In this week’s edition of Option Flows, Tony Stewart is commenting on the continued BTC ETF net inflows that have assisted an overall market support.

7days of BTC ETF net inflows have assisted market support in terms of buys & sentiment.

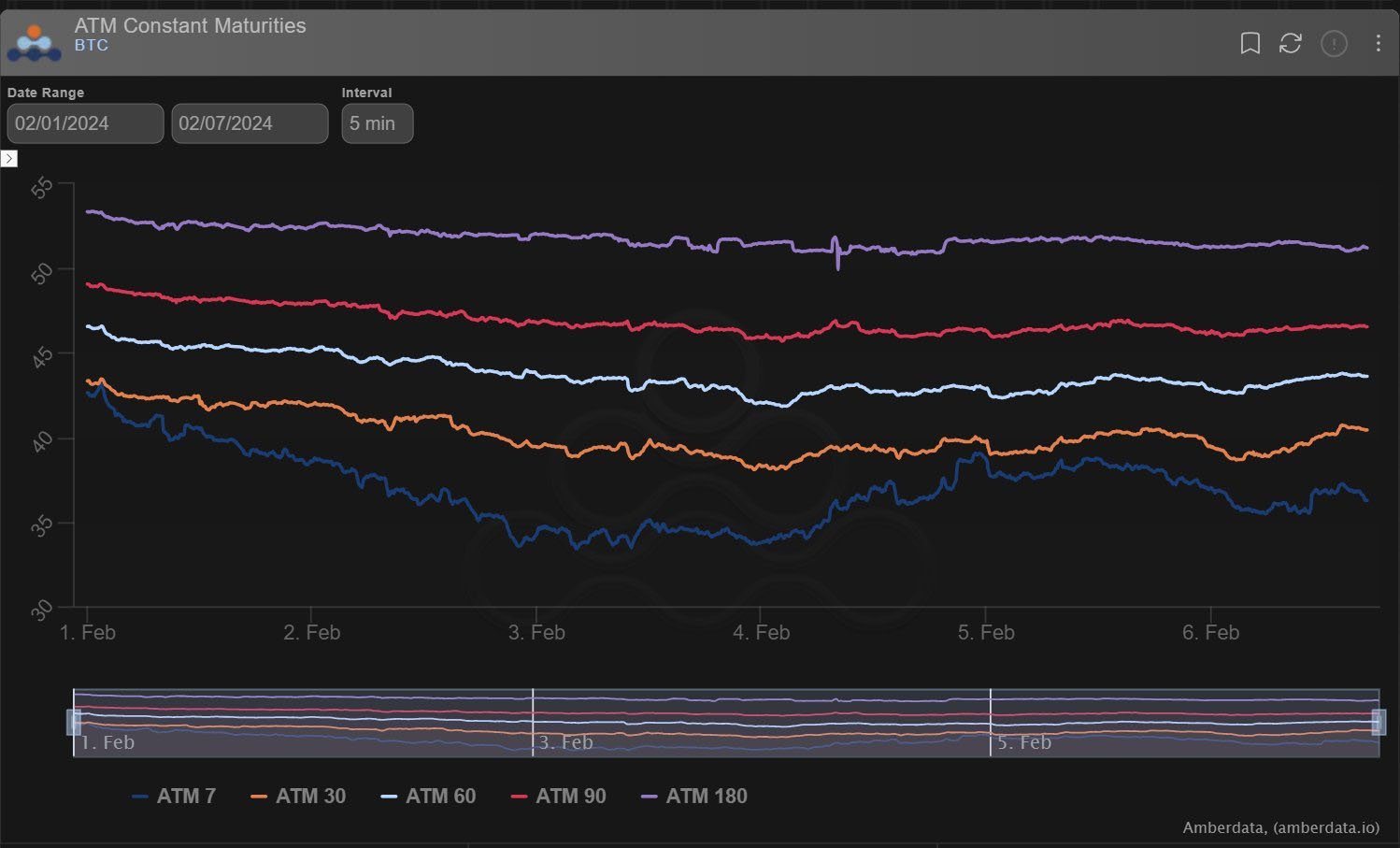

But BTC Option flow has been subdued and technical rather than directionally informative, with low RV punishing holders of optionality.

