In this week’s edition of Option Flows, Tony Stewart is commenting on a very mixed week with different signals.

Mixed signals ahead of Easter, after a week of mixed BTC ETF flow and ETH ETF conflict.

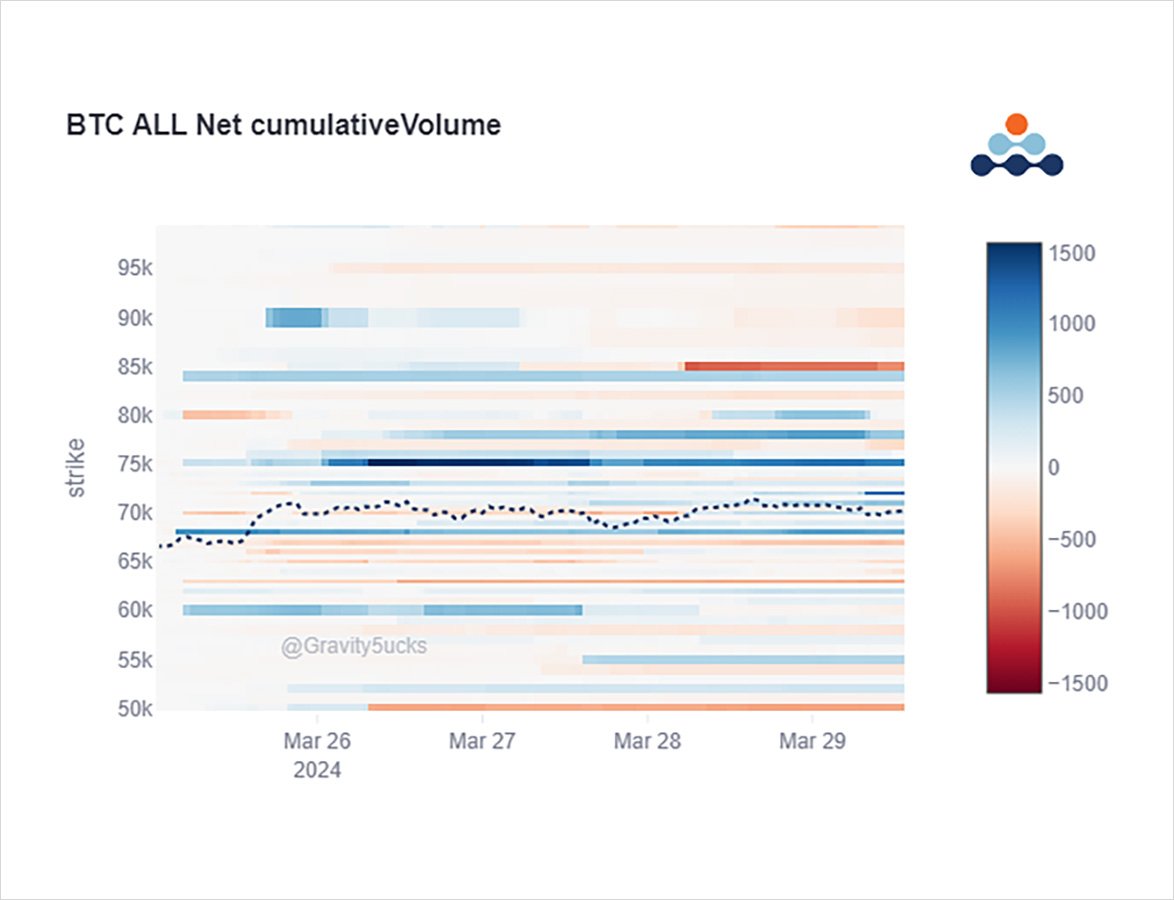

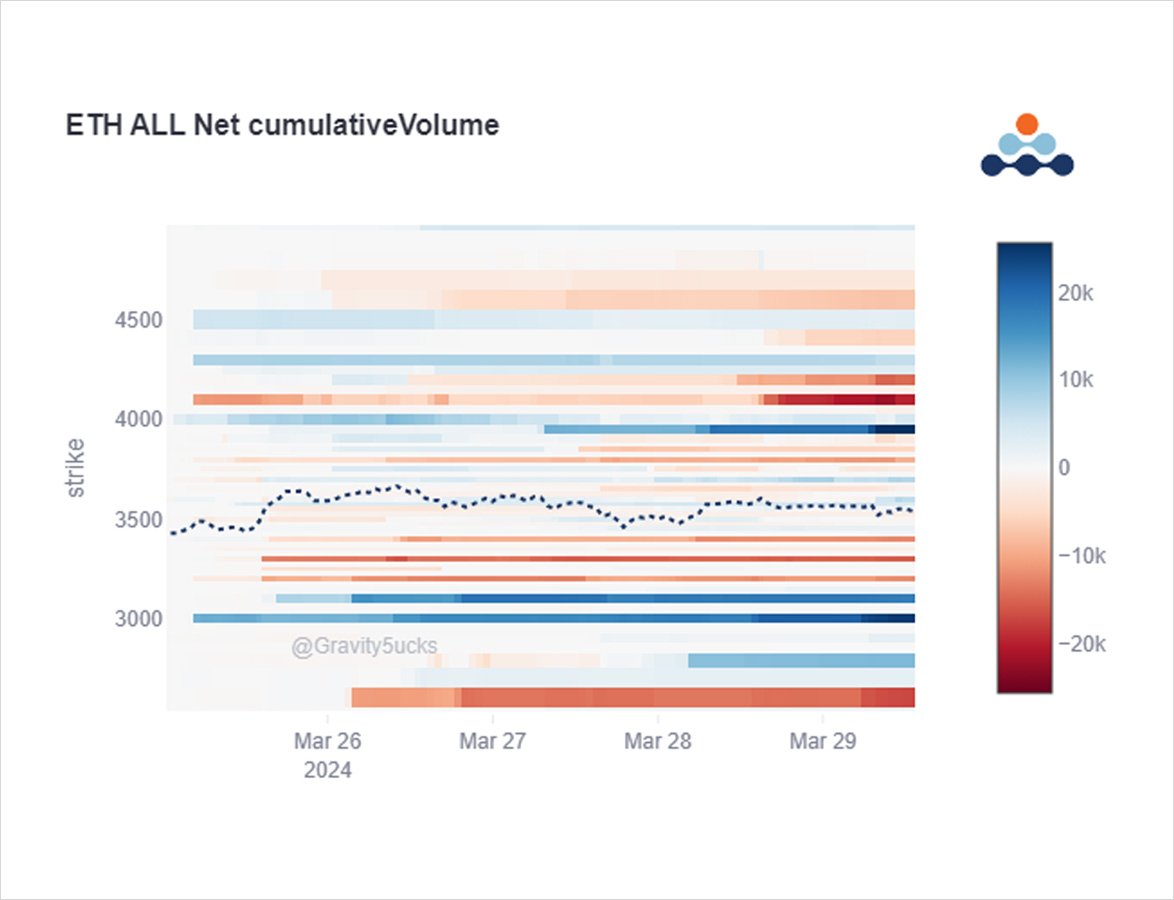

BTC observed Apr 68-72Puts bearish/hedges, but bullish Apr ATM Call spreads, plus over-writing. ETH observed Apr 2.8-3.6kPuts bearish/hedges, but bullish 3.7-4k Calls, plus over-writing.

2) After the last report highlighted the Spot lows, reinforced via Size Put selling & Call buying from 61k+3.1k to Spot currently trading 70k+3550, the news+ETF flows and ensuing Option flows have been incompatible with an unwavering narrative but compatible with great trading.

