In this week’s edition of Option Flows, Tony Stewart is commenting on the market post DOJ-Binance statements.

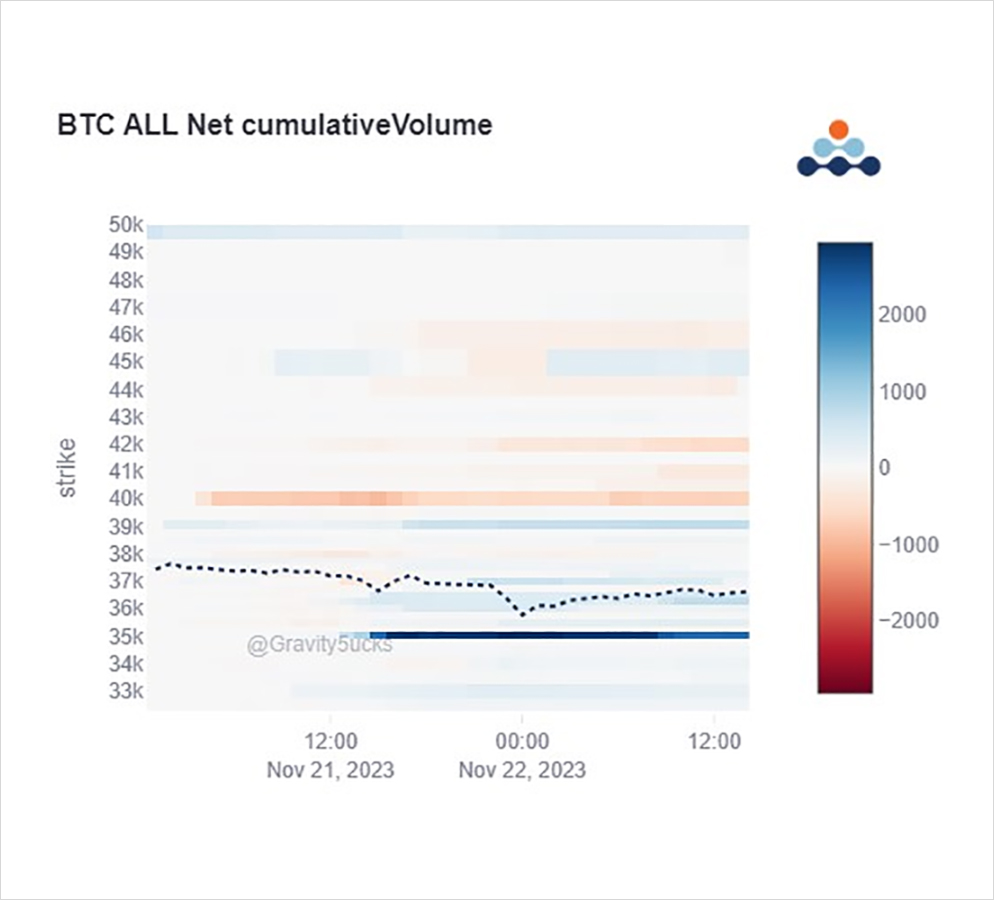

A panic/play with strong buying of Nov 35-36k Puts x3k prior to the Doj-Binance statements, and Spot almost fulfilling down to 35.6k.

As one prominent actor left the stage, BTC >36.5k.

