In this week’s edition of Option Flows, Tony Stewart is commenting on Bitcoins recent ATH, MSTR buying again, and robust net ETF flows.

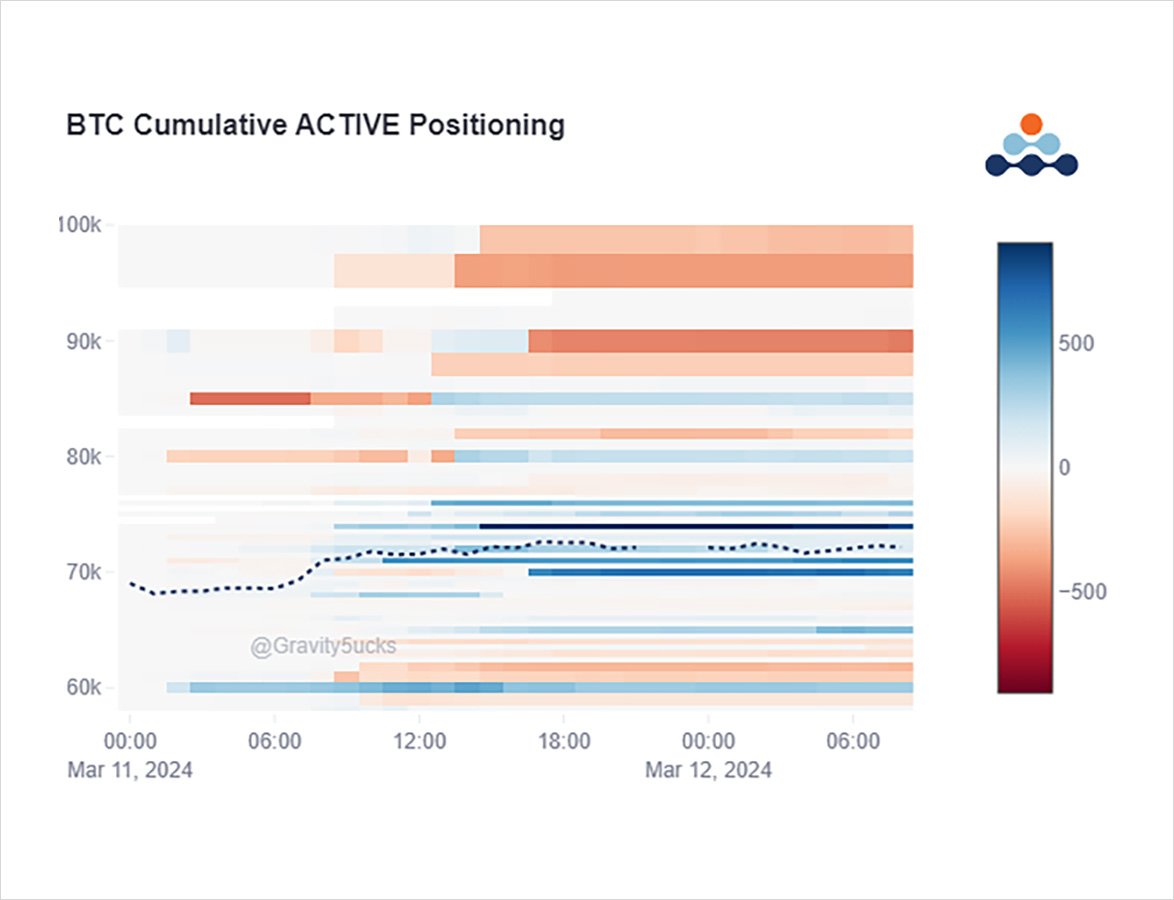

MSTR $800m BTC top-up and robust net ETF flows pushed BTC to 73k; ETH followed to 4.1k.

Option flows appeared bullish bias with BTC+ETH April ATM Call spreads bought, Jun OTM Call spreads and Mar85k Calls lifted.

Spot+IVs prompted Call TP & sales.