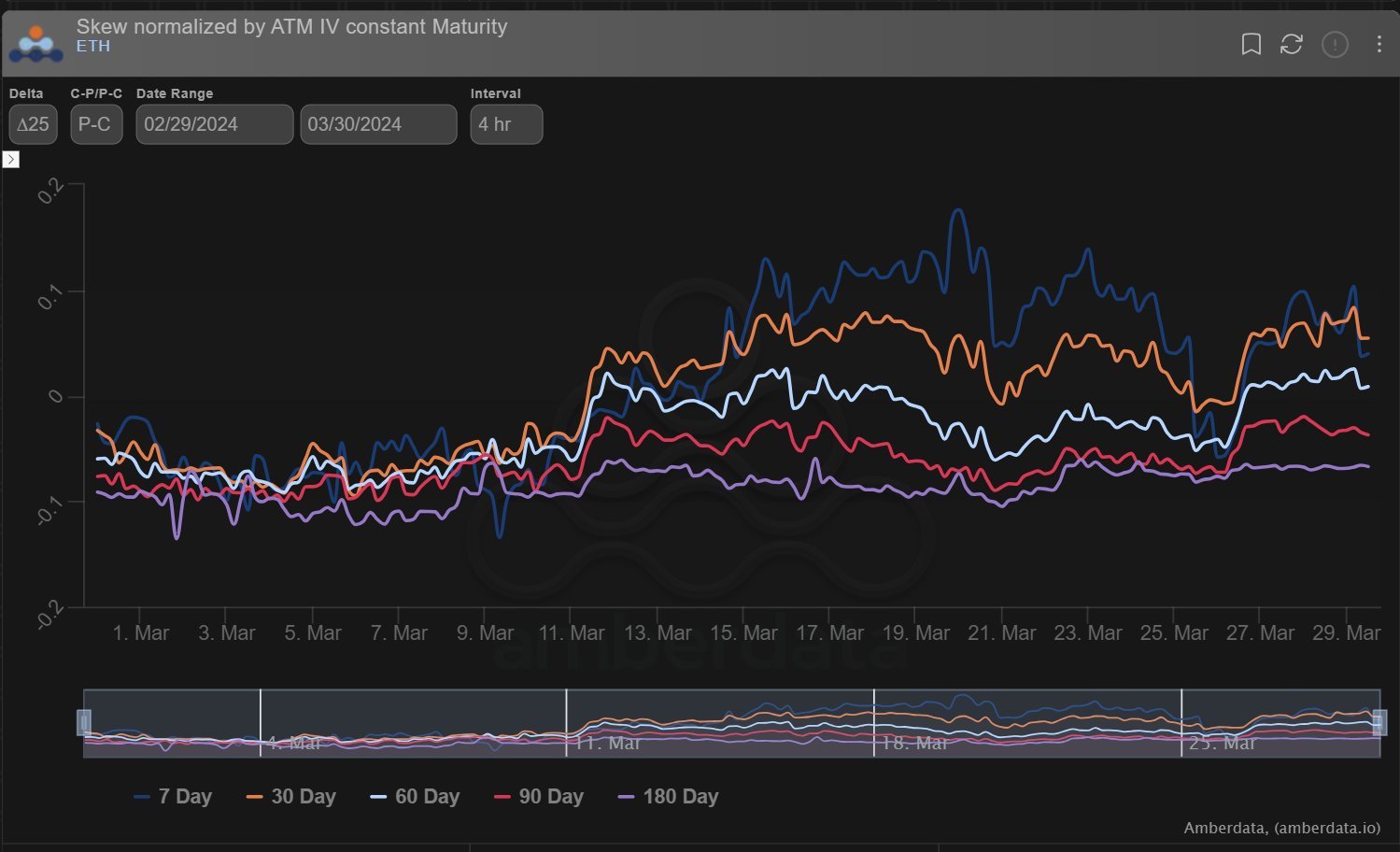

3) The powerful rally brought about hedging from some: $10m premium net BTC Apr 68-72k Puts bought, and a strip of ETH Apr 2.8-3.6k Puts + 3.1-2.6k Put spreads, none of which have yet fulfilled their promise, but perhaps have calmed nerves and/or locked in bullish AUM. Skew firm.

4) For some, the upside beckoned more, whether from being underexposed or wanting outperformance.

BTC saw Apr Call spreads and even buyers of Dec 100k Calls.

ETH saw Apr 3.6-4k Calls bought.

