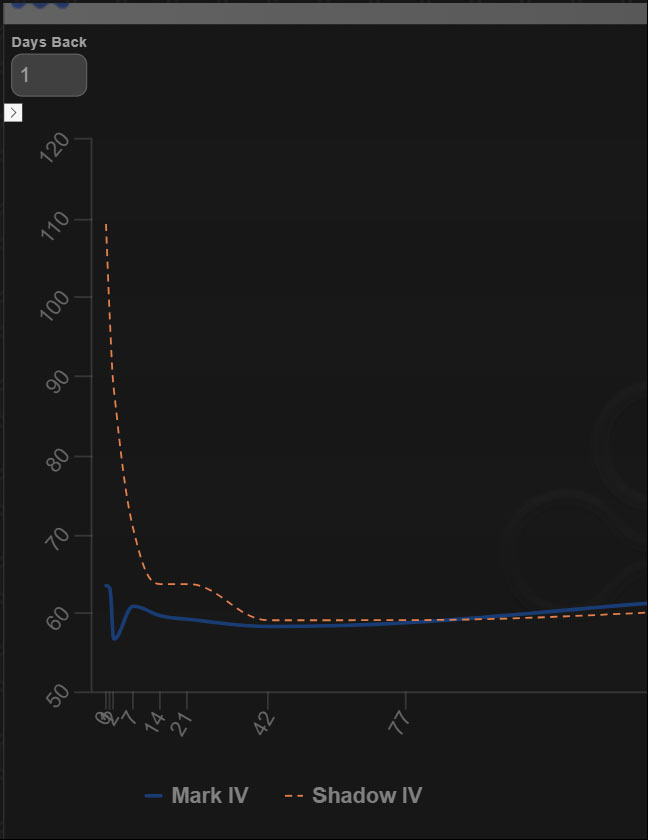

3) Most of the elevation in Implied Vol originated at the Gamma-loaded front end of the curve.

7day rolling expiry (blue line)

30day rolling expiry (orange line).

Both were decimated as would be expected from such an underpromised immediate reaction.