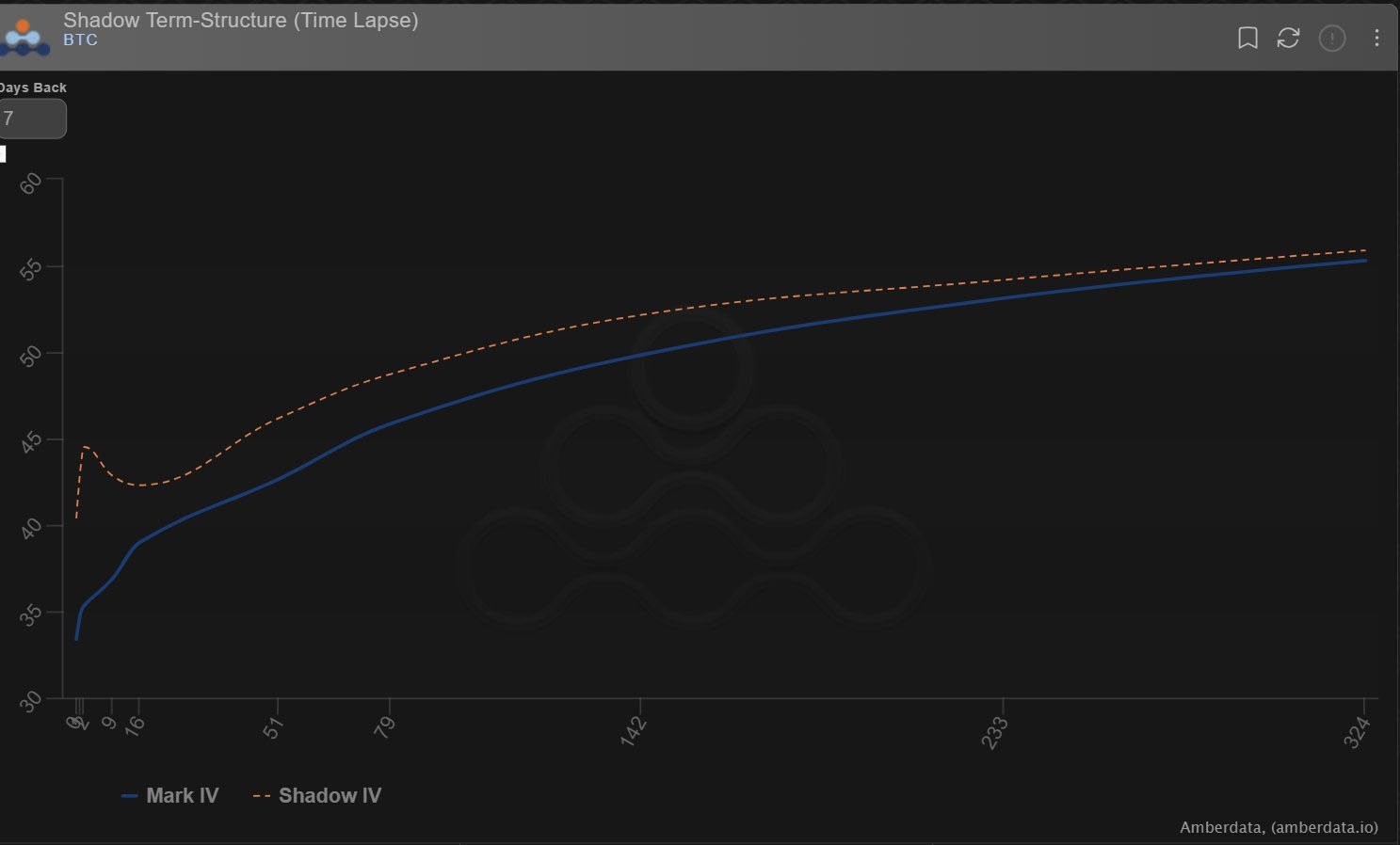

Calendar sellers of Vega.

ETH Overwriter concern.

2) Rangebound trading for majors has resulted in lower Realized Vol pulling down Implied Vol.

Decay and Gamma losses at the front end have punished Long-holders of optionality.

