In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements over the weekend.

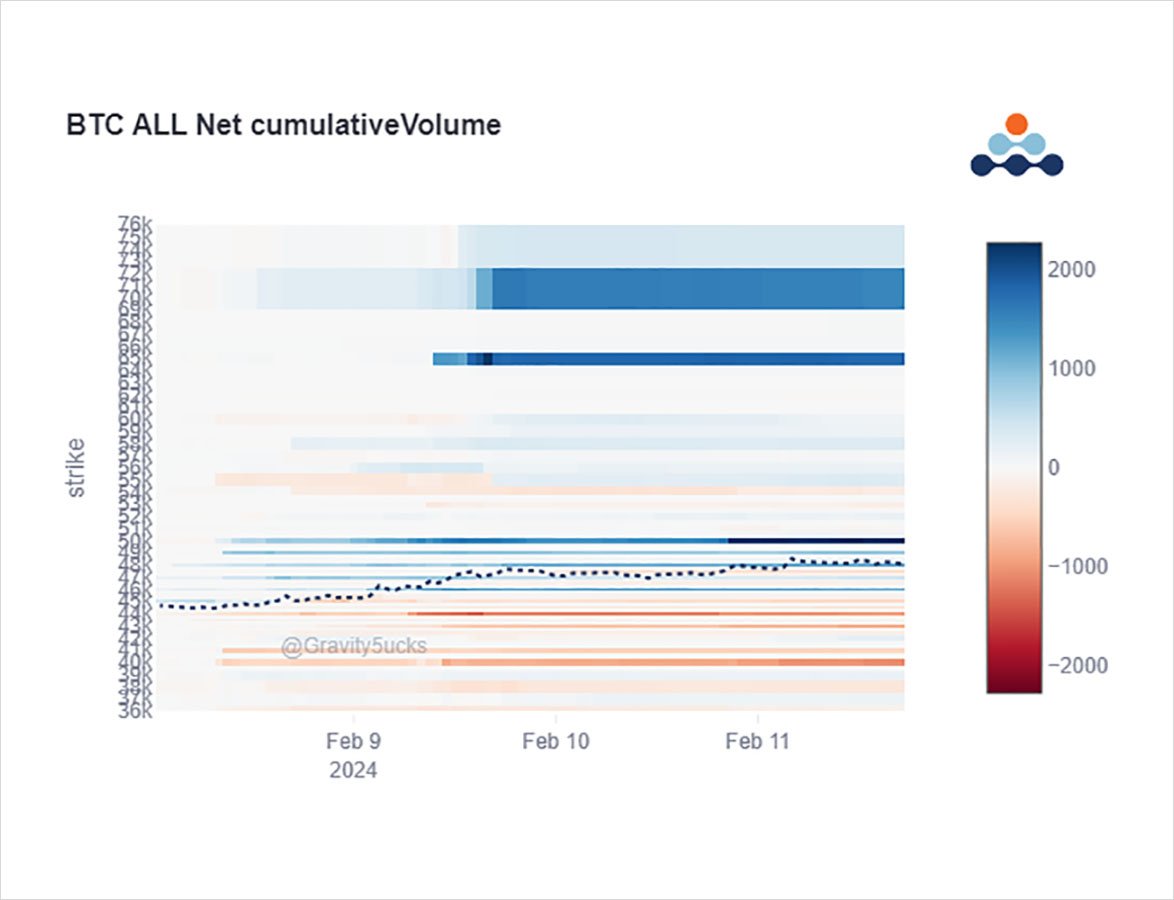

Size buying of Apr, Jun, Sep+Dec 65-75k Calls. Possible TP and rollup from the Jun 40k Calls.

ETF Net inflows materially improve and clear Spot bid.

