In this week’s edition of Option Flows, Tony Stewart is commenting on the past few days market movement, and a possible rotation into ETH.

A temporary delay in proceedings as BTC stalls, Vol drift, BTC Put(+spreads) bought, BTC retraces, rotation to ETH initially looks strong, ETH Overwriter non-reaction, BTC+ETH Vol dumped, focus turns away to rampant Alts, before BTC relights forcing re-engagement of BTC Calls!

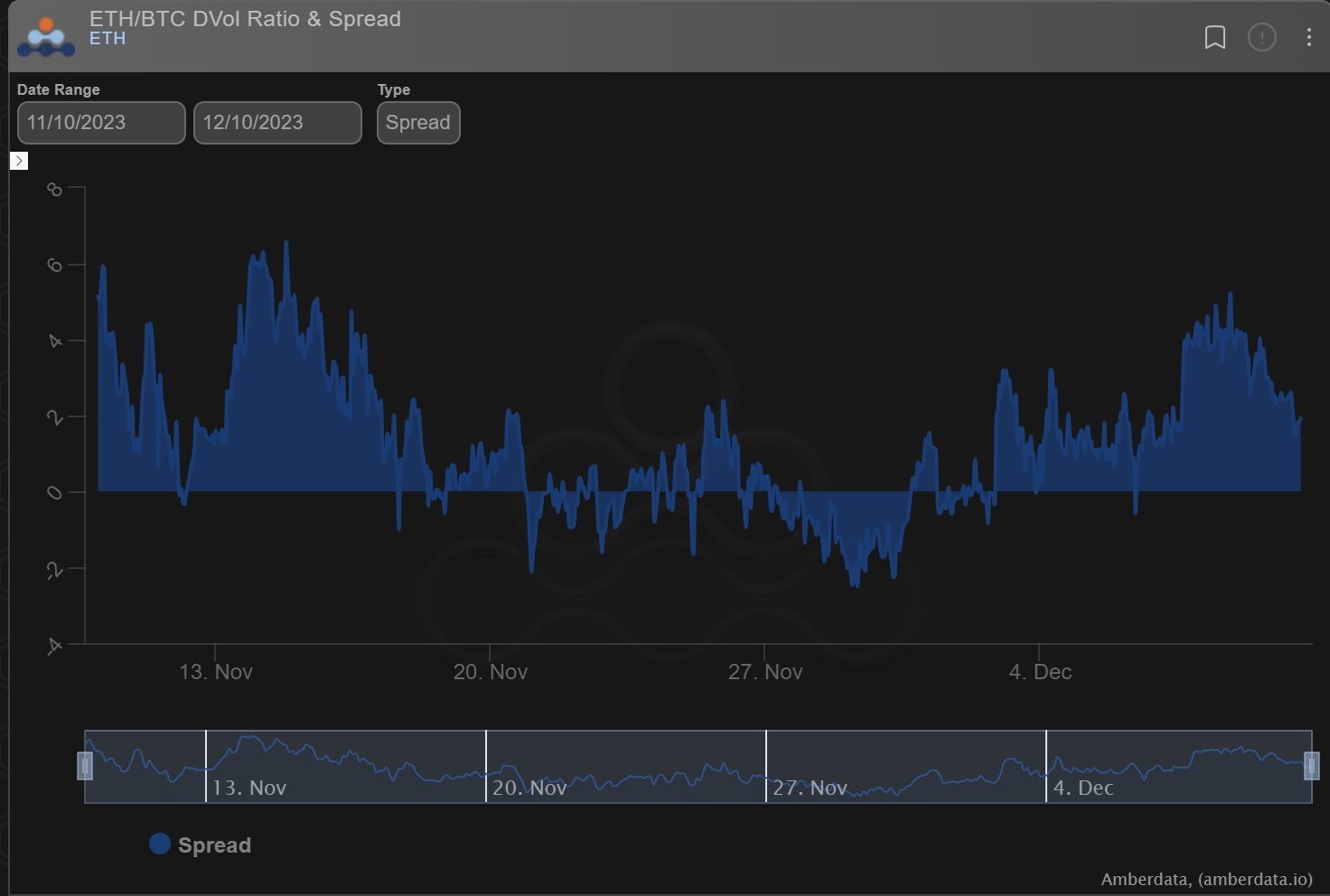

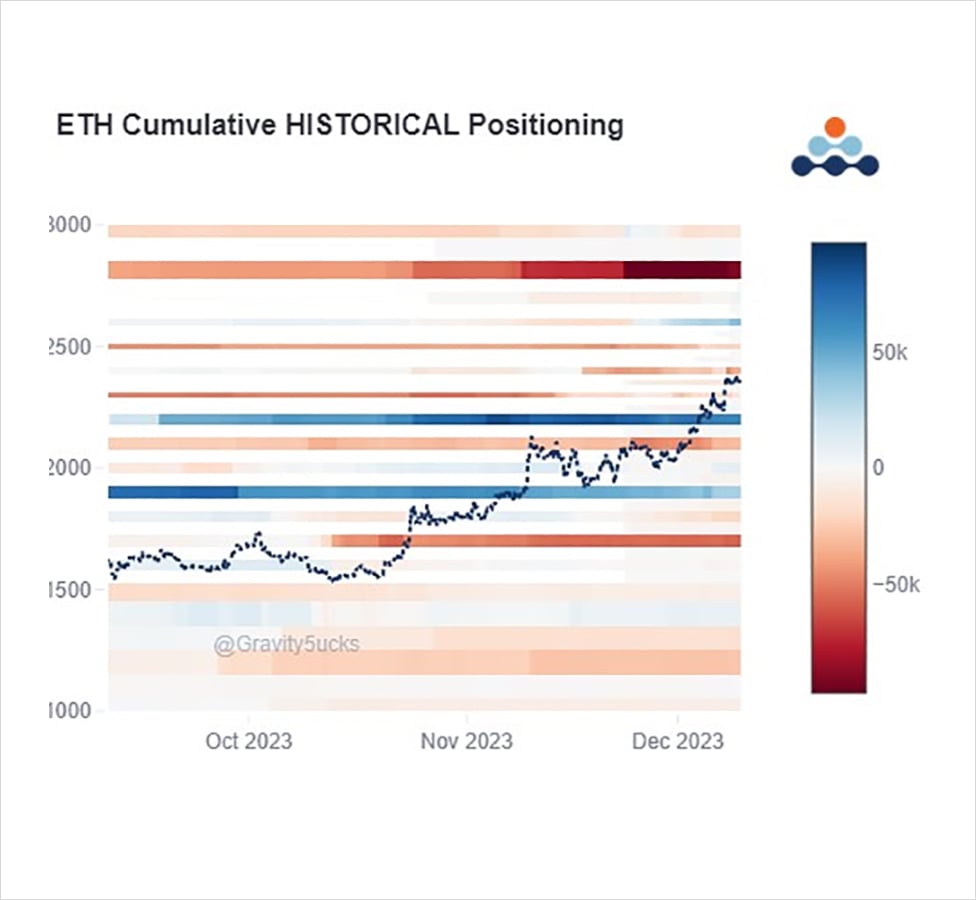

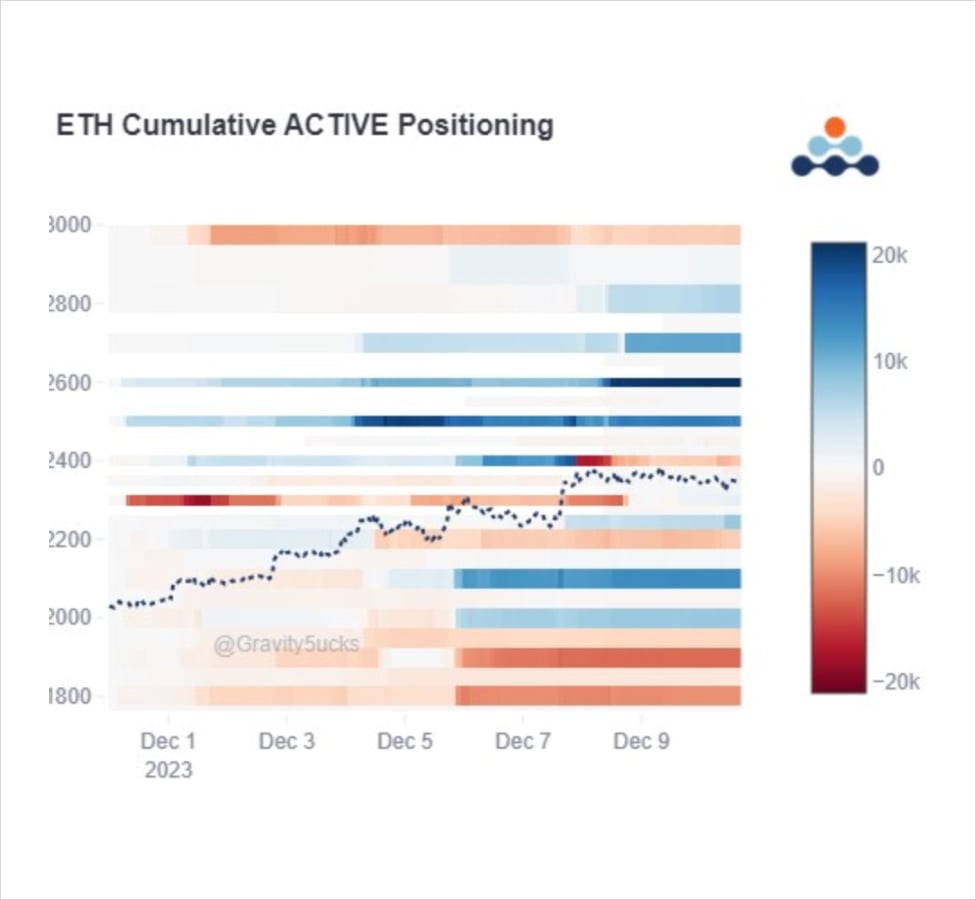

2) 44k initiates some ETH rotation, aligned with raging Alts. BTC IV performance and related unwinds of Calls, while hopes the ETH overwriter may buy back Jan 2.4k Calls keeps ETH IV>BTC. But reaction by the ETH overwriter not forthcoming; less short Calls, better collateralized?

3) Stall + IV underformance perhaps triggered a Vol sale of 1k BTC 44k Straddles and 18k ETH 2.4k Straddles; unclear ofc if a Vol proxy sale vs a Long Vol book or an opening trade, but the former seems more likely in current market conditions.

4) The Spot stall also catalyzed Put(+spread) buying in Dec and some far OTM Puts in Jan+Mar are starting to be accumulated.

A BTC retrace back to 43k came as expected, while ETH powered higher, more Calls bought.

But BTC re-engaged, bouncing to 44.7k, forcing Call deployment.

View Twitter thread.

AUTHOR(S)