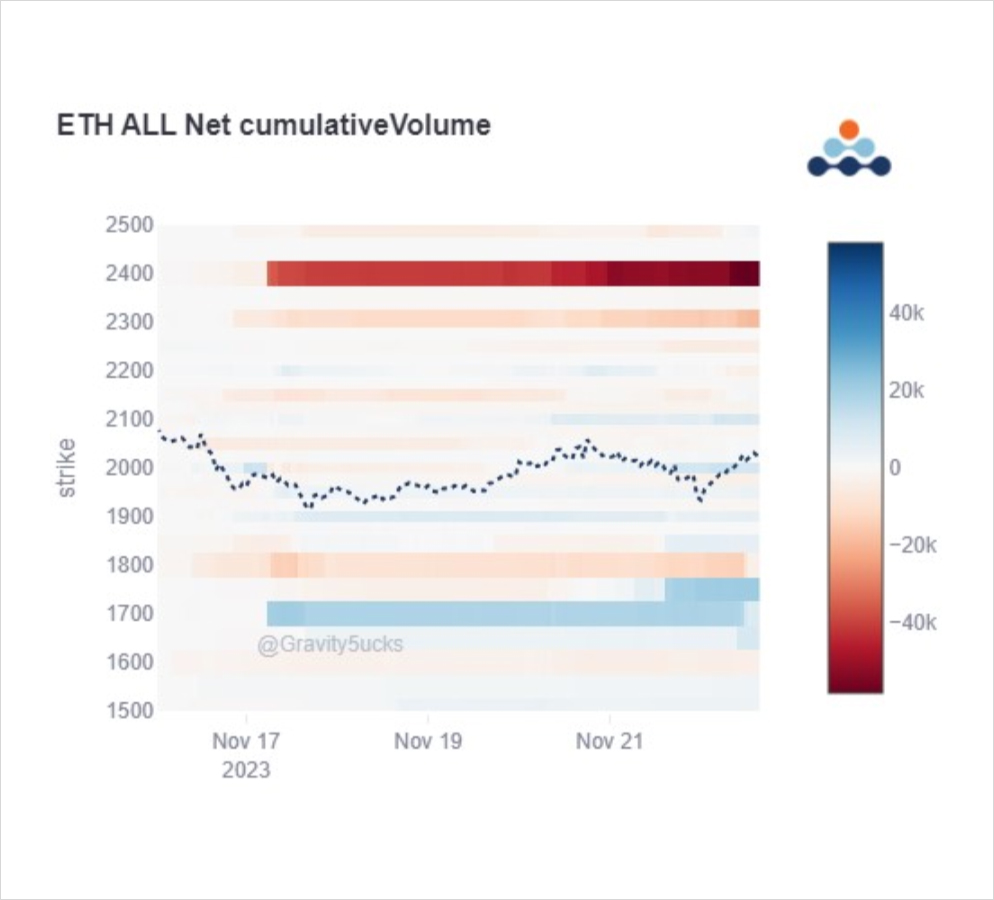

Mt Gox info stimulated an ETH/BTC bid.

Just as (THE ?) ETH Call Overwriter actor returns.

2) Differing Binance reactions led to Nov24 35-36k Puts purchased for downside, plus Dec(38-40k), Jan(50k)+Mar(45k) Calls being bought for upside.

Spot whipsawed.

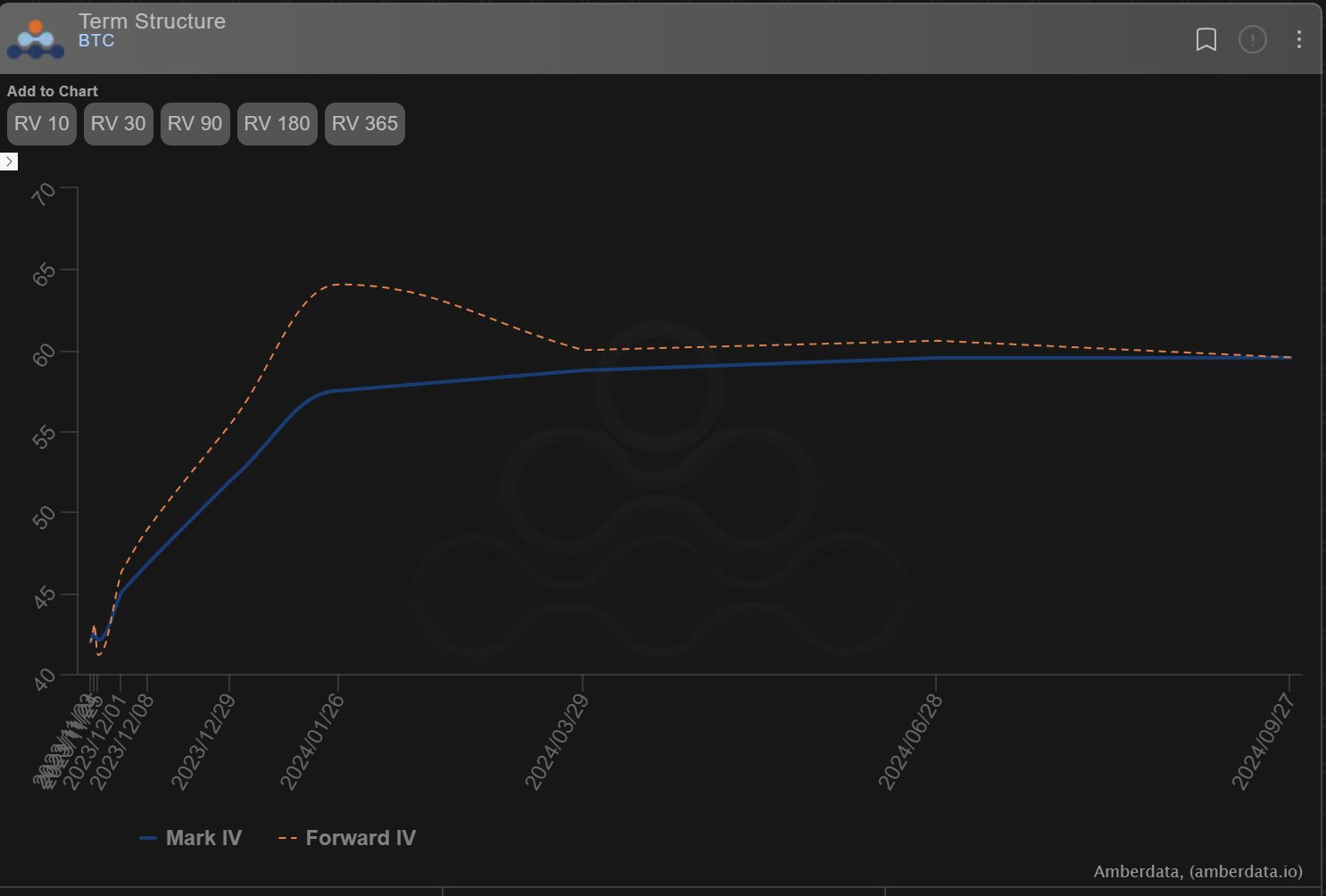

IVs remained quite stable, with firmness before the official announcement, and some relief following.