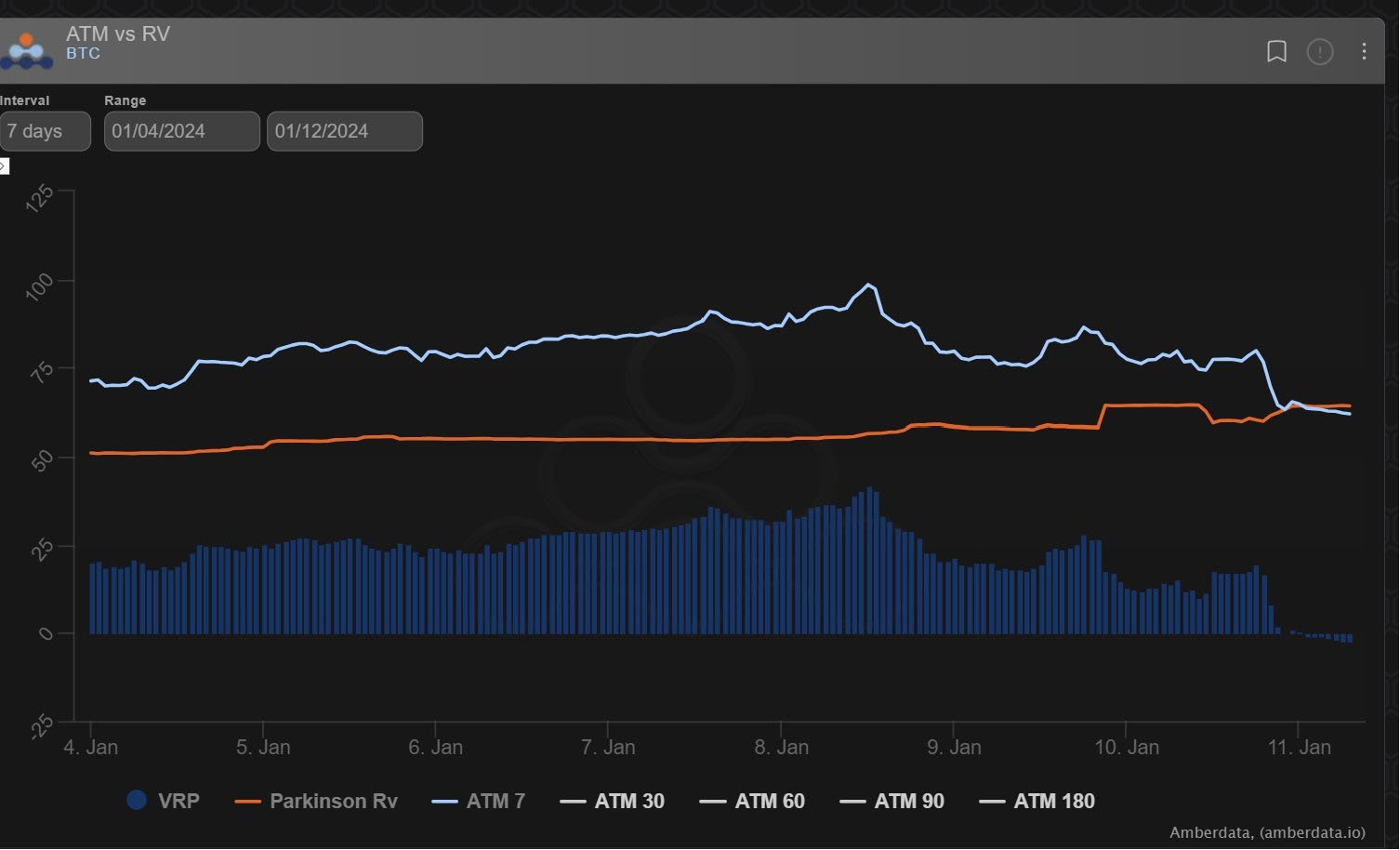

4) 7day IV has fallen back so much that it now sits in line with 7day Realized Vol.

The market awaits the success of day1 ETF capital inflows.

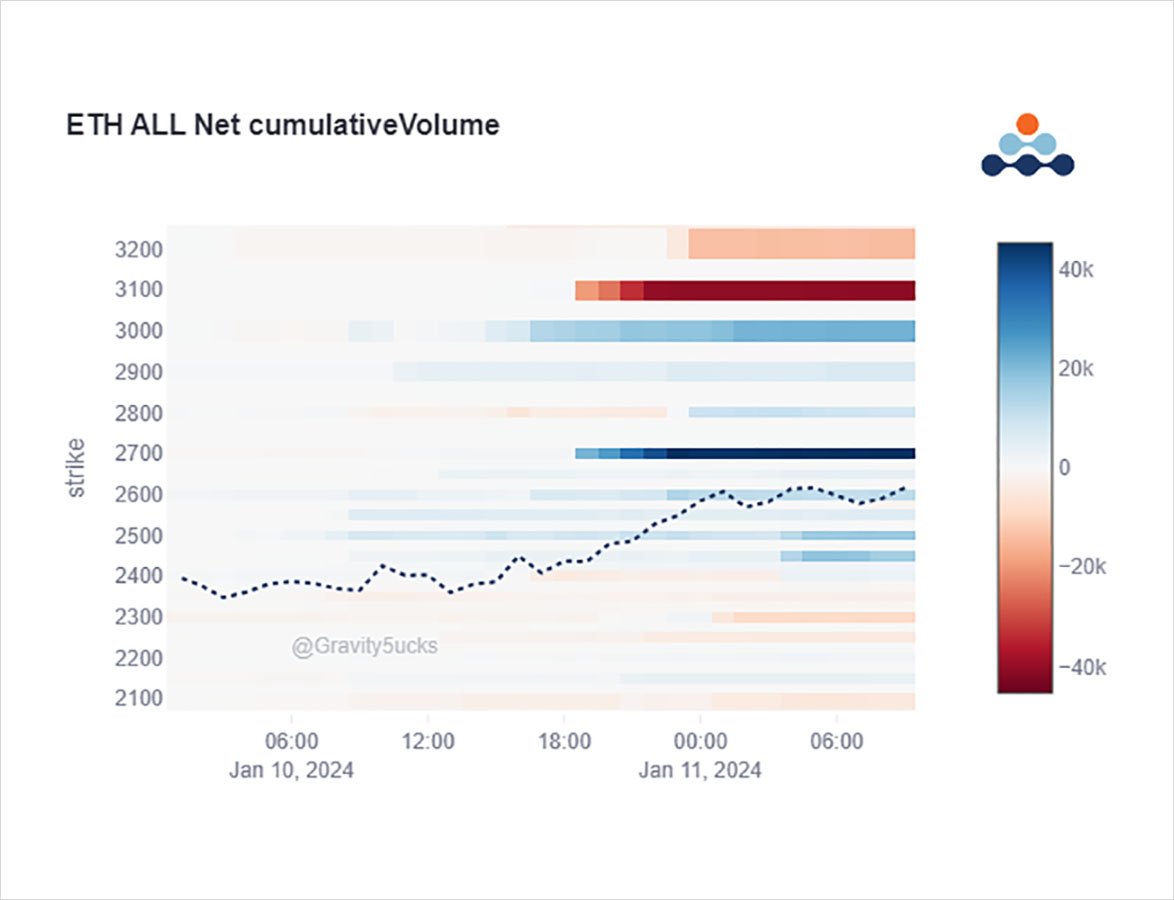

5) Meanwhile, attention turned to an ETH ETF, some time away, but having seen the BTC run-up rally the narrative is powerful.