Observed technical trades have been selling Calendars – ie selling April+June to buy Feb shorts.

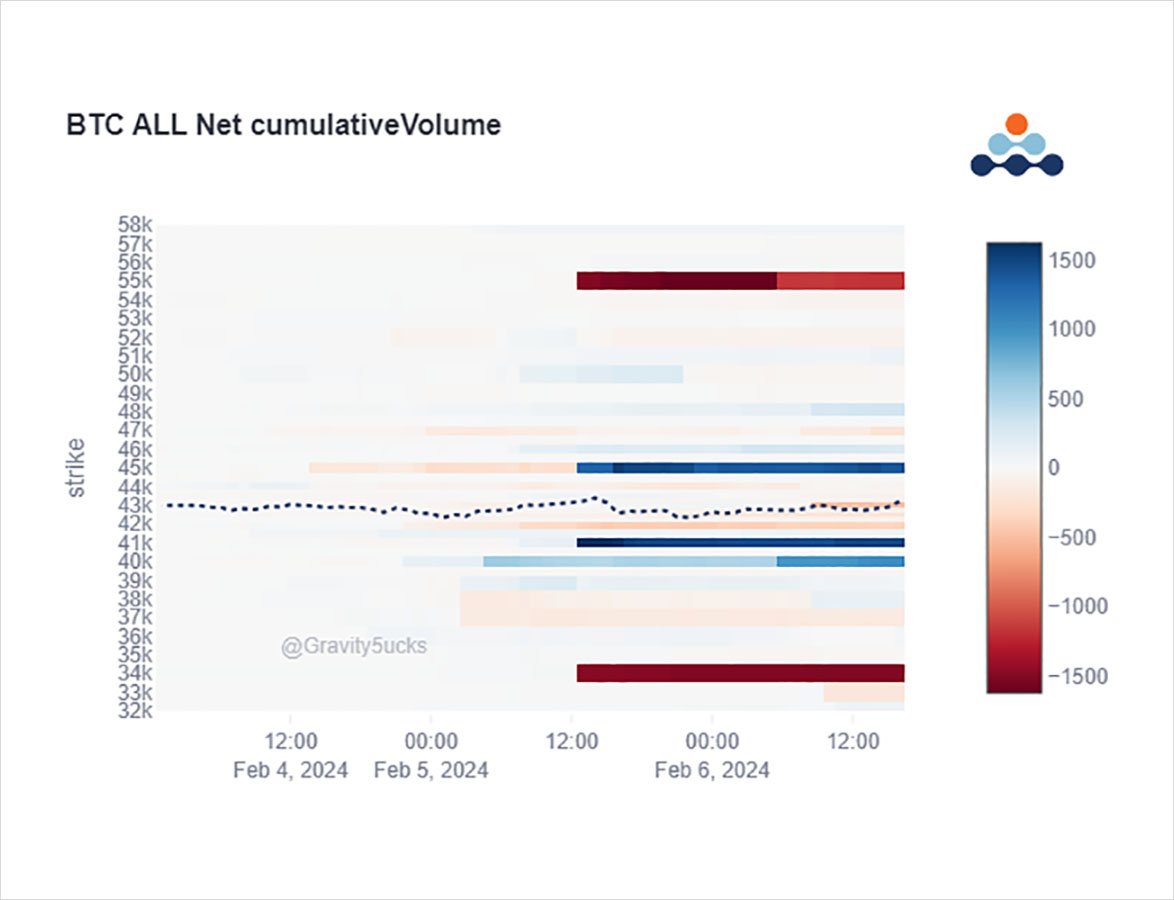

3) A structural BTC trade executed two weeks back to buy April and sell ratioed Feb Strangles was rolled back via selling the April 34-55k Strangle to buy back Feb Gamma via the Feb 41-45k Strangle x1.5k.

Similar ‘steepner-compression’ flow, selling Jun-Feb 45k Call Calendars.

4) LPs have in general been content to sell Vega+Gamma in this rangebound market.

But there is clear evidence of flows (not impacting IV) where Funds have been nibbling at these IV levels.

BTC Jun 40-55k Strangle, Jun 30k Puts, Mar 50k Calls all bought into drifting IV levels.