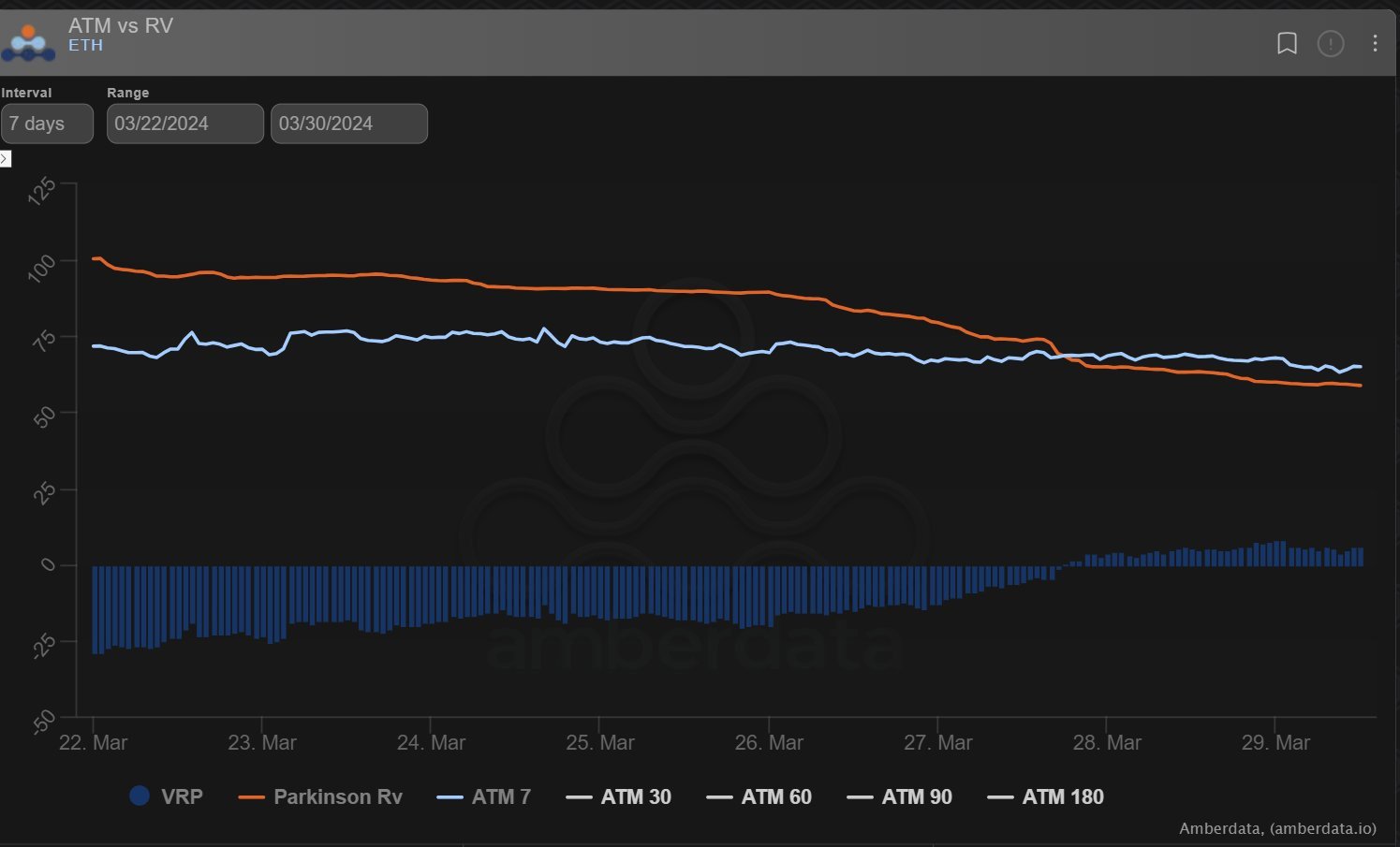

ETH 14day+ IV has stayed firm despite near-dated IV+RV drifting ahead of Easter wknd.

5) But firmer IV levels have also allowed long AUM Funds to sell Covered Calls.

A familiar entity on ETH rolled short Mar 3.8-4k Calls to Apr 3.9-4.1k Calls, giving Gamma back to LPs and supply to counter the buying above.

On BTC we observed May 85k, Sep90k, Dec100k Calls sold.

6) For a period, near-IV traded at a discount to Realized and provided great Gamma opportunities to Long optionality. 7day Gamma has now drifted on BTC+ETH, with Spot in a holding pattern, and Options showing unclear direction.

Market says short-lived. 30d IV-RV still discounted.

View Twitter thread.

AUTHOR(S)