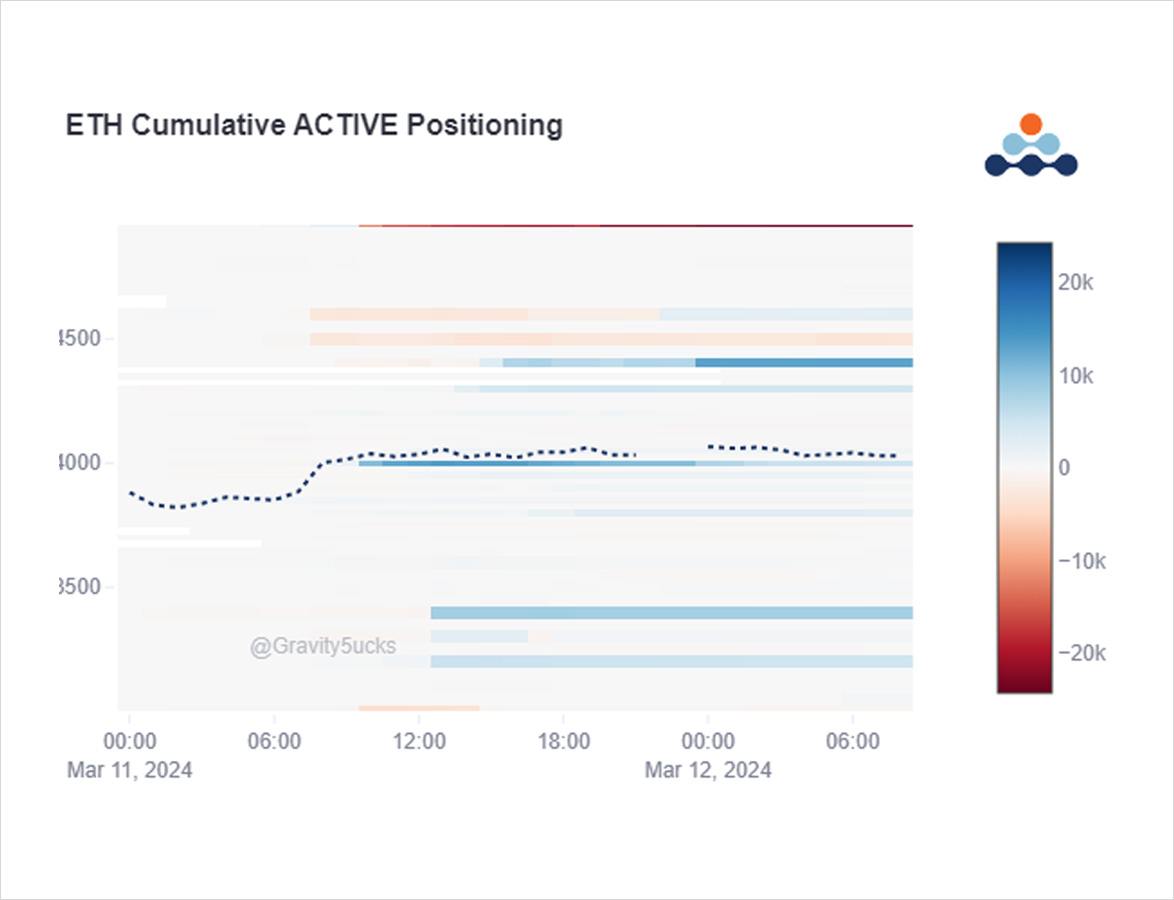

ETH saw ETF-related hedges.

2) Rising Spot and Dvol >80% prompted some Call sales (BTC Jun 85k, ETH Mar 4.5k+5ks), and TP sale of Mar 70k Calls rolled up to 80-100k Call spreads.

April Call spreads bought on BTC (70k-90k) & ETH (4k-5k) to try and mitigate some of the high IV but still paid $9.3m premium.

3) More aggressive upside was lifted via Sep 80k, Mar 85k, and Jun 100k Calls, plus Jun OTM Call spreads such as the Jun 90-110k.

These pushed IVs to a high of the day, before Spot + correlated IV drifted later.

4) Some respected ETF specialist analysts halved their ETH ETF approval odds for May’24 to 35%.

This perhaps prompted purchases of ETH Mar 3.2+3.4k and April 3k Puts – net spend of $1.5m premium.

Following BTC, ETH pulled back to 4k. There hasn’t been further hedging as of yet.

View Twitter thread.

AUTHOR(S)