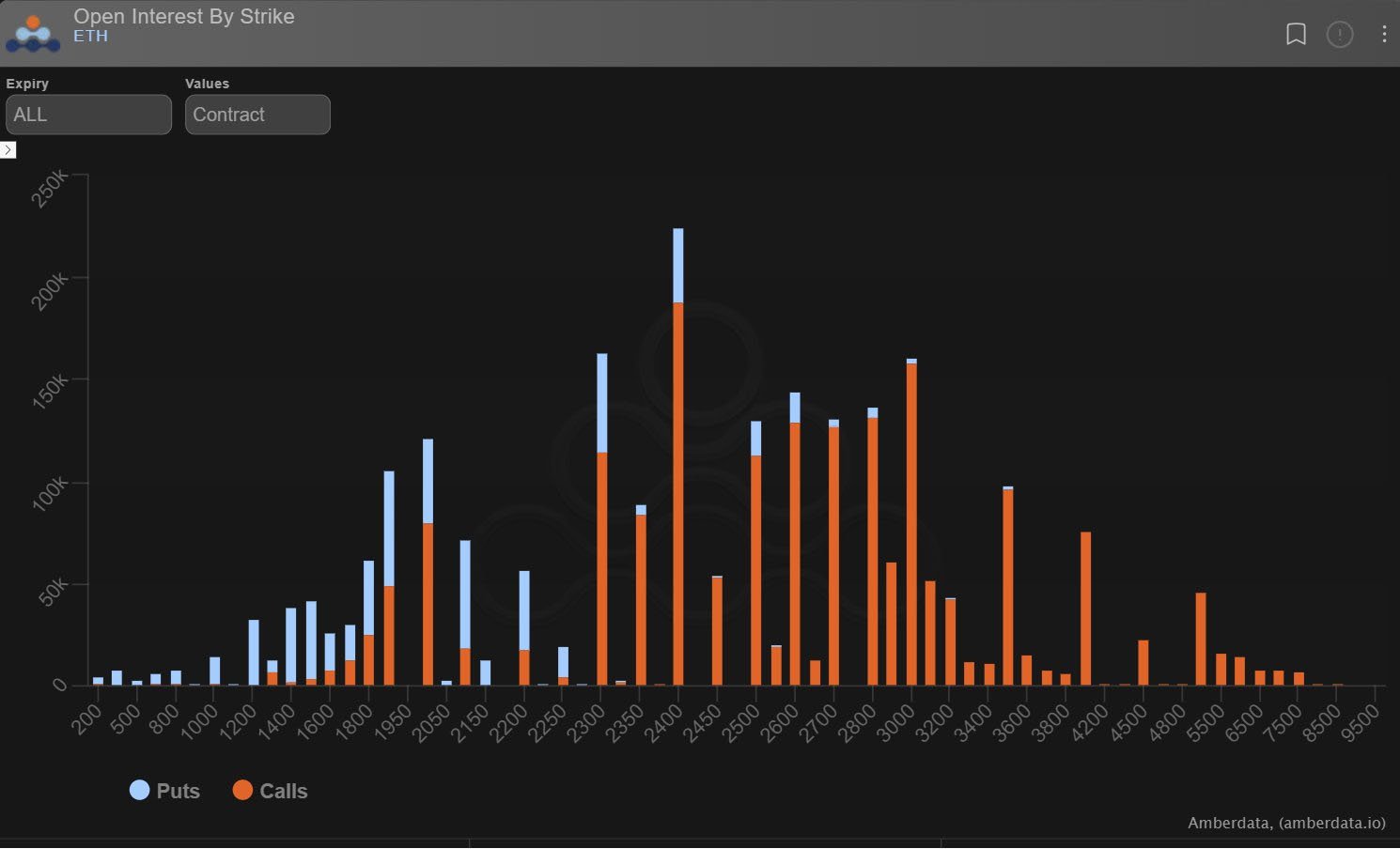

5) ETH Spot has started to perform, perhaps from BTC strength, ETF narrative, or ETH staking demand.

This triggered an ETH Feb 2.5k Call short-cover last week and at 2350+ trading level now must be of concern to force some reaction to the large short in the ETH Feb 2.4k Calls.

View Twitter thread.

AUTHOR(S)