Scrambled buying of 30k ETH Jan12 2.4, 2.45, 2.5k Calls set the tone, ~50% of which were short-covering.

Then 50k Feb ~27-31 Call spreads Fund acquired.

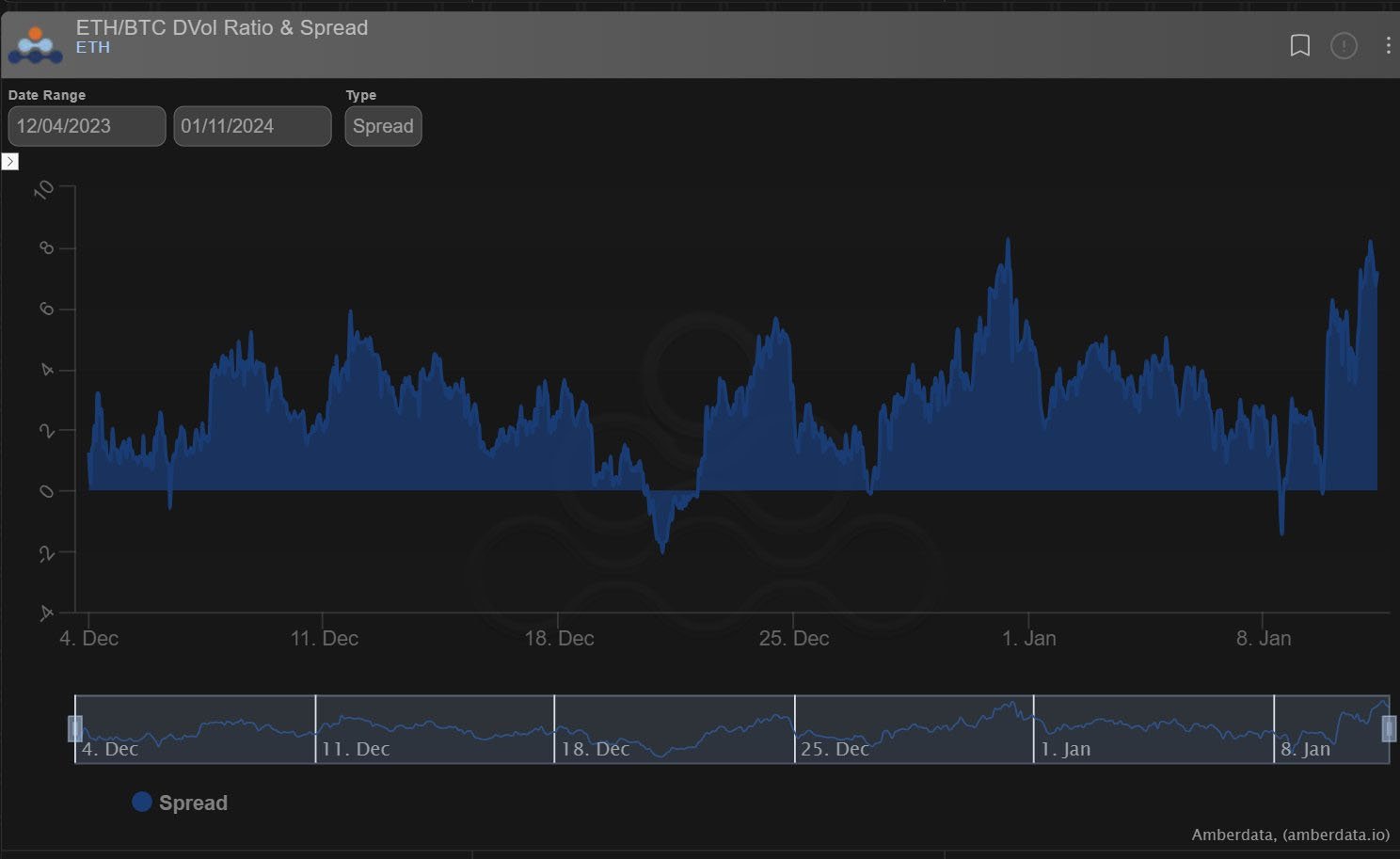

6) ETH IV remained orderly during yesterday’s move.

MMs were initially long Gamma, although this was reduced as the pre-mentioned buyers paid up for supply.

BTC Dvol 60%, ETH 68%

Momentum moved from BTC to ETH, and the previous large seller of BTC IV to buy ETH IV benefitting.

View Twitter thread.

AUTHOR(S)