In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements after the BTC ETF approval.

GBTC selling compounded the ‘Sell the news’ ETF launch as Great Expectations unmet, at least not yet.

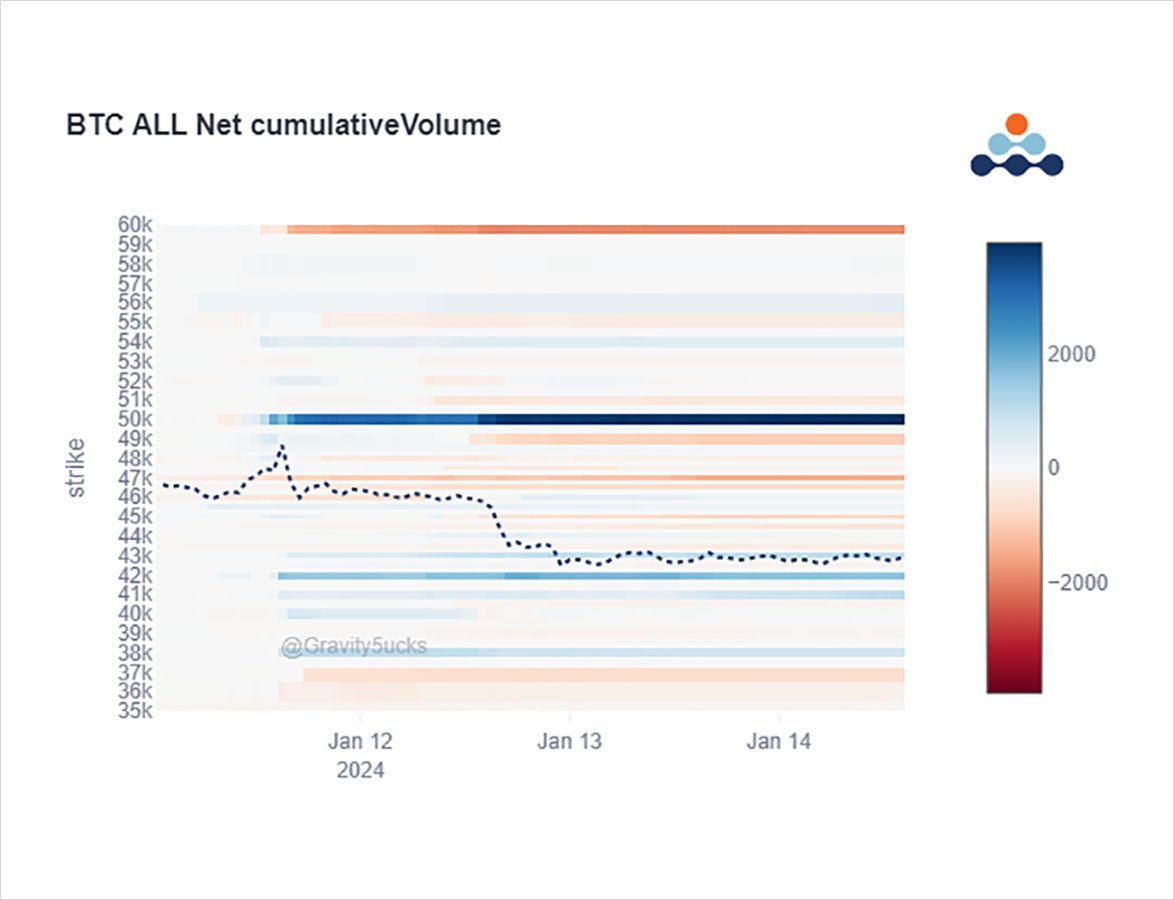

At first buyers of Jan50k, Feb+Mar 50-60k Call spreads x3k bought on initial strength & dips.

But then, buying turned to downside, with Jan 40-42k Puts swept, and rewarded.

2) Given the quantum of the moves and unprecedented event, Option volumes took a back seat, with many participants already having positioned.

Sell flows that offset the buying came from unwinds of Calls across the Term-structure, Jan 47-49, Feb 47-53, and Mar+Jun ITM+ATM Strikes.

3) Not surprisingly, when Option flows flipped from Call buying to Call unwinds and Put buying, Puts firmed and the result was to move the short-term 25delta Skew negative (in terms of the Call).