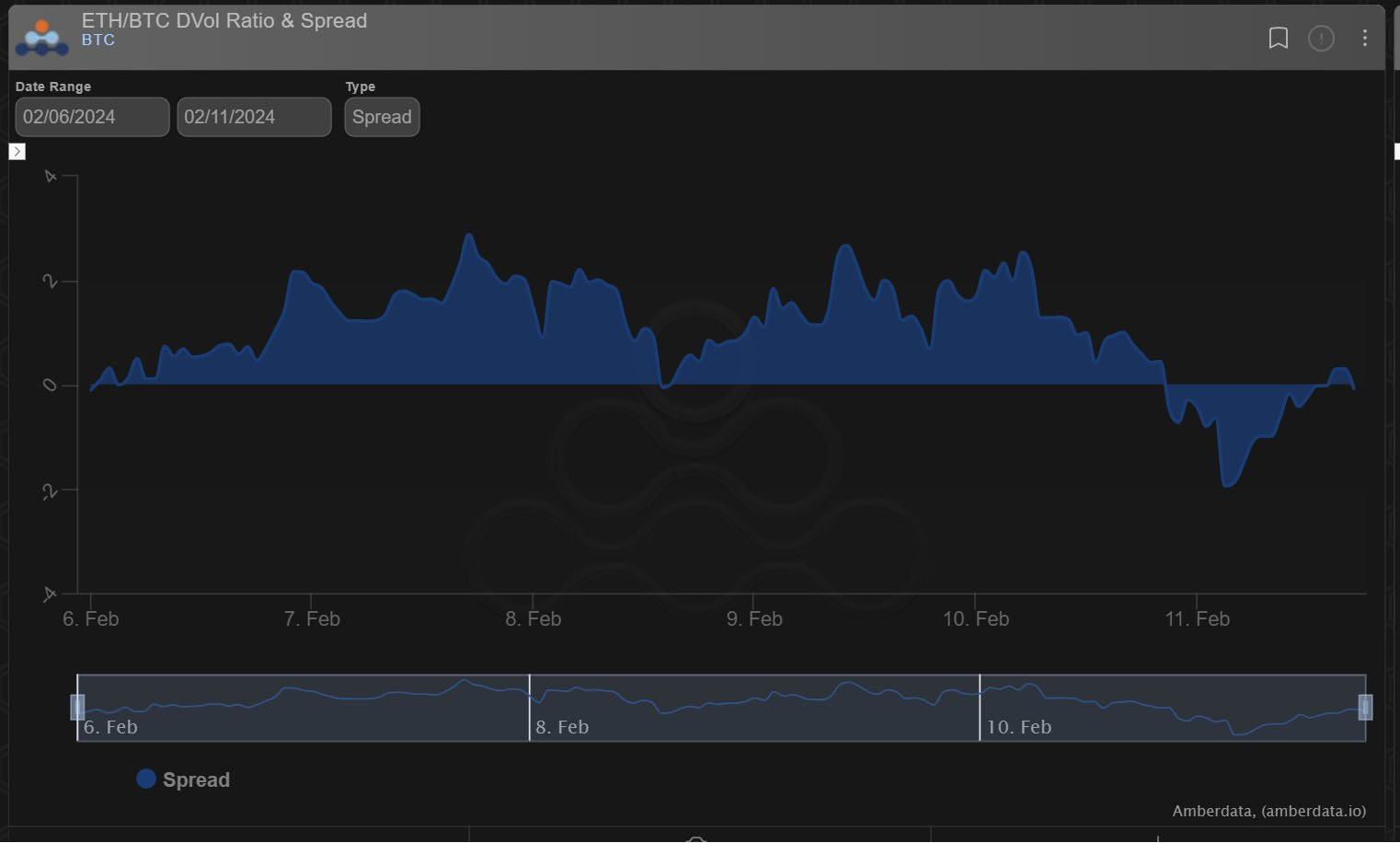

And with BTC Implied Vol at a discount to ETH Vol, despite where all the action remains, the Fund took the upside opportunity.

2) Fast money buying of Feb 48-50k Calls as continued ETF data hits the market.

And then a mass of Apr 65k (x500), Jun 65k (x1600), Jun 70k (x1k), Sep65k+Dec75k (x500) net $8.5m premium scooped up in European hours.

Noticeable a seller of 430x Jun 40k Calls – $4.5m. TP+Roll up?

3) Whether this was a rollup or not, it equated to a net ~375k of Vega aggressively bought from the market.

This was executed at a moment when BTC IV traded at a discount to ETH IV, despite BTC Spot outperforming ETH considerably.

Interestingly, ETH bounced back on little flow.