Captured:

3) If we get through Thanksgiving unscathed, the BTC term-structure will start to represent a clear Jan BTC Spot ETF decision bid.

Funds moving exposure to Jan from Dec and buying Jan Calls for outperformance.

Assumes two things:

1. SEC Jan decision

2. Jan IV offsets Xmas Theta.

4) With news from Mt Gox that they are preparing, over a period, distributions to its creditors, ETH/BTC Spot firmed this morning.

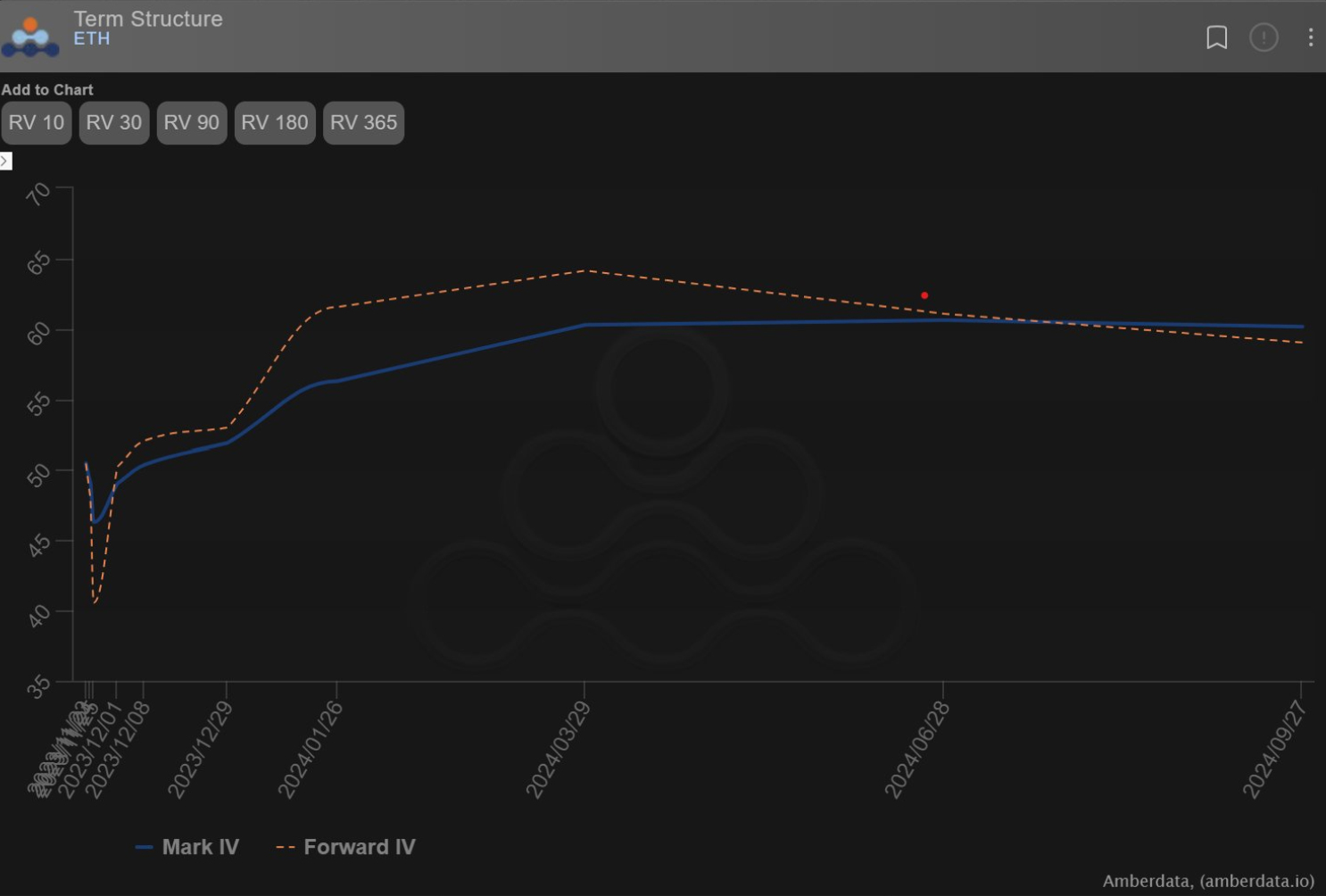

The ETH term-structure also has some kinks in Jan and March with no ETH approvals set; although ofc a BTC approval will create an ETH reaction.

5) Forensics show familiar patterns in terms of execution as one large Entity has decided to take advantage of the Jan IV blip and sell Jan 2.4k Calls, (perhaps some Dec 2.2+2.3k Calls too) while also there has been short-covering in Nov 1.65-1.75k Calls.

Co-incidence? OWE back?

View Twitter thread.

AUTHOR(S)