In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements which ones again was affected by the ETF launch and especially GBTC.

After Spot sold off 15%, the week promised volatility on GBTC-ETF wargames.

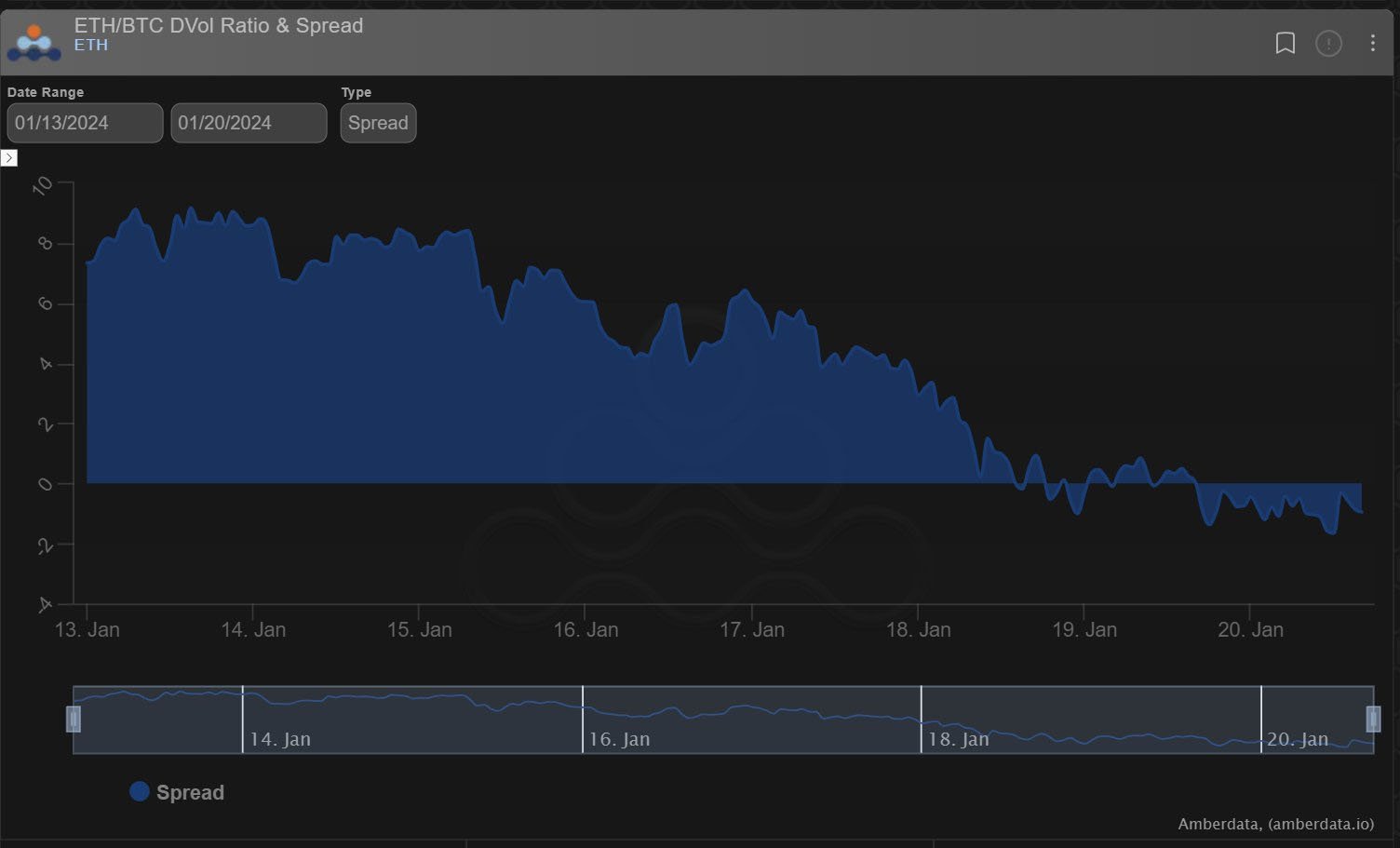

Instead, Mon-Wed Spot 3% rangebound, failed Calls sold, and ETH overwriter further crushed ETH Dvol 17%, BTC Dvol followed lower 8%.

Vol longs bled.

Until Feb Straddles lifted Thurs.