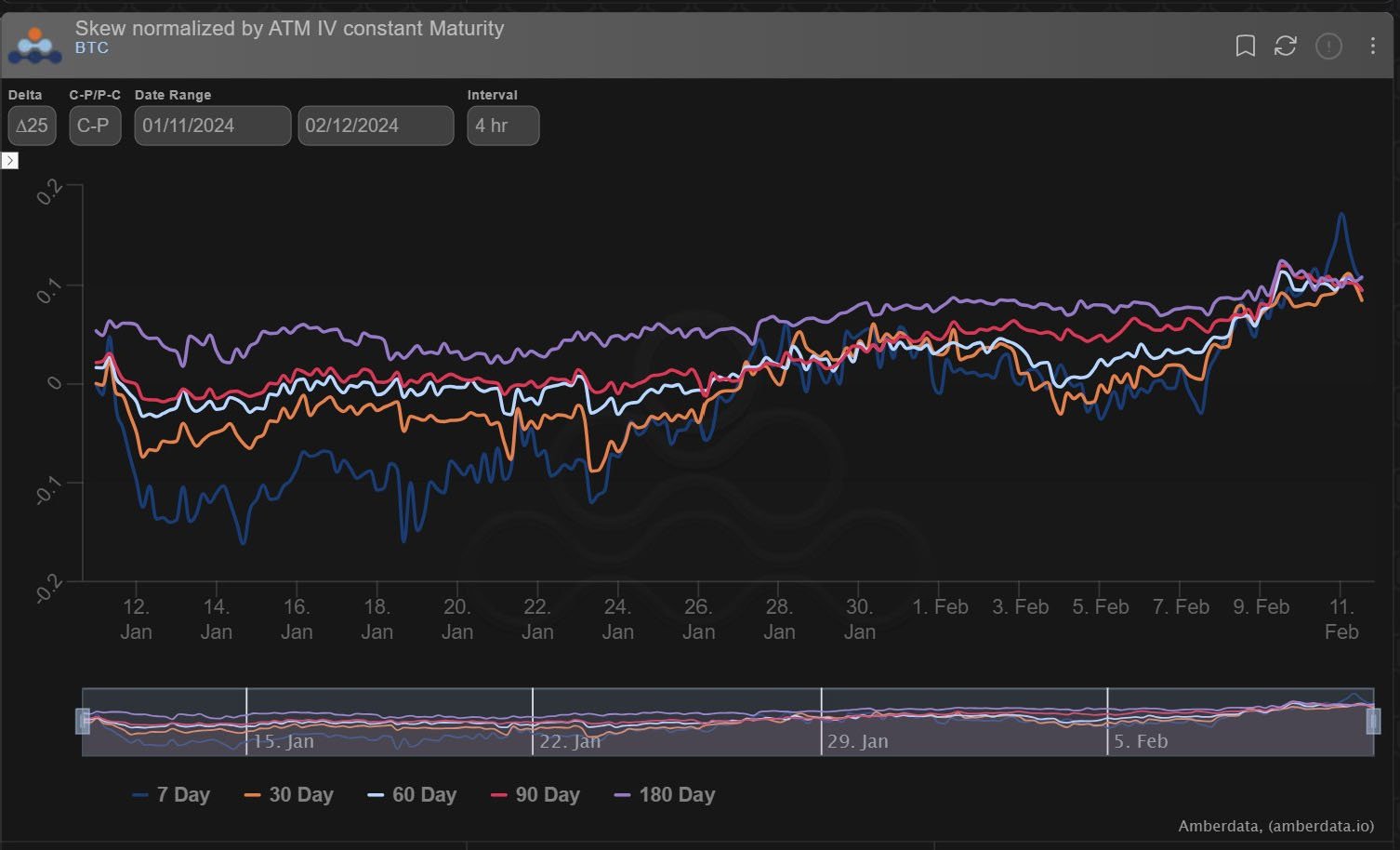

4) Ofc, this Fund buyer of Upside Calls not only bought decent level IV, but also well-priced Call Skew after a period where Puts had been more in demand and Calls less favored on the post-ETF-news sell-off.

Selecting Apr+ maturities hints at a longer-term ETF+Halving narrative.

View Twitter thread.

AUTHOR(S)