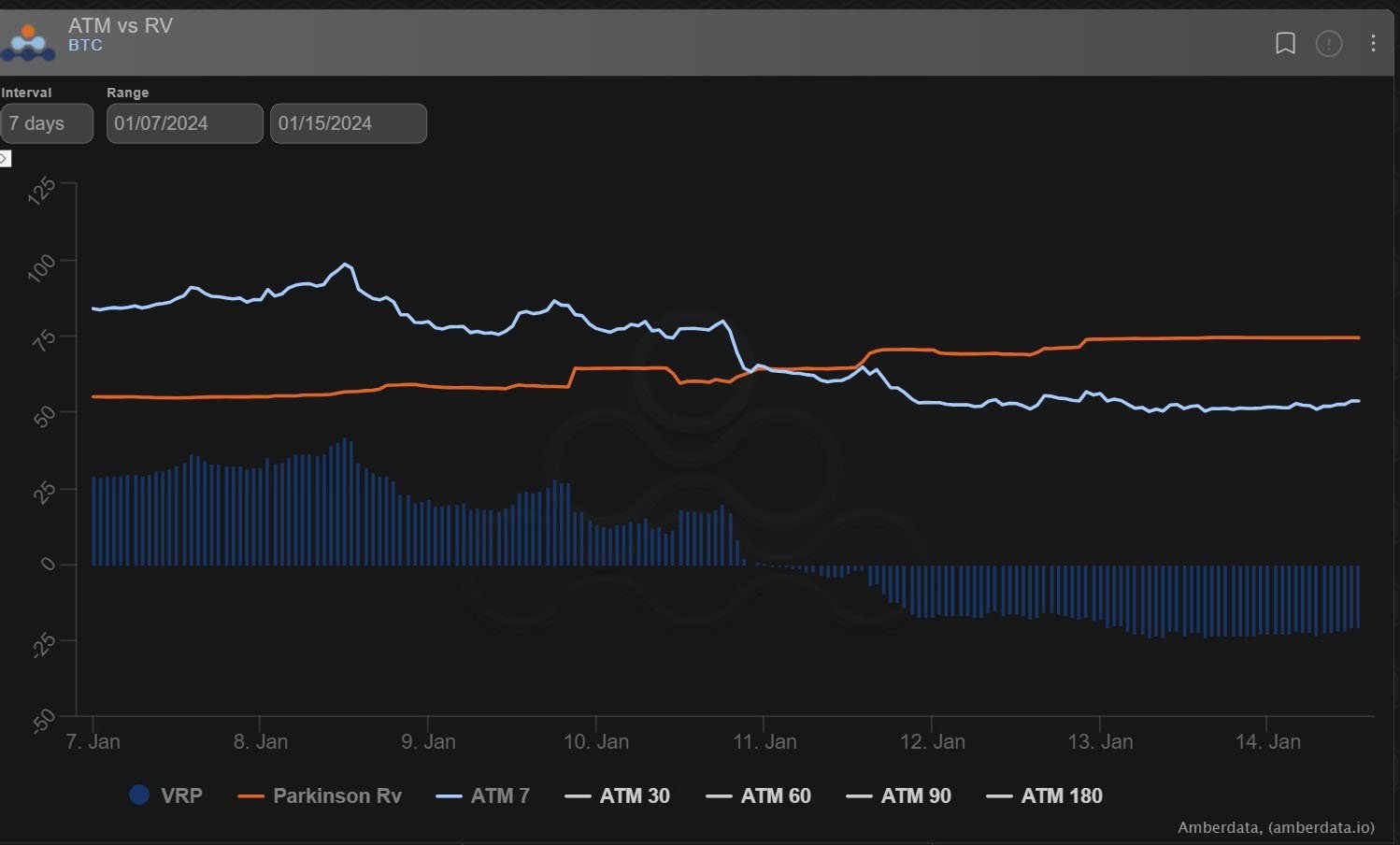

4) Perhaps more surprisingly given the large Realized Vol shock higher was a very muted reaction in Implied Vols resulting in a rare negative VRP.

NB as a reminder RV can illustrate the environment, but is backward-looking while IV is forward-looking – an estimate of future vol.

5) BTC Dvol sits at 55%, ETH Dvol is at 64%.

Most focus will continue this week to reside with BTC, but ETH is having its moment with counterstatements from BlackRock and SEC on a potential ETH Spot ETF, which created choppy 2-way flow in Spot, much heralded by long Gamma holds.

View Twitter thread.

AUTHOR(S)