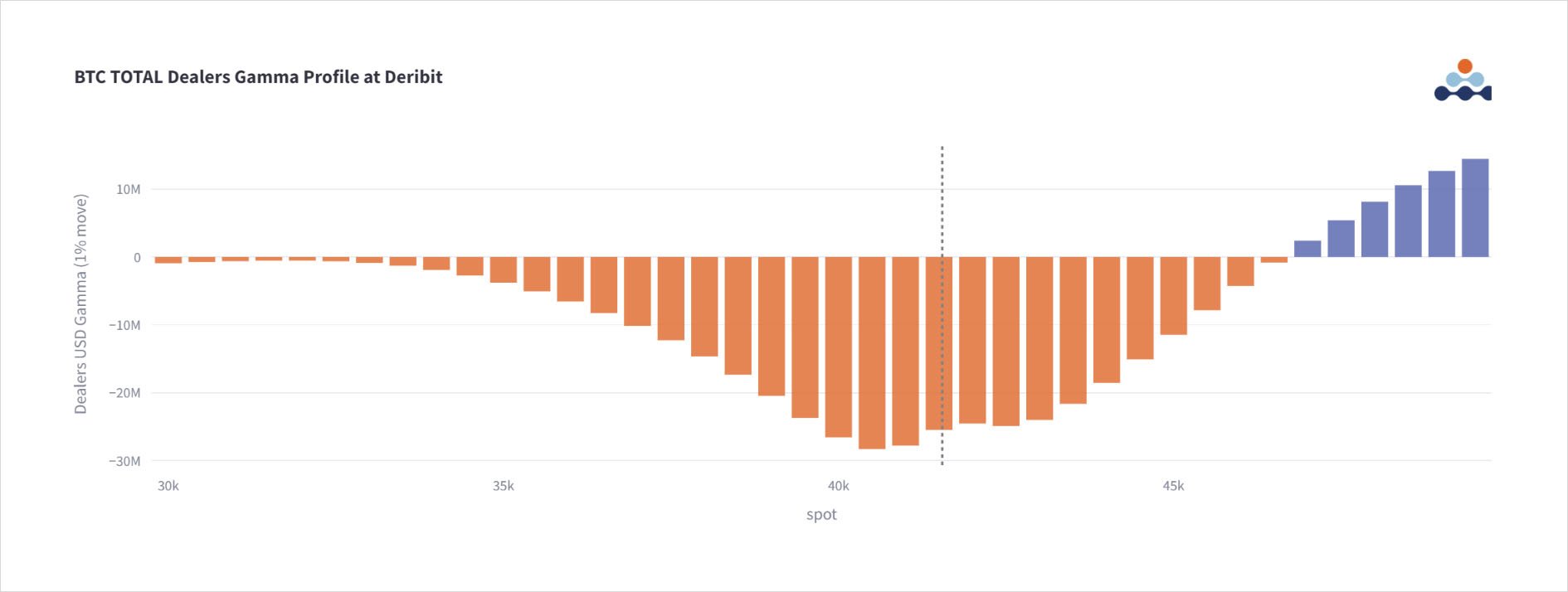

BTC tested 40k.

2) The most impactful IV selling trades originated on ETH, predominantly Call selling, some giving up on Longs, and some overwriting ETH Spot AUM.

Feb 2.7k Calls sold 45k.

Mar 2.9k Calls sold 28k.

Jan 2.6k covered to sell Apr 2.9k Calls 25k.

Significant other Call 2way in Feb Calls.

3) ETH vol over the week fell from 64% to 47%, using Dvol proxy. BTC IV fell on similarly structured Call selling but from 55-47%.

Vol buyers were run over as Spot failed to react to GBTC-CME-ETF tug-of-war flows early in the week.

ETH gave back all its premium Vol gains cf BTC.

4) One Fund Thursday US session sensed a change coming and bought the BTC 44k Staddle at 46% x1k.

Within an hour Spot had broken its support at 42.3k and by the US close was trading 40.5k.

Such was positioning, pre-expiry-pre-weekend, that IV barely reacted, 7day up 5%, 1m up 2%.

5) Another test on Friday down to 40.3k met with Jan+Feb Call buying and heavy Spot bids layered down to 40k as ETFs, Funds (and shorts) looked to take advantage of 5 consecutive days of GBTC wallet transfers, CME selling, and Coinbase discounts.

When will the tipping point be?

View Twitter thread.

AUTHOR(S)